Best GST Software

List of the best GST software solutions are HostBooks, myBillBook, Tally, ClearTax, and GSTHero. Such GST return filing software enables an organization to manage taxes in one system and helps to securely return filing with calculated tax automatically per the applicable GST rates.

No Cost Personal Advisor

List of 20 Best GST Software

Category Champions | 2024

Pocket Friendly GST Ready Software

Simple, easy-to-use business accounting system to help you manage your accounts online. You can download 14 days free trial of Zoho books. Zoho Books is an easy-to-use, online accounting software for small businesses to manage their finances and stay on top of their cash flow. Read Zoho Books Reviews

Explore various Zoho Books features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Zoho Books Features- VAT / CST / GST Reports

- Quotation & Estimates

- Time Tracking

- Product Database

- Discount & Schemes

- Payment Processing

- Barcode Integration

- Invoice Designer

Pricing

Zoho Books Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Best Integrated GST Ready Software

TallyPrime is one of the leading business management solutions in the world, known for its accounting, stock control, reporting and payroll features. With TallyPrime, you don’t need to pay extra for additional features, which makes it affordable for small and medium businesses. It is used by 2 million businesses worldwide. Read TallyPrime Reviews

Explore various TallyPrime features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all TallyPrime Features- 24/7 Support

- Product Database

- Production Management

- Document Printing

- GST Tax Invoice

- GST Ready

- Data Exchange Capabilities

- GST Compatible

TallyPrime Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Top GST Return Filing Software in India

myBillBook is India's #1 invoicing, GST billing, accounting & inventory management software for small & medium businesses. Grow your business with the best invoicing software. Paid plans start from Rs.34 per month. Read myBillBook Reviews

Explore various myBillBook features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all myBillBook Features- Integration with GSTN Portal

- Invoice generation

- Loyalty Program Support

- Business Loans

- Cash Drawer Management

- E-Way Bill Generation

- Billing & Invoicing

- Compliance Management

Pricing

Silver Plan

$ 0

Per Month

Diamond Plan

$ 3

Per Month

Platinum Plan

$ 3

Per Month

myBillBook Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Simple and affordable best GST software

Vyapar is a GST-compatible invoicing and accounting solution for small businesses. You can use it to create GST bills, fulfill orders, generate GSTR reports, track payments/expenses, and manage your inventory. Besides, you can use it to customize invoices and collect payments online. Read Vyapar Reviews

Explore various Vyapar features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Vyapar Features- Item Management

- Service Tax

- MRP

- General Ledger

- Customer tracking

- Credit Notes

- Native App

- Bills of Material

Pricing

Silver- Desktop (1 year)

$ 40

Device/Year

Silver- Desktop + Mobile (1 year)

$ 47

Device/Year

Silver- Desktop (3 years)

$ 92

Device/ 3 Years

Vyapar Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Best GST System Software for CA & Tax Professionals

EasyGST is the Best software for GST Return filing, Invoice and ITC Reconciliation in India. EasyGST Software is Trusted by Thousands of Chartered Accountants, Tax Professionals and Corporates users. Download free EasyGST Software. Read EASYGST - GST Return Filing & Reconciliation Reviews

Explore various EASYGST - GST Return Filing & Reconciliation features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

- Fast Search

- Importing tax data from previous years

- Permission Management

- Sales Management

- Data Security & Accuracy

- Dashboard

- Multi-User

- Tax Calculation and GST Compliance

Pricing

EasyGST (Light)

$ 40

Per Installation

EasyGST (Professional)

$ 111

Per Installation

EasyGST (Poplular)

$ 54

Per Installation

EASYGST - GST Return Filing & Reconciliation Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

A Complete GST Ready Software

Marg GST software is useful for every business be it retail, distribution or manufacturing. It makes GST billing and filing, generation of E-way bills for transportation business, invoices & 1000's of reports, management of accounts, reconciliation of bank statement easy. Read Marg GST Software Reviews

Explore various Marg GST Software features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Marg GST Software Features- MIS Reports

- Mobile App

- Online Accounting

- Multi Company

- e-Payment

- Billing & Invoicing

- SMS Integration

- Responsive Support

Pricing

Basic Edition

$ 113

Full licence/ Single User

Silver Edition

$ 175

Full licence/Single User

Gold Edition

$ 350

Full Licence/ Multi-User

Marg GST Software Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Best GST Return Filing Software

Xero is award-winning web-based accounting software for small business owners and their accountants. It is beautifully designed and easy to use online bookkeeping for expense management. Read Xero Accounting Reviews

Explore various Xero Accounting features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Xero Accounting Features- Invoice

- Time Tracking

- Inventory Management

- Loan & Advances Management

- Product Database

- HR & Payroll

- Bonus

- Task Management

Pricing

Starter

$ 9

Per Month

Standard

$ 30

Per Month

Premium

$ 60

Per Month

Xero Accounting Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Online GST Ready Software for Small Businesses

QuickBooks is an online accounting software for business owners to make stay on top of their finances. Easy to use interface, 100% data security and features such as Online bank connect and Whatsapp integration helps business owners to focus on growing their business. Read QuickBooks Online Reviews

Explore various QuickBooks Online features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all QuickBooks Online Features- GST Tax Invoice

- Accounting

- Multiuser Login & Role-based access control

- Client Portal

- Customizable invoices

- Data Security

- Sales Management

- Dunning Management

Pricing

Simple Start

$ 30

Per Month

Essentials

$ 60

Per Month

Plus

$ 90

Per Month

QuickBooks Online Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

GST Return Software for Small and Medium Businesses

An integrated bussing accounting and management solution, BUSY is a one-stop solution for your financial and payroll needs. It offers multi-location inventory, multi-currency support, order processing capabilities, and helps you make informed decisions. Moreover, it is best suited for the FMCG, retail, manufacturing, trading, and distribution businesses. Read Busy Accounting Reviews

Explore various Busy Accounting features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Pricing

Basic version

$ 100

Per Year

Standard version

$ 188

Per Year

Enterprise version

$ 275

Per Year

Busy Accounting Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Best GST software for CA

GSTHero is a cloud-based GST reconciliation software. It is accurate, provides top-security to data, helps in real-time sharing of data with your CA, seamlessly integrates with other accounting software in use, etc. Read GSTHero Reviews

Explore various GSTHero features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all GSTHero Features- Invoicing

- Monthly GST Report

- Data Backup and Restore

- MIS Reports

- GST Compliance

- Data Security & Accuracy

- Contact management

- Dashboard

GSTHero Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Reliable Online GST Return Filing Software in India

Giddh is the latest cloud accounting software that provides all the accounting solutions like Cash management, Inventory, Invoicing, Ratio analysis, P&L, Bank Reconciliation, Ledger, and has Tally plug in for a hassle free switch. Read Giddh Reviews

Explore various Giddh features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Giddh Features- Accounts payable

- Multi Layer Security

- Reporting

- Invoice Designer

- Online invoicing

- Ecommerce Integration

- Multi-Location

- Accounting Management

Pricing

Birch

$ 21

Per Company/Yearly

Oak

$ 56

Per Company/Yearly

Vine

$ 139

10 Companies/Yearly

Giddh Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Best GST Return Software for Professional CA

Smaket is One of the super easy GST Compatible online billing & accounting software for small and medium businesses. You can enroll for our 14 days free trial. You don't need prior accounting knowledge to use our software, generate several reports including GST report. Read Smaket Reviews

Explore various Smaket features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Smaket Features- Invoicing

- POS Transactions

- Purchasing & Receiving

- Purchase Order Management

- Billing & Invoicing

- Procurement Management

- VAT / CST / GST Reports

- Receipt Printing

Pricing

Premium

$ 33

Yearly License / Single User

Gold

$ 72

Yearly License / Single User

Smaket Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Easy to use GST System Software

ANKPAL is one of the best online accounting software, offering you convenience and total security for your data. It’s time to stop unnecessary paperwork and manual accounting methods. It’s time to count on ANKPAL! Read Ankpal Reviews

Explore various Ankpal features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Ankpal Features- Revenue Recognition

- Multi-Store Management

- Invoice Management

- Multi Currency

- Document Templates

- Bank Reconciliation

- Multiuser Login & Role-based access control

- Dashboard

Pricing

Shuruaat

$ 139

Full License/Two User

Sahas

$ 278

Full License/Multi User

Ankpal Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Best GST Software for Small Business

ProfitBooks is a simple and fastest business accounting software for small businesses. It lets you create beautiful invoices, track expenses and manage inventory without any accounting background. Read ProfitBooks Reviews

Explore various ProfitBooks features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all ProfitBooks Features- Online Banking Integration

- Taxation Management

- Payments

- Inventory Management

- Multiuser Login & Role-based access control

- Multi Layer Security

- Banking Integration

- Security

Pricing

Professional Plan

$ 83

Per Year

SMB Plan

$ 125

Per Year

ProfitBooks Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Cloud-Based Solution for GST Return Filing

Swipe invoicing software is an online cloud-based solution. Using Swipez you can collect payments faster, organize company expenses, automate vendor payouts & perform e-invoicing GST filing. Automate your company billing using Swipez free billing software. Read Swipez Billing Reviews

Explore various Swipez Billing features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Swipez Billing Features- Online Payment Processing

- Invoice Management

- Banking Integration

- Split Billing

- Recurring invoice

- Invoice

- Recurring/Subscription Billing

- Payment Gateway Integration

Pricing

Free

$ 0

Per Year

Startup

$ 83

Per Year

Growth

$ 167

Per Year

Swipez Billing Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

One of the Best GST Software

CaptainBiz is a simple-to-use software solution to manage your business hassle-free. Generate tax invoices, track inventory in real-time, manage customers & suppliers, and monitor cash & bank transactions, all in one place, over PC or mobile. Endorsed by GST govt. of India as an affordable and easy-to-use solution for both GST and non-GST companies. Read CaptainBiz Reviews

Explore various CaptainBiz features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all CaptainBiz Features- Responsive Support

- Print Or Email Invoices

- Sales Management

- Customer tracking

- Sales Tracking

- GST Ready

- Document Printing

- Billing & Invoicing

CaptainBiz Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Easy-to-Use GST Return Software for Small Business

Saral GST solution is a comprehensive and user-friendly return filing software to suit your diverse GST needs. Other than return filing, we also have software for accounting, billing and invoicing. With Saral GST, e-filing of GSTR is now simplified. Read Saral GST Reviews

Explore various Saral GST features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Saral GST Features- MIS Reports

- Reporting

- e-Payment

- Permission Management

- Data Backup and Restore

- Monthly GST Report

- Data Security & Accuracy

- Online GST Portal

Pricing

Saral GST Standard

$ 96

1 Lisence

Multi User

$ 208

Multiple users

Saral GST Premium

$ 0

Customized

Saral GST Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Seamless GST Return Filing Software

HostBooks GST simplifies the process of working on GST with the effortless filing of returns & easy reconciliation of the mismatches. It reduces the compliance time by at least 50% and cuts down the cost by half. Hence, HostBooks enhances your efficiency by leaps and bounds. Read HostBooks GST Reviews

Explore various HostBooks GST features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all HostBooks GST Features- Billing & Invoicing

- ITC Match/Mismatch Report generation

- Customer Management

- e-Payment

- GST Ready

- Compliance Management

- Multi-Currency

- GST Compliance

Pricing

All in One Single sign up

$ 56

Per Year

HostBooks GST Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Easy to Use and Best Software for GST Return Filing

Swipe billing software and the app helps you to create sales/purchase invoices, quotations, manage inventory, save customers & vendors and be in control of your business. Create GST compliant invoices & share them with customers easily. Read Swipe - Billing Reviews

Explore various Swipe - Billing features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Swipe - Billing Features- Accounts payable

- Supplier Management

- Analytical Reporting

- Recurring Billing

- SMS Integration

- Multiple Billing Rates

- Quotation & Estimates

- Payment Gateway Integration

Pricing

Swipe PRO Plan

$ 21

Per Year

Swipe JET Plan

$ 39

Per Year

Swipe RISE Plan

$ 49

Swipe RISE Plan

Swipe - Billing Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Software by Reach Accountant

One of the Best GST accounting software for small and medium businesses. The best GST software for professionals makes taxation much easier and to supported business owners in any type of business such as sales services, manufactures, trade, etc. in the reach accounting software with auto GST calculation. Read Reach GST Reviews

Explore various Reach GST features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Reach GST Features- Online GST Portal

- Mobile App

- GST returns

- Collaborate

- Online Accounting

- Reporting

- Financial Management

- Billing & Invoicing

Pricing

FREE

$ 0

Onetime

BRONZE

$ 250

Per Year

SILVER

$ 583

Per Year

Reach GST Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

What is GST software?

GST software is a tool that enables organizations to manage GST compliance and ensures that businesses adhere to mandatory national and state tax systems like VAT, service tax, excise duty, etc.

GST software helps organizations simplify the hassles of filing returns and generating GST invoices. Utilizing effective GST software can aid businesses in managing their finances, accounts, inventory, purchase, sales, payroll, taxation management, and other processes efficiently.

What are the Benefits of GST Software Solutions?

The GST software in India has been a book for business owners and service providers who would not know how to handle the new taxation process without the billing software. Listed below are its advantages:

-

Efficient Tax Filing with Great Ease:

Accounting, finance management, different tax calculations, filing tax returns, and billing can be daunting tasks. Proper and accurate tax filing is imperative for a business to avoid any unwarranted problems in the future. A user-friendly GST return software makes tax filing feel like a walk in the park and aids in the accurate and fast filing of taxes and returns.

-

Management of Accounting Activities:

It enables both cash and cashless accounting. It allows easy printing of professional invoices to be sent to the customer. It helps to keep track of receipts, expenses, and paid and unpaid invoices to generate estimates. It defines GST rates according to the products and helps with sales orders, debits, and credits. Some software also offers multi-currency support.

-

Management of Inventory:

The best GST software allows the management of business inventory. It helps to keep track of the list, send invoices, and place orders for products depending on their requirements. It allows the entry of stock issues and wastage as well. Some software even has a barcode scanner that helps efficiently manage the inventory. It also helps generate various reports like sales inventory reports, service reports, items in inventory reports, and the movement of products reports.

-

Management of Taxation:

With all the tax rates being predefined, one just has to put down the products and select appropriate tax rates, and the software will help calculate all GST returns, refunds, and taxes, such as CGST, SGST, and IGST. It is also designed to add any other extra rates and penalties, thus making tax management easier.

-

Management of Payroll Activities:

The payroll system is crucial for business and employee relations. Timely payments are vital for financial trust. The new GST software streamlines payroll, making it easier for business owners. It helps generate automatic payrolls with all the taxes and other things added automatically and helps create fast and accurate invoices.

-

Remote Management In Real-Time:

Customize GST compliance software for various industries like Retail, Restaurants, automobiles, Apparel, etc., to suit specific needs and rates. This solution aids distributors in categorizing sales, increasing retail profit margins, and managing invoices and inventory efficiently. Real-time reports enable tracking business operations from any device, ensuring seamless workflow management with GST return software.

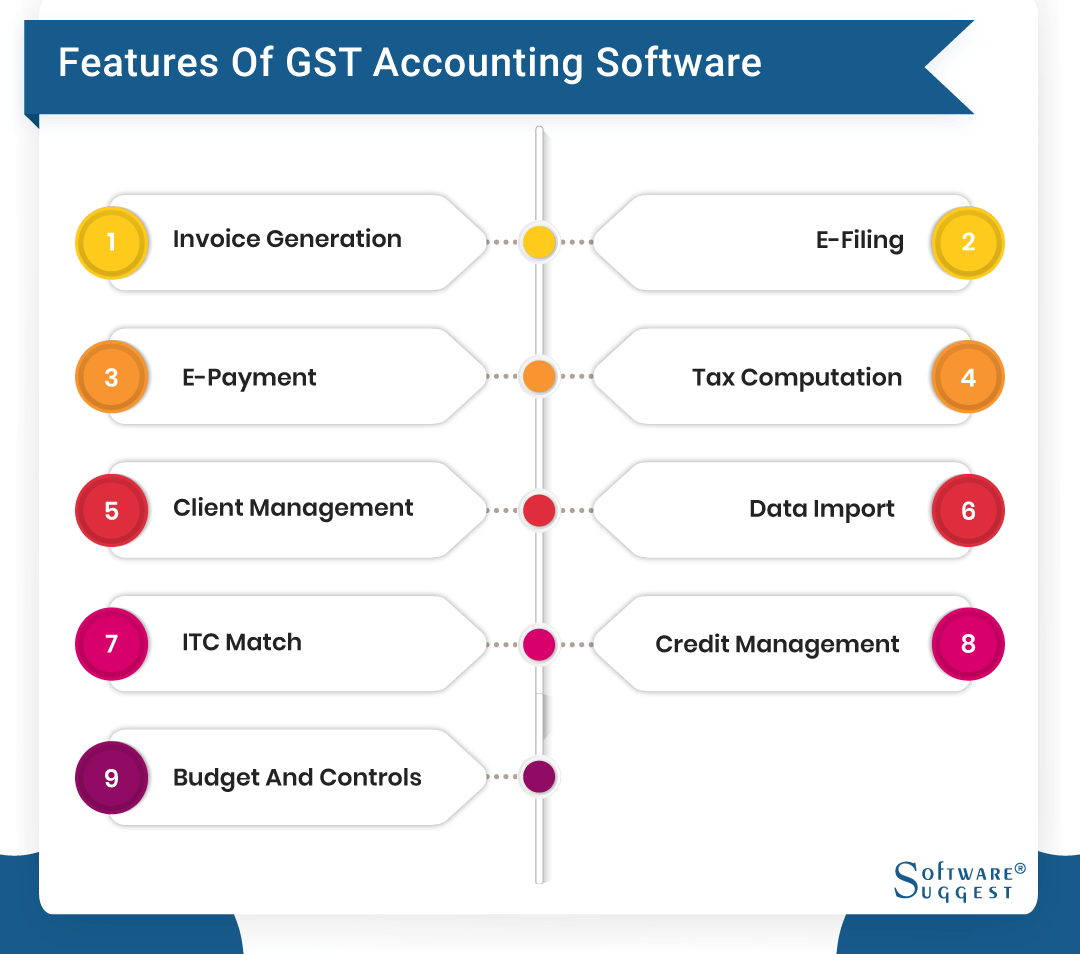

What are the Key Features of GST Software?

Seeing the importance of the GST software in India, many business organizations and traders have already adopted the implementation of the GST system software for a smooth tax-paying experience. In addition to the ease of paying the GST, business organizations also benefit from its essential features. Here are some of them:

-

Invoice Generation as per the GST Standards: Business organizations can prepare a proper GST tax invoice format for their taxation and other financial records that abide by the GST standards. It helps businesses' inadequate regulation of their income and expenses.

-

E-Filing for the Returns and Return Reconciliation: Now, business owners do not need to rush to the concerned official building to file their tax returns. There are many types of GST returns With the help of the GST return filling software solution, it can all be achieved with a one-step e-filing of the returns and return reconciliation.

-

E-Payment Facility: To top it all, the GST solution also offers the ease of paying tax returns through the e-payment facility. It is a hassle-free process to make the payment online securely.

-

Tax Computation and Validation: All the computations are done on the GST computer systems and are entirely validated.

-

Client Management: The top GST software also offers the ease of effective client management for business organizations.

-

Data Import: The data relevant to the organization’s purposes can be easily imported with the help of specialized software.

-

ITC Match/Mismatch Report Generation: If there is any trouble or mismatch in the ITC filing, then the GST accounting software creates the proper report.

-

Credit Management: The GST software can help minimize debt and improve the overall cash flow of the business by allocating varying GST credit limits to different parties.

-

Budget and Controls: Business organizations can efficiently utilize the funds and can control the overall expenditure.

What are the Essential Characteristics of a Good GST Software?

-

Security: As one might have to deal with vast amounts of money, the software must ensure secure transactions. Secure GST software would protect confidential information related to any business, avoiding any compromise that might threaten the business information. Therefore, the GST offers robustness in filing returns and ensuring overall data security for business organizations.

-

Multi-Platform Adaptability: Functioned well on multiple platforms to keep up with the various compliance requirements. It is easily accessible from PCs, laptops, and even smartphones through the app. This tends to increase the ease and speed of return filing through the online medium.

-

Flexibility: Several businesses use the ERP system and various accounting tools to manage tax filings. Therefore, your GST return software should be flexible enough to integrate well with the existing GST computer system and offer a seamless experience to the users.

-

Cognizance: Under the new GST regime, an average taxpayer registered in one state will have to file as many as 37 returns during a financial period. The software can evaluate the possible events that might be coming the way of the traders. This will ensure that no deadline is missed in the process and that the business remains up and running.

-

Friendly User Interface and Reporting: The software should offer a simple user interface and informative dashboard, including various MIS reports for quick decision-making and transparency in operations. The availability of real-time information might help business owners avoid over/understocking of goods. This might save a lot of capital if it operates on a minimum user interface principle.

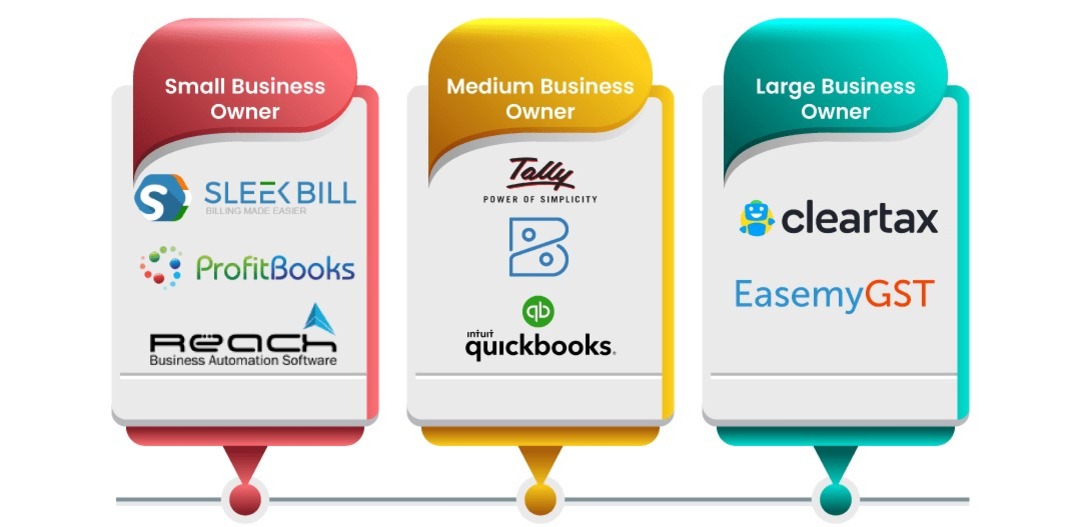

What are Different Types of GST Software for Different Buyers?

A) Small Business Owners:

Small business owners do not typically need significant GST filing software with extra features. They would require a solution that does its work to the point without beating around the bush.

1. Sleek Bill is the best GST software explicitly catering to the needs of small businesses. It has a fast mechanism and offers many features like stocks, tax management, and multiple invoice generation. The other parts are:

- Online Integration with banks

- Inventory management

- Free software to design invoices

- Handles payments and accounts

2. ProfitBooks is a GST software for small businesses that allows the creation of invoices, management expenses, and inventory without specialization and accounting background. Key features are:

- Strong multi-layered security

- Email and SMS notification

- Management of customers and suppliers

- Backing up of data

3. Reach Accountant is an best software for GST returns that stores all the information in the cloud. Not only does it help in billing and tax calculation, but it also provides good customer service. It has an excellent workflow, tracks employees, and gives real-time updates. It has an easy implementation process and can be operated from desktops, laptops, and mobiles, thus, making it easy for users to work from anywhere. Some of its key features are:

- Automation of business

- Bank synchronization

- Creating invoices

- Accounting

- Email management

B) Medium Business Owners:

1. Zoho Books is one of the best GST software in the market. It is tailor-made for medium-sized businesses and provides simple and cost-effective GST and accounting solutions and features like:

- Barcode integration

- Multi-currency compatibility

- Email integration

- Billing, invoicing, and expense tracking

2. QuickBooks is another GST system with efficient navigation, automation, and high security, making it apt for medium-sized businesses. Some of its essential features are:

- Accounting in the cloud

- Desktop and mobile application

- Report generation

- Allows multiple users

- Free customer support

3. TallyPrime GST accounting software is one such software that provides solutions for enterprises. Its simplicity, accuracy, and user-friendliness have made it one of the best in business. Its key features are:

- Advance payment handling

- Error-free GST returns computation

- GSTR-1 and GSTR-3B form support

- Outstanding reports for traders

C) Large Business Owners:

1. EasemyGST is a cloud-based GST software for enterprises. It has a full tax management feature that helps generate new GST invoices according to rules and file GST returns. This GST filing software enables efficient accounting and tax management along with the following features:

- Data security

- CA to help GST compliance and tax filing

- Multiple GSTIN management

2. Clear tax is the best software that automates billing and accounting. It caters to all types of small, medium, and large organizations. It also helps in the generation of an e-way bill. Some of its unique features are:

- Easy ERP integration

- Dedicated support and accounts manager

- Automatic data import

- Online and offline mode

- No manual data entry

- Imports from Tally and Busy

E-Way Bill in GST: All You Need To Know

A) What is Meant by the E-Way Bill?

Eway bill is the acronym for electronic waybills and is generated for the smooth movement of goods through the Eway bill portal. A GST-registered operator cannot transport goods whose value exceeds Rs 50,000 in any vehicle without possessing a valid Eway bill authorized through ewaybillgst.gov.in.

Many technological platforms, such as GST and tax return software, help organizations generate valid E-way bills. Investing in advanced GST E-way bill ERP software is a good choice for organizations as it enhances operational efficiency through the seamless generation of E-way accounts.

B) When and Who Can Generate an E-Way Bill?

GST invoice software can help any company generate an Eway bill automatically when there is a planned movement of goods in a conveyance, and the value of goods is higher than Rs. 50,000 either in each invoice or aggregate of all invoices:

- About a supply

- For reasons other than supply (e.g., return)

- Due to an inward supply from an unregistered person

The following parties are authorized to generate an E-way bill:

-

Register Person: E-way bill can be easily generated when a movement of goods exceeds Rs. 50,000 by a registered person. A registered party or transporter may choose to produce an Eway bill through the E-way bill software or GST system even if the value of the goods is below the limit of Rs. 50,000.

-

Unregistered Person: GST software is an excellent platform to help even unregistered parties generate a valid Eway bill. When a supply is made from an unregistered person to a registered person, the receiver must ensure that all the compliances are met. GST invoicing software can help managers overcome any hurdles.

-

Transporter: GST tax software can also be used by transporters carrying goods by rail, road, and air, as they must generate an authorized E-way bill.

GST compliance software is a revolutionary tool that automates and streamlines the entire process of generating Eway bills; hence investing in a sophisticated GST return software is highly recommended for organizations that deal with a frequent heavy volume of goods movement.

C) How Can GST Software Help the Generation Of Authorized E-Way Bills?

GST invoice software is an innovative and automatic solution that can help generate E-way bills in large quantities. The best aspect of GST return software is that it is a user-friendly tool that can significantly reduce organizations' legal compliance burden.

Getting software is a wise decision as it can help in generating E-way bills in the following ways:

-

GST tax software enables new system users to sign up with the E-way bill generation portal.

-

GST return software can add multiple users to generate an E-way bill per organizational requirements.

-

GST invoice software helps in documentation management and fills in the correct details to generate a valid E-way bill.

-

GST tax software assists in the printing and storing of E-way bills for future reference.

How to Choose the Best GST Software?

With many GST system software available in the market, one should select the software based on the needs and size of the business. There are several factors to be taken into consideration before purchasing a software for your organization. They are:

-

Online and Offline Mode:

Choose between online or offline GST software based on your business needs. Online software offers secure cloud storage, easy access, automatic updates, and government compliance. Offline software lacks continuous updates and may compromise security compared to online options.

-

Security:

When buying top GST software, its security features must be thoroughly examined and ensure that the data is in safe hands. In offline versions, one should consider whether the software is equipped with proper features to prevent hacking and virus attacks.

-

Features:

When choosing software for GST, ensure the income tax software meets business needs. It should offer easy user registration, simplify GST processes for accurate tax calculation, and generate invoices in preferred formats. The system must track business processes, expenditures, and returns, manage accounts, handle inventory, track goods movement, and handle supplier/customer relationships. Additionally, it should manage employee salary payments and support transactions in different currencies.

-

Integration:

Integrating the product with the current enterprise resource planning and accounting systems should be smooth and easy. It should also be able to integrate data from multiple sources.

-

Scalability:

Before choosing GST software, consider your business size and needs. Don't be swayed by fancy features; assess if the software truly aligns with your requirements. Some software may struggle to handle increased data and fail in calculations as your business grows. Thorough research is essential to ensure the software can effectively manage your evolving business demands.

-

Complexity:

Choose a straightforward GST software to avoid complex return filing and calculations. Request a GST software demo to assess user interface, usability, and ease of understanding. User-friendly software can save costs on hiring a chartered accountant.

-

Software Customization:

Good software must be easily customizable and accommodate your business needs rather than adjusting as per the software. The GST system software should be able to fit the needs of the business in case it grows. It should not take a lot of time for initiation and waste your time on its working.

-

Customer Support:

Since the GST and the whole taxation system are still new and in their implementation phase, not many people will be fully aware of some associated terms. So, the GST tool must have a strong customer support unit that will be able to support the smooth usage of the software.

-

A Complete Solution:

The software bought by you should be a complete package of accounting and taxation solutions, as using different software for different things causes many integration problems and confusion. It reduces the efficient running of a business and is cumbersome. A GST system software with a complete solution will improve money management and your business workflow drastically.

-

Cost:

Cost is one of the most important factors when buying software. It is a common notion that more expensive software operates better, which is entirely wrong. The software must be decided based on your business needs and size. A small business will not need expensive software. The price spent on the software should suit the company and be worth it.

Challenges in the Implementation of the GST System Software

Like any enterprise, the software can be challenging to implement. Though you can easily overcome these challenges, they can make a big difference in your GST software implementation. Let's delve into some common challenges you may face during the software implementation.

-

Length of Time:

If you buy an on-premise GST system software, its implementation process will be lengthy and time-consuming. For some robust systems, the implementation process can even last for months. This will disturb your day-to-day workflow. Implementing a cloud-based GST system is the key to dodging this obstacle. Cloud-based solutions don't require manual installation; you can get them up and running almost instantly.

-

Change in Business Operations:

Your staff is used to working without GST software. Adopting a new system will suddenly be a challenge for your staff. Conducting business as usual, migrating to a new GST computer system, and learning to use it can be too much for your team.

-

Consistent, Adequate Training:

You'll need to train your staff to use the GST software. Unless you have IT professionals, your employees will have difficulty figuring out how to use the new tool. Therefore, you will need to conduct appropriate training sessions to ensure all the desired employees know how to use it.

-

Burdensome Data Migration:

Arguably, data migration is the biggest hurdle for GST implementation. Let's say; you used a standard accounting system before implementing the new software. Your existing tool would have years, maybe decades, of data that your staff will need to transfer manually to the new system.

-

Lack of Support:

Most GST software solutions lack ample support. In the case of on-premise software, you'll likely not receive free support beyond the implementation phase.

Latest Market Trends in GST Software

The introduction of GST software has changed the way accounting systems work. Here's a quick look into the latest market trends in GST software.

-

Integrated Accounting: Businesses need periodic and accurate reporting. With modern-day GST software solutions, accountants and business owners generate financial reports quickly and precisely. This provides a transparent view of cash flow and profit/loss, which catalyzes intelligent decision-making.

-

Seamless GST Compliance: During the day, accountants had to calculate and file GST returns manually. Not only was this process tedious, but it was also prone to human error. GST systems have automated GST filing and invoicing, helping businesses stay compliant.

-

Data Privacy and Security: Cloud-based GST software is on the rise, and rightly so. They are cost-effective, easy to implement, and seamlessly scalable. However, data security was a major concern for users of online GST systems. This concern diminishes as GST software vendors implement enhanced data privacy and security features. Some advanced security capabilities include multi-factor authentication, encryption, and synchronization configuration.

Related Research Articles:

FAQs

The GST software price range is Rs.500 to Rs.25000, depending on the number of customized features, including the number of users, security, support, and various services the vendor offers.

Implementation shouldn’t take more than seven days if you don’t require many customized features.

The GST replaced all current central and state taxes on businesses, including the Central Sales Tax (CST) and the Value Added Tax (VAT).

The HSN code stands for “Harmonised System of Nomenclature,” It is used to classify goods and services under the GST regime. This unique numbering system allows for the easy identification of products and their classification under different headings.

Yes, the full-featured GST software for professionals includes invoicing and billing functionality, allowing businesses to generate invoices in compliance with GST regulations.

Software development is categorized as a service under the GST, but any software that is physically included as information technology software—whether branded or custom—must be registered as goods under the Customs Tariff Act under the HSN code 8523 80 20. Software sold in physical form is likewise subject to an 18% GST rate.

By Industries

- Accounting & CPA

- Advertising

- Agriculture

- Architecture

- Auto Dealership

- Banking

- Construction

- Consulting

- Distribution

- Education

- Engineering

- Food & Beverage

- Healthcare

- Hospitality

- Insurance

- Marketing Services

- Manufacturing

- Media & Newspaper

- Pharmaceuticals

- Property Management

- Real Estate

- Retail

- Transportation

- Telecommunications

- Textile

- Financial

- Hotel & Restaurant

- Sales

- Service

- Apparel

- Garment

- Fashion

- Government

- eCommerce

.png)

.png)