Best Bookkeeping Services

Best bookkeeping services include TallyPrime, Nimble Property, myBillBook, and LEAD ERP. All the bookkeeping services ease the complex task of accounts management and also permit remote access.

No Cost Personal Advisor

List of 20 Best Bookkeeping Services

Contenders | 2024

Airbase, the leading spend management platform for

Airbase modern spend management combines accounts payable, expense management, and corporate cards on one platform. It offers a guided procurement experience to manage all spend. Read Airbase Reviews

Explore various Airbase features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Airbase Features- Mobile App

- Accounting Integration

- Automated Scheduling

- Fund Management

- Transaction Approval

- Invoice Processing

- Expense Tracking

- Financial Reporting

Airbase Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Cloud Accounting Software Making Billing Painless

This bookkeeping software makes your accounting tasks easy, fast and secure. Start sending invoices, tracking time, and capturing expenses in minutes. We uphold a longstanding tradition of providing extraordinary customer service and building a product that helps save you time because we know you went into business to pursue your passion and serve your customers - not to learn to account. Read FreshBooks Reviews

Explore various FreshBooks features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all FreshBooks Features- Late Fee Calculation

- Warehouse Management

- Online Banking Integration

- Expense Tracking

- Taxation Management

- Invoice

- Budgeting

- Recurring Billing

Pricing

FreshBooks Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

A Businessman's Best Friend

Vyapar is a GST-compatible invoicing and accounting solution for small businesses. You can use it to create GST bills, fulfill orders, generate GSTR reports, track payments/expenses, and manage your inventory. Besides, you can use it to customize invoices and collect payments online. Read Vyapar Reviews

Explore various Vyapar features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Vyapar Features- Fixed Asset Management

- Online Billing

- Item Management

- For Retail

- Mobile Sync

- Stock Management

- Accounts payable

- Currency Management

Pricing

Silver- Desktop (1 year)

$ 40

Device/Year

Silver- Desktop + Mobile (1 year)

$ 47

Device/Year

Silver- Desktop (3 years)

$ 92

Device/ 3 Years

Vyapar Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Power of Simplicity

TallyPrime is India’s leading business management software for GST, accounting, inventory, banking, and payroll. TallyPrime is affordable and is one of the most popular business management software, used by nearly 20 lakh businesses worldwide. Read TallyPrime Reviews

Explore various TallyPrime features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all TallyPrime Features- Audit Trail

- Sales Management

- Production Management

- Multi Currency

- Collections

- GST Tax Invoice

- Budgeting

- Web Access / Restoration

TallyPrime Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Online Accounting Software for Growing Businesses

Simple, easy-to-use business accounting system to help you manage your accounts online. You can download 14 days free trial of Zoho books. Zoho Books is an easy-to-use, online accounting software for small businesses to manage their finances and stay on top of their cash flow. Read Zoho Books Reviews

Explore various Zoho Books features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Zoho Books Features- Sales Tracking

- Monthly GST Report

- Customer Management

- Payroll Management

- Product Database

- Security

- Bank Reconciliation

- Online Banking Integration

Pricing

Standard

$ 10

Organisation/Month Billed Annually

Professional

$ 21

Organisation/Month Billed Annually

Premium

$ 42

Organisation/Month Billed Annually

Zoho Books Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

#1 GST billing software

myBillBook is India's #1 invoicing, GST billing, accounting & inventory management software for small & medium businesses. Grow your business with the best invoicing software. Paid plans start from Rs.34 per month. Read myBillBook Reviews

Explore various myBillBook features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all myBillBook Features- 24/7 Support

- Centralized Data

- Customizable Dashboard

- Bill generation and printing

- Compliance Management

- Billing Estimates

- Accounting Management

- Billing Templates and Customization

Pricing

Silver Plan

$ 0

Per Month

Diamond Plan

$ 3

Per Month

Platinum Plan

$ 3

Per Month

myBillBook Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Hotel Accounting Software

Nimble Property is a comprehensive tailor-made accounting and analytics solution for the hotel industry to provide insights and visibility into both financial & operational data in real time. Read Nimble Property Reviews

Explore various Nimble Property features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Nimble Property Features- Multiuser Login & Role-based access control

- Bookkeeping Services

- MIS Reports

- Warehouse Management

- Accounts Receivable

- Banking Integration

- Expense Management

- General Ledger

Pricing

Single Property

$ 300

one property

Nimble Property Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Making Modern Businesses GST friendly

QuickBooks is an online accounting software for business owners to make stay on top of their finances. Easy to use interface, 100% data security and features such as Online bank connect and Whatsapp integration helps business owners to focus on growing their business. Read QuickBooks Online Reviews

Explore various QuickBooks Online features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all QuickBooks Online Features- Payments

- Expense Tracking

- Mobile App

- Delayed Billing

- Multi Currency

- Document Management

- Purchase Management

- Project Management

Pricing

Simple Start

$ 30

Per Month

Essentials

$ 60

Per Month

Plus

$ 90

Per Month

QuickBooks Online Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Accounting success stories in numbers

LEAD Accounting Plus is a simple but comprehensive accounting software for small & medium businesses for billing, inventory management, taxation and financial reporting along with industry specific features like manufacturing. Read LEAD Accounting Plus Reviews

Explore various LEAD Accounting Plus features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

- Data Entry

- Member Database

- Mobile Payments

- RFI & Submittals

- Online Payment Processing

- Rules-Based Scheduling

- Report Export

- Expense Tracking

Pricing

BASIC

$ 208

License

STANDARD SINGLE USER

$ 347

License

STANDARD MULTI USER

$ 833

License

LEAD Accounting Plus Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

myBooks Online Accounting Software

myBooks is an easy-to-use online accounting software for small business owners. This powerful online accounting software helps you manage your finances, save you time and money. Small business owners can create invoices and quotes, manage bills and expenses. Read myBooks Reviews

Explore various myBooks features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all myBooks Features- General Accounting

- Billing & Invoicing

- Invoice

- Expense Tracking

- Multi Currency Support

- Cashflow

- Database backup/restore (Management)

- Taxation Management

Pricing

Premium

$ 10

Per Month

myBooks Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Services by Xero Limited

Xero is award-winning web-based accounting software for small business owners and their accountants. It is beautifully designed and easy to use online bookkeeping for expense management. Read Xero Accounting Reviews

Explore various Xero Accounting features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Xero Accounting Features- Taxation Management

- Supplier and Purchase Order Management

- HR & Payroll

- Bonus

- Invoice

- Banking Integration

- Time Tracking

- Inventory Management

Pricing

Starter

$ 9

Per Month

Standard

$ 30

Per Month

Premium

$ 60

Per Month

Xero Accounting Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Digital Munim For Your Business

Munim is a cloud-based accounting software in India that offers all accounting, invoicing and taxation solutions in one place. It is a reliable and easy-to-use software for all types of businesses. Read Munim Reviews

Explore various Munim features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Munim Features- VAT / CST / GST Reports

- Balance Sheet

- GST returns

- Government

- ACH Payment Processing

- Accounts payable

- Billing & Invoicing

- Online invoicing

Pricing

Accounting & Billing

$ 0

Free for Now

Munim Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

The Language of Business

HostBooks GST simplifies the process of working on GST with the effortless filing of returns & easy reconciliation of the mismatches. It reduces the compliance time by at least 50% and cuts down the cost by half. Hence, HostBooks enhances your efficiency by leaps and bounds. Read HostBooks GST Reviews

Explore various HostBooks GST features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all HostBooks GST Features- Customer Management

- Invoice

- Collaborate

- Taxation Management

- GST Ready

- VAT / CST / GST Reports

- Multiuser Login & Role-based access control

- Product Database

Pricing

All in One Single sign up

$ 56

Per Year

HostBooks GST Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Services by Sage

Sage offers a complete desktop accounting software that helps you spend less time managing your accounts and more time developing your business. With its easy to use interface, Sage 50cloud Accounting has aided small businesses and entrepreneurs to operate efficiently and effectively. Special Offer: 40% off Sage 50cloud annual subscriptions | Coupon Code: D-1929-0020. Read Sage 50cloud Reviews

Explore various Sage 50cloud features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Sage 50cloud Features- General Ledger

- Project Accounting

- Mobile Payments

- Contact Database

- Fixed Asset Management

- Government

- Billing Portal

- Bank Reconciliation

Pricing

Pro Accounting

$ 51

Per Month

Premium Accounting

$ 78

Per Month

Quantum Accounting

$ 198

Per Month

Sage 50cloud Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

GST Billing Software-Complete Accounting Solutions

BTHAWK is a cloud-based GST accounting software that helps users in every task related to accounting, GST filing, supplier management, etc. Users can focus on other core business activities. They can live burden-free, let BTHAWK bear the burden. Read BTHAWK Reviews

Explore various BTHAWK features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all BTHAWK Features- Billing & Invoicing

- Billing for Data

- Billing Rate Management

- Online Invoice Payment

- GST Tax Invoice

- Account Management

- Billing Portal

- Accounting

BTHAWK Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Run your limited service hotels profitably

Cost-effective Accounting & Bookkeeping Solutions for limited-service hotel property owners, leveraging integration and automation. Schedule a demo today on our Hotel Accounting Software or speak to our Bookkeeping Experts to discover more. Read Hotelier Books Reviews

Explore various Hotelier Books features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Hotelier Books Features- Multiple Company

- Multiuser Login & Role-based access control

- Financial Accounting

- Revenue Management

- Bonus

- Billing & Invoicing

- Accounting Management

- General Ledger Entry

Hotelier Books Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Visitor, Society & Accounting Management System

Experience world-class technology that is built to make your community living more convenient and more secure. It’s easy to use, available in all local languages and made for all! Read NoBrokerHood Reviews

Explore various NoBrokerHood features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all NoBrokerHood Features- Employee Management

- TDS Calculation

- Parking Lot Management

- Landing Pages/Web Forms

- Polling Booth / ballot

- Deployment Management

- VAT / CST / GST Reports

- Alerts Notifications

NoBrokerHood Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

GST Accounting Software for a Founder, Businesses

Easiest GST ready accounting Software to prepare GST Compliant Billing, Invoicing, maintaining books, get to know how well your business is doing real-time, and prepare your GST Returns. Works even for a non-accountant. Read EZTax Books Reviews

Explore various EZTax Books features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all EZTax Books Features- Document Printing

- User-Friendly Interface

- Multi Currency

- Mobile Support

- Billing & Invoicing

- Checks & Controls

- Payment Management

- Comprehensive Services

Pricing

Annual Subscription

$ 0

Per Year

EZTax Books Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

ab bill banana hua asaan

BillClap is a mobile/desktop billing software for creating invoices, GST billing, manage inventory, track ledgers & account transactions for Indian companies. Read BillClap Reviews

Explore various BillClap features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all BillClap Features- Expense Tracking

- Proposal Management

- Accounting

- Purchasing

- Invoice

- Expense Management

- Invoice Processing

- Billing Portal

Pricing

Club

$ 11

Annual/Single user

Gold

$ 21

Per Year

BillClap Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

The Language of Business

HostBooks, an automated all-in-one accounting & compliance software provides you with a comprehensive platform for GST, TDS, eWay Bill Accounting, Tax & Payroll. Read HostBooks Accounting Reviews

Explore various HostBooks Accounting features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

- Mobile Support

- Outstanding

- Time Tracking

- Bank Reconciliation

- Service Tax

- Invoice Designer

- Multiuser Login & Role-based access control

- Bills of Material

Pricing

All-in-One Single Sign Up

$ 76

Per Year

HostBooks Accounting Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Finding accounting services is crucial whether you're a small business owner, an entrepreneur, or just want to simplify your financial management. We'll lead you through a hand-picked list of the top online bookkeeping services in this guide. Each will provide a selection of features catered to your own requirements.

Explore features like easy ways to put in data, keep a close watch on your spending, get accurate expense reports, and make the software work together smoothly. Get detailed insights into your company's financial health. Our guide on bookkeeping services will help you make important decisions and steer toward lasting financial success.

What Is Bookkeeping?

Bookkeeping is methodically recording, organizing, and managing a company's financial transactions. It comprises maintaining track of earnings, outlays, assets, debts, and equity throughout a certain period decided in advance. By ensuring accurate and current financial records, bookkeeping helps organizations stay on top of their finances, make wise decisions, and comply with regulations.

Various duties are involved in this procedure, such as classifying transactions, balancing accounts, creating financial statements, and creating reports for taxation. Businesses can obtain insights into their financial performance, spot trends, and create budgets. Ultimately ensure financial stability and growth by maintaining accurate and thorough bookkeeping.

What Are Bookkeeping Services?

Bookkeeping services are fundamental financial tasks that entail the organized recording, organization, and monitoring of a company's financial transactions. Bookkeeping is a crucial part of any business. These services play a crucial part in the maintenance of correct and up-to-date financial records. It enables businesses to monitor their own financial health, make decisions based on reliable information, and comply with the standards imposed by legal and regulatory authorities.

Bookkeeping services for small businesses entail entering different financial activities, such as sales, purchases, expenses, and payments, into ledgers or other accounting software. As a result, the process of analyzing an establishment's performance, keeping tabs on its cash flow, and preparing financial statements such as balance sheets, income statements, and cash flow statements is simplified.

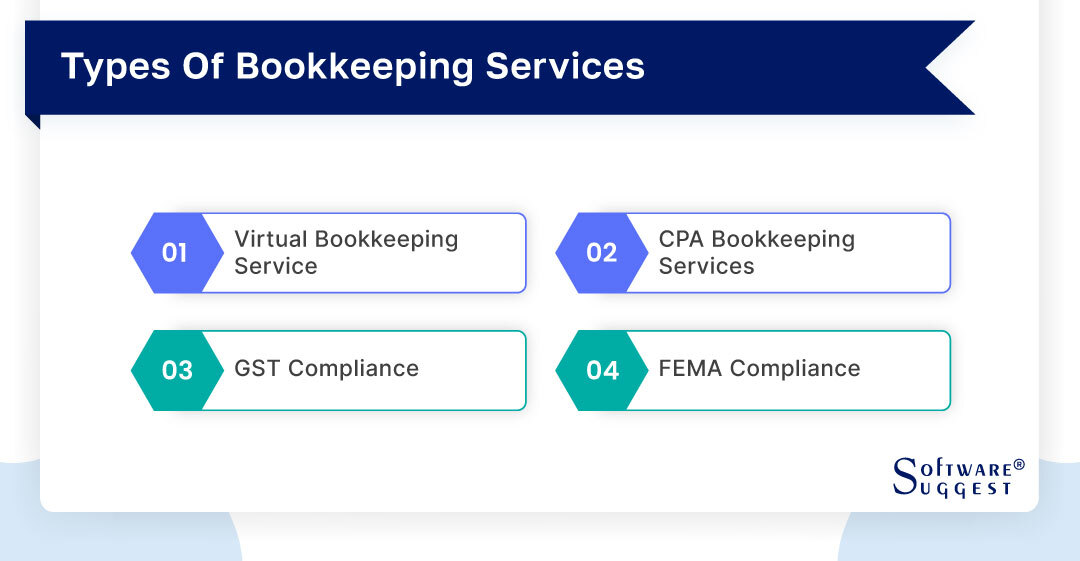

Different Types Of Bookkeeping Services

Accounting and bookkeeping services play a pivotal role in ensuring establishments' financial health and success. This section explores some prominent categories of payroll services. Let's see them in detail:

-

Virtual Bookkeeping Service

The rise of remote work and digitalization has given birth to virtual bookkeeping services. This type of service offers establishments the flexibility to outsource their bookkeeping tasks to remote professionals who manage financial records and transactions virtually.

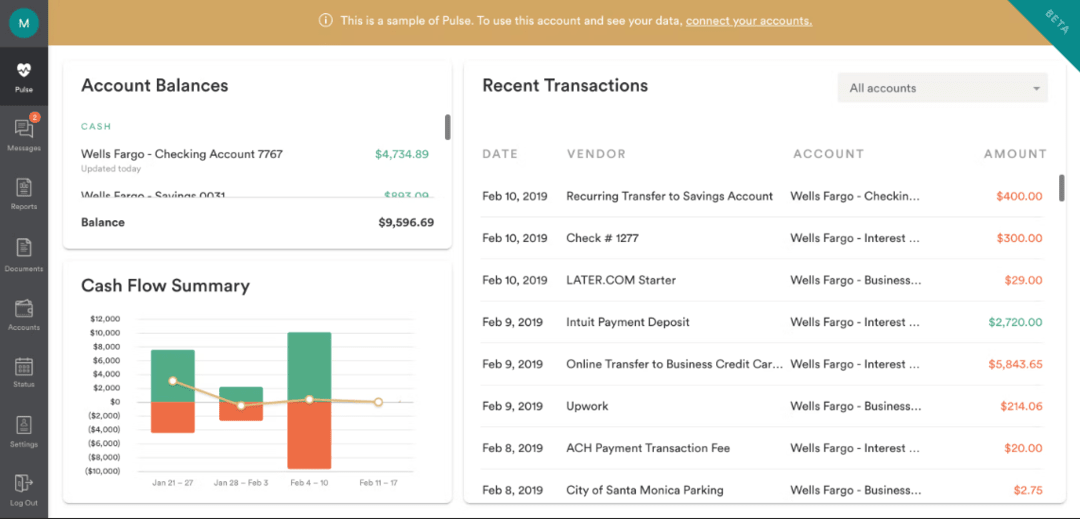

Cloud-based accounting software is what virtual bookkeepers use to keep precise records of clients' revenue, expenses, and other financial operations. Businesses are able to have access to financial data in real-time and effortlessly work with their virtual bookkeepers when they make use of technology.

-

CPA Bookkeeping Services

Certified Public Accountants (CPAs) bring a higher level of expertise and credibility to the world of bookkeeping. CPA Bookkeeping Services offers businesses the advantage of working with qualified professionals who have undergone rigorous training and certification processes. These professionals not only manage financial records but also provide valuable insights and financial analysis.

CPA bookkeepers ensure adherence to accounting standards and regulations while also offering strategic financial advice that can guide business decisions. This service is particularly important for companies that require in-depth financial expertise and guidance beyond basic bookkeeping.

-

GST Compliance

Goods and Services Tax (GST) compliance is a critical aspect of financial operations for businesses operating in regions where this tax system is in place. GST Compliance Bookkeeping Services specialize in accurately tracking GST-related transactions, calculating GST liability, and ensuring timely filing of GST returns.

These services help businesses avoid penalties and legal complications by maintaining precise records and ensuring adherence to GST regulations. As tax laws and rates evolve, GST compliance bookkeepers stay up-to-date to ensure accurate reporting.

-

FEMA Compliance

Foreign Exchange Management Act (FEMA) compliance is essential for businesses engaged in international transactions, especially in countries like India, where FEMA regulations govern foreign exchange transactions and cross-border investments. FEMA Compliance Bookkeeping Services assist businesses in recording and reporting foreign exchange transactions.

Adhering to FEMA guidelines and ensuring that international financial activities are transparent and compliant. This type of bookkeeping service helps companies navigate the complexities of cross-border finance while avoiding potential legal and financial pitfalls.

Who Should Opt For Bookkeeping Services?

Bookkeeping services provide a reliable solution for businesses and individuals seeking to streamline their financial management processes. This section delves into various categories of entities that can greatly benefit from professional bookkeeping services. Let's see them in detail:

-

Free Businesses and Startups

For fledgling businesses and startups, bookkeeping can often be a daunting task. Limited resources and a focus on growth might mean that financial record-keeping takes a backseat. However, opting for bookkeeping services can offer these entities a strategic advantage.

Professional bookkeepers assist startups in setting up robust financial systems from the outset, ensuring accurate record-keeping, expense tracking, and proper categorization. With bookkeeping professionals managing the financial side, startups can concentrate on what they do best – innovating and expanding their business.

-

Freelancers and Self-employed Individuals

Freelancers and self-employed professionals often navigate complex financial landscapes that involve varying sources of income, deductible expenses, and estimated tax payments. Amid their busy schedules, meticulously managing finances can become a challenge. Engaging bookkeeping services offer freelancers and self-employed individuals the advantage of precise income and expense tracking.

This ensures that tax obligations are met, deductions are optimized, and financial surprises are minimized. With accurate financial records, these individuals can also gain insights into their earning patterns and make informed financial decisions for the future.

-

Consultants and Professionals

Consultants, lawyers, doctors, and other professionals have distinct financial needs due to the nature of their work. Balancing client appointments, projects, and administrative tasks often leaves them with limited time to manage their finances. By utilizing bookkeeping services, consultants and professionals can focus on delivering their expertise while leaving financial management to experts.

Bookkeepers help them keep track of billable hours, manage client invoices, and monitor business expenses. This ensures timely payments, efficient client interactions, and a clear overview of their financial performance.

-

Goods Traders

Businesses involved in the trading of goods, whether on a local or international scale, face intricate financial transactions. These transactions encompass inventory management, sales, purchases, and often import-export activities. Bookkeeping services tailored to goods traders provide assistance in tracking inventory levels, managing accounts payable and receivable, and reconciling transactions accurately.

Such services ensure that financial data remains organized, tax obligations are met, and profit margins are maximized. Ultimately, this enables goods traders to make informed decisions to optimize their supply chain and profitability.

-

Nonprofit Organizations

Nonprofit organizations operate with the mission to create social impact rather than generate profits. However, they are not exempt from stringent financial reporting requirements. Nonprofits must demonstrate transparency in their financial management to maintain donor trust and comply with regulatory standards.

Bookkeeping services for nonprofit organizations specialize in tracking donations, grants, program expenses, and other financial aspects unique to the nonprofit sector. These services help nonprofits maintain accurate records, prepare required financial statements, and navigate the complexities of fund accounting.

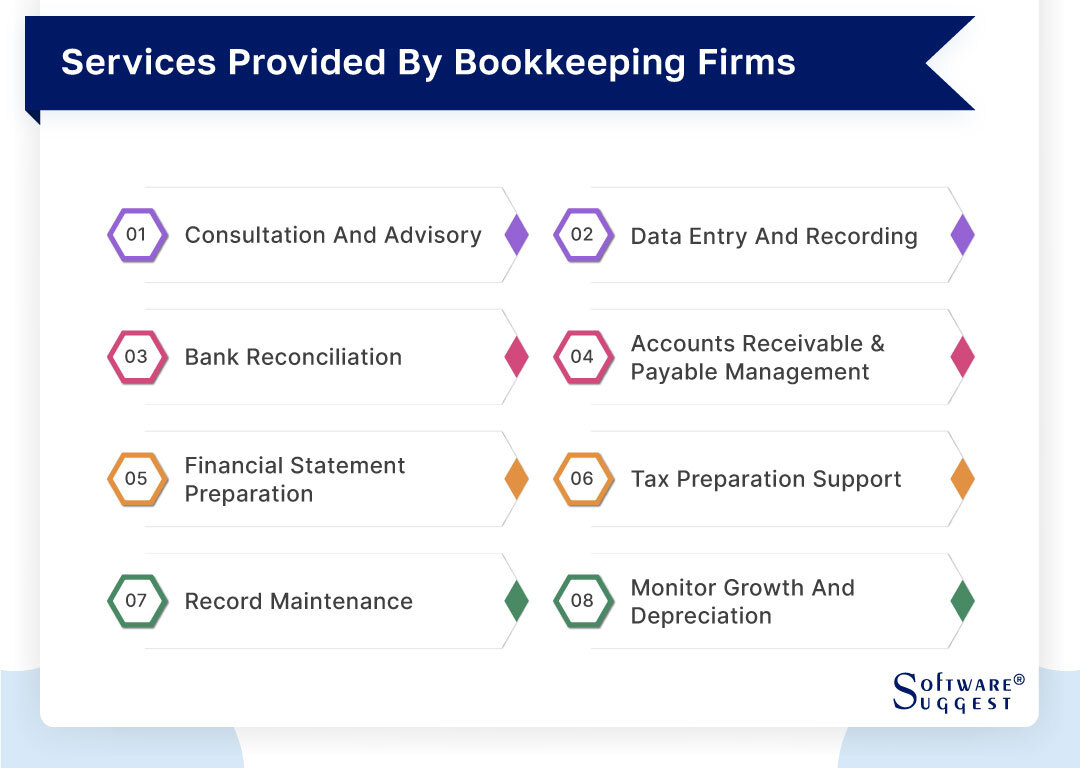

What Are The Services Provided By Bookkeeping Firms?

By utilizing the best bookkeeping services, businesses can effectively manage their financial documentation, adhere to regulations, and make well-informed decisions. Let's see various offerings presented by bookkeeping entities. Let's delve into the details:

-

Consultation and Advisory

Bookkeeping firms go beyond merely recording financial transactions. They offer valuable consultation and advisory services to help businesses navigate complex financial decisions. These services often include budgeting, cash flow analysis, and financial forecasting.

By thoroughly understanding a company's financial position, bookkeeping experts can provide insights that guide strategic planning and growth initiatives. Because of their experience, they make it possible for firms to recognize potentially lucrative possibilities and respond proactively to obstacles.

-

Data Entry and Recording

The fundamental component of efficient bookkeeping is data entry that is accurate. Bookkeeping establishment services are responsible for the accurate recording of various financial transactions, such as sales, costs, payroll, and more.

This service ensures that all financial activities are properly documented, categorized, and organized. Accurate data entry forms the basis for generating various financial reports and statements, which are essential for decision-making, tax filing, and regulatory compliance.

-

Bank Reconciliation

Bank reconciliation is a critical task that ensures the consistency and accuracy of financial records. Bookkeeping firms perform regular bank reconciliation by comparing a company's recorded transactions with bank statements.

This process identifies discrepancies, errors, or missing entries, allowing for timely corrections. Accurate bank reconciliation helps maintain the integrity of financial data and provides a clear view of a company's actual financial position.

-

Accounts Receivable & Payable Management

Managing accounts receivable (AR) and accounts payable (AP) is essential for maintaining healthy cash flow. Bookkeeping firms oversee AR and AP processes, including tracking customer payments, sending invoices, and managing vendor payments.

Timely AR management ensures that outstanding payments are collected promptly, while efficient AP management helps businesses avoid late fees and maintain strong vendor relationships.

-

Financial Statement Preparation

A picture of a company's financial health and performance can be obtained from the company's financial statements. Accounting companies are responsible for the preparation of fundamental financial statements such as income statements, balance sheets, and cash flow statements.

These statements offer insights into a company's profitability, assets, liabilities, and liquidity. Accurate and well-prepared financial statements are crucial for internal decision-making, investor communication, and compliance with regulatory requirements.

-

Tax Preparation Support

Tax preparation is a complex and time-consuming process. Bookkeeping firms offer tax preparation support to ensure accurate and timely submission of tax returns. They help gather relevant financial data.

Also, apply for applicable tax deductions and credits, and generate the necessary tax documents. By collaborating with tax professionals or Certified Public Accountants (CPAs), bookkeeping firms help businesses optimize their tax positions and comply with tax regulations.

-

Record Maintenance

The foundation of efficient and profitable business operations is the upkeep of comprehensive and well-organized financial records. Bookkeeping services provide a safe repository of financial data and ensure that all records are well-organized and simple to access.

This practice not only aids in day-to-day financial management but also serves as a valuable resource during audits, regulatory inspections, or financial analysis.

-

Monitor growth and Depreciation

Bookkeeping firms play a vital role in monitoring a company's financial growth and asset management. They track revenue trends, expenses, and profit margins over time, helping businesses identify patterns and make informed decisions. Additionally, bookkeeping firms monitor asset depreciation, ensuring accurate recording and reporting of the decrease in value of assets over their useful lives.

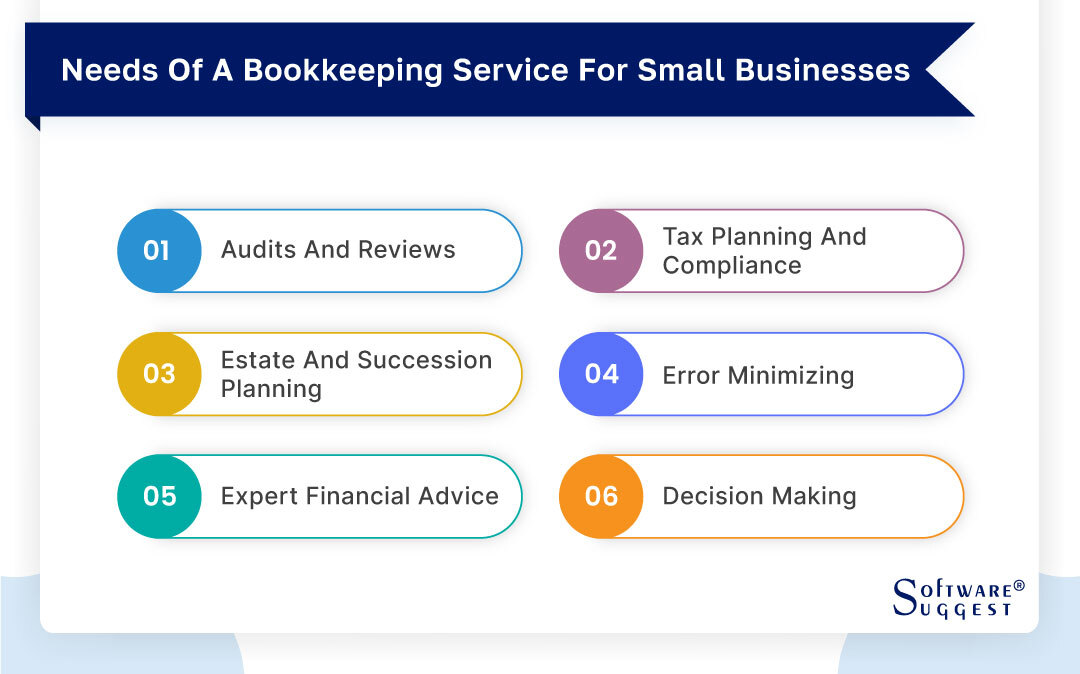

What Is The Requirement of A Bookkeeping Service For Small Businesses?

Small businesses form the backbone of economies worldwide, contributing to innovation and growth. This section examines the indispensable role of accounting services for small businesses. Let's see them in detail -

-

Audits and Reviews

While small businesses might not undergo the rigorous audits of larger corporations, periodic internal reviews are crucial. AML software provides systematic reviews of financial records, ensuring accuracy, consistency, and transparency.

These reviews act as preventative measures, identifying potential errors before they escalate into serious financial discrepancies. By conducting regular audits, bookkeeping services safeguard the financial integrity of small businesses and instill trust in stakeholders.

-

Tax Planning and Compliance

Navigating the intricate landscape of taxes is a challenge for small businesses. Single-double entry bookkeeping offers specialized tax planning and compliance assistance. They stay abreast of tax laws, deductions, and credits relevant to the business.

Thus, ensuring proper tax classification and timely filing. By optimizing tax strategies, bookkeepers help small businesses reduce tax liabilities while complying with legal obligations, ultimately contributing to financial stability.

-

Estate and Succession Planning

Incorporating estate and succession planning is a prudent move for small businesses with aspirations for longevity. Budgeting software assists in structuring financial assets, identifying potential successors, and planning seamless transitions. By facilitating proper estate distribution and succession strategies, these services ensure business continuity even through ownership changes, maintaining stability and sustainability.

-

Error Minimizing

Small businesses often have limited resources, leaving little room for financial errors. Bookkeeping services act as a vigilant gatekeeper against inaccuracies. Their meticulous data entry and regular reconciliations prevent discrepancies from emerging, preserving the accuracy of financial records. This not only fosters operational efficiency but also prevents financial losses stemming from errors.

-

Expert Financial Advice

The insights of seasoned financial professionals are invaluable to small businesses. Bookkeeping services offer more than just record-keeping; they provide expert financial advice. Analyzing financial trends, bookkeepers offer strategic guidance that aids in budgeting, resource allocation, and financial decision-making. This expert input empowers small business owners to make informed choices that contribute to sustainable growth.

-

Decision Making

In the competitive business landscape, well-informed decisions are paramount. Bookkeeping services equip small businesses with accurate and up-to-date financial information. This data-driven approach enables owners to evaluate the financial implications of various choices. These are investments, expansions, or cost-cutting measures. Informed decisions founded on reliable financial insights pave the way for smart and successful ventures.

What Are The Benefits Of Bookkeeping Services?

In the complex world of today's business, keeping exact money records isn't just needed; it's also a smart advantage. Let’s see the various benefits of nonprofit accounting software. Let's see them in detail:

-

Time and Cost Saving

The intricate chore of managing financial records can consume a significant chunk of time and resources. Outsourcing this task to professional remote bookkeeping services liberates businesses from the burden of day-to-day financial administration.

This time-saving allows businesses to allocate resources to core activities, fostering growth and innovation. Moreover, outsourcing often proves cost-effective as it eliminates the need to maintain an in-house accounting department, reducing overhead costs.

-

Financial Transparency

Clarity in financial matters is indispensable for making informed decisions. Bookkeeping services provide this transparency by maintaining accurate and organized financial records.

Business owners can access comprehensive reports and statements that offer a clear view of income, expenses, assets, and liabilities. This transparency empowers stakeholders to evaluate the financial health of the business accurately, facilitating strategic planning and partnerships.

-

Healthy Cash Flow Management

Cash flow forms the lifeblood of any business. Bookkeeping services play a pivotal role in managing cash flow by meticulously tracking accounts receivable and accounts payable. This ensures that incoming revenue is balanced with outgoing expenses.

Thus, preventing cash shortages or overextending credit. By identifying potential cash flow gaps early, bookkeepers help businesses take preemptive measures to maintain a healthy financial flow.

-

Reduce Tax Liabilities

Navigating the complex tax code can be a daunting task for businesses. Bookkeeping services specialize in tax planning and compliance, optimizing deductions, credits, and exemptions to minimize tax liabilities.

Their expertise ensures that businesses take advantage of available tax benefits while staying within the boundaries of tax regulations. This strategic tax management can result in substantial savings for businesses.

-

Budget Monitoring

Effective budgeting is the cornerstone of financial success. Bookkeeping services not only help create budgets but also monitor adherence to them. By tracking expenses against budgeted amounts, they provide real-time insights into financial performance.

If discrepancies arise, adjustments can be made promptly to align with financial goals. This proactive approach helps businesses make financial decisions that align with their budgetary constraints.

-

Access To Virtual Accounting Services

The digital age has revolutionized how businesses operate, and bookkeeping services have evolved accordingly. Virtual accounting services allow businesses to collaborate with professionals remotely, eliminating geographical barriers.

This access to virtual bookkeeping services provides flexibility, real-time data sharing, and responsive support. This is particularly beneficial for businesses seeking nimble financial management solutions.

-

Expert Financial Analysis

Beyond the world of record-keeping, bookkeeping services offer expert financial analysis. Professionals in these services can dissect financial data, offering insights into trends, patterns, and opportunities.

This expert analysis goes beyond numbers, providing strategic guidance to businesses. Equipped with this information, businesses can make well-informed decisions that drive growth and sustainable profitability.

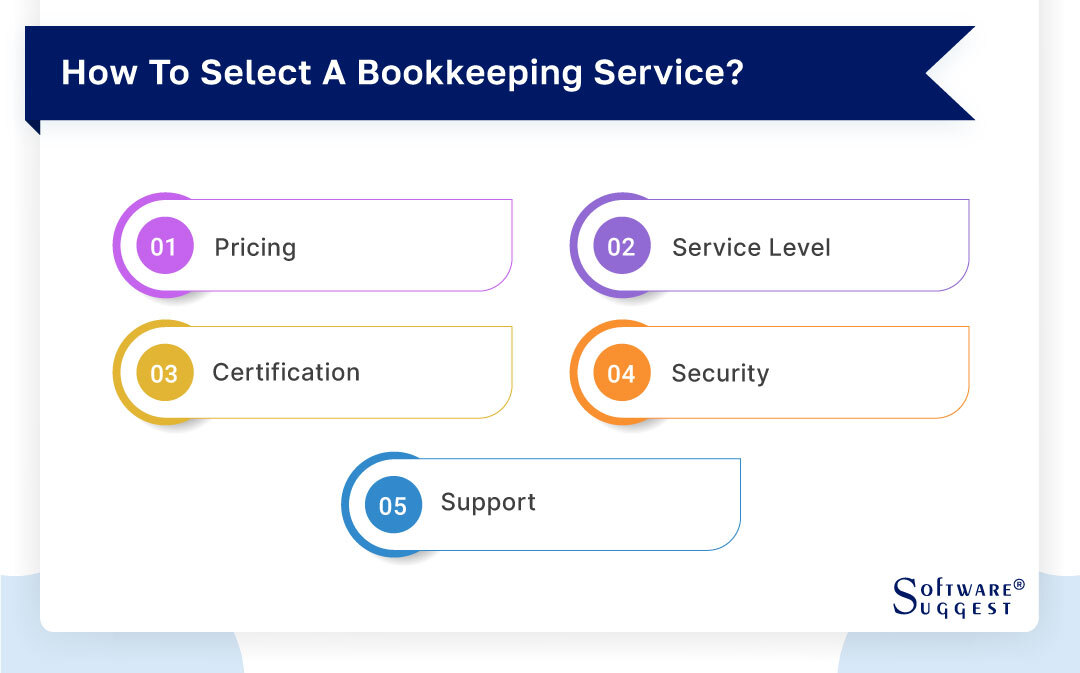

What To Consider When Selecting A Service For Bookkeeping?

The decision to opt for the right bookkeeping service has a substantial influence on your enterprise's financial well-being and operational efficiency. Let's delve into the paramount factors that warrant careful consideration. Thus, let's see them in detail:-

-

Pricing

One of the foremost factors to consider when selecting a bookkeeping service is the pricing structure. There are several different price structures that can be used for the same service, including hourly rates, flat costs, and subscription-based package deals.

Look for pricing that is clear and make sure there aren't any surprises waiting for you down the road in the form of additional expenses. Consider your budget and the specific services you require to find a pricing arrangement that aligns with your financial goals.

-

Service Level

The service level offered by a bookkeeping provider directly influences the quality of financial management you will receive. Consider what level of service your business requires. Some cash flow management software offers basic data entry and record-keeping, while others provide comprehensive financial analysis, reporting, and strategic guidance.

Determine whether the service can cater to your specific needs and scale as your business grows. Assess the range of services offered to ensure they align with your short-term and long-term financial goals.

-

Certification

Certification and qualifications are essential indicators of a bookkeeping service's expertise and professionalism. Look for certifications such as Certified Public Accountant (CPA), Chartered Accountant (CA), or certifications from recognized accounting associations.

These credentials demonstrate that the professionals handling your financial records have undergone rigorous training and adhere to industry standards. Certification also signifies that the service is equipped to handle complex financial tasks and provide accurate insights.

-

Security

Your financial information's security is of utmost importance. Ask a prospective bookkeeping provider about their data security procedures before hiring them. Inquire about access controls, data storage mechanisms, and encryption techniques.

Strong security measures should be in place at a trustworthy service to guard against unwanted access, data breaches, and information leaks. In order to safeguard the security of your financial details, it is also recommended to ask about their data backup practices.

-

Support

Establishing effective communication and robust support mechanisms is paramount in fostering a successful bookkeeping partnership. It's essential to assess the service's responsiveness to inquiries and concerns. Does it provide dedicated account managers or specialized customer service agents?

Clear and transparent communication is pivotal for promptly addressing any potential issues and maintaining the accuracy and currency of your financial records. A service that offers swift and dependable assistance significantly contributes to a streamlined and productive collaboration.

Top 5 Providers of Bookkeeping Services

|

Name

|

Free Trial

|

Demo

|

Pricing

|

|---|---|---|---|

|

30 Days |

Yes |

Starting price at $13.60/month | |

|

30 Days |

Yes |

Starting price at $15/month |

|

|

14 Days |

Yes |

Starting price at $399/month |

|

|

30 Days |

Yes |

Custom pricing. |

|

|

30 Days |

Yes |

Starting price at $249/month |

Let's discover the leading names in Bookkeeping Services, meticulously chosen for their exceptional financial management solutions. This list showcases the top 5 providers known for their expertise in maintaining accurate records, streamlined processes, and reliable bookkeeping.

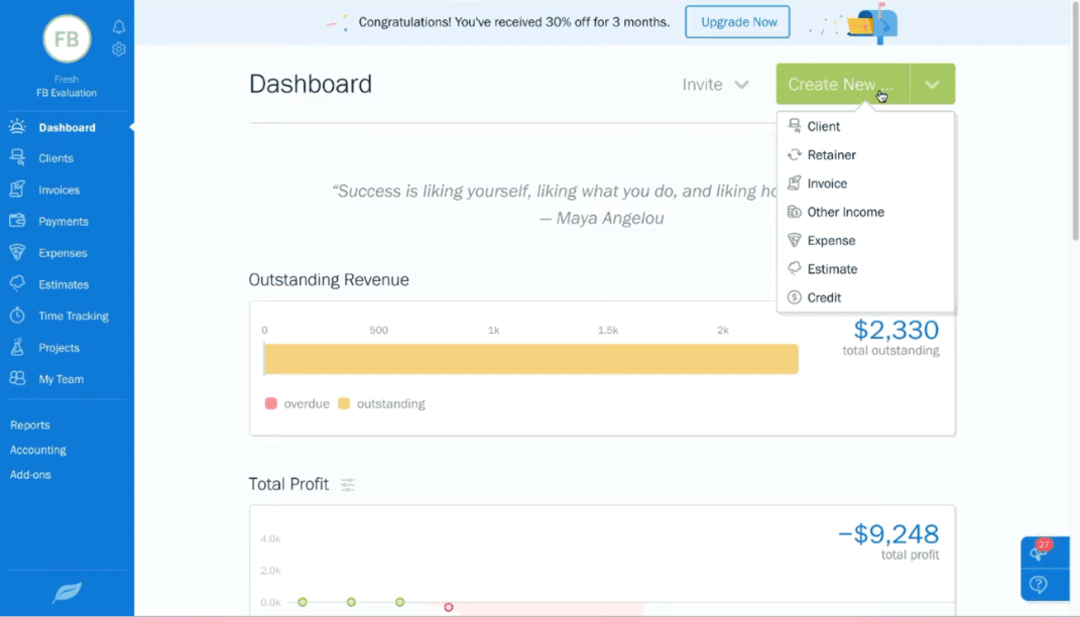

1. FreshBooks

FreshBooks offers accounting solutions that are hosted in the cloud and are designed with the needs of freelancers and small businesses in mind. Invoicing, time and project management, as well as cost tracking, are all included in its feature set. Even those with little or no accounting experience can understand it.

The software can communicate with a wide variety of apps, which significantly boosts productivity. Most notably, it offers superior levels of customer service. This alternative is suitable for both small businesses and freelancers seeking efficient accounting because it is both cost-effective and easy to use.

- Balance sheet

- General ledger

- Accounts payable

- Reports

- Mileage tracking app

- Bookkeeping

- It offers intuitive usability, making it accessible even to new users

- FreshBooks is known for its out-of-the-box functionality

- The exceptional customer support options ensure better customer service and satisfaction

- FreshBooks integrates with various software applications

- The invoicing and billing features offered by FreshBooks stand out for their efficiency

- The limited reporting capabilities within FreshBooks can pose challenges for highly high-end users

- FreshBooks' lack of advanced inventory management features

- Occasional delays in resolving issues have been voiced by some users

- FreshBooks might need to introduce updates or additional features

Pricing

- Lite- $ 13.60 per month

- Plus- $ 24 per month

- Premium- $44 per month

2. QuickBooks

QuickBooks stands as a versatile accounting software catering to small and medium-sized businesses. It offers an encompassing solution, streamlining accounting tasks with a rich feature set that covers inventory management, payroll handling, and bank reconciliation. Users have the liberty to choose between a desktop and a cloud-based variant, tailoring their choice to specific needs.

The QuickBooks online account ensures accessibility from any internet-enabled location, while the desktop counterpart delivers robust functionalities. Thus, QuickBooks partner software is an excellent choice for businesses aiming to simplify their accounting processes.

- Invoice creation

- Expense management

- Billing

- Project creation

- Sales tax

- E-commerce transactions

- This bookkeeping software doesn't demand prior accounting knowledge

- Users can fine-tune the software to match their exact needs

- With a host of integrations, the software effortlessly collaborates with other tools

- Equipped with a mobile app, users can manage their finances anytime

- The software excels in maintaining precise records and streamlining financial tasks

- Users might face challenges with sporadic and slow customer support responses

- The software's speed and responsiveness might diminish when handling extensive data

- Certain advanced features might pose a learning curve

Pricing

- Simple start- $ 15 per month

- Essentials- $ 30 per month

- Plus- $ 45 per month

- Advanced- $ 100 per month

3. Bookkeeper.com

Bookkeeper.com offers comprehensive bookkeeping services through its software. For businesses of all sizes, the software is intended to expedite and simplify the bookkeeping process. It offers precise and effective financial administration with features including automated data entry, bank reconciliation, and financial reporting.

Additionally, the best online bookkeeping services guarantee data security and adherence to industry rules. Businesses can concentrate on their main operations while putting the bookkeeping responsibilities in the experienced hands of Bookkeeper.com by using its software.

- Bookkeeping service

- Payroll management

- Tax management

- Billing

- Financial planning & investments

- The platform automates many manual tasks, saving time and improving efficiency in managing financial records

- The software helps minimize human errors by automating calculations and providing checks and balances

- The tax filing services provide real-time access to financial data

- It allows multiple users to collaborate and access financial data simultaneously

- It integrates with other business tools and platforms

- Transitioning to a new bookkeeping software may require some initial learning and training

- The software relies on stable internet connectivity to access and update financial data

- The pricing model is high for small businesses

- There are limitations in tailoring the software to meet specific customization requirements

Pricing

The pricing starts at:-

- Payroll- $125 per month

- Tax- $350 per month

- Bookkeeping- $399 per month

4. FinancePal

FinancePal offers top-notch small business bookkeeping services through its advanced software. Their program makes financial management for business owners simpler with an intuitive design and strong functionality. Small businesses can stay organized and make wise financial decisions.

It is due to FinancePal's software, which tracks income and expenses and produces reliable financial reports. FinancePal's software is a dependable option for small business owners wishing to automate their bookkeeping procedures. It is because it offers secure data storage and dependable customer service.

- Transaction recording

- Income statement preparation

- Balance sheet preparation

- Quarterly payroll tax returns

- Annual payroll tax returns

- FinancePal offers small business bookkeeping services with a team of experienced professionals

- Users save valuable time and resources by using FinancePal

- FinancePal offers scalable bookkeeping solutions that can grow alongside your business

- It utilizes advanced tools to streamline processes and improve efficiency

- FinancePal may lack the personal touch that some businesses prefer

- FinancePal has a steep learning curve

- Some users have reported that FinancePal's customer support is not always responsive

- The software lacks the flexibility to meet their specific needs

Pricing

Custom pricing.

5. Bench

Bench is a user-friendly software that simplifies bookkeeping for small businesses. It streamlines financial management activities so business owners may concentrate on expanding their enterprises due to its user-friendly layout and robust features.

Bench streamlines data entry, classifies transactions and produces meaningful reports to provide companies with a comprehensive picture of their financial health. The platform's secure cloud architecture guarantees data privacy while facilitating communication with bookkeepers and accountants.

- Document collection

- Reporting

- Income statement

- Balance sheet

- Trial balance

- Tax-ready financials

- Bench's highly hands-on customer service has received good reviews from users

- Bench offers dedicated bookkeepers to manage responsibilities

- Users have expressed their admiration for Bench's staff, structure, tools, and software

- A complete and competitive collection of tools is available to streamline the bookkeeping

- Bench uses 256-bit SSL/TSL encryption to protect user data

- Bench's price has been criticized by some users as being too pricey

- Bench takes more time than handling their own bookkeeping on a straightforward spreadsheet

- The lack of a live chat feature may hinder immediate assistance for users with urgent inquiries

- Bench primarily focuses on serving businesses in the United States

Pricing

- Essential- $249 per month

- Premium- $399 per month

Strategies To Improve Client Bookkeeping Services

Efficient bookkeeping is the backbone of a successful tally partner business. This section delves into 6 key strategies to improve client bookkeeping services and client satisfaction.

-

Clear Communication

Effective communication lies at the heart of any successful client-service provider relationship. This is particularly true in the world of bookkeeping services, where transparency and clarity can prevent misunderstandings and errors. Regular and open communication channels should be established from the outset of the engagement.

Clients must be informed about the process, expectations, and timelines. Moreover, any changes or discrepancies should be communicated promptly. A dedicated point of contact for addressing queries and concerns can further streamline communication and enhance the client's confidence in the services.

-

Regular Training

The field of finance and bookkeeping is ever-evolving, with new regulations, software, and techniques emerging regularly. To provide top-notch services, bookkeeping professionals must stay up-to-date with these developments. Regular training sessions should be conducted for the bookkeeping team.

It is to ensure they are well-versed in the latest practices and tools. This not only ensures accurate and compliant bookkeeping but also reflects a commitment to professional growth and excellence. Clients are more likely to trust bookkeepers who demonstrate a dedication to continuous improvement.

-

Customized Solutions

No two businesses are identical, and neither should their bookkeeping solutions be. Every client has unique requirements, depending on factors such as industry, size, and growth stage. Offering customized solutions demonstrates a deep understanding of the client's needs.

Also, it positions the bookkeeping service as a valuable partner rather than a mere provider. Tailoring services can range from designing specific reports that align with the client's goals to integrating their preferred accounting software for seamless collaboration.

-

Timely Reporting

Timeliness is paramount in the world of bookkeeping. Clients rely on financial reports to make informed decisions, and delays can impede their ability to do so effectively. Establishing a clear schedule for generating and delivering reports ensures that clients have the information they need when they need it.

This can also assist in the early identification of problems, which enables proactive problem-solving to take place. Tax consulting services have the ability to promote themselves as credible and trustworthy partners by achieving reporting deadlines on a frequent basis.

-

Regular Reconciliation

The process of reconciling one's financial records with external sources such as bank statements is referred to as "reconciliation." It is an extremely important part of the process of locating inconsistencies and possible errors. Incorporating regular reconciliation procedures into the bookkeeping process helps catch inaccuracies before they snowball into larger issues.

This strategy not only ensures the accuracy of financial records but also enhances the credibility of the bookkeeping service. Clients appreciate the diligence and attention to detail demonstrated through such practices.

-

Value-Added Services

To truly stand out in the competitive landscape of bookkeeping services, offering value-added services can make a significant difference. These services go beyond the basic requirements and provide additional insights that can benefit the client's business.

Examples include financial analysis, budgeting assistance, and cash flow forecasting. By offering these services, bookkeepers position themselves as proactive advisors rather than reactive record-keepers, fostering deeper client relationships and long-term loyalty.

How Much Does A Bookkeeping Service Cost?

The cost of accounting software varies widely depending on the size of the organization and the functions that are required. Options with a more comprehensive feature set may cost up to $5,000 annually, while solutions geared toward smaller businesses may be found at prices as low as $500 per year.

When it comes to accounting services, new businesses typically begin with the most fundamental kind of self-bookkeeping, which turns out to be more cost-effective. On the other hand, if an establishment continues to grow, it may soon require the services of a specialized bookkeeper.

The cost of providing bookkeeping services on a part-time basis often ranges from a few hundred to a few thousand dollars each month. If you want more extensive assistance, the costs of full-time services could range anywhere from $3,000 to $4,500 per month (benefits not included).

Conclusion

In conclusion, the buyer's guide for the best bookkeeping services provides a comprehensive overview of top-tier solutions. It highlights the essential criteria to consider when selecting a service, such as accuracy, automation, security, and scalability. Businesses can confidently make informed decisions tailored to their unique needs by evaluating offerings based on these factors.

Whether it's a small startup or a growing enterprise, this guide equips buyers with the knowledge to streamline financial processes, enhance data integrity, and ultimately foster sustainable growth. Making the right choice in bookkeeping services is an investment in organizational efficiency and long-term success.

FAQs

Yes, maintaining records of financial transactions is essential for accurate reporting, tax compliance, and informed decision-making within a business.

Bookkeeping involves recording daily transactions, while accounting interprets, analyzes, and summarizes financial data to provide insights into a company's financial health.

Absolutely, even small businesses benefit from organized financial records. Bookkeeping helps track expenses, income, and taxes, aiding in effective financial management.

Online bookkeeping services vary in cost, often offering flexibility to choose plans that suit your business size and requirements, making them a cost-effective option for many.

By Countries

By Cities

By Industries

.png)