Best Finance Management Software

Best finance management software used by organizations includes QuickBooks, FreshBooks, Xero, Zoho Books, and Quicken. Such financial management software solutions help to automate all the financial transactions and management of small, medium, and large-scale enterprises.

No Cost Personal Advisor

List of 20 Best Finance Management Software

Contenders | 2024

Best-in-class Cloud Accounting & Financial Managem

Sage Intacct is a cloud-based financial statement solution designed for small and mid-sized businesses. This robust and innovative software automates critical finance and accounting processes besides providing users with real-time financial insights. Read Sage Intacct Reviews

Explore various Sage Intacct features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Sage Intacct Features- Financial forecasting

- Customizable invoices

- Purchasing

- Collections Management

- Budgeting and planning

- Version Control

- Accounts Receivable

- Forecasting

Sage Intacct Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

#1 Cloud ERP for Fast-Growing Businesses

NetSuite, #1 cloud ERP, is an all-in-one cloud business management solution that helps more than 29,000 organizations operate more effectively by automating core processes and providing real-time visibility into operational and financial performance. Read Oracle NetSuite ERP Reviews

Explore various Oracle NetSuite ERP features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

- Lead Management

- Sales Quotes

- Commission management

- Opportunity Management

- Audit Trail

- Customer Management

- Payment Handling

- Expense Management

Oracle NetSuite ERP Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

One of the Bet Financial Management Solutions

Simple, easy-to-use business accounting system to help you manage your accounts online. You can download 14 days free trial of Zoho books. Zoho Books is an easy-to-use, online accounting software for small businesses to manage their finances and stay on top of their cash flow. Read Zoho Books Reviews

Explore various Zoho Books features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Zoho Books Features- GST Tax Invoice

- Payment Gateway Integration

- e-Payment

- Multi-Currency

- GST Ready

- Import/Export Data

- Profit & Loss Statement

- Multiuser Login & Role-based access control

Pricing

Zoho Books Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Development to Deployment DSLC, your scalability p

DSLC is a comprehensive platform for rapid application development on both the front and back end through drag-and-drop functionality with blockchain integration providing secure and scalable growth. Read Cyberium DSLC Reviews

Explore various Cyberium DSLC features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Cyberium DSLC Features- Source Control

- Mobile Development

- Customer Engagement

- Deployment Management

- Web App Development

- Customer Management

- Code Refactoring

- Reporting/Analytics

Pricing

Cyberium DSLC Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Advanced payment management software

We offer a fully certified and advanced payment management software suitable for every online business, ranging from banks and payment providers to financial organizations and e-commerce companies Read Paytiko Reviews

Explore various Paytiko features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Paytiko Features- Node management

- SaaS Operations Management

- Automate IT Tasks

- POS Transactions

- Ad hoc Reporting

- Spend Management

- Container Management

- Renewal Management

Paytiko Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Cloud Accounting Software Making Billing Painless

This bookkeeping software makes your accounting tasks easy, fast and secure. Start sending invoices, tracking time, and capturing expenses in minutes. We uphold a longstanding tradition of providing extraordinary customer service and building a product that helps save you time because we know you went into business to pursue your passion and serve your customers - not to learn to account. Read FreshBooks Reviews

Explore various FreshBooks features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all FreshBooks Features- Electronic Receipts

- Accounts Receivable

- Electronic Signature

- Invoice Processing

- Multi Currency

- Account Tracking

- Dashboard

- Billing & Invoicing

Pricing

FreshBooks Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Model and plan business processes for better decis

Oracle Fusion Cloud Enterprise Performance Management (EPM) helps enterprises model and plan across finance, HR, supply chain, and sales for better decision making. Read Oracle Fusion Cloud EPM Reviews

Explore various Oracle Fusion Cloud EPM features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

- Profitability Analysis

- Inventory Management

- KPI Tracking and Measurement

- Project Portfolio Management

- Dashboard

- Strategic Planning

- General Ledger

- Financial Planning and Budgeting

Oracle Fusion Cloud EPM Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Best Finance Business Software

NetSuite, #1 cloud ERP, is an all-in-one cloud business management solution that helps more than 29,000 organizations operate more effectively by automating core processes and providing real-time visibility into operational and financial performance. Read Oracle NetSuite ERP Reviews

Explore various Oracle NetSuite ERP features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

- Outstanding

- Case Notes

- Automated Scheduling

- Sales and Distribution

- Sales Tax Management

- Drill Down Reports

- Billing & Invoicing

- Real Time Synchronization

Oracle NetSuite ERP Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

A Businessman's Best Friend

Vyapar is a GST-compatible invoicing and accounting solution for small businesses. You can use it to create GST bills, fulfill orders, generate GSTR reports, track payments/expenses, and manage your inventory. Besides, you can use it to customize invoices and collect payments online. Read Vyapar Reviews

Explore various Vyapar features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Vyapar Features- Customer tracking

- Cash Management

- Data Security

- Profit & Loss Statement

- Online invoicing

- Barcode Scanning

- Reminders

- Customizable Catalogs

Pricing

Silver- Desktop (1 year)

$ 40

Device/Year

Silver- Desktop + Mobile (1 year)

$ 47

Device/Year

Silver- Desktop (3 years)

$ 92

Device/ 3 Years

Vyapar Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Software by Vena Solutions

Vena is the current Accounting software for budgeting, planning and predicts with strong reporting and analytics. It offers functionalities i.e database, manage an enterprise, strong reporting and modern analytics with excel. Learn more about Vena

Explore various Vena features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Vena Features- Cash Management

- General Ledger

- Supplier and Purchase Order Management

- Fixed Asset Management

- CPA Firms

- Production Management

- Bank Reconciliation

- Taxation Management

Vena Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Making Modern Businesses GST friendly

QuickBooks is an online accounting software for business owners to make stay on top of their finances. Easy to use interface, 100% data security and features such as Online bank connect and Whatsapp integration helps business owners to focus on growing their business. Read QuickBooks Online Reviews

Explore various QuickBooks Online features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all QuickBooks Online Features- Discount Management

- Expense Tracking

- Receipt Management

- Data Security & Accuracy

- Import & Export Data

- Reorder Management

- Banking Integration

- Payment Gateway Integration

Pricing

Simple Start

$ 30

Per Month

Essentials

$ 60

Per Month

Plus

$ 90

Per Month

QuickBooks Online Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Software by Workday, Inc

Workday Adaptive Planning is a fully featured Enterprise Performance Management Software designed to serve Agencies, Enterprises. Workday Adaptive Planning provides end-to-end solutions. This online Enterprise Performance Management System offers Budgeting & Forecasting, Qualitative Analysis, Quantitative Analysis, Ad hoc Analysis at one place. Read Workday Adaptive Planning Reviews

Explore various Workday Adaptive Planning features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Workday Adaptive Planning Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Software by Anaplan

Anaplan is a fully featured Accounting Software designed to serve Enterprises, Agencies. Anaplan provides end-to-end solutions designed for Windows. This online Accounting system offers Key Performance Indicators, Incentive Programs, Dashboard, Territory Management, Idea Management at one place. Learn more about Anaplan

Explore various Anaplan features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Anaplan Features- Scenario Planning

- Opportunity Management

- Idea Management

- Compensation Assessment

- Incentive Programs

- Performance Metrics

- Dashboard

- Modeling & Simulation

Anaplan Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Software by Xero Limited

Xero is award-winning web-based accounting software for small business owners and their accountants. It is beautifully designed and easy to use online bookkeeping for expense management. Read Xero Accounting Reviews

Explore various Xero Accounting features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Xero Accounting Features- Bonus

- Supplier and Purchase Order Management

- Taxation Management

- Time Tracking

- Inventory Management

- HR & Payroll

- Banking Integration

- Task Management

Pricing

Starter

$ 9

Per Month

Standard

$ 30

Per Month

Premium

$ 60

Per Month

Xero Accounting Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

One of the best online budgeting tools

Quicken is the simple budget software for helping you manage your money in the best possible manner. It can help you get access to more than 11,000 online billers with bill PDF downloads. You can get the latest features without any upgrading. You can have the option of expanded custom report layout options. You can utilize all these functionalities and much more by using this software. Read Quicken Reviews

Explore various Quicken features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Quicken Features- Cash Management

- Balance Sheet

- Consolidation / Roll-Up

- Profit / Loss Statement

- Forecasting

- Project Budgeting

- Income Statements

- Run Rate Tracking

Quicken Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

The Cloud ERP

Founded in 2008, Acumatica is a future-proof Cloud ERP solution for managing the complexities of distribution such as purchasing, ordering, tracking inventory, filling orders, and delivering customer support. Read Acumatica Reviews

Explore various Acumatica features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Acumatica Features- Barcode Integration

- Deferred Billing

- Reporting/Analytics

- Multicurrency payment processing

- Warehouse and Fulfillment

- Sales Management

- Recurring Orders

- Accounting

Acumatica Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Captain Biz is a sales and purchase invoice manage

CaptainBiz is a simple-to-use software solution to manage your business hassle-free. Generate tax invoices, track inventory in real-time, manage customers & suppliers, and monitor cash & bank transactions, all in one place, over PC or mobile. Endorsed by GST govt. of India as an affordable and easy-to-use solution for both GST and non-GST companies. Read CaptainBiz Reviews

Explore various CaptainBiz features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all CaptainBiz Features- Customer tracking

- GST Tax Invoice

- Profit & Loss Statement

- Sales Management

- Document Printing

- Monthly GST Report

- Purchase Management

- Sales Analyse Report

CaptainBiz Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Software by GnuCash.org

GnuCash ease you into the "Assets = Liabilities + Equity" accounting equation and help you keep tabs of your budget without using the categories commonly used in commercial personal finance software. Read GnuCash Reviews

Explore various GnuCash features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all GnuCash Features- Invoices

- Track Account

- Import & Export Data

- Cash Management

- Multi Company

- Financial Management

- Billing & Invoicing

- EMI Calculator

GnuCash Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Software by The Infinite Kind

Moneydance is the one of the best budgeting software especially meant for Mac users. This simple budget software can automatically download dealings and send payments online choosing from hundreds of financial organizations you have done business with. It has a number of characteristics which includes making online bill payments, accounts management, keeping track of your investments, capacity to handle multiple currencies, and much more. Read Moneydance Reviews

Explore various Moneydance features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Moneydance Features- Income Statements

- Profit / Loss Statement

- Run Rate Tracking

- General Ledger

- Forecasting

- Balance Sheet

- Multi Company

- Capital Asset Planning

Pricing

Starter

$ 50

Per Month

Moneydance Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Take Control Of Your Financial Future

Buxfer is a Budgeting a Forecasting platform to help users track their finances across 20,000+ different institutions, and planning for retirement, mortgage payoff, vacations, and more. Learn more about Buxfer

Explore various Buxfer features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Buxfer Features- Mobile Support

- Forecasting

- Account Tracking

- Analytics

- For Traders

- Ad Hoc Reports

- Goal Setting / Tracking

- Mobile Access

Pricing

Plus

$ 4

Per Month

Pro

$ 5

Per Month

Prime

$ 10

Per Month

Buxfer Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

What is Financial Management Software?

Financial Management software is a blend of methodologies and tools that allow businesses to record their income, expenses, and other assets. This record is crucial to maximizing profits and the sustainability of the company.

Several things are taken care of by efficient finance management software. It aims to improve business performance both in the short and long term by streamlining the invoices and bill collection, minimizing redundancy, removing accounting errors, helping with budget planning, and offering flexibility to accommodate change and growth.

There is no doubt that financial management is the topmost challenge that every business faces. Whether a newly established or successful business, it needs to deal with many financial complexities. Without financial management software, you cannot track how much profit the company has earned or how much it has to pay as a loss. As the business management authority has many other core tasks to focus on, they find difficulty in keeping a record of their finances. And as it is a confidential task too, they hesitate to give it to a person unless he/she is trusted.

This difficulty faced by business organizations has given rise to financial management software. If you are wondering what such a system is all about, here is all you need to know about the financial management system.

What are the Benefits of Finance Software?

-

Automate the Bill Payment Process

The world is digital, and businesses must keep pace with the current trends or be left behind. Nobody wants to wait for a sluggish and old-fashioned business–customers wish for efficient, fast, and reliable services, that financial software offers.

Gone are businesses and individuals relying on writing and mailing checks. Nowadays, bills can be paid online within minutes. Several financial software tools are available to pay bills online, making it efficient and fast–giving you time to do other things.

With financial software tools for bill payment, you can easily connect your accounts and make payments. Payments of all kinds can be easily made with such software–as credit card payments or utility bills. Payments can even be saved and completed later, and you can easily keep tabs on your expenses.

-

Tracks Your Spending

Another aspect of financial software tools is that they make tracking your spending efficient and easy. For instance, details on bills paid with bill payment software are usually saved on the account history and can be accessed any day and at any time.

Since all of your bills are paid from one place, it is easy for you to keep tabs on the bills and the payments. Keeping track of your spending is key in business–it will prevent you from filing for bankruptcy or shutting down your business completely. This will help you to organize your expenditures better and know where your money is going at any point in time.

-

Reduces Operating Cost

Companies spend a lot of money on expense reports. Studies show that 50% of companies process at least 500 expense reports per month, and up to 25% process up to 2500 reports. Moreover, since a company spends about $41.12 to manually process a statement, the cost of operation significantly increases due to the expense reports.

However, this cost can be minimized by making use of the software. With an automated expense reporting solution, the reporting process can be made efficient, seamless, fast, and simultaneously; the aforementioned costs can be minimized or eliminated.

Interestingly, with automated expense reporting software solutions, the cost of processing a report can be reduced to $7.17. This solution could help companies save money and improve their operations significantly.

-

Ease and Efficient Budgeting

Most companies are investing in budgeting software tools due to their importance in keeping tabs on companies’ budgets and operations. Budgeting software tools are easy to use and manage and offer many benefits over manual budgeting.

With budgeting software, it is easy to have an overview of the company’s budget, and it is also easy to automate accounting tasks. Accounting software makes it easy for anyone to handle the accounting processes and makes the entire process a lot easier, making it easier for the business to make a profit.

Furthermore, budgeting software is often used for cost-cutting purposes. The software is a powerful tool for adjusting a company’s expenditures, categorizing expenditures, providing monthly projections, and therefore helping you know what to expect from your business.

-

Efficient Invoicing System

Invoicing is an integral part of a business. In traditional companies, employees are hired to take care of the invoices–however, in today’s world, all invoicing processes can be handled with software.

Electronic invoicing software tools can be used in managing and creating invoices. These software tools have the advantage of accuracy, speed, and precision–which will reduce mistakes in more ways than one.

Small businesses need such technologies to optimize their operations and keep tabs on their growth. It’s easy to track invoices and manage your operations on your phone, ensuring the business process is optimized and improved.

-

Streamline Your Business

You can make your life easier and your business effective with several financial software. Some software tools can be used for invoicing, budgeting, automated bill payment, tracking spending, and reducing operating costs.

You want to stay on top of things as best you can for a successful business. Using software to help you will improve your business and keep you up to speed with your competition.

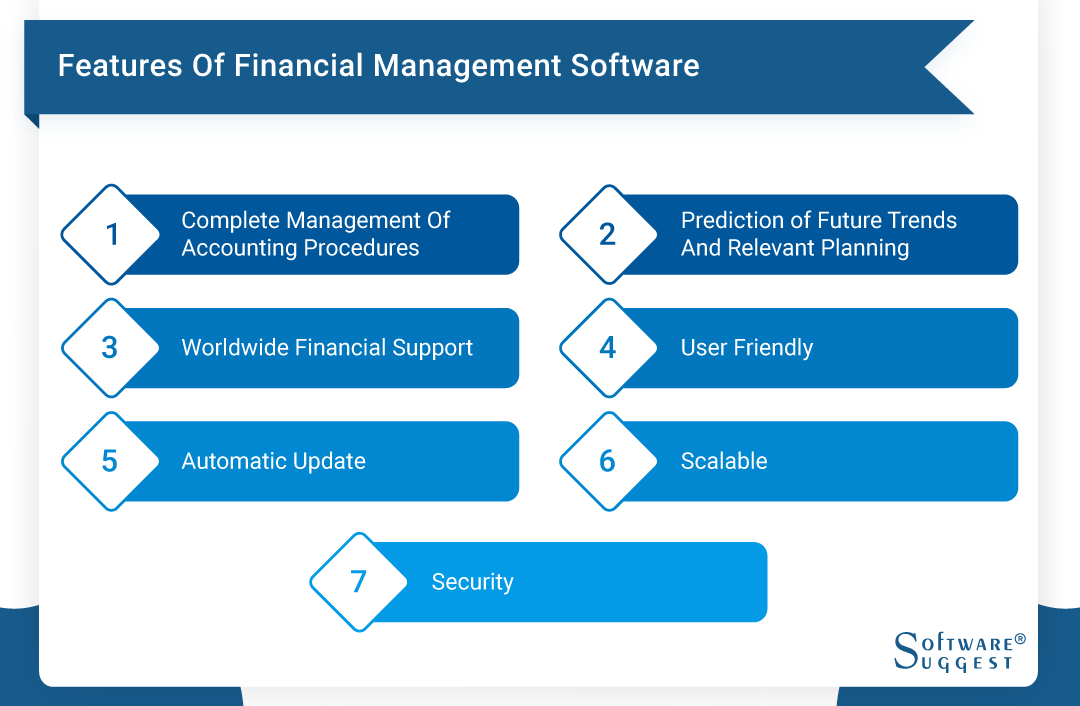

What are the Features of Finance Management Software?

-

Complete Management of Accounting Procedures

Financial management software streamlines all the economic processes of the organization from start to finish. It includes the management of accounts receivable, accounts payable, payroll, cash flow, small and big purchases, and all other finance-related procedures.

-

Prediction of Future Trends And Relevant Planning

A financial management system allows business organizations to use their historical data to predict future trends and patterns in expenses, income, and revenues. It also lets businesses understand market conditions, allowing them to plan accurately for the future.

-

Worldwide Financial Support

Financial management software provides businesses the tools and technologies to coordinate activities among multiple departments and manage their financial tasks worldwide. The support for languages and various currencies, along with their conversion, laws, and guidelines specific to each country, are the things that are well supported by financial management software.

-

User friendly

If a software solution is not user-friendly and is difficult to understand, the user will feel discouraged as it will be a time-consuming and complicated task for him. Since every individual does not necessarily have the technical knowledge, the interface of finance management software must be user-friendly. For this reason, being user-friendly is probably one of the most important features of any software.

-

Automatic update

A good business financial management system should automatically update itself. This helps the client take advantage of all the new features added to the software from time to time. A client would like to invest in software that saves his time and is completely automatic and not one that needs to be updated occasionally. If the software is not automatically updated, it will also affect the reports and records.

-

Scalable

A business is meant to grow. So a small company today can grow to be bigger tomorrow and later. Good software grows with the growing needs of a business. It is not just expensive but also an unwise decision to change the software with the growing needs of a business. So it is important that the financial software used by the business updates and upgrades itself with the company's growing size.

-

Security

Financial management software means one that has all the financial data of a business; nothing is more important than keeping that data safe and secure. One of the basic features to look for in any finance software is the level of safety it offers. Make it a priority while choosing one for your organization.

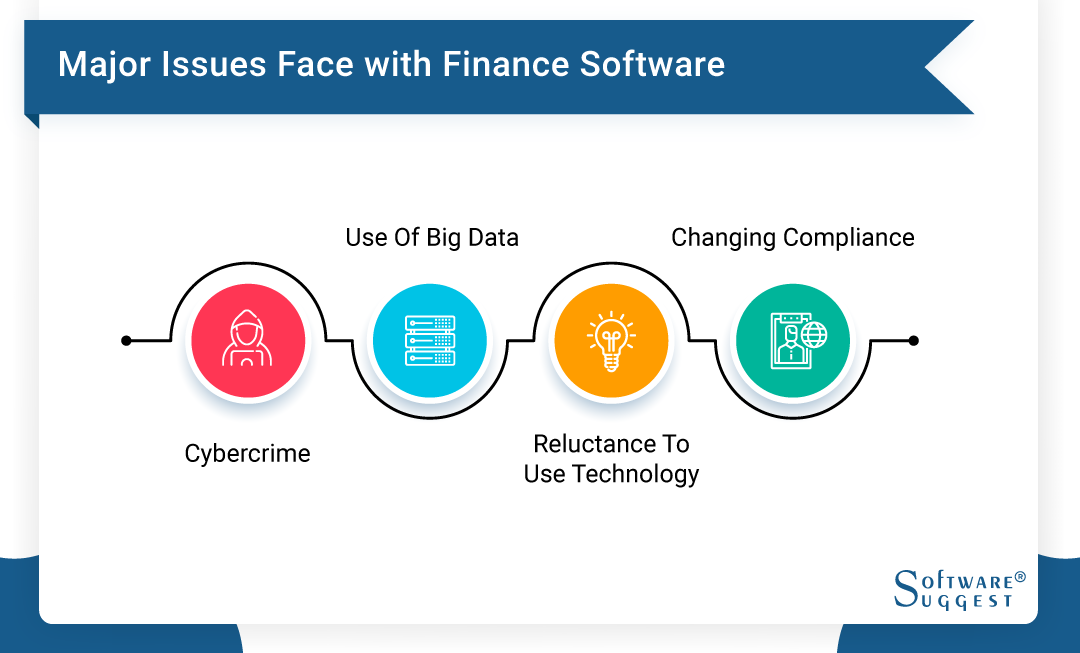

What are the Challenges Faced in Finance Software?

Issues with offline and/or online finance management tools have been mostly generational, so when it comes to the challenges faced by finance software, they are mostly related to this generation being digital.

Here are some of the major issues with Finance Software:

-

Cybercrime

With the rise in the use of technology, there have also been augmented cases of cybercrimes. According to statistics, data breaches involving finances have increased manifold within a year. If we want to keep financial data secure, our online financial management tool must be secure and reliable enough.

-

Use of big data

An immense quantity of unstructured data goes into the usage of financial software. While the mammoth amount of data is an asset, it also becomes an obstacle in different ways. Finding useful information from such enormously sized unstructured data is no child’s play. Thanks to the data analytics solutions, things are looking better.

-

Reluctance to use modern technology

It might sound surprising, but the facts prove that a very thin percentage of financial companies prefer to use modern methods such as cloud-based technology. A large portion of people prefer to use the traditional form of banking and are reluctant to use technologies and software.

-

Changing Regulatory Compliance

Regulatory compliance in the finance industry changes constantly, which also becomes challenging for finance software. However, several companies are emerging with solutions to resolve compliance issues and help the finance industry.

What Type of a Buyer Are You?

There are three types of buyers. The first category consists of small business buyers; others are best-of-breed and enterprise buyers. The financial requirements of all these buyers are quite different from each other. Small business buyers would look for other things than the two other types of buyers. Therefore, when looking for open-source software, consider your business needs and search for the one that best suits your needs. When you purchase software in line with the requirements and size of your business, it will enhance your business's efficiency and performance.

Finance is undoubtedly the lifeline of any business. It is a crucial part of any business and must be handled and managed carefully. Failing to manage your finances can make you face losses and troubles. Hence, it makes sense to take good care of your finances to keep a finger on the heart of your business. When everything is managed and well taken care of, chances are that it will take your business to the pinnacles of success. The open-source finance management software can greatly help you manage your finances so that you can concentrate on other core areas of work.

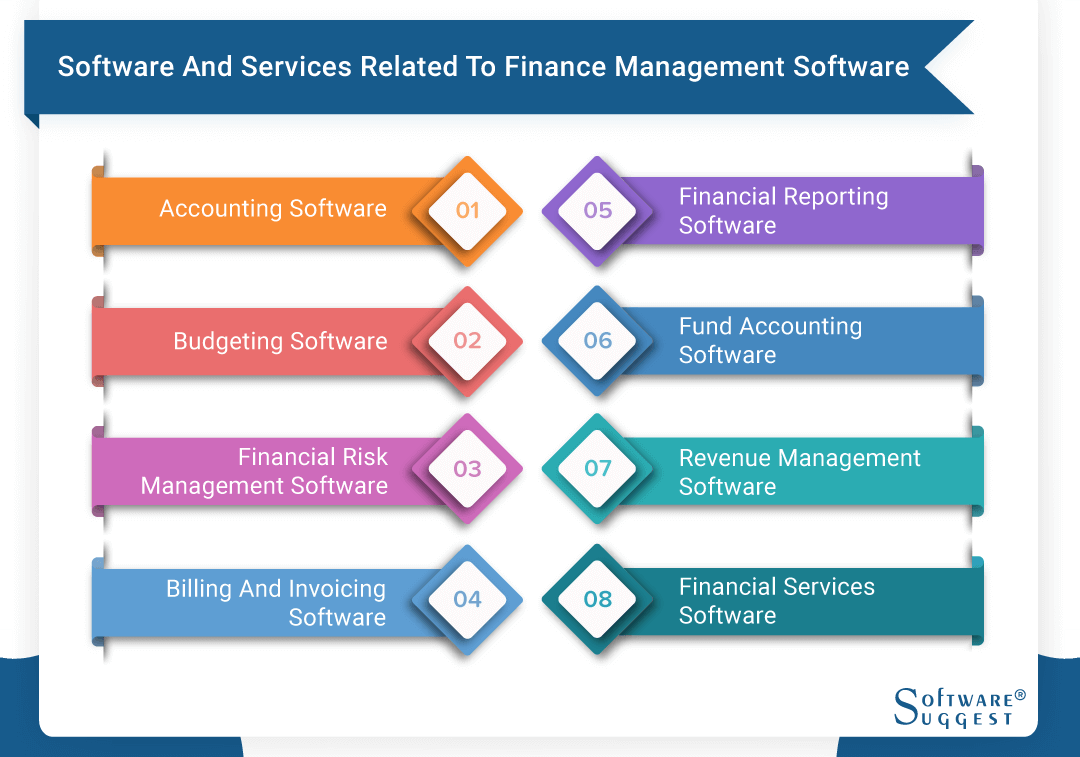

Software Related to Finance Management Software

Finance Software can be broadly classified into two categories: finance management system or money management software and Tax management software.

While top financial management software helps in managing investments, planning, banking, and income flow, free income tax management software aids in the preparation of tax forms and e-filing of taxes. Here is the list of software and services related to finance management software

-

Accounting Software

Accounting software takes care of an organization's financial transactions and automates them. The different elements of accounting software are general ledger, billing, accounts payable, accounts receivable, and payroll.

-

Budgeting Software

Budgeting software helps an organization balance its financial resources and expenditures. All the operations are related to budget management and distribution.

-

Financial Risk Management Software

Financial Risk Management Software examines and evaluates credit and market risk intended for financial institutions.

-

Billing and invoicing software

Billing and invoicing software automates generating invoices and sending them to customers. It also automates receiving payments. This category is also counted as the best personal financial software category because most individuals need this functionality only.

-

Financial Reporting Software

As the name suggests, financial reporting software automates reporting of an organization's financial results, transactions, and financial status.

-

Fund Accounting Software

Fund accounting software is used by non-profit organizations, government agencies, private foundations, private bankers, alternative asset managers, etc. It helps in the automation of accounting functions and the management of portfolios.

-

Revenue Management Software

The basic functioning of revenue management software involves optimizing prices based on different factors, such as offers by competitive businesses, demand, and seasonality. This optimization of prices helps the firms to attract more customers and, thus, generates more revenues.

-

Financial Services Software

Financial services software is used to take care of the everyday operations of organizations that offer financial services to the general public or other businesses. These include banks, credit unions, or other similar organizations.

By Countries

By Cities

By Industries

.png)