Best Cheque Book Printing Software

Best Cheque printing software includes Cheque360, Sterling, ATSCP, DumiSoft Cycle, and ChequePRO. This cheque book printing software helps to automate the check printing process.

No Cost Personal Advisor

List of 20 Best Cheque Printing Software

Category Champions | 2024

Best cheque print software India

Cheque360 provide a complete online cheque printing software solution which can print all the cheque elements like Payee, Bearer, A/C Payee Only, Amount, Date, auto-conversion of numbers into words etc. Read Cheque360 Reviews

Explore various Cheque360 features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Cheque360 Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Best Cheque Book Printing Software

Sterling is a one of the most popular cheque printing software that has features like checkbook templates with drag and drop facility. It lets you print, store, and search cheques with fingertips. It also has a Secure Password to access the software. Read Sterling Cheque Printing Reviews

Explore various Sterling Cheque Printing features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Sterling Cheque Printing Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Easy and complete Cheque writer software

ATSCP is best free Cheque Printing Software it reduces spelling errors and writing mistake. It gives a better impression of your company. You can print on any of your office printers. Read ATSCP Reviews

Explore various ATSCP features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all ATSCP Features- Support All Printers

- Easy Backup and Restore

- Cheque Book Management

- Password Protection

- ExcelCSV Cheque Printing

- Cheque Format Designer

- Cheque Book Reports

- Lifetime Email Support

ATSCP Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

DumiSoft Cycle best cheque print software

DumiSoft Cycle is a popular cheque printing software that allows you to print cheques with help of your office printer. Additionally, it supports post dated cheque (PDC) management and also petty cash management among other helpful features through cheque print software. Read DumiSoft Cycle Reviews

Explore various DumiSoft Cycle features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all DumiSoft Cycle Features- Post-Dated Cheques

- Font & Size Selection

- Bank Wise Report

- Cheque Book Reports

- Cheque Format Designer

- Cheque Book Management

- Easy Backup and Restore

- Password Protection

Pricing

Cheque Book

$ 104

One Time

Cheque Book Plus

$ 118

One Time

Professional

$ 132

One Time

DumiSoft Cycle Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Cheque Writer Software by Advanced & Best Technologies

ChequePRO is a cheque writing software that prints on any size of cheque from any country to a normal office printer. Cheque Printing software supports multi-company, user, bank account, checkbook, currency, and language. Read ChequePRO Reviews

Explore various ChequePRO features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Pricing

Lite

$ 9

User/ Month

Professional

$ 99

User/ Month

Enterprise

$ 199

User/ Month

ChequePRO Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Best cheque print software India

ChequeExpert is an Intelligent Free cheque printing software to print neat & clean cheques for professional use. Compatibilty with all Banks, Cheques and follows RBI norms. Read ChequeExpert Reviews

Explore various ChequeExpert features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all ChequeExpert Features- Bank Wise Report

- ExcelCSV Cheque Printing

- Multiple Bank Connection

- Post-Dated Cheques

- Password Protection

- Cheque Book Reports

- Supports multiple Account Holders

- Print Cheques

Pricing

Single User

$ 3500

Year

Multi User

$ 6000

Year

ChequeExpert Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Software by Chirag Infotech Solutions

Cheque Print Plus is an easy to use software for bank cheque printing. It is a functional software as per the new RBI CTS 2010. You can even print without purchasing a new extra printer. This check print software allows you to print as many cheques as you want of various banks and also print non-serialized cheques with bulk printing. Learn more about Cheque Print Plus

Explore various Cheque Print Plus features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Cheque Print Plus Features- MIS Reports

- Password Protection

- Print Cheques

- Easy Backup and Restore

- Voucher Printing

- Bulk Cheque Printing

- Support All Printers

- Cheque Format Designer

Cheque Print Plus Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Software by Pinsoftek Infosolutions

KeyByss is best cheque printing software which helps to computerize the cheques of any bank in any language and printer. It prints cheques at a pace that you require and the process is extremely easy. Learn more about KeyByss

Explore various KeyByss features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

KeyByss Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Best cheque print software India 2021

ChequeManager is a cheque printing software that allows you to print cheques from any bank. It provides cheque formats of different banks, scanning, and storage of cheques, automatically printing on the cheque leaves in precise alignments. Read Cheque Manager Reviews

Explore various Cheque Manager features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Cheque Manager Features- Support All Printers

- Supports multiple Account Holders

- MIS Reports

- Cheque Book Management

- Lifetime Email Support

- Cheque Book Reports

- Password Protection

- Font & Size Selection

Pricing

Standard

$ 125

Per Year

Professional

$ 300

Per Year

Corporate

$ 450

Per Year

Cheque Manager Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

cheque writer software in arabic french english

Cheque Factory is a simple program that will assist you in creating and printing your cheques in three languages Arabic, English or French. This software may also be used to easily create labels or tickets with support for several types of barcodes, business cards and other documents to be printed. Learn more about Cheque Factory

Explore various Cheque Factory features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Cheque Factory Features- Bank Wise Report

- Password Protection

- Print Cheques

- Post-Dated Cheques

- Voucher Printing

- Bank Reconciliation

- Easy Backup and Restore

- Cheque Book Management

Cheque Factory Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Professional Cheque Printing Software

ChequeMate is simple to use cheque writing and printing software. With just three clicks and within 10 seconds you can print a cheque and EMI Cheques in single and batches. It maintains all records party-wise, bank-wise, and generate record slip. Read ChequeMate Reviews

Explore various ChequeMate features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all ChequeMate Features- Multiple Bank Connection

- Password Protection

- ExcelCSV Cheque Printing

- Export to Tally

- Support All Printers

- Font & Size Selection

- Import from Tally

- Print Cheques

Pricing

ChequeMate - Pro

$ 50

One Time

ChequeMate - LAN

$ 146

One Time

ChequeMate Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Software by Prime Software Solution

Prime Cheque Print Software is a simple yet powerful application used to make the process of printing of your Cheques faster and easier. It prints on your own personal cheques.There are many features that simplify the whole process of printing personal cheques. Learn more about Prime Cheque Printing

Explore various Prime Cheque Printing features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Prime Cheque Printing Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Software by Delicate Software Solutions

FastCheque lets you to print cheques on any bank's cheque books. You can avoid spelling mistakes, writing errors and same time putting a professional impression on your suppliers. Learn more about FastCheque

Explore various FastCheque features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

FastCheque Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Free Cheque Printing Software India

ChequePot is a Free Online Cheque Printing Application that accurately prints on any size of cheque from any country. - Print Cheques in Multiple Languages (English, Hindi, Gujarati) - Multi Currency - No Installation - Instant Live Preview and more Read ChequePot Reviews

Explore various ChequePot features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all ChequePot Features- Multiple Bank Connection

- Print Cheques

- Cheque Book Management

- Supports multiple Account Holders

- Cheque Format Designer

- Lifetime Email Support

- Easy Backup and Restore

- Cheque Book Reports

Pricing

Free

$ 0

1

ChequePot Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Web/Cloud based ERP customisable for any vertical

Prime Technologies is an ERP solutions provider that can provide spectrum of ERP systems which help the companies and organizations to operate business in the perfect and smart way. Read Prime ERP Reviews

Explore various Prime ERP features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Prime ERP Features- Invoicing

- Bill of materials (BoM)

- CRM

- Inventory Management

- Financial Management

- HR & Payroll

- Supplier and Purchase Order Management

Prime ERP Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Power of Simplicity

TallyPrime is India’s leading business management software for GST, accounting, inventory, banking, and payroll. TallyPrime is affordable and is one of the most popular business management software, used by nearly 20 lakh businesses worldwide. Read TallyPrime Reviews

Explore various TallyPrime features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all TallyPrime Features- Collections

- Accounting Integration

- GST Tax Invoice

- Multi-Branch Connectivity

- Live Chat

- Integrate Different Payment Gateways

- Barcode Integration

- Quotation & Estimates

TallyPrime Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Cheque Printing Software

The best check printing software india in the Nation. Cloud-Based. Military grade security. Set up in Minutes, print professional personal or business check at home or business. Print deposit slip. Read Online Check Writer Reviews

Explore various Online Check Writer features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

- Recurring/Subscription Billing

- Recurring Billing

- Fraud detection

- Income Statements

- MIS Reports

- Pay Slip

- Purchasing & Receiving

- Accounting Management

Pricing

Free

$ 0

Per Month

Standard

$ 20

Per Month

Business

$ 30

Per Month

Online Check Writer Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

For Retail Stores & Chains

RetailGraph is a reliable Retail management software for Small & mid-market Retailers. Manage Retail billing, inventory, accounting, GST filling, POS system & more. Get real-time updates from Multi-stores. Multiple reports to analyze business performance. Read RetailGraph Software Reviews

Explore various RetailGraph Software features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

- Gift Shop POS

- For Retail

- GST returns

- Customer Segmentation

- Issue & Return Management

- Job Work

- POS Integration

- Search Option

Pricing

Composition Addition

$ 139

Full License/Single User/Single Location

GST Addition

$ 208

Full License/Single User/Single Location

RetailGraph Software Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Cheque Printing and Management Software

ChequeMaster is a Free Cheque Printing and Management Software that accurately prints on any size of cheque from any country. Print Cheques in Multiple Languages (English, Hindi, Gujarati) - Multi Currency - Overcome Cheque Writing Mistakes. Read ChequeMaster Reviews

Explore various ChequeMaster features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all ChequeMaster Features- Font & Size Selection

- Cheque Format Designer

- Print Cheques

- MIS Reports

- Lifetime Email Support

- Password Protection

- Support All Printers

- Cheque Book Management

Pricing

Paid

$ 11

Lifetime

ChequeMaster Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Software by Duminex General Trading LLC

DumiSoft CWS is one of our featured and on demand developed software. We are proud of it since many of our clients are using it on their business carryout. Dumisoft CWS is a windows based, user friendly Cheque Printing software that helps you to organize, print and track your cheques very easily. Read Dumisoft CWS Reviews

Explore various Dumisoft CWS features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Dumisoft CWS Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

What is Cheque Printing Software?

Cheque printing software essentially organizes the payments and the various transactions by facilitating pre-printed checks to the payees. Chequewriter software delivers a sophisticated and corporate look. Check printing software allows companies or individuals to customize the appearance and the information on the cheque, thus reducing the cost of pre-printed cheque stock while also increasing its security and reliability.

Why do you need Cheque Printing Software in Your Business?

Cheque printing software is highly essential owing to the fact that they provide for the centralization of the data, especially in large corporate organizations, for better facilitation of time and energy for higher profits. Also, the digitalization of the transactions in cheque payments derives a greater sophistication outlook for business clients and creates a potential for customization features as per your business requirements. Also, when check printing software needs bulk printing of cheques, this online cheque print software shall come in quite handy and thus help you achieve your objective successfully.

These cheques are specially made through laser printing devices and the security issue is handled correctly by unique passwords, encryption services, and MICR security features. The online cheque printing software provides the perfect platform for digitalizing corporate transactions and creates a better scope for professional-level business solutions on the whole.

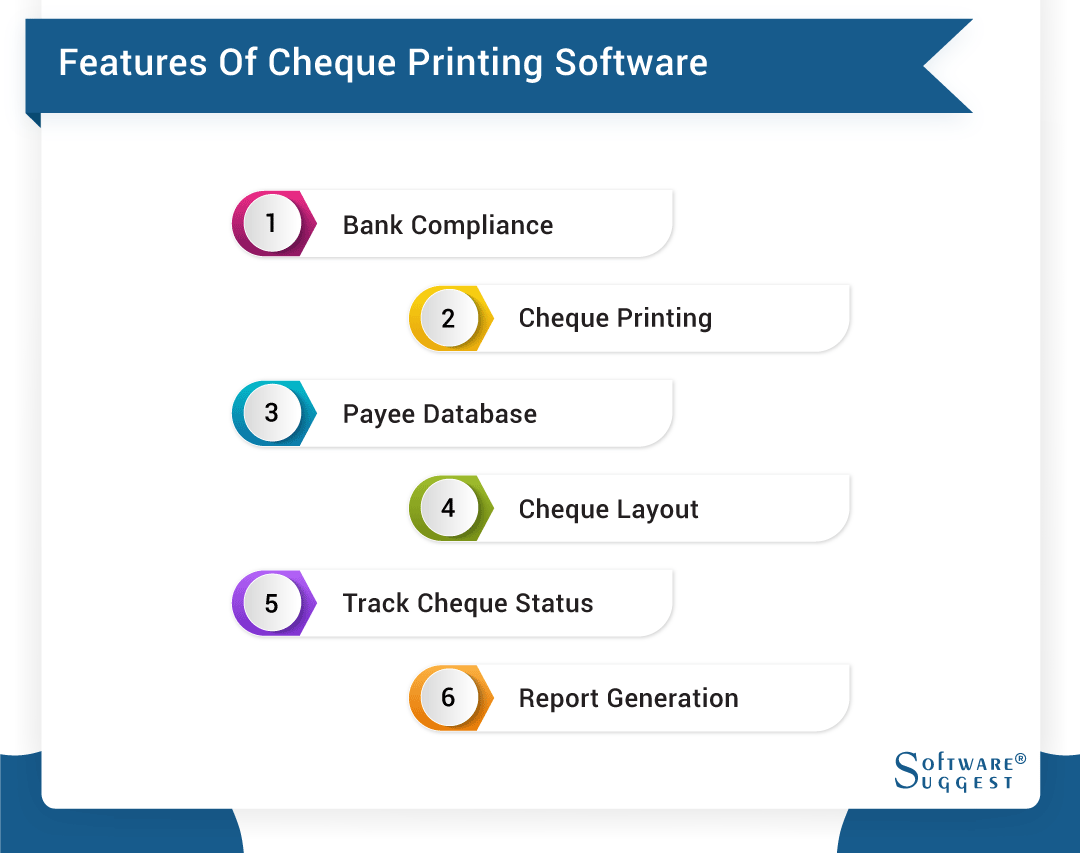

Features of Cheque Printing Software

There are various kinds of cheque printing software available in the market. Cheque print software India is essential to research the different systems available and choose the best cheque writer software for your organizational requirements. Here are some significant features to look out for

1. Bank Compliance:

Full compliance with the bank statements and the database thus cheque writer software obtained can be easily integrated and synchronized for the printing requirements.

2. Cheque Printing:

Support for internet-work cheque printing, hence creating a potential for usability on a broader scale.

3. Payee Database:

The one-time entry of the payee details into the database provides for automatic detail display henceforth.

4. Cheque Layout:

Customization features for different designing layouts of cheques for various banks and organizations.

5. Track Cheque Status:

Keep complete track of cheque status as well as monitor canceled ones with efficiency with the help of checkbook printing software.

6. Report Generation:

Best cheque print software India manages complete payment details and detailed report generation on individual modules.

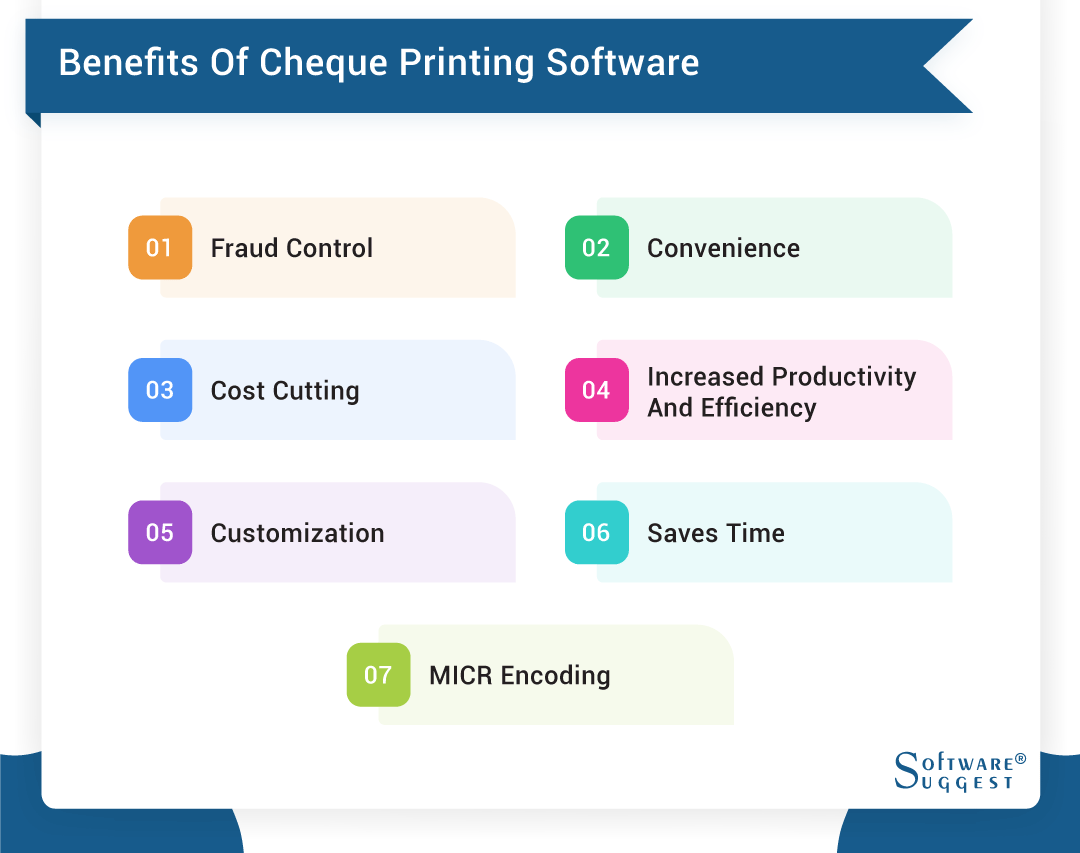

Benefits of Cheque Printing Software

Cheque printing software is essential because they provide for the centralization of the data, especially in large corporate organizations, for better facilitation of time and energy for higher profits. The digitalization of the transactions in cheque payments derives a higher sophistication outlook for business clients and creates a potential for customization features as per your business requirements. When check printing software needs bulk printing of cheques, this online cheque print software shall come in quite handy and thus help you achieve your objective successfully.

Organizations need to print cheques regularly for smooth business transactions. It is imperative to invest in good cheque print software to save time and enhance productivity. Here are some benefits of cheque printing systems:

1. Fraud Control

Online cheque printing software offers security features such as Password Protection and Data Backup. Cheque writer software also ensures that cheques are printed only when required, and this drastically minimizes the possibility of fraud.

2. Convenience

Best cheque print software India ensures that the user never runs out of cheques, along with ensuring legibility. Best free cheque print software eliminates the need for review and increases the overall ease of use. This lets the user concentrate on more critical tasks. Check printing software a user changes a bank or any other information, the hassle of having new cheques printed is also eliminated.

3. Cost Cutting

Online cheque print software helps in saving money when compared to the cost of having cheques pre-printed. This simple, streamlined option eliminates the cost of expensive processing equipment such as decorators and bursters used in workplaces.

4. Increased Productivity and Efficiency

Cheque writer software can be set to print more than one cheque per page, automatic cheque-signing, and even send it to multiple cheque printers, thereby increasing the organization's productivity. The professional touch, little to no chance of information being misread, and reduced human error when reading and writing cheques increase efficiency.

5. Customization

This best cheque print software India provides options such as: choosing from various colors of paper, logo options, changing the position of the cheque (on top, middle or bottom), etc. The best free cheque printing software even enables the user to customize and personalize the cheque according to his needs and requirements.

6. Saves Time

Check printing software mere click can import data or print hundreds of it, saving plenty of your precious time. Cheque writer software is especially helpful for payroll cheques in companies and large organizations. Users can also generate a comprehensive tax report that helps in decision-making, with a few clicks.

7. MICR Encoding

Online cheque print software also can print Magnetic Ink Character Recognition (MICR) encoding, i.e., the line found at the bottom of all cheques, from the cozy comfort of home or office.

Top Cheque Printing Software Vendors by Company Size

Small And Retail Operators

1. Cheque360:

Cheque360 is a complete and customizable online solution that offers mobile support. Best cheque print software india can print all cheque elements like payee, date, amount, bearer, a/c payee only, etc. The best free cheque printing software has email support, and a 30-day free trial offers too.

2. ATSCP:

ATSCP is a complete solution for printing cheques through the office printer. This window-based best free cheque print software has password protection, format designer, reporting, backup, and restore features too.

3. ChequePot:

ChequePot is a multi-lingual, multi-currency online application with no installation. Best free cheque printing software supports all printers, multiple bank connections, post-dated cheques, and cheque management with reports.

4. ChequeMan:

ChequeMan is a smart, easy, and efficient solution for desktop printers. Check printing software can choose standard, pro, and multi-user editions with fixed/unlimited accounts, import, and batch print features of best free cheque print software.

Medium-sized Business

1. Online Check Writer:

Online Check Writer supports multi-banks, multi-accounts with QuickBooks integration. You can send checks by post, or accept payments by phone, email, and fax.

2. Chequeout:

Chequeowww.softwaresuggest.com/chequeoutut software has a friendly UI. You can print, format, track, and organize checks systematically.

3. DumiSoft Cycle:

DumiSoft Cycle is popular cheque writer software that supports post-dated cheque management. You can set privileges, customize vouchers, print EMI cheques, and add multiple accounts.

Large Companies

1. ChequePRO:

Cheque Pro software proactively manages multiple accounts with cheque writer, alignment engine, payee database, and other features.

2. Cheque Print Plus:

Cheque Print Plus is a convenient and functional software that complies with the latest regulations. Check printing software can choose from one of the packages to print in bulk, manage books, and use book and MIS reports.

3. Yewtec Cheque Printing:

Yewtec Cheque Printing user-friendly software facilitates convenience, customization, quick reports, and transactions.

Some large companies also opt for Tally ERP 9, and Prime ERP for business accounts management and customizable cloud solutions across the verticals.

Factors to Consider While Buying Cheque Printing Software?

There are many kinds of cheque print software free available in the market. This makes cheque-writer software difficult and confusing for decision-makers, and often, they are unable to choose the best cheque printing software. Here are some essential factors to keep in mind while purchasing the best cheque print software India:

-

A highly important aspect to keep in mind is the compatibility factor of the given checkbook printing software. Cheque writer software should be able to integrate with existing devices and systems to make cheque print software easier for data transfer.

-

A good cheque print software free should have an excellent user interface with friendly features. This ensures ease of understanding amongst the users and helps in quick implementation.

-

Cheque print software free should be compliant with the latest governmental guidelines and adhere to mandatory regulations.

-

It is vital to purchase scalable cheque print software. This will ensure that organizations can purchase additional features and modules at a later stage, according to business requirements.

-

Make sure to invest in a credible vendor that provides a robust support system for any kind of future problems or issues.

Make sure to determine the time duration of one specific operation. Lower the time taken implies higher profits for better economic standards on the whole.

Challenges to Implementing Cheque Printing Software

Traditionally, handwritten cheques are the primary tool for conducting authentic transactions. But now writer software can design, print, and manage cheques with great ease. However, implementing such cheque-writer software is not as simple or convenient. The first hurdle is choosing a trustworthy and error-free solution. Otherwise, the customers will lose faith and flock to a different vendor.

Let us look at some issues that crop up while implementing a high-quality product:

1. Integration

Printing is a fundamental activity involved in this type of technical solution. But the market has different types of printers such as laser, inkjet, and dot matrix ones. Is the software compatible with the printer specifications that check printing software use in your office space? Beyond this, the cheque writer software should be compatible with legacy systems for retrieving data.

2. Banking regulations

Banking regulatory authorities have strict compliance rules. The software has to facilitate faster clearance of cheques. Apart from features and functionality, flexibility is also a key ingredient. The software should be accommodative of your bank's specific requirements.

3. Trustworthiness

Best cheque print software India is essential to educate your employees and customers about the authenticity of the cheque delivered via the Free cheque printing software India. A large chunk of the population might not accept such changes, especially in transaction tools.

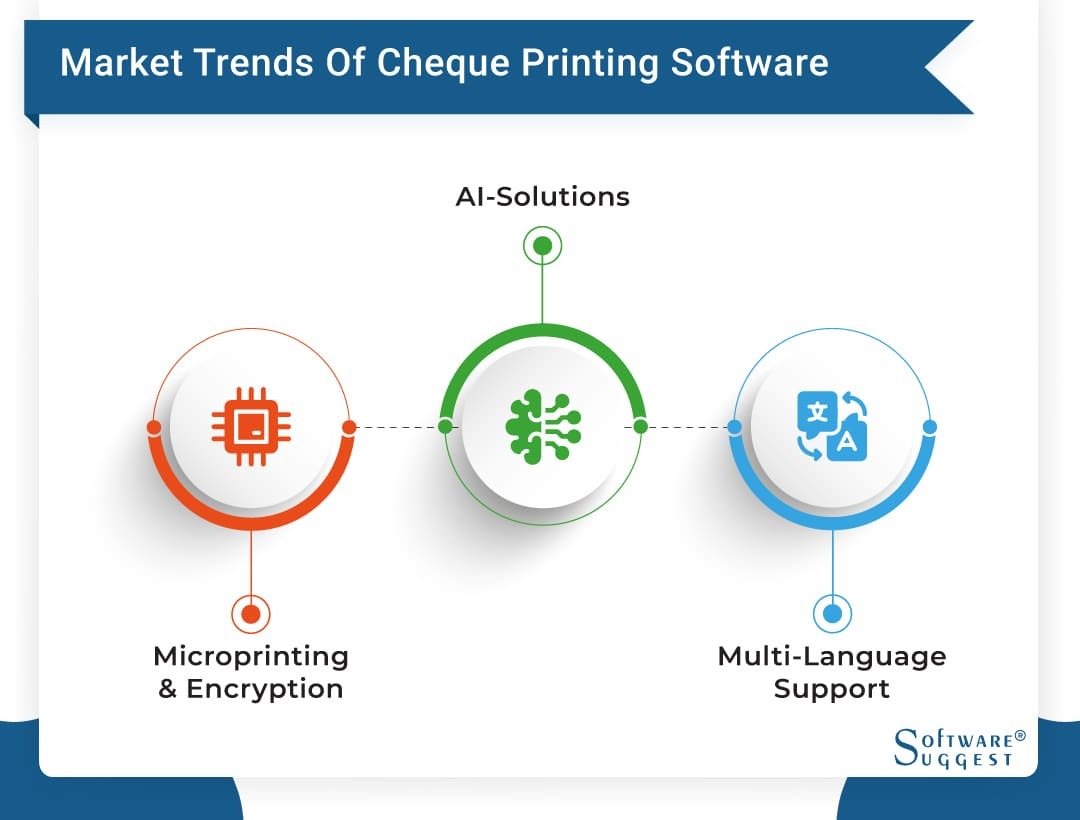

Latest Market Trends of Best Cheque Printing Software India

Best cheque printing software India has a global demand with substantial growth prospects. Vendors are developing diverse products for computers, tablets, and mobile phones. Cheque writer software also designs solutions for personal, retail, small, and large-scale businesses.

1. Microprinting and encryption

Free cheque print software India has to deliver secure documents and business cheques. Microprinting and encryption technologies are useful under these circumstances. The microprinting industry will reach a value of US$670 million by 2024, while encryption is a billion-dollar industry.

2. Multi-language support

The modern cheque print software free also offers multiple language support. The new technology of cheque print software enabled to improve business productivity too. Nowadays, check printing software can purchase the software in English, Gujarati, Hindi, and other languages.

3. AI-solutions

Banks are increasingly dependent on AI-powered solutions. They even use chatbots to communicate with the customers. Future cheque print software will deliver cheques that are AI-friendly. These cheques will get directly validated by AI instead of human employees.

In conclusion, the future of free cheque print software in India looks bright. The new solutions have rich features like international compatibility, graphical dashboards, and business intelligence reports. Experts predict the commercial printing market to grow by a CAGR of 2.24% during 2020-2025.

The Ultimate Guide to Cheques and Cheque Printing Software

A cheque is a written order that is issued by a bank account holder to pay a stated sum to an individual or company from his or her bank account. Cheque print software can also be used to transfer funds to another bank account, for example: writing a cheque to make the electricity bill payment. The biggest advantage of cheques is that it is one of the safest payment methods as its entry is made by the bank, making cheque printing software easy to trace back if required. Another advantage is that it is useful when high-value transactions cannot be made with hard cash.

The following details are mandatory in a Cheque

-

Must be drawn upon a specified bank (Drawee) and signed by the Drawer (person issuing the cheque)

-

Must have the name of the Payee (recipient of the cheque) and amount of money in Words and Figures as well as the Date

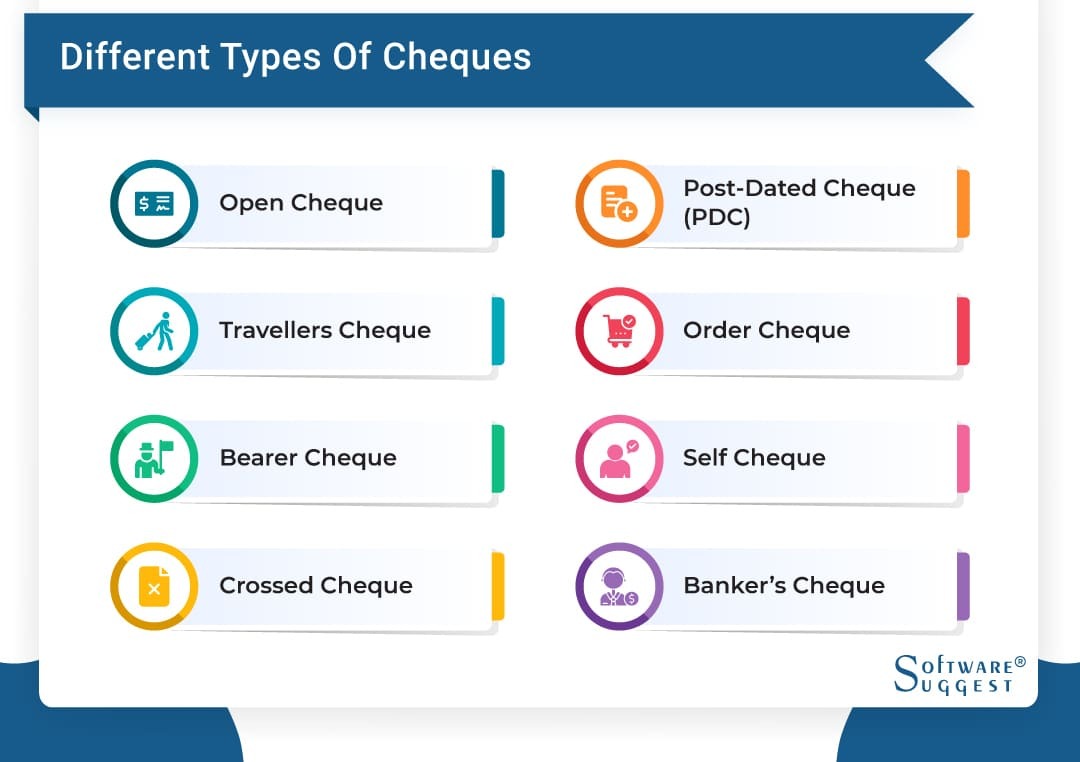

Different types of Cheques

1. Open Cheque

Used to receive cash over the counter at the bank or deposit the check-in their own account or even pass it to another individual by signing the back of the cheque.

2. Travellers Cheque

Printed cheques are used instead of cash while traveling abroad. Free cheque printing software in India is widely accepted and come with a lifelong validity and replacement guarantee and unused ones can be used on the next trip.

3. Bearer Cheque

Cheque print software can be easily transferred from one person to another and the owner can negotiate payment for the cheque.

4. Crossed Cheque

Cheque print software cannot be cashed at the bank counter and can be done by adding 2 parallel lines on the top left corner of the check and instructing the bank to make the payment to the payee’s account only.

5. Post-Dated Cheque (PDC)

Type of account payee bearer/crossed cheque dated to meet the payment at a future date and is valid for 3 months from the date of issue.

6. Order Cheque

‘Bearer’ is canceled and instead ‘Order’ is written and the amount is payable to a particular person. By signing the payee’s name on the back, Check printing software can be transferred to someone else.

7. Self Cheque

It can be issued in one’s own name or pay self is written by the account holder to receive money from Payer’s branch.

8. Banker’s Cheque

Issued by bank drawing money from its own funds as opposed to from account holders and is done only after the bank verifies the account status of the requestor. The amount is then immediately deducted from the customer’s account

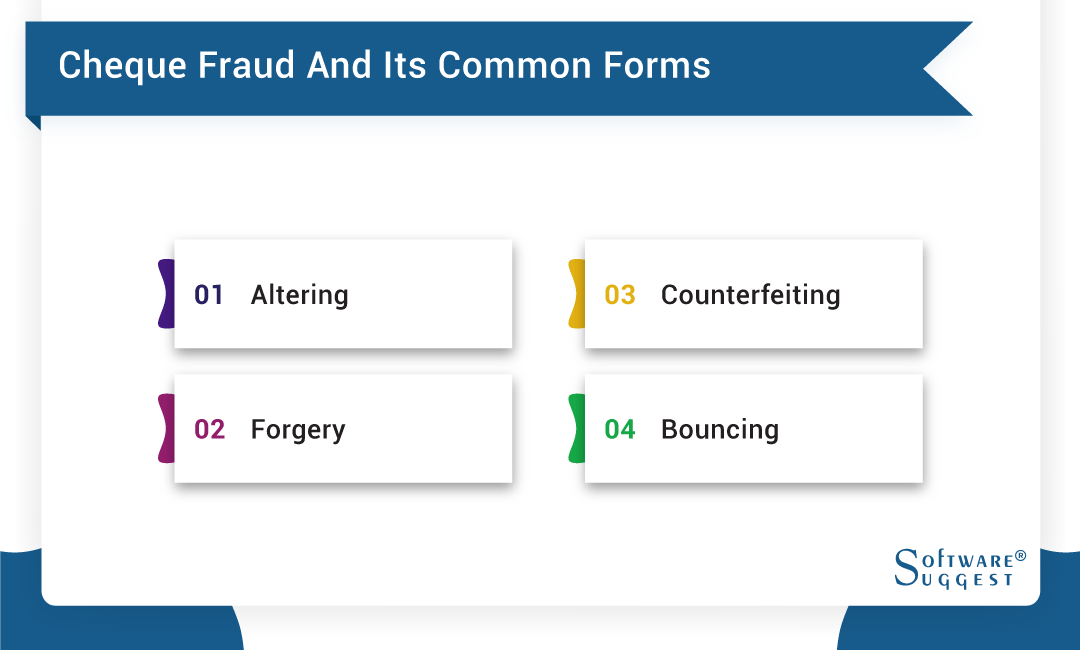

Cheque Fraud and its Common Forms

Though technology has ensured the efficiency of banking systems, it has also helped sophisticated criminal activities allowing advanced cheque print software to create, alter, and manipulate cheques. Hence, it is crucial to understand the ways in which fraud can be committed.

1. Altering

This involves altering the information on a real cheque by simply writing or using complex chemical methods, allowing it to pass as an official cheque while other methods may fail

2. Forgery

Check printing software involves signing a check using a forged signature. The only way this can be noticed is if the bank asks for identification

3. Counterfeiting

This involves creating a fake cheque and using fake or even stolen information on free cheque printing software in India.

4. Bouncing

This method involves taking advantage of places that will accept cheques, then spending on goods or services and getting away before the check bounces

Staying Away From Cheque Fraud!

While banks and other institutions do their best to eliminate fraudulent cheque practices, businesses also have to undertake some steps to prevent check printing software. Instant dismissal or legal action against check fraud and educating employees about simple techniques can help discourage these practices within the company. Steps like keeping cheques locked safely when not in use and reporting stolen cheques immediately can help greatly. Also, checking Id and comparing the signature, putting limits on the amount, and using verification services along with knowing the procedure for testing the security features built into the check can help your business avoid such fraud.

Cheque Printing Software Related Articles:

FAQs

It is effortless to use this application. In just 1-2 clicks, you create a cheque. It is tamper-free, typo-free, and also has an in-built cheque alignment engine and many more.

Various fonts and styles are available for printing a cheque. Not only that, but you can also download it with a single click.

By Countries

By Industries

.png)