Best Accounts Receivable Software

The top accounts receivable software in 2024 are CaptainBiz, Vyapar - Accounting & Invoicing, Zoho Books, QuickBooks, and Sage Business Cloud Accounting. These accounts receivable management software are designed to improve invoicing and payment processes for businesses, leading to enhanced accounts receivable management.

No Cost Personal Advisor

List of 20 Best Accounts Receivable Software

Category Champions | 2024

Online Accounting Software for Growing Businesses

Simple, easy-to-use business accounting system to help you manage your accounts online. You can download 14 days free trial of Zoho books. Zoho Books is an easy-to-use, online accounting software for small businesses to manage their finances and stay on top of their cash flow. Read Zoho Books Reviews

Explore various Zoho Books features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Zoho Books Features- e-Payment

- Data Backup and Restore

- Multi Company

- Online Accounting

- Monthly GST Report

- Accounting Management

- Taxation Management

- Multiuser Login & Role-based access control

Pricing

Zoho Books Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Invoice to Cash Flow Solution

Gaviti is an invoice to cash flow automation solution that helps accounts receivable teams make better reduce DSO, issue credit with less risk, and reconcile payments faster. Learn more about Gaviti

Explore various Gaviti features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Gaviti Features- Credit Bureau Reporting

- Partial Payments

- Credit Risk Management

- Client Management

- In-House Collections

- ACH Payment Processing

- Dashboard

- Risk Management

Pricing

Gaviti Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

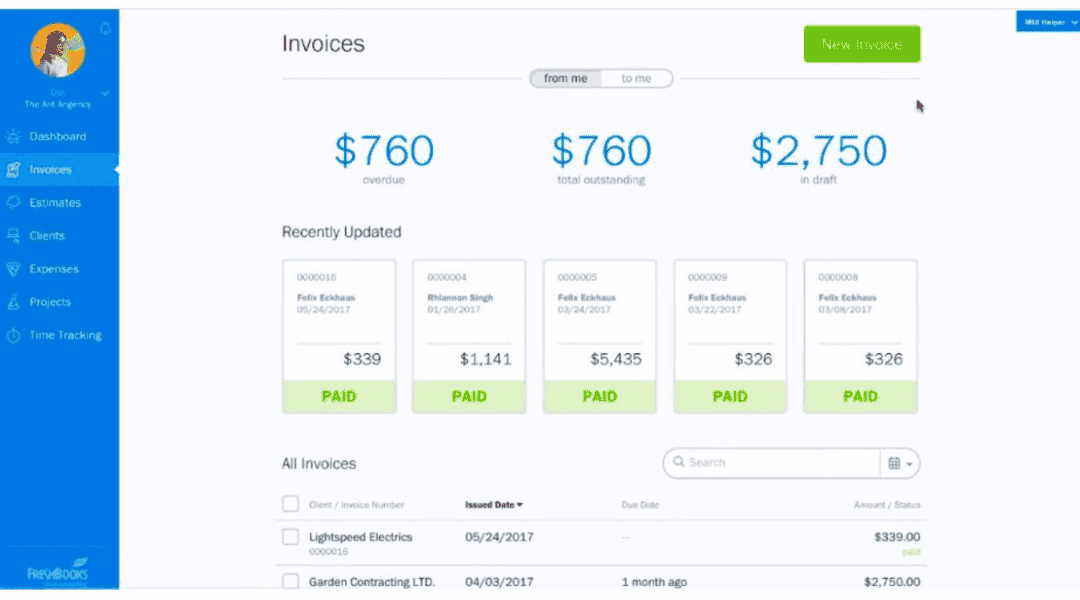

Cloud Accounting Software Making Billing Painless

This bookkeeping software makes your accounting tasks easy, fast and secure. Start sending invoices, tracking time, and capturing expenses in minutes. We uphold a longstanding tradition of providing extraordinary customer service and building a product that helps save you time because we know you went into business to pursue your passion and serve your customers - not to learn to account. Read FreshBooks Reviews

Explore various FreshBooks features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all FreshBooks Features- Bookkeeping

- ACH Check Transactions

- Reminders

- Late Fee Calculation

- Work order management

- Customizable invoices

- Invoice Management

- Workflow Management

Pricing

FreshBooks Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Leading cloud-based business management solution

Oracle Fusion Cloud ERP is a cloud-based, end-to-end, business management solution designed for mid to enterprise-level customers with advanced capabilities. Read Oracle Fusion Cloud ERP Reviews

Explore various Oracle Fusion Cloud ERP features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

- Historical Reporting

- Project Management

- Warehouse Management

- Appointment Scheduling

- Commission management

- Quotes/Proposals

- Version Control

- Audit Management

Oracle Fusion Cloud ERP Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

A Businessman's Best Friend

Vyapar is a GST-compatible invoicing and accounting solution for small businesses. You can use it to create GST bills, fulfill orders, generate GSTR reports, track payments/expenses, and manage your inventory. Besides, you can use it to customize invoices and collect payments online. Read Vyapar Reviews

Explore various Vyapar features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Vyapar Features- Budgeting

- Data Backup Scheduling

- Data Import & Export

- For Retail

- Account Management

- Customer Management

- Item Management

- Real Time Synchronization

Pricing

Silver- Desktop (1 year)

$ 40

Device/Year

Silver- Desktop + Mobile (1 year)

$ 47

Device/Year

Silver- Desktop (3 years)

$ 92

Device/ 3 Years

Vyapar Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Plug and Play Cloud ERP Solutions

TYASuite Procurement software is designed to effectively drive down costs, improve cash flow & automate multi-layered approval processes, in a single view. Read TYASuite Procurement to Pay Reviews

Explore various TYASuite Procurement to Pay features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

- Document Management

- Budget Management

- Task Management

- Duplicate Payment Alert

- Spend Analysis

- Global Sourcing Management

- Order Fulfillment

- Requisitions & Approvals

Pricing

Start-up (Post Series B) 50+ Users

$ 12

Per Month

Start-up (Pre-Series C) 10 to 50 Users

$ 14

Per Month

Startup Plan Up to 10 Users

$ 17

Per Month

TYASuite Procurement to Pay Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Software by Invoiced

Invoiced is a fully featured Billing & Invoicing Software designed to serve SMEs, Enterprises. Invoiced provides end-to-end solutions designed for Windows. This online Billing & Invoicing system offers Tax Calculator, Online Payment Processing, Customizable invoices, Online payments, Partial Payments at one place. Learn more about Invoiced

Explore various Invoiced features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Invoiced Features- Invoice Processing

- Multi-Currency

- Partial Payments

- Dunning Management

- Online Payment Processing

- Recurring Billing

- Billing Portal

- Online payments

Pricing

Startup

$ 50

Per Month

Growth

$ 100

Per Month

Invoiced Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Making Modern Businesses GST friendly

QuickBooks is an online accounting software for business owners to make stay on top of their finances. Easy to use interface, 100% data security and features such as Online bank connect and Whatsapp integration helps business owners to focus on growing their business. Read QuickBooks Online Reviews

Explore various QuickBooks Online features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all QuickBooks Online Features- GST returns

- Vat

- Billing System

- Invoice Processing

- Inventory control

- VAT / CST / GST Reports

- Expense Tracking

- Reconcile Statements

Pricing

Simple Start

$ 30

Per Month

Essentials

$ 60

Per Month

Plus

$ 90

Per Month

QuickBooks Online Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Special offer of 40% off for new customers | Valid until 30th November

Sage Business Cloud Accounting software is designed to meet the needs of start-ups, sole traders and small businesses. Choose the right plan for your business that allows you to track and send invoices, track what you’re owed, calculate and submit VAT and more. You can also add Payroll as part of your purchase. Visit Sage to buy now and save, or take out a free trial. Read Sage Accounting Reviews

Explore various Sage Accounting features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Sage Accounting Features- AutoEntry

- Mobile App

- Compliance Management

- Accounting Integration

- Intelligence Reporting

- Recurring Billing

- Invoice

- Compliance Reporting

Pricing

Start

$ 5

Per Month

Standard

$ 10

Per Month

Plus

$ 12

Per Month

Sage Accounting Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

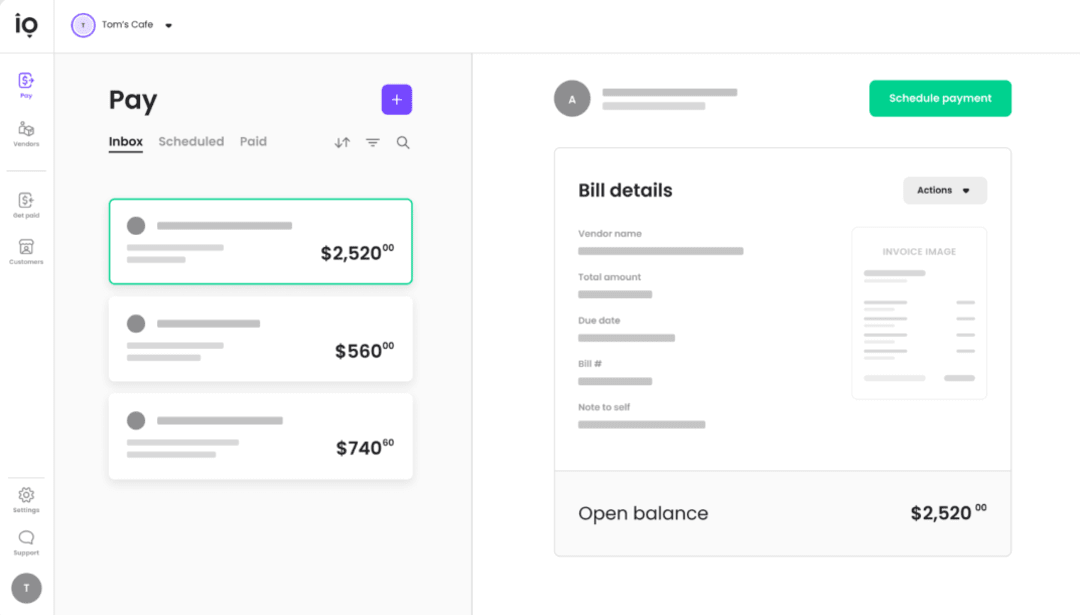

Software by Bill.com

Bill.com is complete online-based accounting software for ACH payments, and send electronic invoices and payment reminders. It takes less time to solve the problem and unique content of the site attracts to users. Read Bill.com Reviews

Explore various Bill.com features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Bill.com Features- Check Processing

- Fixed Asset Management

- Manufacturing

- Online Payment Processing

- ACH Payment Processing

- Payment Handling

- Collection management

- Accounts Receivable

Pricing

Essential

$ 29

User/Month

Team

$ 39

User/Month

Corporate

$ 59

User/Month

Bill.com Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

The Cloud ERP

Founded in 2008, Acumatica is a future-proof Cloud ERP solution for managing the complexities of distribution such as purchasing, ordering, tracking inventory, filling orders, and delivering customer support. Read Acumatica Reviews

Explore various Acumatica features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Acumatica Features- Returns Management

- Warehouse and Fulfillment

- Purchasing

- Backorder Management

- Invoice Processing

- Transportation Management

- Quotes/Estimates

- Account Management

Acumatica Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Software by Open Systems Inc.

TRAVERSE Distribution software allows you to penetrate new markets, maintain customer loyalty, and improve your ability to serve your existing customers. Getting your products to customers smoothly and efficiently is even better. You can have it all with the TRAVERSE Distribution software suite of applications. Learn more about Traverse Distribution

Explore various Traverse Distribution features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

- Purchasing

- Collection management

- Returns Management

- Order Management

- Performance Tracking

- Overpayment Processing

- Billing Management

- Shipping Management

Traverse Distribution Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Software by VersaPay Corporation

VersaPay is a well operational accounts receivable software with lots of updated features that can manage the inflow of cash with greater efficiency. Resentment, collaboration, collections payment, and cash application are managed ably by it. Read VersaPay Reviews

Explore various VersaPay features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all VersaPay Features- Partial Payments

- Online Payment Processing

- Overpayment Processing

- Recurring Billing

- Check Processing

- Collection management

- ACH Payment Processing

- Receipt Management

VersaPay Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Software by Quadient

YayPay is the current finance management tool for expanding productivity, cash flow, and CRM software. Advanced qualities i.e dynamic report, record ERP, email, and receipts, and store old data. It takes very less time to complete all the qualities. Learn more about YayPay

Explore various YayPay features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all YayPay Features- Partial Payments

- Accounting Management

- Accounting Integration

- Income Statements

- Billing & Invoicing

- Collection management

- Data Import & Export

- Accounting

YayPay Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Software by Passport Software, Inc

PASSPORT is the main company accounting software for ACA reporting solutions. It's having characteristics i.e reliable, outstanding support of us, gather all the data and delete unnecessary data and give risk-free solutions. This is one of the best accounting software suitable for SME's size of businesses. Learn more about Passport Business Solutions

Explore various Passport Business Solutions features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

- Billing & Invoicing

- Accounts payable

- Accounts Receivable

- Accounting

- Check Processing

- Tax Management

- Expense Tracking

- HR & Payroll

Passport Business Solutions Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Captain Biz is a sales and purchase invoice manage

CaptainBiz is a simple-to-use software solution to manage your business hassle-free. Generate tax invoices, track inventory in real-time, manage customers & suppliers, and monitor cash & bank transactions, all in one place, over PC or mobile. Endorsed by GST govt. of India as an affordable and easy-to-use solution for both GST and non-GST companies. Read CaptainBiz Reviews

Explore various CaptainBiz features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all CaptainBiz Features- Sales Analyse Report

- GST audit report

- Billing & Invoicing

- GST Tax Invoice

- Responsive Support

- Reporting

- SMS Integration

- Financial Management

CaptainBiz Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Software by Vanguard Systems, Inc

Vanguard System is an Accounts Receivable Management Software for small business that manages all kind of account management at an improved pace. It streamlines Email Invoices, has an intuitive AR system, set filters for ad-hoc reporting. Learn more about Vanguard

Explore various Vanguard features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Vanguard Features- Collection management

- Invoice Processing

- Receipt Management

- Online Payment Processing

- Check Processing

- Overpayment Processing

Vanguard Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Power of Simplicity

TallyPrime is one of the leading business management solutions in the world, known for its accounting, stock control, reporting and payroll features. With TallyPrime, you don’t need to pay extra for additional features, which makes it affordable for small and medium businesses. It is used by 2 million businesses worldwide. Read TallyPrime Reviews

Explore various TallyPrime features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all TallyPrime Features- Reports

- Online document storage (back-up)

- Loan & Advances Management

- Voucher Management

- Data Exchange Capabilities

- Fund accounting

- Quotation & Estimates

- Accounting

TallyPrime Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Australia's #1 Accounts Receivable Software

ezyCollect is the top debetors management company. Provide the fastest and most reliable solution for the accounting. Quickly set up and synchronize with accounts, accurately manage the cash flow and with very politely engage with customers. Learn more about ezyCollect

Explore various ezyCollect features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all ezyCollect Features- Collection management

- Customer Management

- Recurring Billing

- Invoice Processing

- Partial Payments

- Billing & Invoicing

- Email Integration

- Overpayment Processing

Pricing

XERO

$ 40

Per Month

MYOB

$ 40

Per Month

ezyCollect Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Software by Nomad Web Ventures Inc

MyAbakus Accounts Receivable Software helps the businesses and non-accounting people handle invoicing, sales data, collection data, cash flow details and more. It lets you perform cash control, inventory control and profitability analysis practically. Learn more about myAbakus

Explore various myAbakus features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all myAbakus Features- ACH Payment Processing

- Check Processing

- Invoice Processing

- Partial Payments

- Overpayment Processing

- Collection management

- Online Payment Processing

Pricing

Starter

$ 17

Per Month

Premium

$ 69

Per Month

myAbakus Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

What is Accounts Receivable Software?

Accounts receivable software automates your accounts receivable process by simplifying data entry, tracking customer payments, and sending billing reminders. You can use it to monitor customer invoices, payment due dates, and cash flow status.

The system also helps keep accurate records of all your financial transactions for tax purposes or other regulatory requirements. Reports generated from AR management software can be used to make data-driven decisions about pricing strategies, inventory management, and marketing campaigns.

What Does Accounts Receivable Software Do?

Accounts receivable solutions help you keep track of customer payments, invoices, and other essential information related to your financial operations. They can also automate your manual processes and reduce your document-tracking workload. It can also help with your approval proceedings like CapEx approval management or operational expenses confirmation.

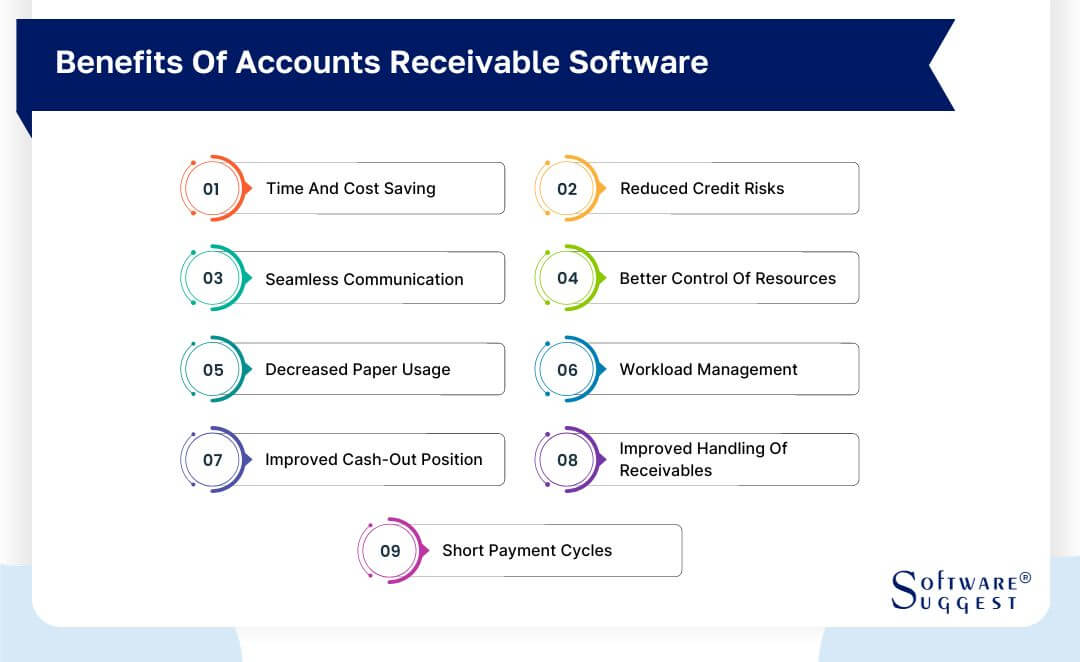

What are the Benefits of Accounts Receivable Management Software?

Accounts receivable management software can be a great asset to any business. It offers many benefits, such as.

-

Time and Cost Saving

The automated nature of the software ensures accuracy in your billing process, not to mention the immense amount of data entry it can easily handle. You don’t have to waste valuable resources and time on manual billing processes and manual data entry.

-

Reduced Credit Risks

Having access to timely information helps reduce risk when providing credit to customers. Accounts receivable programs also allow you to assess your customer’s financial status before extending them credit and build better relationships with existing clients with a history of late payment or bad debt.

-

Seamless Client Communication

With detailed customer account information and tracking capabilities, you can reach out directly to customers with personalized messages and updates on the status of invoices or payments owed. Having a reliable platform for customer communications also helps reduce confusion about billing terms, due dates, and other financial matters.

-

Better Control of Resources

The enhanced ability to monitor and track expenses give you a better understanding of where your money is going and how best to allocate resources. You can also make more informed decisions about financial investments at all levels of your organization.

-

Decreased Paper Usage

By automating many accounting processes traditionally done by hand or with spreadsheets, you can stop relying on paper documents. Accounts receivable tools also eliminate the need for snail mail invoices and check deposits, as it allows customers to securely pay via electronic means, such as credit cards or ACH transfers.

-

Workload Management

Accounts receivable software streamlines the entire AR process of invoicing and collecting customer payments. This frees up time that can be used for more important projects like researching new customer acquisition methods or exploring new markets.

The software can also automate follow-up actions on overdue payments and provide customized reports on account history and performance at any given time.

-

Improved Cash-Out Position

With accounts receivable management tools, you can receive faster payments. The software also helps maintain strong liquidity levels, enabling you to make investments or take advantage of market opportunities. What’s more, the increased speed reduces the risk of late payments, meaning you’re more likely to get paid faster.

-

Improved Handling of Receivables

AR management software offers various methods for tracking customer payments, such as automated payment reminders and streamlined collection processes. It also helps identify overdue payments and ensure that customers are paying on time.

-

Short Payment Cycles

With an accounts receivable platform, you can get paid faster and more reliably. It also helps maintain a better customer relationship by offering more flexible and convenient online payment options.

Additionally, shortened payment cycles allow you to avoid late fees or interest costs associated with delayed payments from customers who fail to meet deadlines.

What are the Features of Accounts Receivable Software?

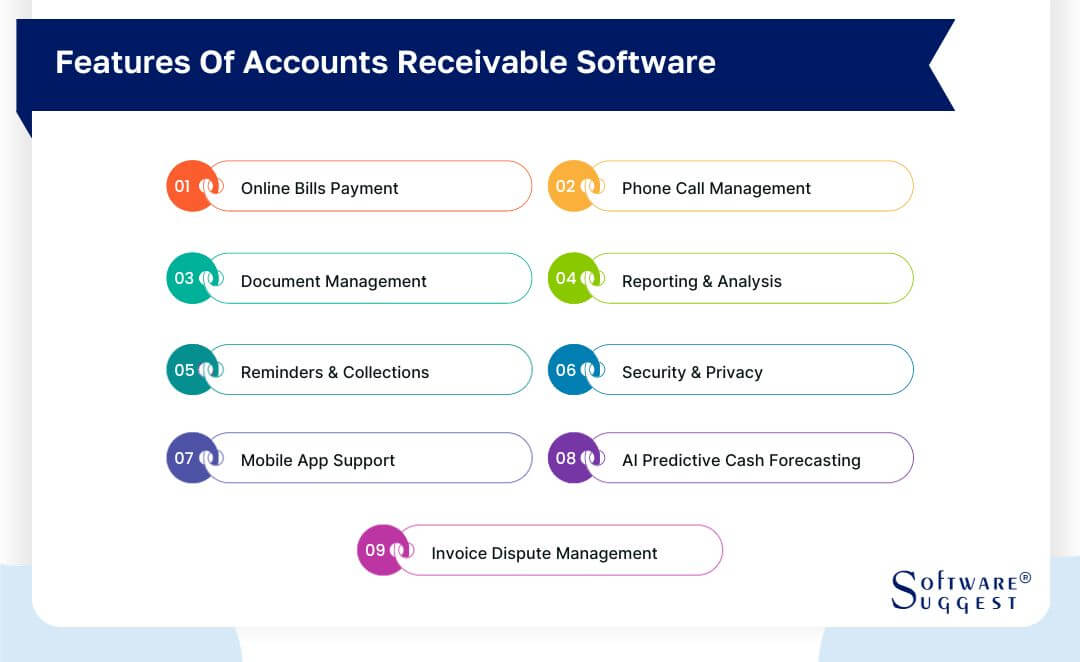

Here are several features that make accounts receivable collections software an invaluable asset for any business.

-

Online Bills Payment

When a customer makes a purchase, they enter their payment information into the system, which is then securely transmitted to your company's bank account for verification. Once verified, the funds are added to your balance sheet in real-time.

-

Phone Call Management

Automatically records each incoming call made by customers. This includes all the necessary details, such as caller information and the duration of the conversation.

-

Document Management

Allows you to create folders and subfolders for file storage, set different levels of user access privileges, label documents with keywords or tags, and comment on specific documents.

-

Reporting and Analysis

Gathers data and creates reports, such as sales figures, inventory levels, customer records, and web traffic analysis. The reports are then analyzed to identify trends and patterns in your company’s performance.

-

Reminders and Collections

Reminders allow you to set up automated emails or text messages that are sent when a customer’s payment is due. Collection tools are also available, such as credit checks, debt collection letters, and payment tracking systems.

-

Security and Privacy

Security features include encryption of data transmissions, two-factor authentication protocols, and limited access controls to prevent unauthorized changes or deletion of customer information.

Privacy features, on the other hand, control how account receivable information is used within your organization by enforcing policies that restrict access only to authorized personnel with specific roles.

-

Mobile App Support

Allows you to log into your account, view invoices, enter payments received, and track payment statuses through a mobile application.

-

AI Predictive Cash Forecasting

Scans customer payment patterns and historical data and then combines them with current market information to accurately predict future payments. It also pulls relevant information from multiple sources, including past orders and customer credit records.

-

Invoice Dispute Management

The disputing process usually begins when a customer finds a discrepancy on their invoice and contacts the business to clarify it. After receiving notification of the dispute, AR management software immediately flags and records it in its system for easy tracking by both parties.

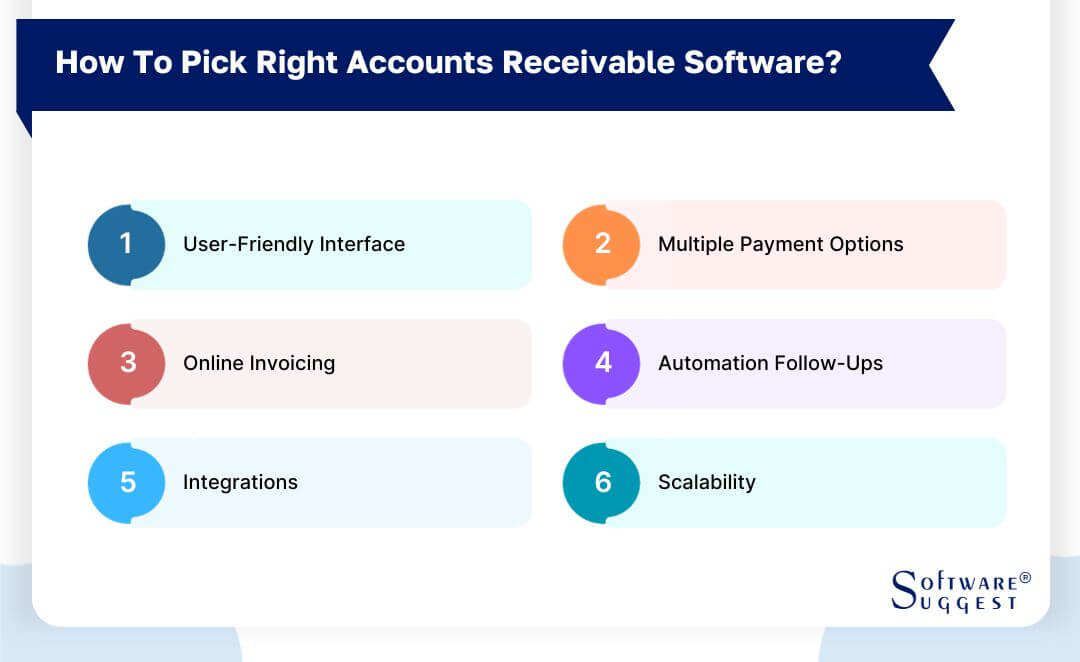

How to Choose the Right Accounts Receivable Software?

To make sure you select the best accounts receivable software for your organization, here are some essential tips to help guide you in making your decision.

-

User-Friendly Interface

Consider whether the software enables users to easily navigate menus, personalize fields according to their company's needs, and efficiently manage data. The goal is you should be able to get up and running without needing much training or technical support from accounts receivable software companies.

-

Multiple Payment Options

An ideal solution should be able to process credit cards, debit cards, e-checks, and even cryptocurrency payments. This means customers can pay quickly and securely with the method they prefer.

-

Online Invoicing

With an online invoicing system, you can create, send, and track electronic invoices easily. Customers can also pay their bills directly from the system without manual processing or paperwork.

-

Automation Follow-Ups

The software should allow you to set up reminders and notifications that will be sent automatically when invoices are due or overdue. It should also include options for sending emails or text messages and tracking customer responses.

-

Integrations

The integration capability will depend on your needs or existing systems. For example, you may need a tool that can integrate with payment gateways or invoicing platforms. The software should be able to connect with your current accounting software to streamline your financial processes.

-

Scalability

If your business is growing rapidly and you need more staff to manage your accounts receivable process, you’ll want software that can handle increased transaction volumes without crashing or slowing down.

Or maybe you're adding new features, such as automated billing and automated payment systems. These are all things that you should be able to do with scalable software in place.

Top 5 Accounts Receivable Software Comparison

|

Name

|

Free Trial

|

Demo

|

Pricing

|

|---|---|---|---|

| Yes |

Yes |

Free to use | |

|

30 Days |

Yes | $19.95/month | |

|

Yes |

Yes |

$979/month | |

| 14 Days |

Yes |

$99/month | |

|

30 Days |

Yes |

$15/month |

Accounts receivable software simplifies the process of tracking invoices and generates reports related to receivables. Here’s a list of the top 5 popular accounts receivable software that you can use to manage your finances:

-

Best for Freelancers and SMBs: Melio

-

Best Cloud ERP Software for Finance: Sage Intacct

-

Best for Nonprofits and Small to Large Businesses: SoftLedger

-

Best for Small to Large Corporations: Oracle NetSuite

-

Best for Freelancers and Small Businesses: FreshBooks

1. Melio

Why We Choose Melio

The leading cloud-based financial management solution for freelancers and small-to-medium-sized businesses. It can sync with your existing accounting software. And the solution has powerful expense-tracking capabilities.

Key Features

- Payment scheduling

- Multiple payment options

- B2B payment transactions

- Payment approval workflows

Pros

- Great customer support

- Free ACH transfers

- Ability to use a credit card

Cons

- Processing of business payments can sometimes be delayed

- Batch processing of payments can be improved

Pricing

- Contact Melio’s team to get custom pricing. Offers free trial. No setup fee.

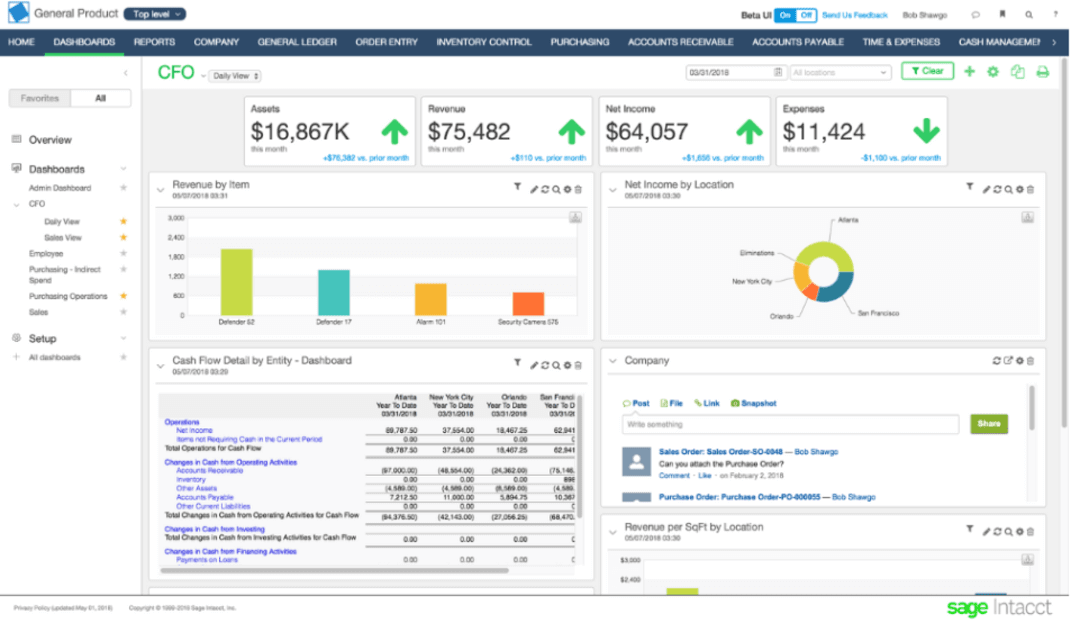

2. Sage Intacct

Why We Choose Sage Intacct

The perfect and affordable solution for nonprofit organizations and businesses of all sizes. It has a multi-entity management feature. And it has accounts receivable automation tools and workflow capabilities.

Key Features

- Payroll management

- Cash flow and workflow customization

- Security features and access controls

- General ledger and configurable accounting system

Pros

- Allows attachment with entries

- Ability to pay bills directly on the platform

- Constant adding and updating of features

Cons

- Fixed asset and prepaid modules can be updated

- Very large transactions may take a very long time to load

Pricing:

Contact Sage Intacct’s team to get a custom quote. Offers premium consulting and integration services. No setup fee.

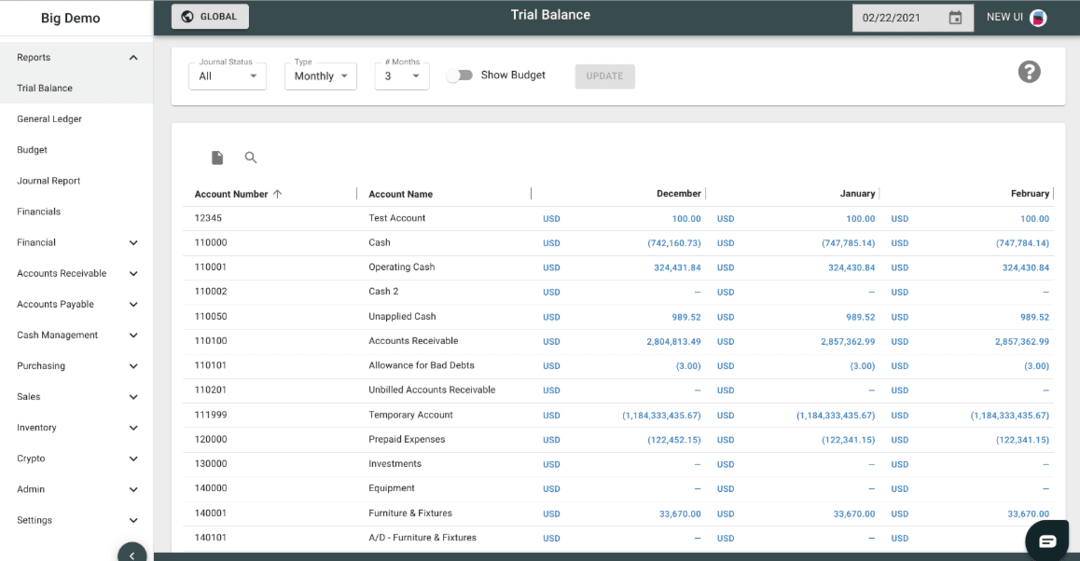

3. SoftLedger

Why We Choose SoftLedger

The best cloud-based solution for SMBs and large corporations. It provides up-to-date data on accounts receivable and accounts payable. It also includes powerful analytics tools. And the software has an automated reconciliation process.

Key Features

- Journals and reconciliations

- Primary and secondary ledgers

- Inventory tracking and automated invoicing

- Credit card processing

Pros

- Very engaging and supportive team

- User-friendly software

- Converts FX transactions with ease

Cons

- The cost for extra users can be highly expensive

- The cryptocurrency module is limited to only one currency

Pricing

- $979/month for SMBs. For enterprises, you may contact SoftLedger’s team to get custom pricing. Offers premium consulting and integration services. A setup fee is required.

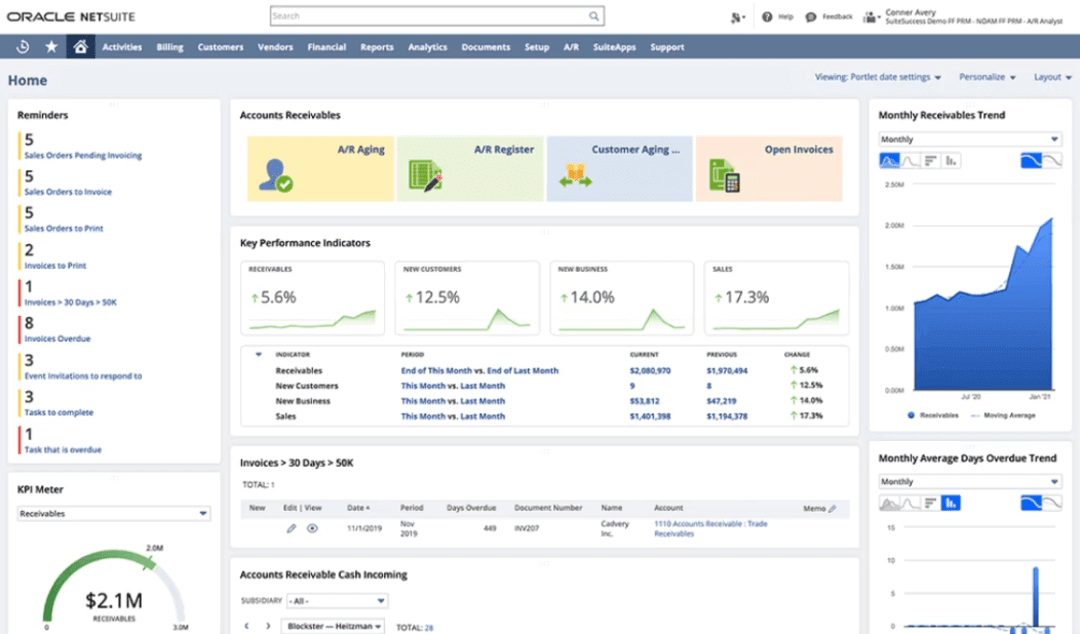

4. Oracle NetSuite

Why We Choose Oracle NetSuite

The top accounts receivable software for small to large corporations. It has a comprehensive financial management suite. And it provides real-time insights into KPIs like cash flow and balance sheet metrics.

Key Features

- Audit trail visibility

- Tax management

- Flexible billing scheduling

- Integrated process workflow

Pros

- Seamless payroll services

- Employee data is easily searchable

- Reports can be customized

Cons

- Financial reporting modules could be simplified

- UI tends to appear a bit clustered for some users

Pricing

- Contact Oracle NetSuite’s team to get a custom quote. No setup fee.

5. FreshBooks

Why We Choose FreshBooks

The best accounts receivable software for small business owners, freelancers, nonprofit organizations, and public administrations. It has an intuitive user interface. It also allows you to create custom reports and export them in various formats. And the software has project-tracking capabilities.

Key Features

- Secure, self-serve portal for clients

- Automatic billing of late fees

- Real time tracking

- Comprehensive financial reporting

Pros

- Easy-to-use interface with great templates

- Customizable invoices

- Multiple payment options

Cons

- Some glitches in invoice processing

- Pricing plans can be a bit confusing

Pricing

- Starts at $15/month for the Lite plan, $25/month for the Plus plan, and $50/month for the Premium Plan. Offers a risk-free 30-day free trial.

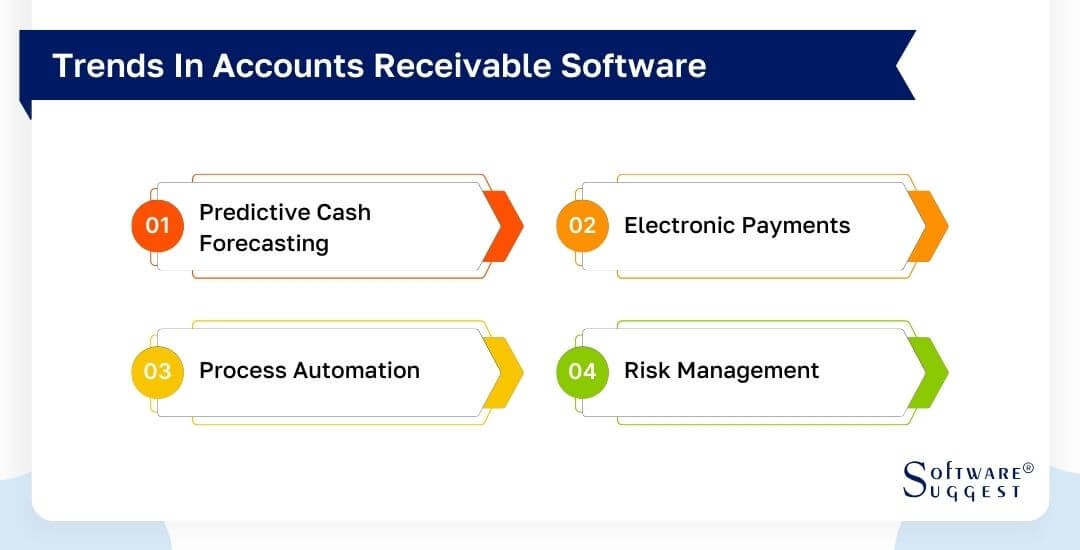

Market Trends in Accounts Receivable Management Software

As technology advances, there are several accounts receivable software trends that accounting firms should be aware of.

-

Predictive Cash Forecasting

With this technology, you can create accurate forecasts that allow you to better anticipate customer payments. It also helps you manage your working capital more effectively, optimize credit decisions, and take care of your overall financial health.

-

Electronic Payments

Make it easy to collect payments directly from customers with minimal hassle. The user-friendly interface also lets you set up your accounts, view transaction history, and manage payment options, such as credit cards or PayPal.

-

Process Automation

This enables you to integrate your existing accounting software with cloud-based solutions that are available around the clock. And with greater access to data anytime and anywhere, you can quickly react to changes in customer behavior or payment status without manually updating records or contacting customers directly.

-

Risk Management

The ability to monitor customer creditworthiness makes it easier to accept or deny new customers with confidence. Automated payment tracking can also prevent late payments or delinquent accounts from slipping through the cracks by sending timely reminders when payments are due.

Pricing Information of Accounts Receivable Software

The pricing structure for AR systems varies greatly depending on features, scalability, and integrations available. Entry-level accounts receivable software usually ranges between $9 and $99 a month.

Enterprise-level solutions, on the other hand, start at $500 a month and usually require obtaining a custom quote from the vendor. These solutions offer advanced functionality, such as accounts receivable automation and reporting capabilities.

Additionally, subscription-based models may provide lower upfront costs but involve additional long-term fees or monthly payments, which you should consider when evaluating pricing information. Nevertheless, free trials are available for most software.

Conclusion

The right accounts receivable software can make a difference in your organization's financial productivity and customer satisfaction. Taking the time to understand your business needs, researching the best options, and testing out different solutions are key to finding what works for you.

With all of the available resources, you can trust that you’ll find an ideal solution for your business. So don't hesitate—get started on finding the best accounts receivable software today!

.png)