ABLE Platform

What is ABLE Platform?

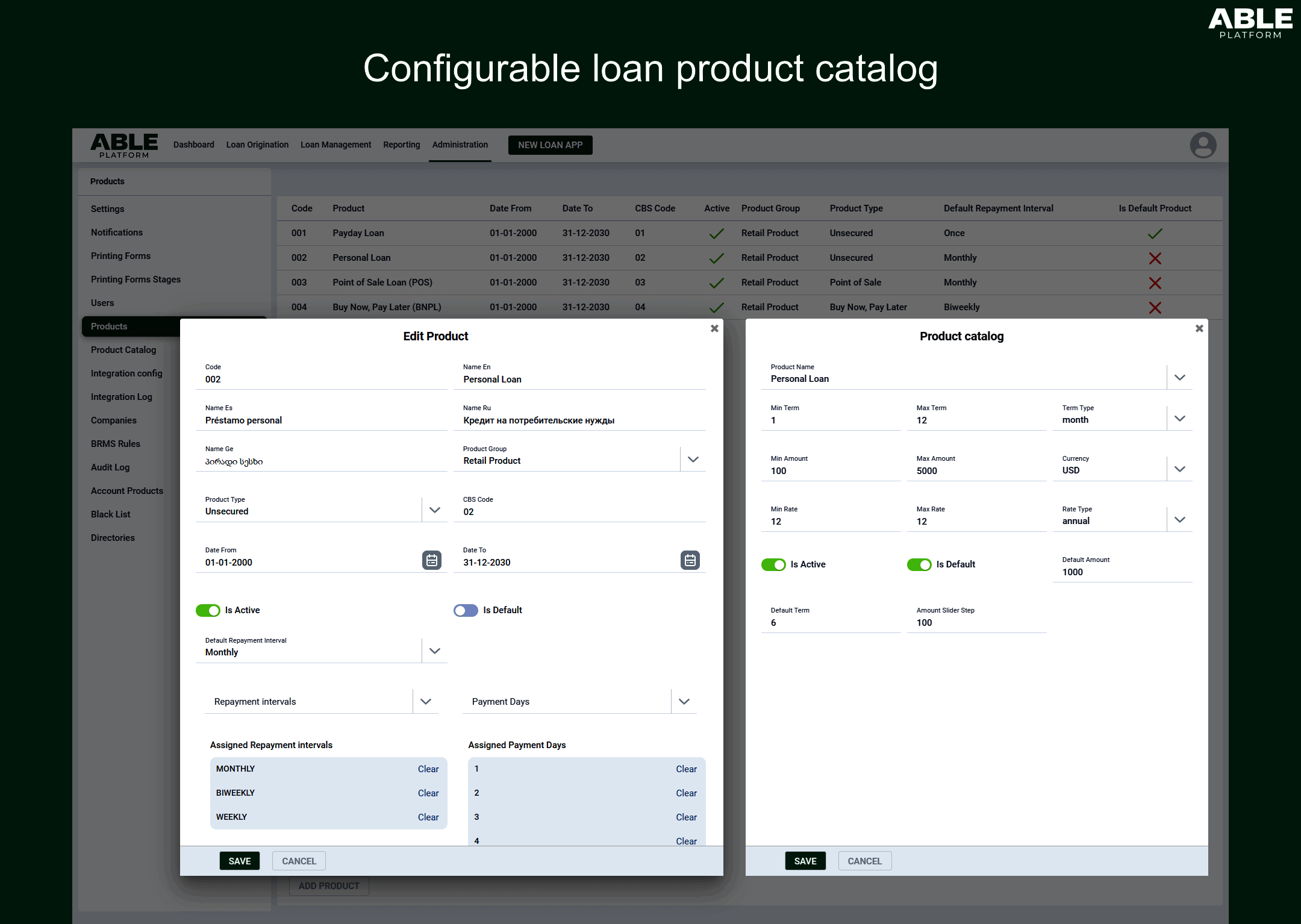

ABLE Platform completely automates the processes of loan origination and loan management for banks, fintechs, retail lenders and microfinance. Manage incoming loan applications, service disbursed loans, configure the loan product catalog, built-in dashboards and more.

ABLE Platform Starting Price

Our Awards and Recognition

Talk with a software expert for free. Get a list of software that's great for you in less than 10 minutes.

Key Features of ABLE Platform

Here are the powerful features that make ABLE Platform stand out from the competition. Packed with innovative tools and advanced functionalities, this software offers a range of benefits.

- Audit Trail

- Document Management

- Fee Management

- Contact Management

- Commission management

- Customer DataBase

- Point of Sale (POS)

- Performance Metrics

- Compliance Management

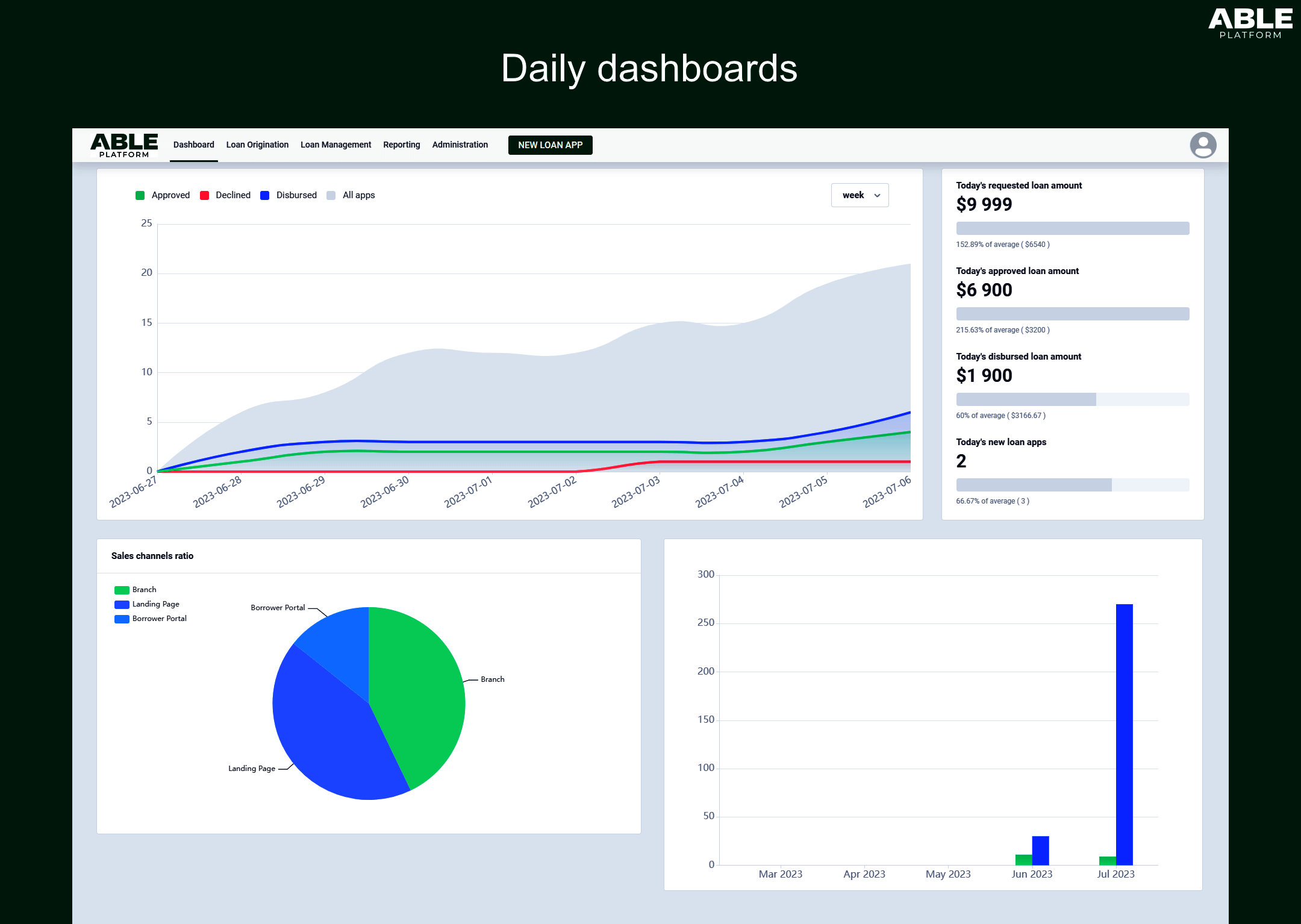

- Dashboard

- Activity Tracking

- Pipeline Management

- Version Control

- Risk Management

- Rules-Based Workflow

- Client Management

ABLE Platform Specifications

Get a closer look at the technical specifications and system requirements for ABLE Platform. Find out if it's compatible with your operating system and other software.

ABLE Platform Description

Here's the comprehensive description of ABLE Platform. Gain a brief understanding of its unique features and exceptional benefits.

ABLE Platform is a multi-module lending web-software that covers the entire loan origination and loan management processes.

The following modules are included:

- Landing page & Borrower portal - to attract and serve borrowers;

- Self-service portal - to manage the whole enterprise activity;

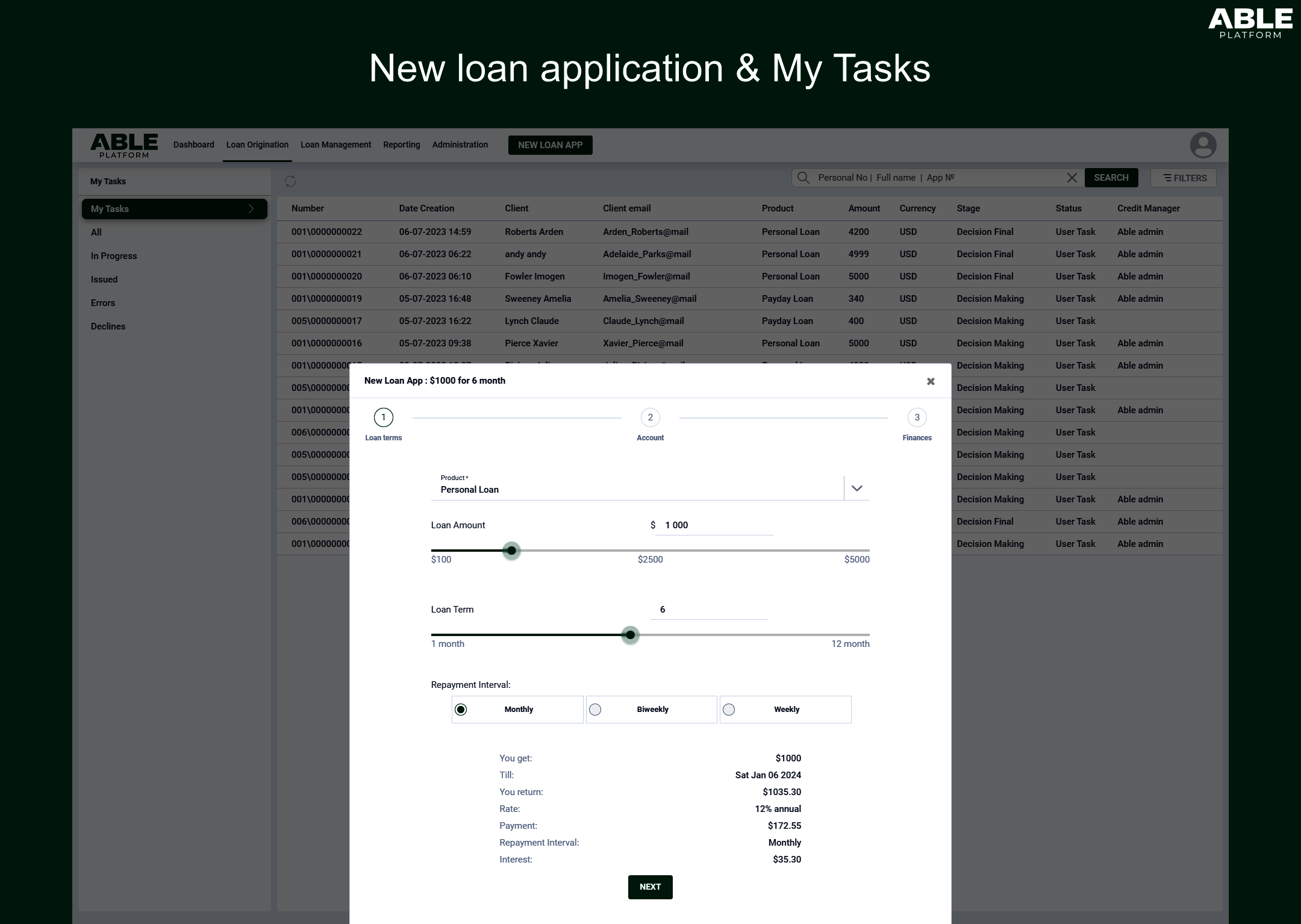

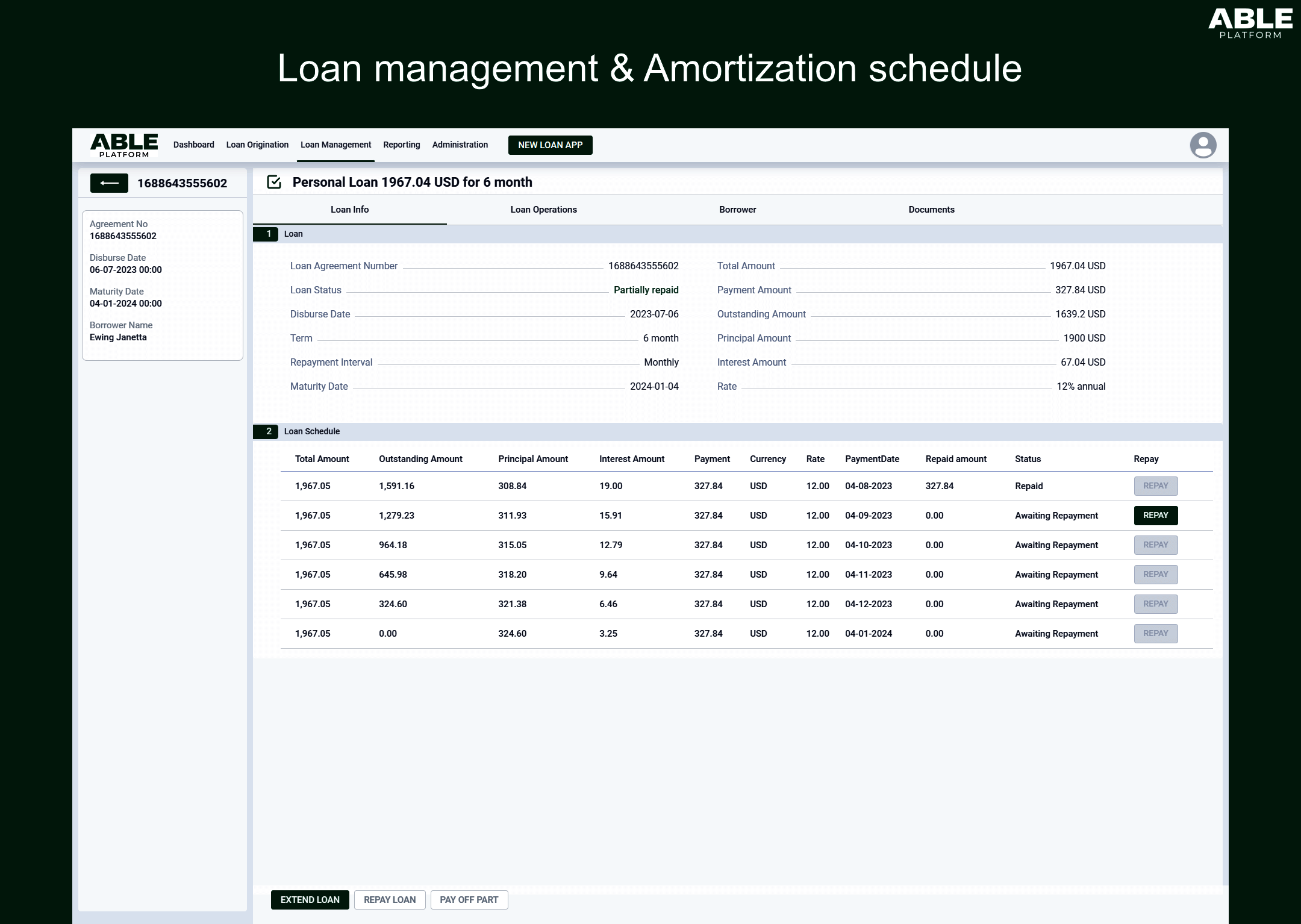

- Backoffice - the core of the platform: manage incoming loan applications, service disbursed loans, configure the loan product catalog, built-in dashboards and more.

The platform can be used as SaaS or On-Premise.

Core Features

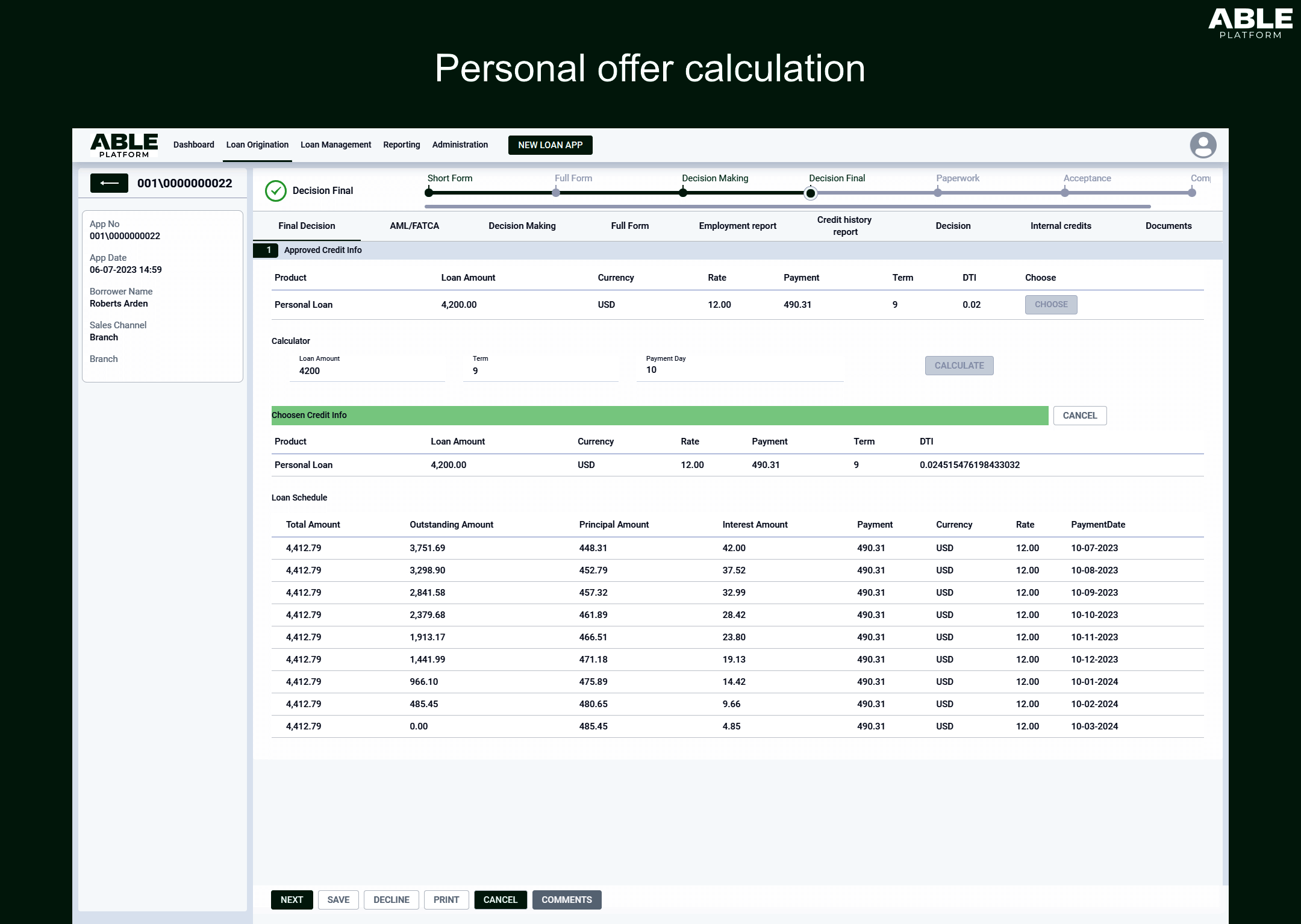

- Personal offers calculation

- Credit scoring

- Rules configuration

- Visual UI

- Scorecards of any type

- AI-driven technologies

- ML algorithms

- 360° customer view

- 400+ pre-configured permissions

- APIs for integration of partner systems

- Testing tools

- Decision strategy calculation

- Analytical reports

ABLE Platform Benefits

- 2-4 months is the average time to market

- <1 sec. loan application processing

- <15 min from application to disbursement

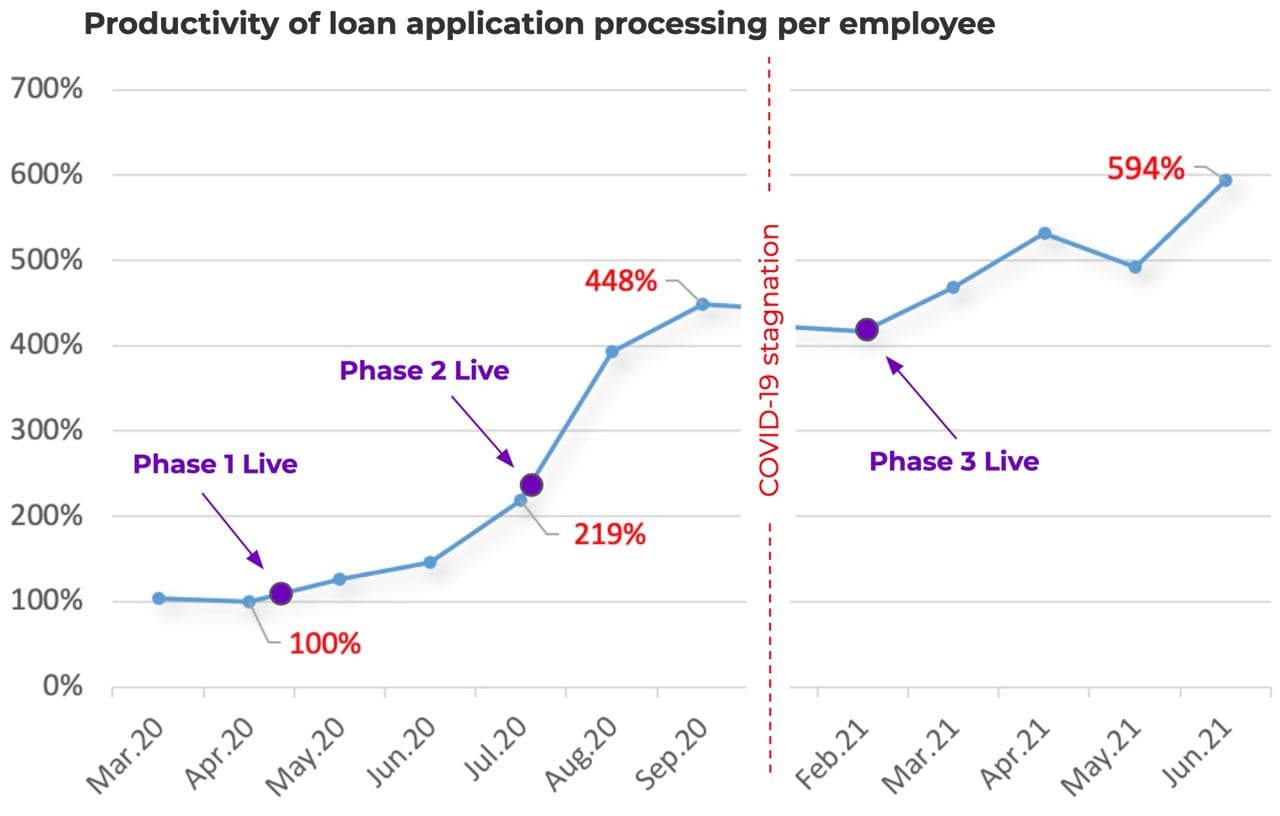

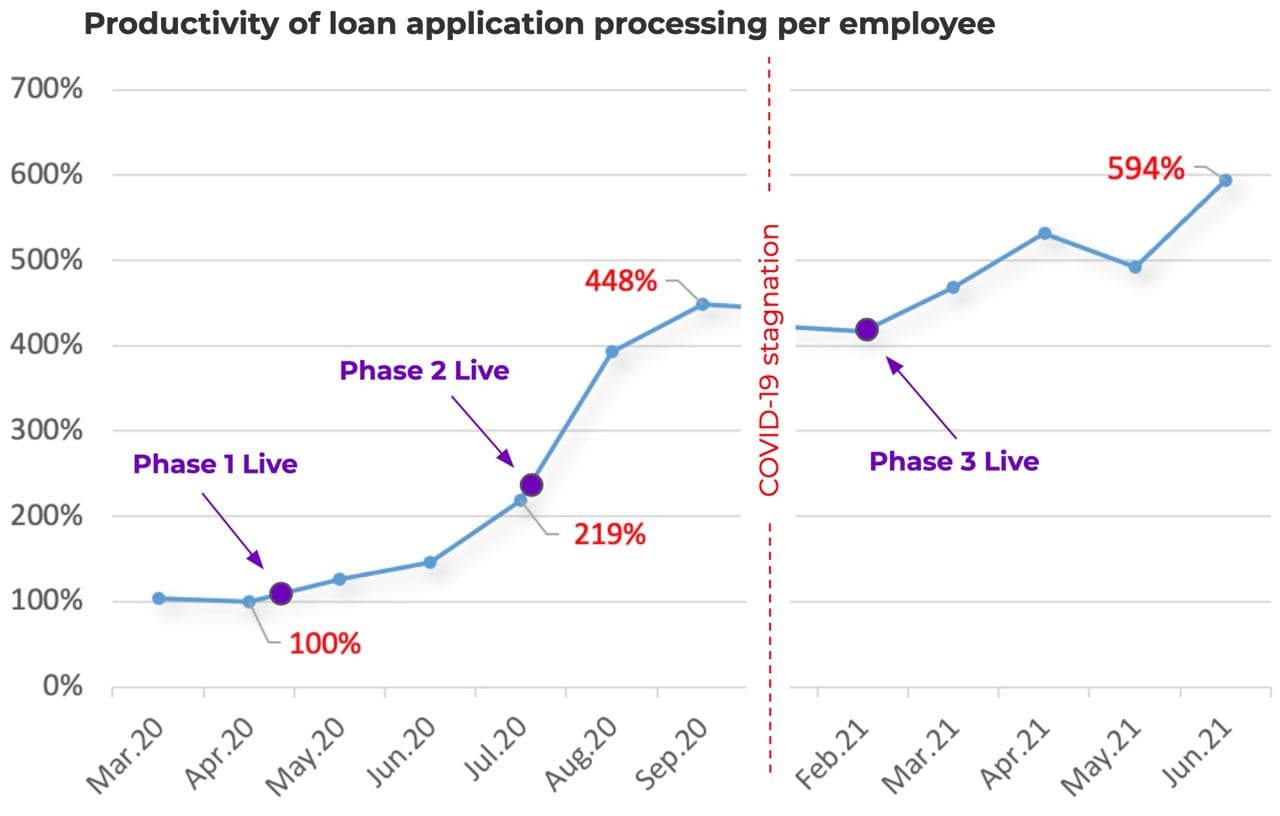

- 600% growth of productivity

- 100% customizable platform

Target Market

Designed for financial institutions worldwide: banks, microfinance institutions, fintechs, retail and alternative lenders, auto-dealers, mortgage lenders and more.

ABLE Platform Resources

ABLE Platform Videos

Overall ABLE Platform Reviews

Thinking about using ABLE Platform? Check out verified user reviews & ratings based on ABLE Platform's features, user-friendliness, customer support, and other factors that contribute to its overall appeal.

ABLE Platform Pros and Cons

"Really mature software for retail and SME loan origination and management. We could create and manage hundreds of loan products. User friendly interface design."

"Many features out-of-the-box. Document management module. Convenient product catalog. No-code decision engine. The team is mature at integrations."

"We had to handle multi-currency."

"Dashboard could be adjusted."

2 ABLE Platform Reviews

Hear directly from customers who have used ABLE Platform. Read their experiences, feedback, and ratings to gain valuable insights into how this software has benefited their businesses.

Vladimir

Used the software for : 2+ years

Company Size :51-200 employee

It improved our productivity

After the implementation of the ABLE Origination solution by RNDPOINT we have drastically improved our productivity and operational efficiency. During the first phase of implementation only, we achieved x2 boost of processed applications.

ABLE Platform Mobile App Experience

ABLE Platform After Sales Service Rating

What do you like best about ABLE Platform?

Really mature software for retail and SME loan origination and management. We could create and manage hundreds of loan products. User friendly interface design.

What do you dislike about ABLE Platform?

We had to handle multi-currency.

Do you think ABLE Platform delivers value for the money spent?

Yes

Are you satisfied with ABLE Platform features?

Yes

Did implimentation of ABLE Platform was easy?

Yes

What features is ABLE Platform currently missing?

In the previous version absent multi-currency. But corrected by now.

What other products like ABLE Platform have you used or evaluated?

ABLE Management and ABLE Scoring.

How ABLE Platform is better/different from its competitors?

It is not only about the product itself. Though the product is really good. It is also about the team. RNDPOINT has a fantastic team of experts that can deliver.

PaulM.

Used the software for : 2+ years

Company Size :51-200 employee

Modern solution for Loan Origination and Management

The platform has many features. It also has modular structure. So one can pick necessary modules for his business. I was surprised by integration level. Also there're many customer acquisition channels supported.

ABLE Platform Mobile App Experience

ABLE Platform After Sales Service Rating

What do you like best about ABLE Platform?

Many features out-of-the-box. Document management module. Convenient product catalog. No-code decision engine. The team is mature at integrations.

What do you dislike about ABLE Platform?

Dashboard could be adjusted.

Do you think ABLE Platform delivers value for the money spent?

Yes

Are you satisfied with ABLE Platform features?

Yes

Did implimentation of ABLE Platform was easy?

Yes

What features is ABLE Platform currently missing?

No

What other products like ABLE Platform have you used or evaluated?

ABLE Scoring and no-code decision engine for risk strategies.

How ABLE Platform is better/different from its competitors?

Modular architecture. Many features out-of-the-box.

Alternatives of ABLE Platform

Explore alternative software options that can fulfill similar requirements as ABLE Platform. Evaluate their features, pricing, and user feedback to find the perfect fit for your needs.

ABLE Platform FAQs

What are the top 5 features for ABLE Platform?

The top 5 features for ABLE Platform are:

- Audit Trail

- Document Management

- Fee Management

- Contact Management

- Commission management

What type of customer support is available from ABLE Platform?

The available support which ABLE Platform provides is:

- Phone

- Live support

- Tickets

- Training

Where is the headquarters/company of ABLE Platform located?

The headquarters/company of ABLE Platform is located at London.