Best Payroll Software for Your Business

Best payroll software includes Keka, PocketHRM, WalletHR, HROne, Spine Payroll, and ZohoPay. Payroll management software helps to automate and simplify business HR payroll management for businesses, allowing for accurate salary calculations, tax deductions, and compliance with regulatory requirements.

No Cost Personal Advisor

List of 20 Best Payroll Software

Best payroll system to grow your business

Paychex is a well-designed payroll management software that allows great flexibility in managing various HR-related tasks. It encompasses services like payroll and taxes, insurance, employee benefits, 401 (k) retirement services, accounting and finance and PEO. Read Paychex Flex Reviews

Explore various Paychex Flex features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Paychex Flex Features- Payroll Management

- Employee benefits enrollment

- Document Management

- Workflow Management

- Attendance management

- Leave Management

- Benefits Administration

- Employee Onboarding and Offboarding

Paychex Flex Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Cloud Accounting Software Making Billing Painless

This bookkeeping software makes your accounting tasks easy, fast and secure. Start sending invoices, tracking time, and capturing expenses in minutes. We uphold a longstanding tradition of providing extraordinary customer service and building a product that helps save you time because we know you went into business to pursue your passion and serve your customers - not to learn to account. Read FreshBooks Reviews

Explore various FreshBooks features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all FreshBooks Features- ACH Payment Processing

- Work order management

- Credit Bureau Reporting

- Late Fee Calculation

- Online Banking Integration

- Billing & Invoicing

- Recurring invoice

- Stock Management

Pricing

FreshBooks Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Software by Rippling

Rippling is a fully featured HR Software designed to serve Agencies, Enterprises. Rippling provides end-to-end solutions designed for Macintosh. This online HR system offers E-Verify/I-9 Forms, Multi-Country, Employee Database, Recruitment Management, Employee Lifecycle Management at one place. Read Rippling Reviews

Explore various Rippling features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Rippling Features- Deduction Management

- HIPAA Compliant

- Leave Management

- Employee Database

- Password Management

- Overtime Management

- Payroll Management

- Multi-State

Rippling Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Software by Multiplier

Multiplier provides a hassle-free platform that empowers companies to seamlessly operate and manage international payroll for their global workforce with utmost precision. Effortlessly onboard employees in any country within minutes, while efficiently overseeing the entire payroll process, ensuring compliance with labor laws, and effectively managing comprehensive benefits. Read Multiplier Reviews

Explore various Multiplier features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Multiplier Features- Wage Garnishment

- Document Management

- Multi-Country

- Compliance Management

- Compensation and Benefits Tracking

- Billing & Invoicing

- Worker Classification

- Expense Management

Pricing

Multiplier Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Software by Justworks, Inc

Justworks HR system is the top most beneficial solution for the employee as well as any size of the organization of providing HR software. It can be helpful in empowering the employees with seamless payroll, tax filing, HR support. Learn more about Justworks

Explore various Justworks features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Justworks Features- Alerts & Reminders

- Onboarding

- Alerts/Notifications

- Vacation / Leave Tracking

- Timesheets

- On-Boarding

- Attendance management

- Payroll Management

Pricing

Justworks Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Payroll Solution For Small, Medium And large Businesses

Process payroll accurately and securely in 3 simple steps with ADP Vista HCM – a highly configurable and secure cloud-based payroll software designed for small, medium, and large businesses. With Vista HCM, you can generate all the necessary payroll and compliance reports easily. Read ADP Vista HCM Reviews

Explore various ADP Vista HCM features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all ADP Vista HCM Features- Email Integration

- Workflow Administration

- Loan & Advances Management

- Salary Adjustment

- Salary Information & History

- Self Service Portal

- Time & Attendance Management

- Employee Data Base

ADP Vista HCM Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Global Payroll and Compliance

Build your remote team with Deel. Hire international employees and contractors compliantly around the world. Run payroll in hundreds of currencies with one click. Read Deel Reviews

Explore various Deel features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Deel Features- Contract Management

- Compliance Reporting

- Equipment Tracking

- Time & Attendance Management

- Payroll Management

- Attendance management

- HR & Payroll

- Reporting/Analytics

Pricing

Deel Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Software by OnPay, Inc

OnPay is among the most powerful payroll software available in the market. It is working from the last 30 years to help small business enterprises. It integrates with Xero, QuickBooks, etc. Read OnPay Reviews

Explore various OnPay features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all OnPay Features- Payroll Management

- Data Imports/Exports

- Pay Slip

- Shift Management

- Expense Management

- Document Management

- Time & Attendance Management

Pricing

OnPay Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Software by Oyster HR, Inc

Oyster Payroll is a cloud-based platform for managing payroll and HR tasks. It is among the best payroll software in India that streamlines business payroll processing with tax management, compliance reporting, and employee self-service features. The platform specializes in managing payroll for remote workers and international employees. Read Oyster Payroll Reviews

Explore various Oyster Payroll features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Oyster Payroll Features- Time & Attendance Management

- Compensation Management

- Attendance management

- Time & Expense Tracking

- Performance Management

- Talent Management

- Benefits Management

- Self Service Portal

Pricing

Oyster Payroll Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Best Fit for Payroll Processes

Papaya Global is a cloud-based payroll application software platform that manages global payroll and HR tasks. This software streamlines payroll processing for businesses operating internationally. It has features such as tax management, compliance reporting, and benefits administration for efficient business workflow. Read Papaya Global Reviews

Explore various Papaya Global features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Papaya Global Features- Scheduling

- Employee Self-Service Portal

- Dashboard

- Financial Modeling

- HR analytics and reporting

- Benefits Management

- Leave & Absence Reporting

- Payroll Data Import and Export

Pricing

Papaya Global Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Keep your time and money

Our secure online payroll system, paying your employees has never been easier. We’ll help you get started by setting up your payroll, employees, payroll tax information, etc. Read Patriot Payroll Reviews

Explore various Patriot Payroll features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Patriot Payroll Features- Document Management

- Salary Information & History

- Vacation/Leave Tracking

- Formula Defined Salary Calculation

- Multiuser Login & Role-based access control

- HR & Payroll

- Dashboard

- Mobile Support

Pricing

Patriot Payroll Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Payroll Management Software for Small Businesses

Gusto is the employee onboarding platform, offering payroll, benefits, HR tools, and world-class support for small businesses. With Gusto, it’s easy to take care of your team and grow your business all in one place. Read Gusto Reviews

Explore various Gusto features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Gusto Features- Time Tracking

- Self-onboarding

- Pay Slip

- Events & Reminders

- Multiuser Login & Role-based access control

- Retirement Plan Management

- Benefits Administration

- Back Office Assistance

Pricing

Gusto Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Award-winning Payroll Software

Keka is a payroll software solution that simplifies HR-related tasks by automating the workflow for better and more accurate results. This software is further equipped with a modern applicant tracking system that empowers HR staff to acquire the right talent. Read Keka Reviews

Explore various Keka features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Keka Features- Goal Setting

- Compensation Plan Modeling

- Reporting

- MIS Reports

- Application Management

- Job Comparison

- Variable Workforce

- Leave Policy Management

Pricing

Foundation

$ 97

Upto 100 Employees

Strength

$ 194

Upto 100 Employees

Keka Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Best Software in Payroll Category

factoHR is an award-winning Best Payroll Platform trusted by 3500 Companies & 2.6 million employees, which includes Tata Steel BSL, DENSO, Cycle Agarbatti, BSE, Murugappa, & many others who have improved their productivity by more than 70 % Read factoHR Reviews

Explore various factoHR features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all factoHR Features- Integration with Biometric

- Organizational Charting

- Attendance Tracking

- Project Management

- Built-in ATS

- Single Sign On

- Dashboard

- Exit Management

factoHR Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Hassle-Free Software For Payroll

Spine Payroll software is a very simple, flexible, user-friendly employee salary software. It takes care of all business requirements related to accounting and management of employees’ payroll. Read Spine Payroll Reviews

Explore various Spine Payroll features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Spine Payroll Features- Appraisal Management

- Salary Information & History

- Multi Company

- MIS Reports

- Integration with Biometric

- Reimbursement Management

- HR & Payroll

- Employee Data Base

Spine Payroll Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Accurate for Payroll Processes

This payroll software manages accurate payroll, compliances & employee benefits in seconds. It is user-friendly and has a diverse range of useful features that enhance operational efficiency. Read Qandle Reviews

Explore various Qandle features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Qandle Features- Template Policies & Guides

- Variable Workforce

- Performance Management

- Overtime Calculation

- Mobile Survey

- Tax Management

- Social Sharing

- Mobile Support

Pricing

Foundation

$ 1

Employee/Month

Regular

$ 1

Employee/Month

Plus

$ 1

Employee/Month

Qandle Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

One-Stop Destination For Your Payroll Needs

Saral PayPack offers you comprehensive payroll system software for all your payroll needs. It is a one-stop destination for your search as it possesses the most sought requirements of payroll, the right choice for automating your payroll. Read Saral PayPack Reviews

Explore various Saral PayPack features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Saral PayPack Features- Reimbursement Management

- Integration with Biometric

- Multiuser Login & Role-based access control

- Offer management

- Employee Self-Service Portal

- Customizable Templates

- MIS Reports

- Sick Leave Tracking

Pricing

Standard

$ 746

Onetime

Corporate

$ 1608

Onetime

Saral PayPack Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Best Payroll Software For Corporate Houses

WalletHR is a complete solution for payroll processes with the main focus on providing corporate payroll solutions. It facilitates smooth task flow, and enhances operational efficiency through a range of innovative features. Read Wallet HR Reviews

Explore various Wallet HR features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Wallet HR Features- Analytical Reports

- Timesheet Management

- Payroll Taxes

- Employment History

- Sick Leave Tracking

- TDS Calculation

- Shift Management

- Shift Swapping

Wallet HR Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Cloud-Based Payroll Software For Seamless Management

Zoho Payroll makes payroll administration simple by automating everything from timekeeping to tax calculations. It handles everything from centralizing and organizing employee records and information to scheduling payrolls and managing statutory compliance. Read Zoho Payroll Reviews

Explore various Zoho Payroll features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Zoho Payroll Features- Statutory Compliances

- Salary Adjustment

- Employee Database

- Mobile Support

- TDS Calculation

- Employee Data Base

- Taxation Management

- Analytical Reports

Pricing

Free

$ 0

Free forever

Standard

$ 1

Employee/Month

Professional

$ 1

Employee/Month

Zoho Payroll Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Best In Payroll Category

2Grow HR is one of the smartest payroll tool available in India. It saves you time and money. 2GrowHR allows you to automate managing the employees’ Salaries, Wages, Allowances, Taxes, EPF, and Deductions and enjoy seamlessly. Read 2Grow HR Reviews

Explore various 2Grow HR features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all 2Grow HR Features- Onboarding

- Attendance Reporting

- Taxation Management

- Fixed Asset Management

- Asset Management

- Vacation/Leave Tracking

- Training Management

- Time & Attendance Management

2Grow HR Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

As businesses grow, managing payroll becomes a complex and time-consuming task. Payroll software can streamline this process, automate calculations, and ensure compliance with tax laws and regulations. Choosing the right payroll system software can be overwhelming with so many available options.

This guide aims to provide a comprehensive overview of the key features and consideratiohttps://www.softwaresuggest.com/blog/best-payroll-software-in-australia/ns to help you make an informed decision that meets your business needs. This guide will help you choose the finest payroll software system for your business, whether you're a small business owner or a payroll administrator.

What Is Payroll Software?

Payroll software is a type of software that helps businesses automate and manage their payroll processes. It simplifies calculating and processing employee payments, including salaries, bonuses, and deductions, by automating tax calculations, paycheck printing, and direct deposit payments.

This software can also help businesses comply with tax laws and regulations by automatically deducting and remitting payroll taxes and generating reports for tax purposes.

Some software may also have features such as employee self-service portals, time and attendance tracking, and benefits administration. Overall, payroll tools help businesses streamline and automate their payroll processes, saving time and reducing errors.

What Role Does Payroll Software Play?

Payroll software plays a crucial role in managing the financial aspects of a business by automating and streamlining the payroll process. Some key roles that payroll platform plays include calculating employee compensation and benefits are automated and streamlined by payroll software, which is essential to modern business operations.

The program allows employers to quickly manage employee payroll activities, including calculating wages, deductions, taxes, and other withholdings.

Payroll system software minimizes errors or compliance problems while ensuring employees receive correct and timely wages. This software can facilitate employee time and attendance data integration, enabling more precise tracking of hours worked and overtime.

Furthermore, many software packages offer reporting and analytics features that give useful information about labor costs, benefit costs, and other financial variables. Ultimately, payroll software is crucial for companies of all sizes since it helps them save time and minimize errors.

What are the Benefits of Payroll Software?

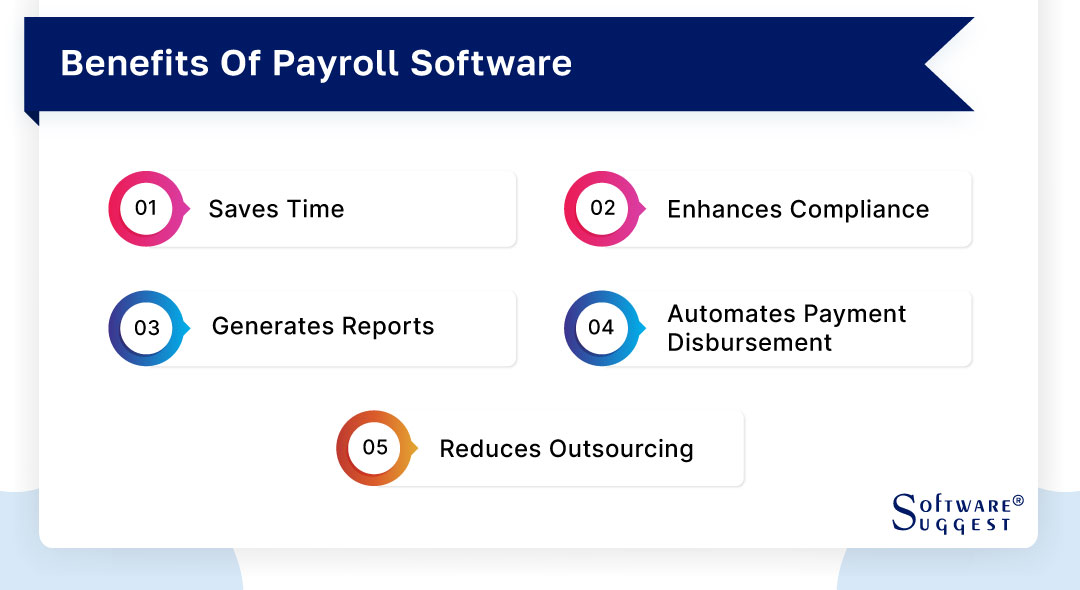

By automating manual (and error-prone) processes, payroll software solutions assist you in conducting employee salaries, wages, bonuses, and deductions. It also keeps track of paid time off, vacation, and perks. Here are some of the key benefits of the software:

-

Saves Time

Setting up and processing payroll via attendance and payroll software solutions is relatively easy. This renders them user-friendly.

Payroll programs minimize the need for manual tracking and payment. This helps your team save time, which may be redirected to other areas of your company, resulting in increased productivity. Tasks such as calculating salary and timesheets can be carried out as quickly as 20 seconds.

-

Enhances Compliance

Tax rules and regulations are subject to change regularly. It may be challenging to calculate taxes, and missing deadlines can result in expensive fines and penalties for companies.

The payroll system software helps businesses remain compliant by providing information and reminders about payroll compliance needs. It is designed to apply tax deductions automatically and track payments in real-time. Some HRMS payroll software can also generate reports for filing tax requirements automatically.

-

Generates Reports

Payroll software enables you to generate reports for internal decision-makers, accountants, and auditors. Summaries of quarterly costs, yearly tax payments, and historical employee benefit participation are all examples of what may be found in a payroll report.

Furthermore, reporting capabilities, such as cost summaries and tax payments, are frequently included in the software.

-

Automates Payment Disbursement

You may also use payroll programs to automate the payment disbursement procedure. Using attendance with single-touch payroll, you may customize hourly or salaried staff and save much of the tedious labor of calculating hours and paychecks.

Also, most HR payroll software systems allow you to provide your employees a choice in how they receive their pay. You may keep employee preferences in the system to ensure that their chosen mode of payment is used every time.

-

Reduces Outsourcing

Payroll platform reduce the risk of disclosing sensitive employee information to a third party. You get complete control over your financial data.

Besides, employers can restrict access to the payroll information of their employees. Employees can easily view their payroll information on the self-service portal. It ensures complete pay transparency.

What are the Key Features of Payroll Software?

The key features of payroll software can vary depending on the specific software, but here are some of the most common features you can expect to find in most software:

-

Employee management

Payroll software typically includes features for managing employee information, such as contact details, salary, benefits, tax status, and other employment-related data.

-

Notifications and Updates

The employee payroll tool keeps reminding you of important notifications like tax payments and salary due dates. You can also set reminders for pending tasks, such as approval of a leave request.

-

Employee Calendars

Payroll calendars are easy to manage in different aspects of employee status, like checking on sick leaves, absences, and overtime. Time & attendance management software with payroll helps employees to make plans and decisions on a particular day.

-

Time and attendance tracking

Many payroll systems include time and attendance tracking features that allow employees to clock in and out, track hours worked, and monitor leave and vacation time.

-

Payroll processing

Payroll platform automates calculating employee salaries, bonuses, and deductions, processing payments, and generating pay stubs.

-

Tax compliance

Payroll system software ensures compliance with tax laws and regulations by automatically calculating and withholding payroll taxes, generating tax forms, and keeping track of changes in tax laws.

-

Direct deposit and check to print

Payroll software typically includes features for processing payments, such as direct deposit or check printing.

-

Employee self-service

Many payroll software solutions include self-service portals, allowing employees to access their pay stubs, update personal information, and request time off.

-

Payslips

This salary slip module helps you generate payslips so your employees and company can keep the payment records.

-

Automates Data Management

Automating the data management software in this tool helps speed up your work process and saves time. Besides, it eliminates the chance of human-made error and ensures accuracy.

-

Tax Computation

Most advanced solutions have a tax computation module that helps you accurately file your tax on time. It complies with all updated government regulations and helps avoid hefty fines for miscalculations or failing to file taxes.

-

Integration with other systems

Payroll software may integrate with other systems, such as time and attendance, accounting, or HR software, to streamline processes and avoid duplicate data entry.

Why Do You Need Payroll Software?

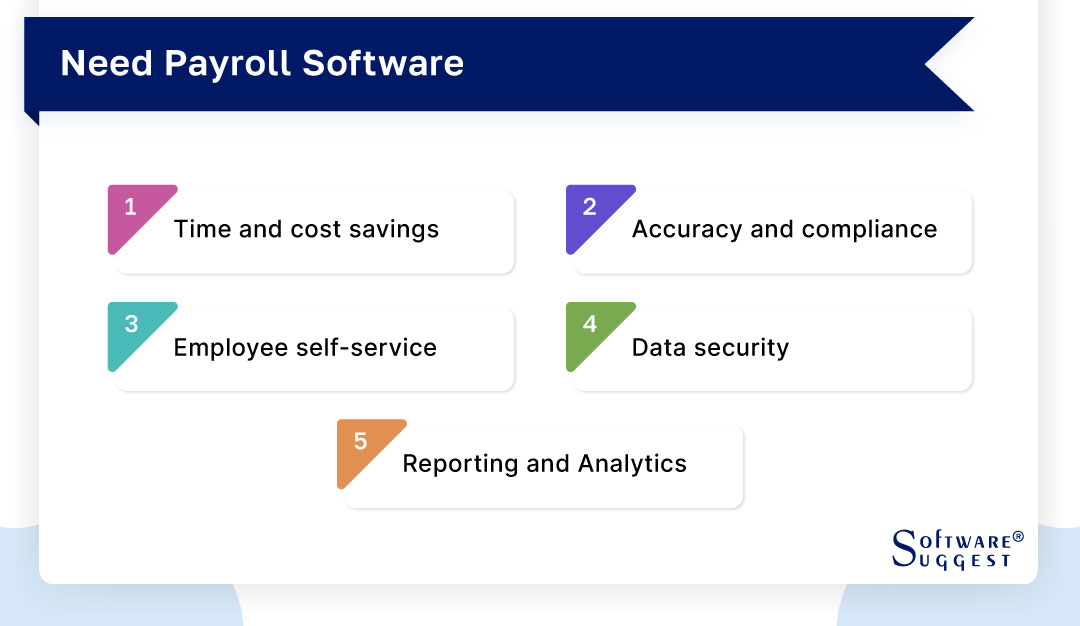

Businesses need payroll software essential for any business to operate effectively and efficiently. Below are some important reasons:

-

Time and cost savings

Payroll tools automate and streamline the payroll process, saving time and reducing costs associated with manual payroll processing, such as data entry, printing and mailing checks, and reconciling payroll data.

-

Accuracy and compliance

Payroll programs ensures accuracy and compliance with tax laws and regulations by automatically calculating taxes and deductions, generating reports for tax purposes, and keeping track of changes in tax laws.

-

Employee self-service

Many payroll software solutions include self-service portals, allowing employees to access their pay stubs, update personal information, and request time off, reducing administrative work for HR staff.

-

Data security

Clous-based payroll software securely stores employee information and payroll data, reducing the risk of data breaches and ensuring compliance with data protection laws.

-

Reporting and Analytics

Payroll software generates reports on payroll costs, tax liabilities, and other financial metrics, providing businesses with insights into their payroll processes and helping them make informed decisions.

How To Choose The Right Payroll Tool?

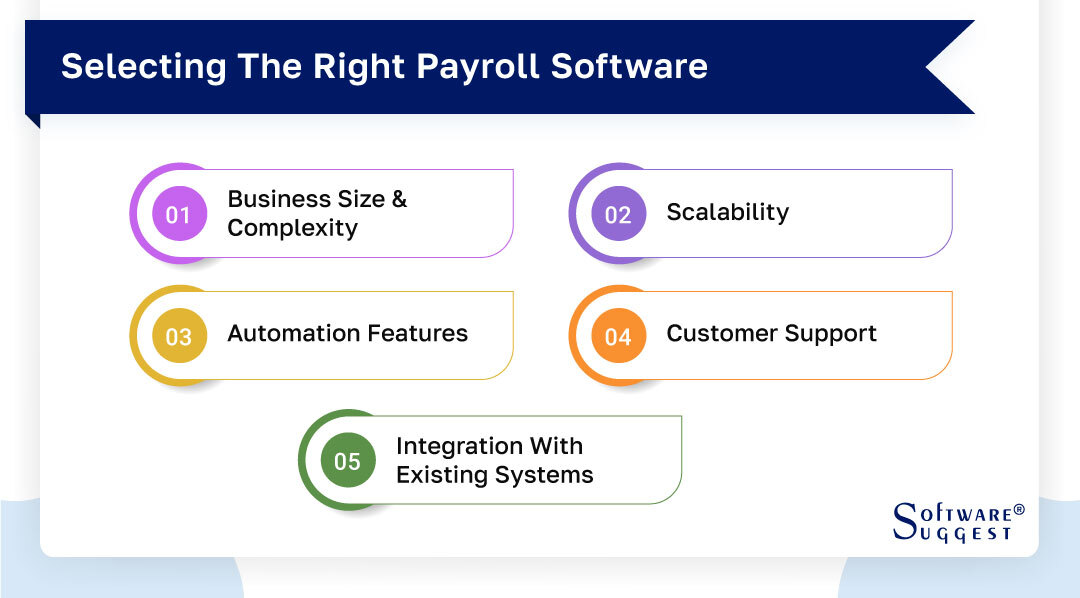

Payroll software is a cloud-based solution that helps you process the employee payroll seamlessly. Below, we have explained the steps on how you can choose the right software for your business for payroll processes:

-

Business Size and Complexity

The payroll software solution helps businesses of all sizes with a well-structured dashboard. Also, it offers multiple functions like analyzing, viewing, and extracting different sets of data at any given time. Large businesses mainly use payroll as they require more resources to manage their employees.

-

Scalability

Scalability is one of the major factors in considering payroll platform for your organization. Using cloud-based payroll software helps the organization scale up or down according to the needs of the business.

-

Automation Features

Automation reduces the error rate and enables HR teams to speed up the screening process. It helps organizations to have a smooth and efficient payroll process, as large businesses require lots of resources to manage their employees.

-

Customer Support

Having good customer support can enhance the performance of the business. The payroll process can be more complex and time-consuming, so consider payroll software with dependable and responsive customer support to ensure a seamless experience.

-

Integration with Existing Systems

Payroll integration means linking payroll software with other tools and programs to make data sharing and syncing happen automatically. This integration fosters a more efficient and error-free payroll management system, contributing to overall business effectiveness.

Top 5 Payroll Tools Comparison

Payroll software is an essential tool for businesses of all sizes, helping to streamline the complex process of calculating and managing employee compensation and benefits. With so many software solutions in the market, it can be challenging to determine which is right for your business. To help you make an informed decision, here are the top five payroll software systems:

|

Name

|

Free Trial

|

Demo

|

Pricing

|

|---|---|---|---|

| 7 Days |

Yes |

INR 6999/ Month | |

|

30 Days |

Yes | INR 2495/ Month | |

|

30 Days |

Yes |

INR 46,500/ Month | |

| No |

Yes |

INR 999/ Month | |

|

30 Days |

Yes |

Free Plan |

1. Keka

Keka software is one of the best payroll software, an all-in-one HR payroll platform that enables you to automate your payroll process and achieve complete efficiency. It can do everything from accurately calculating your employees’ salaries to disbursing them directly to their accounts. Moreover, it considers leaving, bonuses, and other pay compensation factors while calculating an individual’s pay. Global brands like Oyo, Aditya Birla, and UpGrad use Keka to manage their payroll process.

- Expense management loans And bonuses

- Leave attendance management

- Attendance management

- GPS Attendance

- Dedicated mobile apps

- Excellent customer service

- User-friendly dashboard

- Easy leave and absence tracking

- A bit complicated to use

- The features can be more advanced

Pricing

- Foundation: 6,999/month (up to 100 employees) +60/month per additional employee

- Strength: 9,999/month (up to 100 employees) +90/month per additional employee

- Growth: 13,999/month (up to 100 employees) +130/month per additional employee

2. Pocket HRMS

Pocket HRMS is a cloud-based payroll software that comes well-equipped with solutions. It offers solutions tailored to industry needs, including manufacturing, construction, real estate, schools, BSFI, etc.

HR personnel can easily prepare and file tax returns using online payroll tool. It can generate necessary tax forms like eTDS Form 24Q. The best thing is that after accurately calculating employees’ salaries, you can automate disbursing the amount to their accounts directly.

- Self-service portal

- Expense management

- Statutory compliance

- Attendance and time tracking

- Employee benefit management

- Convenient and reliable

- Auto-generated payslips

- Use friendly with seamless accessibility

- Intuitive interface

- Lack of search box

- Not suitable for enterprise businesses

Pricing

- Standard: Starting at 2495 /month(for 50 employees)

- Professional: Starting at 3995 /month(for 50 employees)

- Premium: Call for pricing

3. Saral PayPack

Saral PayPack is a simple yet powerful payroll system software designed to meet every aspect of payroll processing. From tracking attendance punch to payslip generation, it is well-equipped with tools to perform every functionality. Payroll software can be deployed on-premise and on the cloud to enable you to access the system on the go. Moreover, the system ensures that your business complies with all laws and regulations, such as PF, TDS, PT, ESI, etc.

- Leave management

- Exit management

- Reporting and analysis

- Reimbursement management

- Employee self-service

- Simple and easy to use

- Customizable

- Advanced features

- Advanced Reporting

- Customer service can be improved

- Pricing is on the higher spectrum

Pricing

- Standard: 46,500/single user, 70,800 for Multi-user

- Corporate: 100,500/single user, 123,000 for Multi-user

- Premium: On request

4. 247HRM

247HRM Software offers a complete HR-related solution - from payroll and taxes to performance management. With its interactive dashboard, you can easily keep track of every activity and interaction with visual charts. The employee self-service portal accelerates basic HR processes, such as task management, scheduling, and leave requests. There is also a help desk where employees can communicate directly with HR if they have any queries.

- Custom workflows

- Performance appraisal

- Skill management

- Statutory compliance and income tax

- Payroll and expense report

- Reliable customer support

- Generation of reports in real-time

- User-friendly interface

- Customized reporting

- UI needs improvement

- Features are very basic

Pricing

- 247HRM Seed: 1999/Monthly

- 247HRM Shot: 2999/Monthly

- 247HRM Sapling: 3999/Monthly

- 247HRM Tree: 4999/Monthly

5. Zoho Payroll

Zoho Payroll is a leading online payroll software streamlining payroll processes. It acts as a centralized database for all your employees’ information and records and allows you to schedule payroll processing. Zoho tool is well-known for its high accuracy and ability to file returns.

Zoho Payroll ensures that your company complies with all applicable laws and regulations in India. Companies like Indiefolio, Tartlabs, Webcasts, and more trust Zoho Payroll for their payroll activities.

- Supports diverse salary structures

- User and access control

- Salary and payslip templates

- Loan management

- Secure employee portal

- Password-protected files

- Fast and straightforward to use

- Affordable pricing

- User-friendly interface

- The application does not allow easy navigation

- Limited features

Pricing

- Free plan

- Premium plan: 50/employee/month billed annually

Challenges Faced While Using Payroll Software

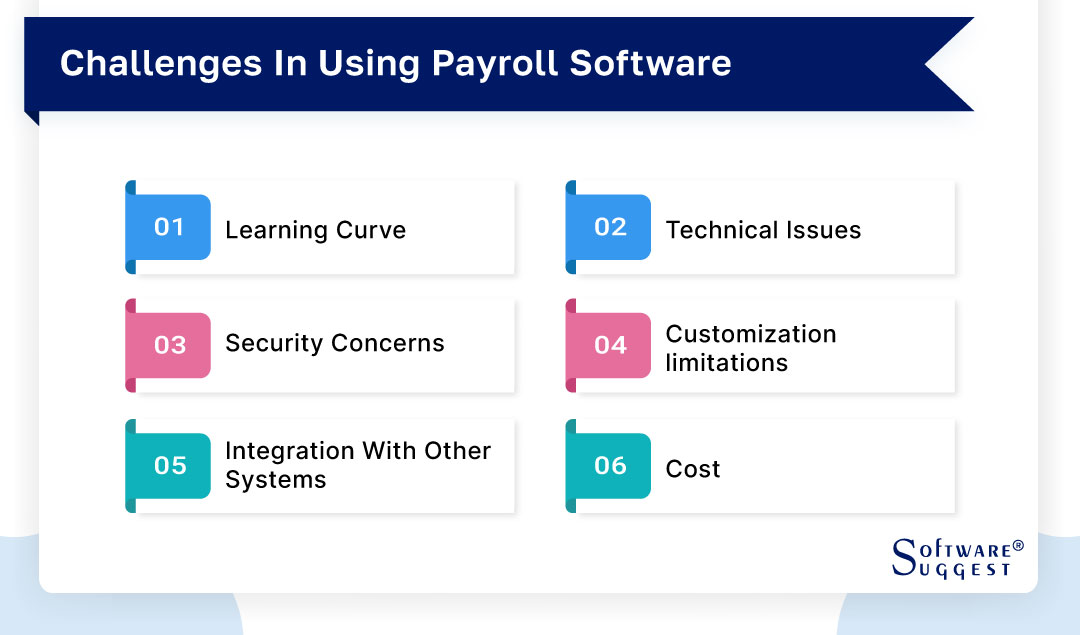

There are many challenges to using payroll software. Some common challenges that users may face while using the software are:

-

Learning curve

Payroll software can be complex and require time to learn and become proficient.

Users may need to invest time in training, reading documentation, and exploring the software to understand its full potential.

-

Technical issues

Payroll programs can sometimes have technical issues, such as bugs, system crashes, or compatibility problems with other software. These issues can disrupt the payroll process and cause delays or errors.

-

Security concerns

Payroll data is highly sensitive and confidential, and users must ensure that the software they use is secure and compliant with data privacy regulations. Any security breach can result in a loss of trust and legal and financial implications.

-

Customization limitations

Depending on the software, some users may find that the software does not meet all their specific payroll needs or does not allow for customization. This can result in workarounds or additional manual work.

-

Integration with other systems

Payroll tools may need to integrate with other systems, such as HR or accounting. Integration can be challenging, and users may face compatibility issues, data inconsistencies, or synchronization problems.

-

Cost

Payroll software can be expensive, and users may need to balance the cost of the software against the benefits and savings it can provide. Some users may find the cost prohibitive and need to look for alternatives.

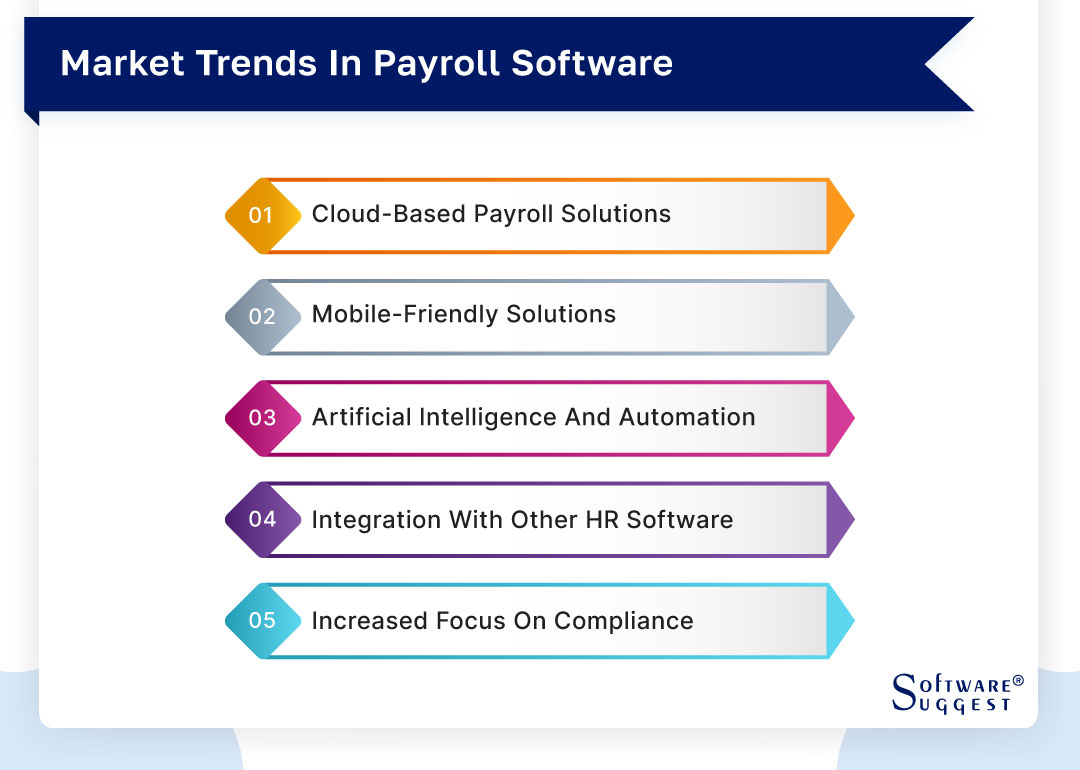

Current Market Trends In Payroll Tool

The payroll software market is evolving to meet the changing needs of companies and employees. These trends will likely shape the industry in the coming years.

-

Cloud-based payroll solutions

One of the biggest trends in payroll software is the shift toward cloud-based solutions. These solutions offer greater flexibility, accessibility, and scalability than on-premise systems, allowing companies to manage payroll data securely and from anywhere.

-

Mobile-friendly solutions

As more employees work remotely or from mobile devices, payroll software vendors are developing mobile-friendly solutions that enable employees to access their pay stubs, benefits information, and other payroll-related data from their mobile devices.

-

Artificial Intelligence and Automation

Payroll software providers integrate artificial intelligence (AI) and automation features into their products to streamline processes, reduce errors, and improve efficiency. AI-powered solutions can automate tax calculations, wage deductions, and compliance reporting, freeing HR and payroll staff to focus on more strategic tasks.

-

Integration with other HR software

Another trend in payroll software is integration with other HR software, such as time and attendance tracking, benefits administration, and performance management systems. By integrating these systems, companies can streamline their HR processes and ensure that all employee data is accurate and up-to-date.

-

Increased focus on compliance

With ever-changing regulations and tax laws, compliance is a top priority for payroll software vendors. They are developing solutions that help companies stay up-to-date with regulations and ensure their payroll processes comply with local and federal laws.

Conclusion

Payroll software is critical for any business to efficiently manage employee compensation and benefits. Best payroll systems can automate complex calculations and streamline administrative tasks, helping to reduce errors, save time, and improve compliance with regulations.

Whether your business is large or small, many payroll software solutions can meet your specific needs, from basic payroll processing to more advanced HR tools. By investing in the right payroll software, businesses can focus on their core operations and free up valuable time and resources for other important tasks.

Related Articles

- Cash Burn Rate : Definition & How to Calculate it?

- Must-Check Best Payroll Apps For Android

- Top Payroll Software for Recruitment Agencies

- Ways to Defeat Payroll Costs: All You Need to Know

- Typical Payroll Accounting Software Problems & Solutions

- How do ESS Portals Help in Managing Payroll issues?

- Understanding The Fluctuating Workweek Method & Overtime Calculation

- Top Hourly Paycheck Calculator Can Make Your Life Easy

- Tips for Successful Payroll Management Services

- Why Use Payroll Automation?

- Best Payroll Practices to Definitely Work

- What is Payroll Tax: Purpose, Types & Example in 2024

- Factors to Consider if Replacing Payroll System is your Next Move

- Forget Manual Payroll: Reasons to Switch to Payroll System

- Comparison Between Manual Payroll vs. Automated Payroll System in 2024

- 15 Best HR & Payroll Templates In Excel for Free Download

- Comprehensive and Effective Ways of Using a Payroll System

- Difference Between HR and Payroll Software

- Pros and Cons of Outsourcing Payroll for Your Business

- New Pay Trends: How Employees Reshaping The Payroll System

- Payroll Security: 12 Best Practices to Protect Your Business Data

- Bi-weekly vs. Semi-monthly Payroll: Key Differences and Benefits

- Top 10 Open Source and Free Payroll Software

- What Is Global Payroll? Benefits, Challenges, and Solutions

- What Is a Pay Stub? A Comprehensive Guide with Examples

- Top 5 Payroll Trends To Watch Out In 2024

FAQs

The average cost of payroll software is around $10 to $30 per employee per month.

Small Businesses are everywhere, and the competition is higher than ever due to start-ups emerging daily. One way to retain your position in the market is to hire and retain the most talented employees. And to do that, you need to pay attention to every small detail that keeps your employees satisfied.

Small businesses need payroll due to the following reason:- No Technical Expertise is Needed

- Saves a Lot of Time:

- Customizable Enough to Fit Small Business Needs

By Countries

By Cities

By Industries

- Advertising

- Agriculture

- Architecture

- Auto Dealership

- Banking

- Banking & Mortgage

- Construction

- Consulting

- Distribution

- Education

- Engineering

- Food & Beverage

- Government Agencies

- Government Contractors

- Healthcare

- Hospitality

- Insurance

- Maintenance & Field Service

- Manufacturing

- Media & Newspaper

- Nonprofit

- Oil & Gas

- Pharmaceuticals

- Real Estate

- Retail

- Transportation

- Trading

- Textile

- Financial

- Hotel & Restaurant

- Sales

- Fashion

- PSA

- Talent Management

- eCommerce

- FMCG

.png)

.png)