Are you struggling to find the perfect Accounting Software that aligns with your complex demands? Our curated list of top-tier solutions offers personalization to meet your unique needs. Additionally, we've created a comprehensive comparison of QuickBooks Online vs. FreshBooks all in one place to simplify your decision-making process. QuickBooks Online is rated 4.4 while FreshBooks is rated 4.6.

You May Also Like

Featured products that are similar to the ones you selected below.

All Accounting Software Products ›››Compare pricing of QuickBooks Online vs FreshBooks with the following detailed pricing plan info. QuickBooks Online comes in 3 packages: Simple Start, Essentials, Plus. On the other hand, FreshBooks comes in 3 packages: Lite, Plus, Premium.

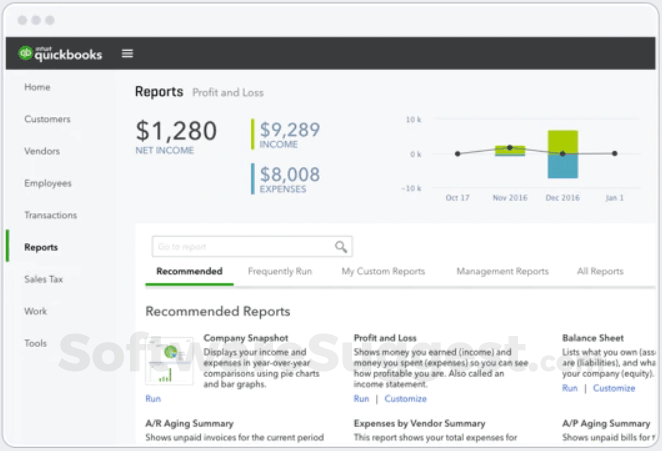

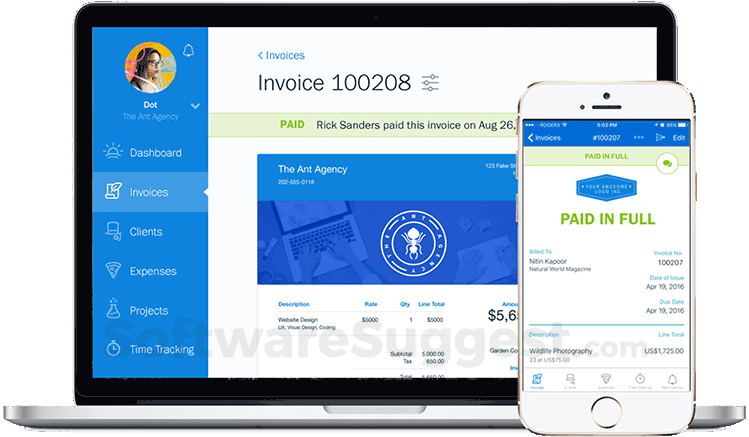

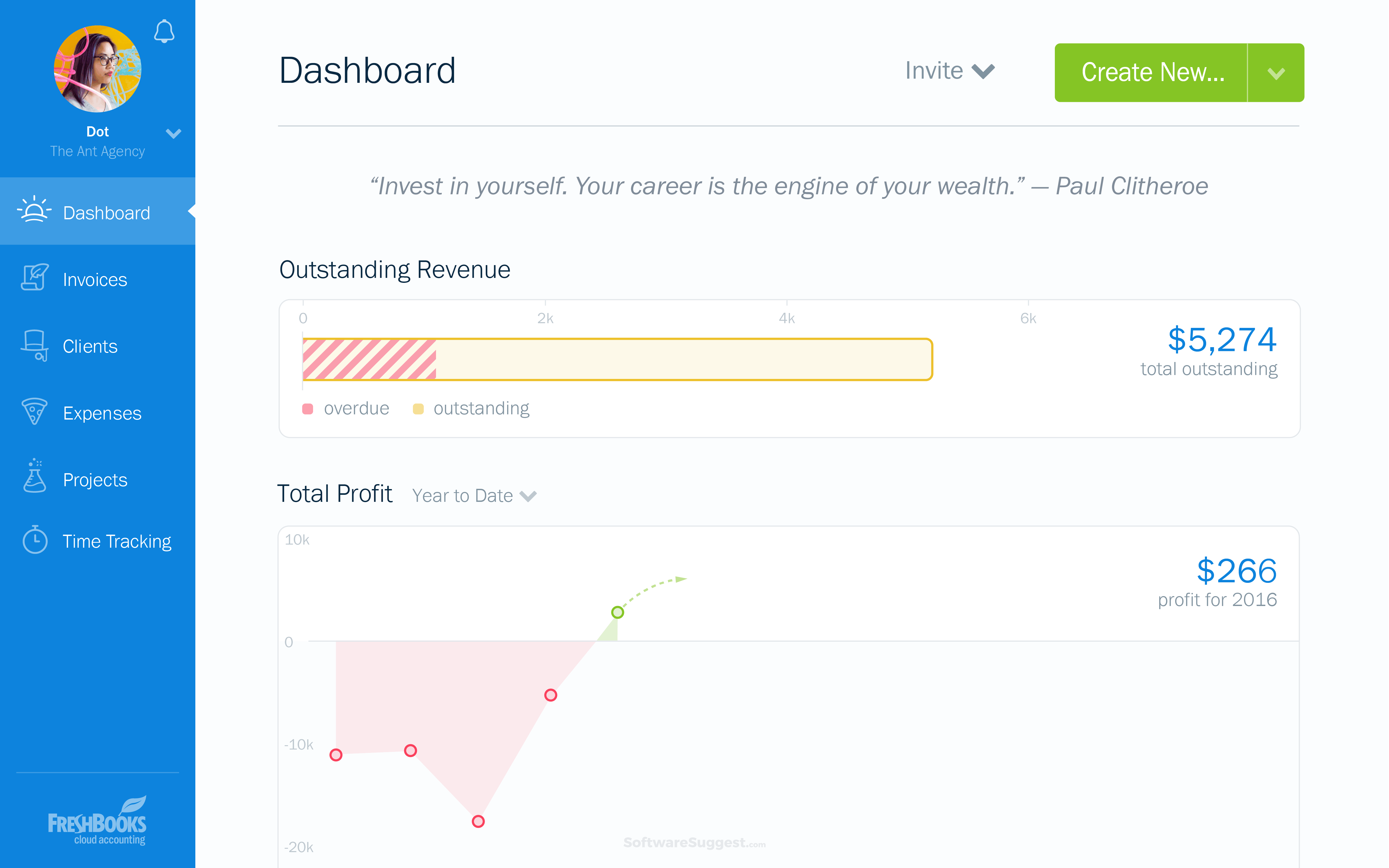

Take a look at the below screenshots and seamlessly compare the user interface of QuickBooks Online and FreshBooks for better insights.

QuickBooks Online and FreshBooks have been awarded by SoftwareSuggest for the selected categories. These awards have been given on the basis of the overall performance of this software in the Accounting Software category.

Below is the comparison of the starting price and payment method of QuickBooks Online and FreshBooks. You can purchase QuickBooks Online with Per Month payment plans. Whereas, FreshBooks provides Per Month payment plans. QuickBooks Online provides a free trial whereas, FreshBooks does not provide a free trial.

Free Trial

Monthly

Yearly

Free Trial

Monthly

Yearly

Free Trial

Monthly

Yearly

Compare between QuickBooks Online and FreshBooks based on their key features and functionalities to pick the right one for your business.

Accounting

Banking Integration

Budgeting

Database backup/restore (Management)

Document Management

Email Integration

Expense Management

Expense Tracking

Financial Management

Inventory Management

Budgeting

Expense Tracking

Invoice

Mobile Support

Multi Currency

Online Banking Integration

Recurring invoice

Reminders

Taxation Management

Time Tracking

Accounting

Expense Management

Expense Tracking

Financial Management

HR & Payroll

Inventory Management

Multi Currency

Multi Location

Payroll Management

Vendor Management

Compare how QuickBooks Online stacks up against FreshBooks in terms of ratings and user experience. Select the Accounting software that perfectly aligns with your business requirements.

Based on all the user reviews and ratings received by QuickBooks Online and FreshBooks in Accounting Software category, we've provided an average user rating for each software below. QuickBooks Online has 44 reviews while FreshBooks has 30 reviews

Solid tool for keeping your online business active

Pros

I love the Intuitive interface which makes work easier and faster doing accounting records and transactions. The reports are fantastic and to the point and can be generated incase you need them. I has seamless integration.

Cons

Nothing have I noted that I don't like. All features are working perfectly without delays or complications of any kind.

Best software

Pros

It's makes receipts and email services and handle accounts quict nicely. Also no need for many employees.

Cons

Service support needs to be more effective because many times when their is a problem. Some one should have their to slove

A tool that seamlessly integrates with other software.

Pros

Sage Intacct is the tool that has a robust system for managing financial and accounting data that helps improve and monitor expenses. I also like the customization of the reports, this is one of the qualities that helps to know exactly which are the parameters that we need to improve.

Cons

It is a software that has the best tools to work in financial management and control. Sage Intacct has shown that the reports can provide detailed information on financial data for better control, it is also a very simple tool due to its very simple interface to run.

Deployment is a crucial factor to consider while buying Accounting Software. QuickBooks Online is available on Windows, MacOs desktop platforms and IOS, Android mobile platforms. FreshBooks is available on Windows, MacOs desktop platforms and IOS, Android mobile platforms.

Windows

MacOs

IOS

Android

Windows

MacOs

IOS

Android

Windows

MacOs

The quality and timeliness of support are important parameters when comparing QuickBooks Online with FreshBooks. QuickBooks Online offers Email, Phone and Live Support to its customers, while FreshBooks provides Email, Phone, Live Support, Training and Tickets.

phone

live support

phone

live support

tickets

training

phone

live support

tickets

training

QuickBooks Online and FreshBooks are supported in the following languages.

English

French

Dutch

English

German

Polish

Spanish

Swedish

Turkish

Arabic

Chinese

Dutch

English

French

German

Indonesian

Polish

Portuguese

Spanish

Thai

The target customer base of QuickBooks Online vs FreshBooks is mentioned below. Check which software fits your business requirements perfectly.

Freelancer

Startups

Freelancer

Startups

Freelancer

Startups

SMBs

Enterprises

Find out which tools QuickBooks Online and FreshBooks integrate with and make the right choice. Get the Accounting software that connects with your preferred apps for best results!

(Not Provided by Vendor)

Square

Acuity Scheduling

NiceJob

WellyBox

SBPay.me

Stripe

BillBjorn

Lendflow

YouLend

TaxBandits

(Not Provided by Vendor)

To gain a better understanding of how these QuickBooks Online and FreshBooks work, you can check out the videos below. Browse through the videos and make the right choice.

Get insight into the company details QuickBooks Online and FreshBooks and learn how they operate. Explore the company name, its location, and more!

.png)

.jpg)

.png)

.png)