Payroll is a nightmare for many HR executives.

As payday nears every month, HR departments go into a tizzy in order to ensure that salaries are released in time. But the process is never as smooth or as accurate as they might have hoped it would be.

In the emerging Indian context, as organizations become more dependent on payroll and HR systems, you might end up opting for a payroll system which turns out to be totally unsuitable to your organizational needs.

So, what do you do for smoother payroll and a relieved HR department?

If your organization is looking for a solution to this dilemma, one of the first things you can do is take a look at Saral PayPack. A Relyon offering with 15+ years in the business, Saral PayPack is the choice of conglomerates such as India TV, Manyavar, Wipro, Manipal, and more.

Not familiar with Saral PayPack? Not a problem, we’ll get you acquainted with it in no time.

Saral PayPack is a complete payroll solution that meets every requirement, from “Punch to Payslip”. Be it attendance, statutory compliance, benefits or TDS management, Saral PayPack covers all your needs. With a robust set of features and flexibility to boot, you can rest assured that all your requirements will be covered.

You can opt for desktop-based on-premise deployment as well as cloud-based deployment with Saral PayPack. There is also an employee self-service (ESS) portal for easy access by employees.

Before we take an in-depth look at how it functions, here’s an overview of its core benefits:

Assured Statutory Compliance

PF, ESI, Bonus, FNF, whatever form of statutory compliance your HR department requires, Saral PayPack already has it built in.

Advanced Leave and Attendance Management

Biometric integration, leave definition, hourly and overtime calculation: manage leaves and attendance seamlessly with Saral PayPack.

ESS + Mobile App

Convenience is maximized for employees and HR. The Employee Self Service Portal and the mobile app allow users to apply for leave and reimbursement, declare TDS, and do much more.

Effortless TDS Management

TDS management is simplified for employees and payroll admins. Easily estimate TDS and automate TDS declaration with details furnished by employees.

Simplified Salary Management

With no manual calculations and built-in statutory compliance, releasing accurate salaries on time is a breeze.

Extensive Reporting + Security

Saral PayPack features a detailed audit trail, showing the smallest changes made by any user. As for reporting, it has an extensive reports suite, covering everything from leave and reimbursement reports to loan repayment schedules and bank statements.

Salient Features of Saral Paypack Payroll and HR Management Software

1. Building the Foundation

In order to have the system running smoothly, you need to have a successful setup. With Saral PayPack, the setup is detail-intensive, but once it’s done, you won’t have to take a second look at it.

Get the basics right

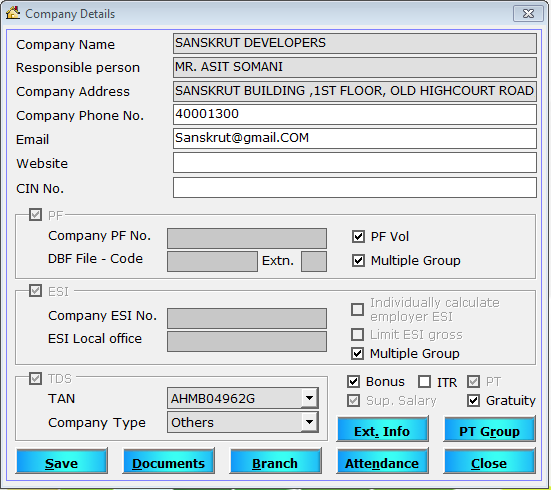

Just go to “Initial Settings” and enter company details like the name, address, CIN number, ESI, and PF number.

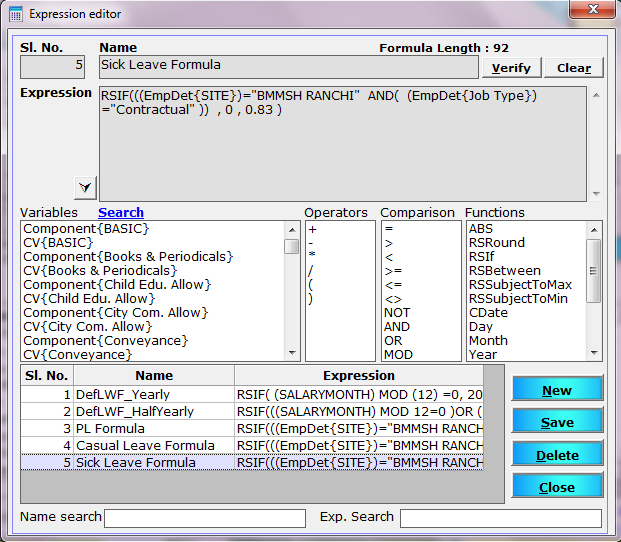

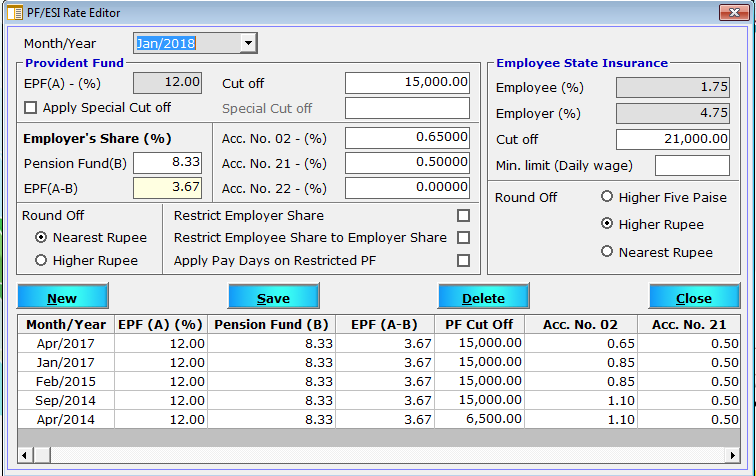

You can customize everything, set rates for PF/ESI, professional tax, as well as loans and advances made by the company. You can even create groups for particular rates. Once you’re done with this, the rates will be applied automatically on salary calculation.

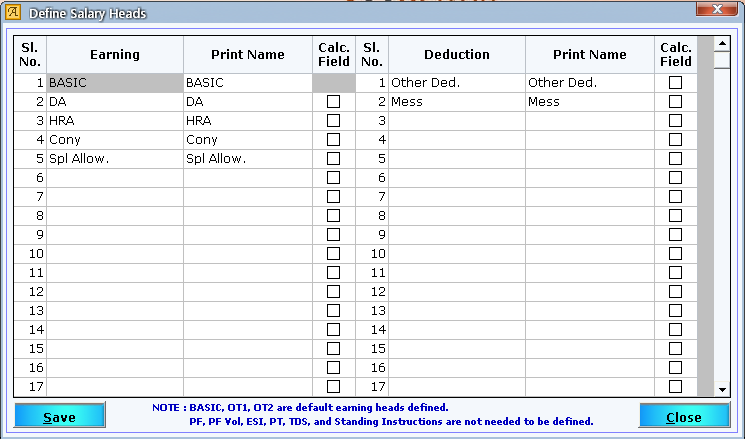

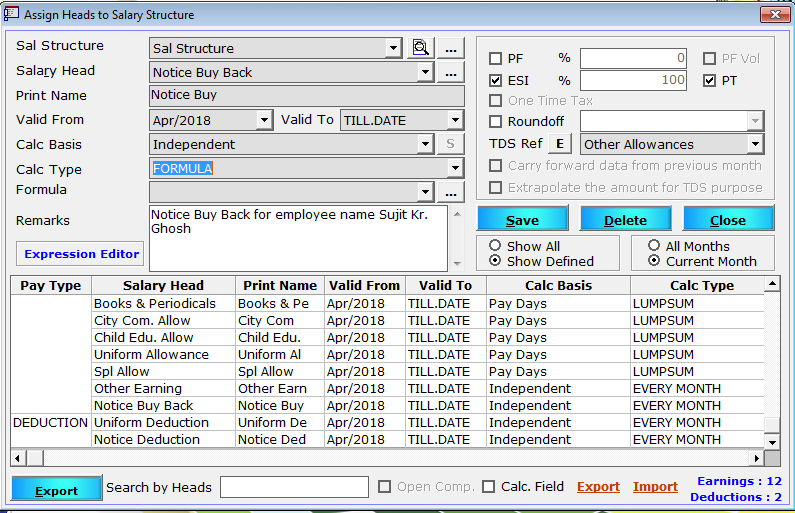

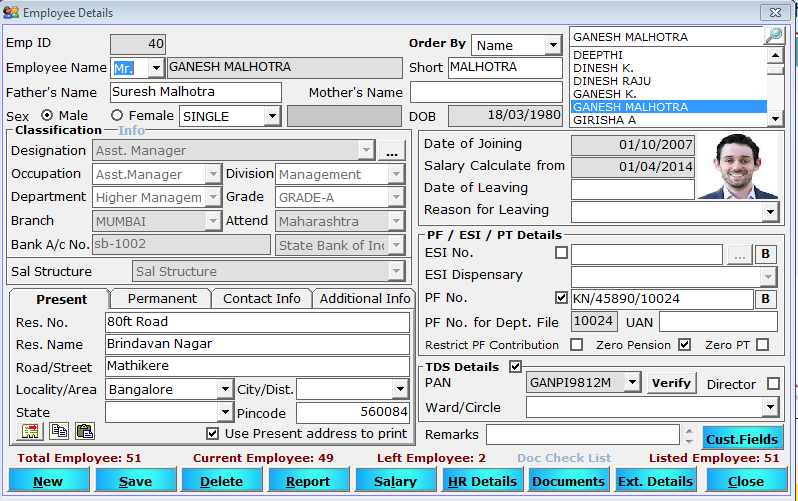

Under Masters, you can configure branch details: define the salary structure and heads, Basic and HR details for employees.

There is also a detailed Employee Asset Tracker in which you can create and assign assets to employees, and the damages if any can be recorded and reclaimed from the said employee. The details automatically show up in the employee account.

Configure everything in accordance with your organizational needs and you’re good to go!

2. Tracking the all-important Leave and Attendance

Attendance and Leaves are quite possibly the most important components when it comes to calculating salary with accuracy. If these are not properly configured, there will be no end to your payroll problems.

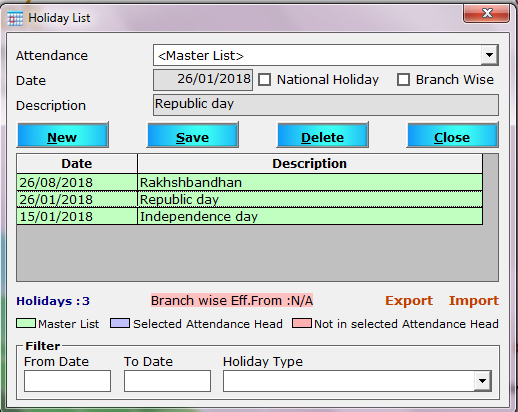

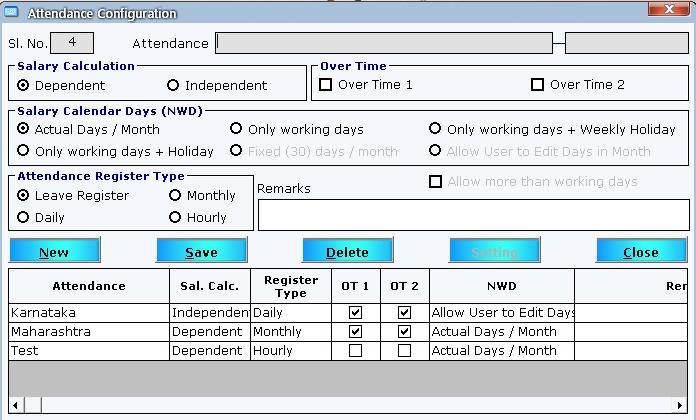

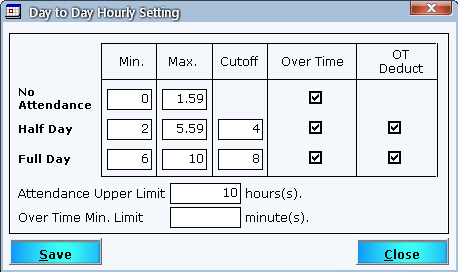

In Saral PayPack, you can set up the attendance settings to capture the minutest nuances. Select the basis on which you want the payable days to be considered: only working days, working days and holidays, etc. Select default overtime or create custom OT heads according to company policy.

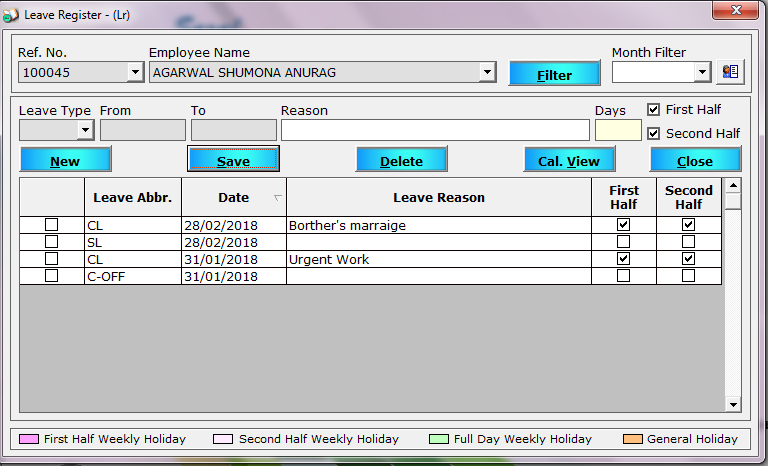

Track each employee’s leave (full or half day leave) along with reason, in the detailed leave register.

Set up the formula/applicable amount for leave encashment for single/multiple employees. You can configure whether you want to pay this amount along in the full and final settlement or separately. TDS, if applicable, will be deducted as well.

Set up the formula/applicable amount for leave encashment for single/multiple employees. You can configure whether you want to pay this amount along in the full and final settlement or separately. TDS, if applicable, will be deducted as well.

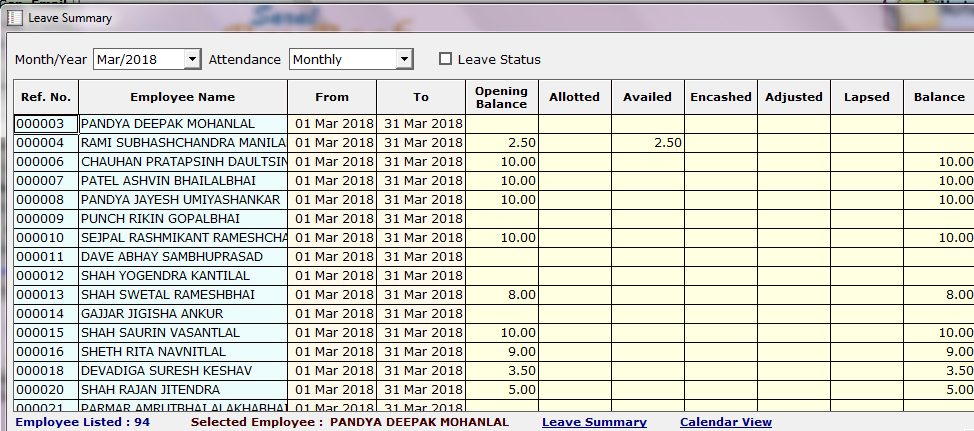

You can see an overview of the leaves allotted to, availed and en-cashed by each employee in the given period in the Leave Summary.

You can see an overview of the leaves allotted to, availed and en-cashed by each employee in the given period in the Leave Summary.

If needed, you can get the individual employee-wise leave details report.

If needed, you can get the individual employee-wise leave details report.

3. Bonus!

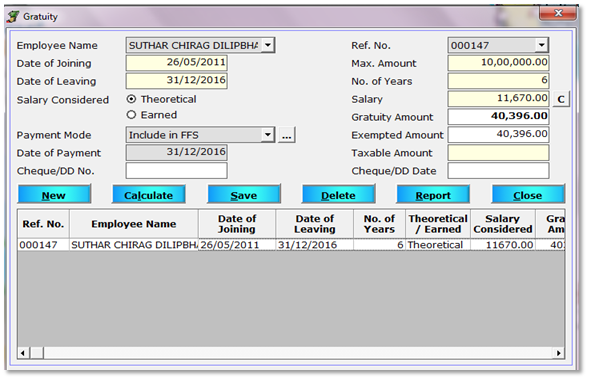

Of course, Saral PayPack includes the bonus/ex-gratia modules. But there are also modules for loans, advances, increment, and gratuity.

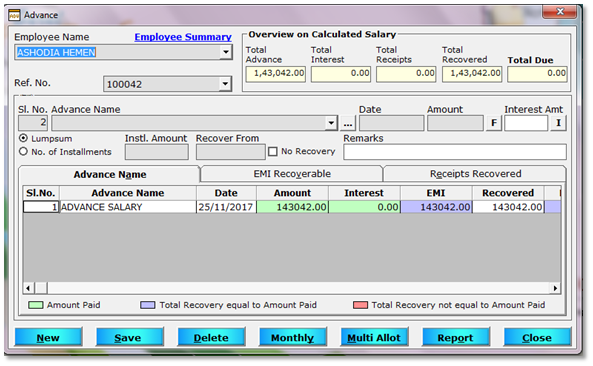

In case the company has forwarded an advance or granted a loan to an employee, you can keep track of the installments recovered and the ones left.

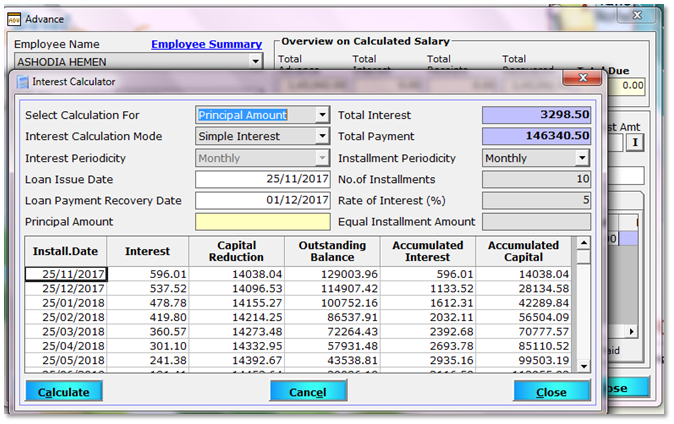

Set the type and rate of interest and the number of installments for the loan/advance in the Interest Calculator. You will get the final EMI amount as well as the amortization schedule automatically.

Set the type and rate of interest and the number of installments for the loan/advance in the Interest Calculator. You will get the final EMI amount as well as the amortization schedule automatically.

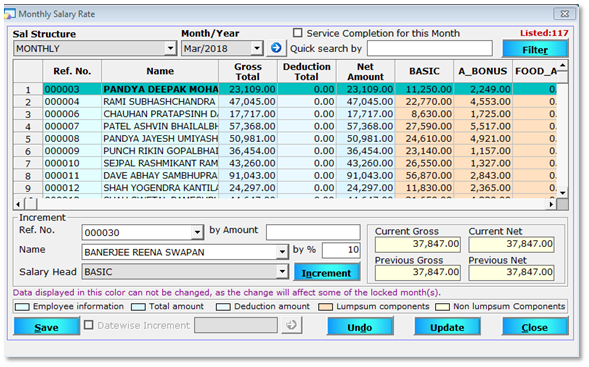

Though crediting increments were a big headache? Not any more. Here, you can simply give a bulk increment to all the relevant employees by selecting the Salary head on which the increment is to be made, and the percentage of increment. It’s as simple as that.

Define bonus and gratuity calculation according to company policy

Define bonus and gratuity calculation according to company policy

4. Payroll, Activated

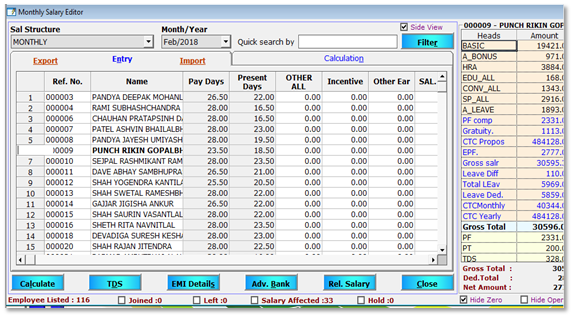

Once all the pre-salary transactions are done with, you can move on with the actual payroll processing. In the monthly salary editor, you will get an overview of the relevant details for each employee. You can edit details individually or in bulk if need be.

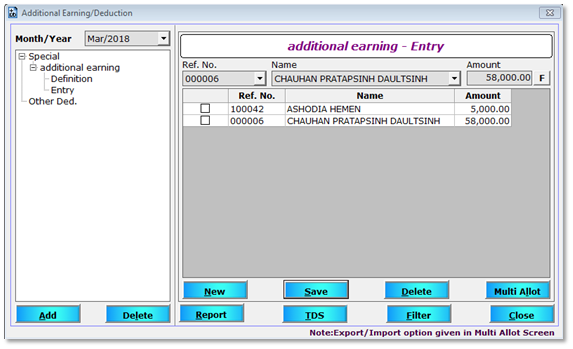

Define any additional earnings or arrears.

Define any additional earnings or arrears.

Once you’re finished, you can activate the Settlement for the employees.

Once you’re finished, you can activate the Settlement for the employees.

5. ESS to the Rescue

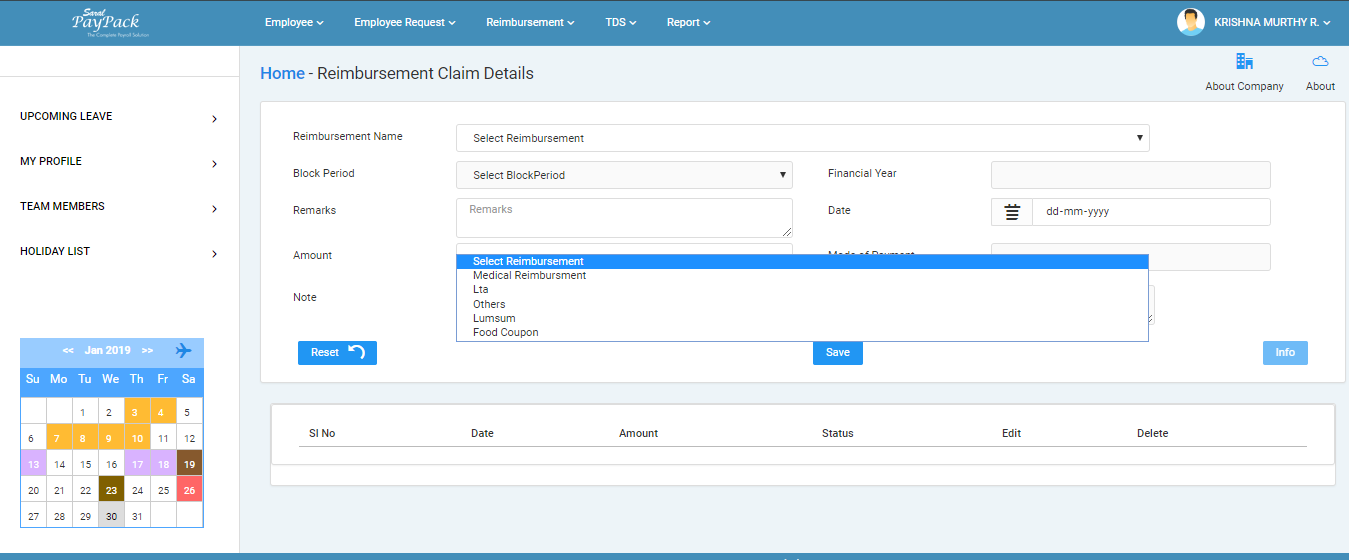

Saral PayPack also has its web/app based Employee Self- Service Portal. It’s a quick and easy way for employees to update their details, apply for leaves, view their leave balances, and get a detailed overview of their tax planning. The interface is minimalistic and simple, which aids ease of use for employees and HR executives.

Employees can also apply for reimbursement from the ESS portal, and attach the bill details. The details will be reflected in the desktop account with the administrator.

Tax planning is simplified, the employee can view the various deductions available to him/her, and recommended amounts for tax saving.

Tax planning is simplified, the employee can view the various deductions available to him/her, and recommended amounts for tax saving.

In all, the ESS module makes for excellent additional support to the complete Saral Paypack Payroll solution.

Summing it Up

Saral PayPack is a classic Payroll solution that is easily deployable and feature-rich. With support from its ESS portal, it makes the job of calculating salaries and releasing the payroll much easier than it would be without such software. It is suitable for all types of organizations and has a familiar, user-friendly interface that makes it easy to operate. Even if you’re launching the software in the middle of the financial year, it has a simple import feature that allows you to migrate data in minutes.

You can rest assured that this is a solution that will truly make the payroll process for your organization simple, Saral, and seamless.

SoftwareSuggest empowers businesses to discover top business software and service partners. Our software experts list, review, compare and offer a free consultation to help businesses find the right software and service solutions as per their requirement. We have helped 500,000+ businesses get the right software and services globally. Get a free consultation today!