Best e-Invoicing Software for Business

Best e-Invoicing software are Zoho Invoice, Vyapar, CaptainBiz, and FreshBooks. Invoices are generated by almost every business, mainly when they handle customers and vendors. Generating the invoices and sending them to your business or back to the vendors or clients will be very easy with these applications.

No Cost Personal Advisor

List of 20 Best E-Invoicing Software

Category Champions | 2024

Best e-Invoicing Software in India

100% free, online invoicing software for freelancers and small to medium enterprises (SMEs). It helps you craft professional invoices, send payment reminders, and get paid faster online. Read Zoho Invoice Reviews

Explore various Zoho Invoice features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Zoho Invoice Features- Mobile Payments

- Invoice Management

- Dunning Management

- Customizable invoices

- Credit Notes

- Payment Processing

- Quotation & Estimates

- Receipt Printing

Pricing

Zoho Invoice Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Cloud Accounting Software Making Billing Painless

This bookkeeping software makes your accounting tasks easy, fast and secure. Start sending invoices, tracking time, and capturing expenses in minutes. We uphold a longstanding tradition of providing extraordinary customer service and building a product that helps save you time because we know you went into business to pursue your passion and serve your customers - not to learn to account. Read FreshBooks Reviews

Explore various FreshBooks features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all FreshBooks Features- Receipt Management

- Expense Tracking

- ACH Check Transactions

- Budgeting

- Reminders

- Billable Hours Tracking

- Online Banking Integration

- Workflow Management

Pricing

FreshBooks Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

One of the Best e-Invoicing Software Provider

myBillBook is India's #1 invoicing, GST billing, accounting & inventory management software for small & medium businesses. Grow your business with the best invoicing software. Paid plans start from Rs.34 per month. Read myBillBook Reviews

Explore various myBillBook features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all myBillBook Features- Bookkeeping

- Loyalty Management

- Batch and Serial Number Tracking

- Invoice customization

- Sales Management

- Billing Templates and Customization

- Online invoicing

- Invoice templates

Pricing

Silver Plan

$ 0

Per Month

Diamond Plan

$ 3

Per Month

Platinum Plan

$ 3

Per Month

myBillBook Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Best e-Invoice Software in India

Vyapar is the simplest GST ready Accounting, Invoicing and Inventory management software. This is best e-invocing software made completely for a businessman, you don't have to waste time learning it. Just start managing your business digitally like before even with no Accounting knowledge. Read Vyapar Reviews

Explore various Vyapar features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Vyapar Features- Real Time Reporting

- Barcodes/Labels

- Custom Fields

- Reminders

- Multi-Office

- Native App

- Accounting

- Accounting Management

Pricing

Silver- Desktop (1 year)

$ 40

Device/Year

Silver- Desktop + Mobile (1 year)

$ 47

Device/Year

Silver- Desktop (3 years)

$ 92

Device/ 3 Years

Vyapar Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Ab Business Karo Tension Free

Swipe billing software and the app helps you to create sales/purchase invoices, quotations, manage inventory, save customers & vendors and be in control of your business. Create GST compliant invoices & share them with customers easily. Read Swipe - Billing Reviews

Explore various Swipe - Billing features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Swipe - Billing Features- GST returns

- Profit & Loss Statement

- Multi Company

- Vendor Management

- Sales Analyse Report

- Accounts Receivable

- Recurring Invoicing

- Online Invoice Payment

Pricing

Swipe PRO Plan

$ 21

Per Year

Swipe JET Plan

$ 39

Per Year

Swipe RISE Plan

$ 49

Swipe RISE Plan

Swipe - Billing Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Best e-Invoicing Software in India

QuickBooks is an online accounting software for business owners to make stay on top of their finances. Easy to use interface, 100% data security and features such as Online bank connect and Whatsapp integration helps business owners to focus on growing their business. Read QuickBooks Online Reviews

Explore various QuickBooks Online features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all QuickBooks Online Features- Inventory control

- Reconcile Statements

- Data Backup and Restore

- Tax Management

- Purchase Order

- Cashflow

- Document Management

- Mobile Support

Pricing

Simple Start

$ 30

Per Month

Essentials

$ 60

Per Month

Plus

$ 90

Per Month

QuickBooks Online Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Software by Sage Intacct, Inc

Intacct is the fast and efficient solution for the accounting. It seamlessly manages the Finance and Strategically vendor management. Automate the workflow of an entire payable process. Eliminate the valuable time of finance, and make it as productive time. Read Intacct Reviews

Explore various Intacct features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Intacct Features- Revenue Management

- Multi-Currency

- Expense Tracking

- Multi Currency

- Accounts Receivable

- CPA Firms

- Production Management

- Inventory Management

Intacct Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Best e-invoicing software for your business

Wave's free invoicing tool is perfect for small business owners, freelancers and entrepreneurs all around the world to ensure you get paid easily and on time. Invoicing by Wave offers customizable invoicing options to go with unlimited billing for FREE! Read Invoicing by Wave Reviews

Explore various Invoicing by Wave features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Invoicing by Wave Features- Invoice Management

- Mobile Support

- POS invoicing

- Recurring Invoicing

- Billing & Invoicing

- Online invoicing

- Invoice Designer

- Invoice Processing

Pricing

Invoicing by Wave

$ 0

Forever

Invoicing by Wave Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Billing, Accounts and Inventory Management

HDPOS is the best accounting software. It has ease of use and nice interface. It is a Windows based Billing, Inventory Management and Accounting Software and it easly Install on single computer or multiple Terminals. Used for finance management system. Read HDPOS Smart Accounts and Billing Reviews

Explore various HDPOS Smart Accounts and Billing features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

- Sales Forecasting

- Manufacturing

- Bookkeeping

- Online Banking Integration

- MIS Reports

- Production Management

- GST returns

- Supplier Management

Pricing

HDPOS smart for single computer

$ 18

Per Month

HDPOS smart for Multiple Terminal

$ 35

Per Month

HDPOS smart on cloud subscription

$ 49

Per Month

HDPOS Smart Accounts and Billing Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

SIMPLIFY YOUR BUSINESS

Everything about your business without hassle. Say goodbye to manual work & auto Saniiro BAIMS is a billing cum inventory and expense management software that is GST ready and generates GST reports and financial statements correctly without any typical operations. Read SANIIRO Reviews

Explore various SANIIRO features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all SANIIRO Features- Multi-Company

- Accrual Accounting

- Accounting Management

- Purchasing

- VAT / CST / GST Reports

- Multi-Location

- Financial Reports

- Point of Sale (POS)

Pricing

SANIIRO BAIMS STANDARD

$ 139

Per Year

SANIIRO BAIMS BASIC

$ 14

Per Year

SANIIRO BILLING LITE

$ 83

Per Year

SANIIRO Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Software by Xero Limited

Xero is award winning web based accounting software for small business owners and their accountant. This e-invoicing software is beautifully designed and easy to use online bookkeeping software. Read Xero Accounting Reviews

Explore various Xero Accounting features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Xero Accounting Features- Time Tracking

- Invoice

- HR & Payroll

- Taxation Management

- Bonus

- Multi Currency

- Product Database

- Inventory Management

Pricing

Starter

$ 9

Per Month

Standard

$ 30

Per Month

Premium

$ 60

Per Month

Xero Accounting Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Integrated with eBusiness Apps & Ready with GST

MARG Billing is specifically software designed to provide support to Individual or Chain Business like Retail, Distribution, Manufacturing, ERP, Accounting and Payroll. Marg understands the demands of all different users, so Marg decided to design billing software whichever is capable of performing the requirements of users. Read Marg ERP9+ Billing & Invoicing Software Reviews

Explore various Marg ERP9+ Billing & Invoicing Software features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

- Billing Management

- Inventory Management

- Banking Integration

- Customer Management

- Mobile App

- Invoice Designer

- Payment Gateway Integration

- Patient Information Management

Pricing

Basic Edition

$ 113

Full Licence/ Single-User

Silver Edition

$ 175

Full Licence/ Single-User

Gold Edition

$ 350

Full Licence/ Multi-User

Marg ERP9+ Billing & Invoicing Software Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Software by Stripe

Stripe is one of the best payment software, which helps you run an internet business. It provides you most powerful and flexible tools for Internet commerce. Stripe’s designed API’s helps you to create the best product for your users while creating a subscription service, an on-demand marketplace, an e-commerce store. Read Stripe Reviews

Explore various Stripe features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Stripe Features- Subscription Billing

- Debit Card Support

- Online payments

- Event Triggers and Webhooks

- Multi-Currency

- Receipt Printing

- Recurring invoice

- Payment Processing

Stripe Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Captain Biz is a sales and purchase invoice manage

CaptainBiz is a simple-to-use software solution to manage your business hassle-free. Generate tax invoices, track inventory in real-time, manage customers & suppliers, and monitor cash & bank transactions, all in one place, over PC or mobile. Endorsed by GST govt. of India as an affordable and easy-to-use solution for both GST and non-GST companies. Read CaptainBiz Reviews

Explore various CaptainBiz features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all CaptainBiz Features- Mobile App

- Document Printing

- Sales Analyse Report

- GST audit report

- Print Or Email Invoices

- Customer tracking

- Profit & Loss Statement

- Data Security & Accuracy

CaptainBiz Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

One of the Best billing Software

TallyPrime is the leading business management software for GST, accounting, inventory, banking, and payroll. E-invoicing software is affordable and is one of the most popular business management software, used by nearly 20 lakh businesses worldwide. Read TallyPrime Reviews

Explore various TallyPrime features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all TallyPrime Features- Banking Integration

- Bonus

- Cash Management

- GST Compliance

- Bank Reconciliation

- GST

- Inventory Management

- Analytics

TallyPrime Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Bill presentment and online payment collections

Swipe invoicing software is an online cloud-based solution. Using Swipez you can collect payments faster, organize company expenses, automate vendor payouts & perform e-invoicing GST filing. Automate your company billing using Swipez free billing software. Read Swipez Billing Reviews

Explore various Swipez Billing features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Swipez Billing Features- Recurring Billing

- Billing Portal

- Online Payment Processing

- Recurring Invoicing

- Billing & Invoicing

- Online invoicing

- Online payments

- Invoice

Pricing

Free

$ 0

Per Year

Startup

$ 83

Per Year

Growth

$ 167

Per Year

Swipez Billing Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Payment Gateway

Easebuzz, a software-enabled payments platform, empowers small businesses to digitize payments seamlessly. It eliminates worries about business process challenges, offering smart APIs and cost-effective solutions in one place. Read Easebuzz Reviews

Explore various Easebuzz features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Easebuzz Features- Zero Setup Cost

- Start in Minute

- Transaction Alerts

- Secured server

- Simplified Integration

- Transaction Data Management

- Robust Security

- Invoice Payments

Pricing

Free Payment Gateway

$ 0

Per User

Easebuzz Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

High Performer | 2024

GST Billing software with Inventory & Accounts

Simple Billing software with complete inventory and accounts modules. It's fast, reliable and easy to maintain. Ideal for businesses that have a large number of invoices and deals in 100's of SKU's. Typically used by distributors, retailers and small manufacturers. Read Horizon ERP Reviews

Explore various Horizon ERP features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Horizon ERP Features- Banking Integration

- GST Tax Invoice

- Monthly GST Report

- For Retail

- Multi-Branch Connectivity

- Vat

- Dues Management

- Transaction History

Pricing

SINGLE PC License

$ 192

One Time

THREE PC License

$ 384

One Time

EIGHT PC License

$ 746

One Time

Horizon ERP Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Business Made Easy

CONNETINBOT web-based application to streamline business operations. B2C and B2B billing system, Stock & Inventory, Reports, CRM tool, Quality Automation, and many more features. Learn more about CONNETINBOT

Explore various CONNETINBOT features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all CONNETINBOT Features- Receipt Management

- Barcode / Ticket Scanning

- Retail POS

- Automated Quoting

- Supplier and Purchase Order Management

- Data Integration

- Forecasting

- Lead Distribution

CONNETINBOT Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Software by Fakturownia

InvoiceOcean is a fully featured Billing & Invoicing Software designed to serve Enterprises, Startups. InvoiceOcean provides end-to-end solutions designed for Web App. This online Billing & Invoicing system offers Customizable invoices, Online payments, Online invoicing at one place. Learn more about InvoiceOcean

Explore various InvoiceOcean features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all InvoiceOcean Features- Customer DataBase

- Billing & Invoicing

- Customizable invoices

- Online invoicing

- Invoice

- Online payments

Pricing

Free

$ 0

Per Month

Basic

$ 7

Per Month

Professional

$ 13

Per Month

InvoiceOcean Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Until 30th Apr 2024

E-invoicing, an innovative solution, revolutionizes the invoicing procedure by streamlining it, minimizing human errors, and improving financial administration. Premium e-invoicing tools don't just automate invoice creation and delivery; they also incorporate various functionalities to streamline invoicing processes, maintain adherence to tax laws, and furnish immediate insights into financial dealings.

What Is E-Invoicing Software?

E-invoicing or electronic invoicing software is a system that enables businesses to create and approve invoices electronically. Introduced in the GST software regime, e-invoicing specifies the invoice schema so that it can be read and operated by all the parties involved and accounting software uniformly.

E-invoicing software helps comply with government regulations, improves transparency, and is cost-effective. They also make it easier for you to adapt to changing GST requirements.

Advanced e-invoicing tools also allow you to set your invoices on recurring mode so you can auto-charge customers and don’t miss any payments.

How Does E-Invoicing Software Work?

To understand how e-invoicing software works, let’s first look at the parties involved. The key participants of e-invoicing include:

-

The business (the one creating the invoice),

-

IRP (Invoice Registration Portal),

-

GST/e-way bill system, and

-

The buyer (the one receiving the invoice)

The e-invoice system is categorized into two parts (as depicted in the below image). The first part consists of the business and the IRP. The second part consists of the GST/e-way bill system and the buyer.

Now, let’s understand how the electronic invoicing system works.

-

The company (you) generates the invoice using e-invoicing software.

-

The invoice is uploaded to the IRP automatically by your e-invoicing platform.

-

IRP validates the invoice generated by your e-invoicing software.

-

Once the invoice is validated, a QR code and an IRN (Invoice Reference Number) are generated. It will also be digitally signed.

-

The invoice data is then transmitted to the e-way bill and GST system.

-

If the seller has all the details of the e-way bill (Part - A and Part - B) during the generation of the e-invoice, the e-way bill will be automatically generated. Similarly, the GST system will also auto-populate the details in GSTR-1 and GSTR-2A.

-

The buyer will then get real-time visibility in GSTR-2A for confirming the ITC of the invoice uploaded by the company (you).

However, all of this happens in the background. As a business owner, you won’t have to go through these steps to generate or share the invoice.

The e-invoice process is pretty simple. You can make e-invoices in just a few steps:

-

Register your business in the e-invoice portal. This will enable you to connect with the e-way bill system.

-

Create API credentials for the GST portal for your e-invoice software.

-

Enter your portal credentials in your e-invoice tool.

-

Upload the invoices to the IRP.

-

You will then get validated, digitally signed invoices with the IRN.

The customer will then receive the acknowledgment.

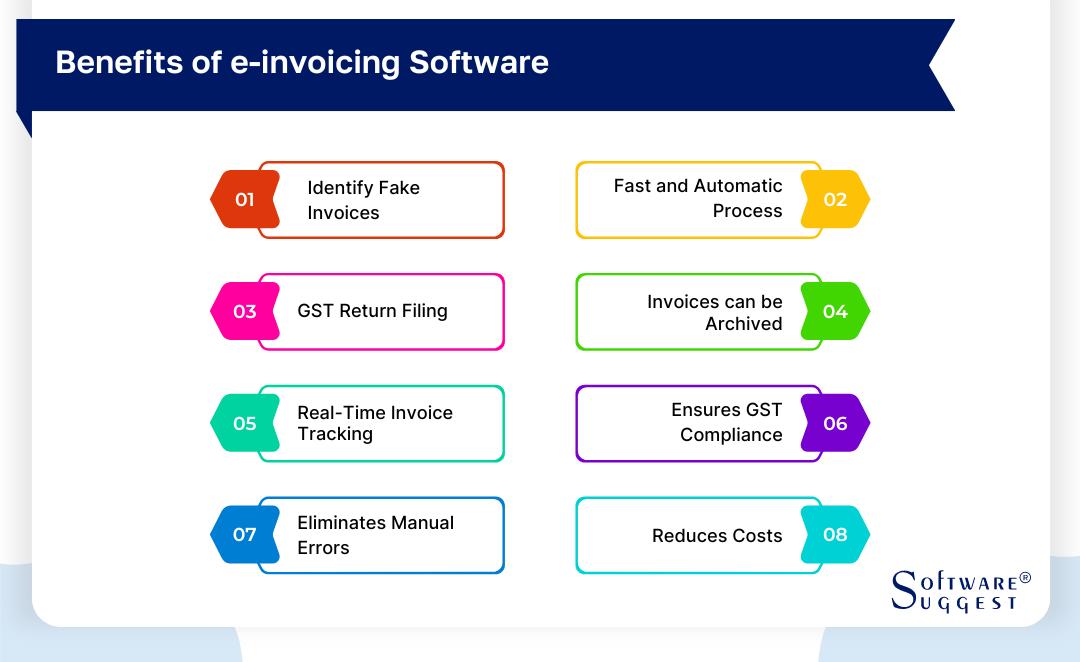

What are the Key Benefits of E-Invoicing Software?

E-invoicing tools offer a myriad of benefits to businesses, such as:

-

Identify Fake Invoices: E-invoicing software offers benefits such as efficient invoice management and fraud prevention by helping businesses identify and prevent fake or fraudulent invoices.

-

Fast and automatic process: Creating an invoice doesn’t take much time. You can even automate invoice generation for regular customers.

-

Auto-population in GST return filing: You don’t have to visit the GST portal to fill in the invoice details. Your e-invoicing system will do that for you.

-

Invoices can be archived so they can be used later: When conducting financial audits, invoices are a must. An e-invoicing tool allows you to store all your old invoices in one place.

-

Real-time invoice tracking: E-invoicing software enables you to track invoice progress in real-time (approved, digitally signed, received by the customer, etc.). This ensures faster availability of input tax credit (ITC).

-

Ensures GST compliance: E-invoicing tools get your invoices approved from the government portal (IRP) and generate a government-validated invoice number. This guarantees the authenticity and credibility of the invoice while ensuring GST compliance.

-

Eliminates manual errors: Since e-invoicing systems auto-populate the GST and e-way bill portal on a real-time basis, it eliminates the need for manual entry, thereby eliminating errors.

-

Reduces costs: With digital invoices, you won’t have to spend on printing or postal fees. Also, it enables you to share invoices quickly, thereby saving working time, which you can use on other value-adding tasks.

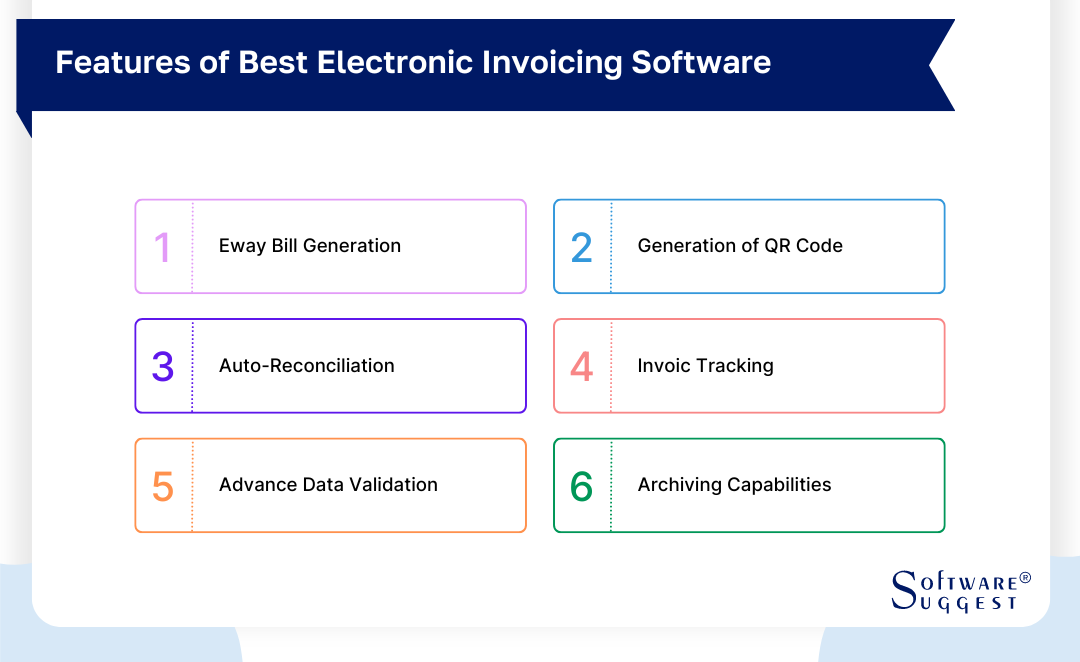

What are the Key Features of Best Electronic Invoicing Software?

The best electronic invoicing software is characterized by a range of essential features that streamline invoicing processes and enhance overall efficiency for businesses. These features include:

-

Eway Bill Generation

E-way bills play a pivotal role in facilitating the movement of goods. A proficient e-invoicing software should seamlessly incorporate the E-way Bill system, enabling users to create E-way bills directly through their invoices. This functionality streamlines adherence to tax protocols, diminishes the need for manual input, and lowers inaccuracies, thereby enhancing logistics efficiency and simplifying tax administration.

-

Generation of QR Code

QR codes on invoices enable quick and convenient access to invoice details for both businesses and customers. A top-notch e-invoicing software should generate QR codes that encapsulate essential invoice information, making it easier for users to scan and verify invoices or for tax authorities to perform audits efficiently.

-

Auto-Reconciliation

Automated reconciliation stands as a vital element assisting enterprises in automatically aligning received payments with their respective invoices. Through this automated process, the software mitigates error possibilities and expedites the management of cash flow.

-

Invoice Tracking

Efficient monitoring of invoices is critical in overseeing their progress from inception to receipt of payment. Competent software should provide live tracking functionalities enabling users to observe the status of invoices, whether sent, viewed, paid, or overdue. This level of transparency guarantees that businesses can effectively pursue payments and improve cash flow.

-

Advance Data Validation

Advanced data validation features help in ensuring the accuracy and completeness of invoice information. The software should have built-in validation checks to verify data such as tax identification numbers, invoice amounts, and product descriptions. This minimizes errors and discrepancies, reducing the risk of non-compliance and disputes.

-

Archiving Capabilities

To comply with tax and legal requirements, electronic invoices must be securely archived and easily accessible. The e-invoicing solution should provide archiving capabilities that store invoices for a specified retention period, ensuring they can be retrieved for auditing or reference purposes. Secure storage and retrieval of archived invoices are vital for regulatory compliance and dispute resolution.

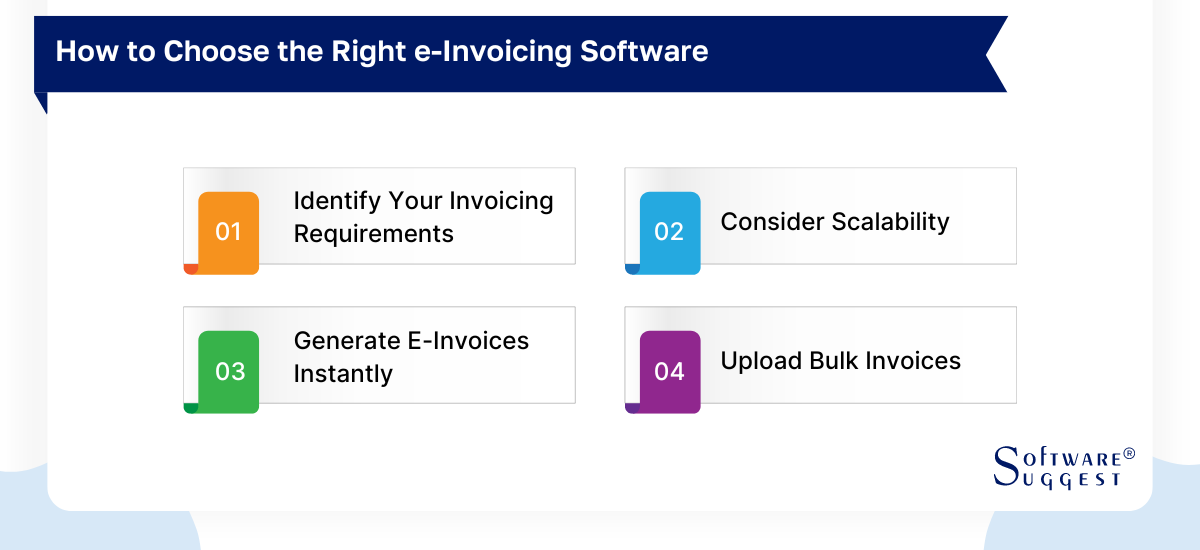

How to Choose the Right E-Invoicing Software?

Selecting the appropriate e-invoicing software is critical for optimizing your business's invoicing processes. To make the right choice, consider the following factors:

-

Identify Your Invoicing Requirements

Start by evaluating your individual invoicing requirements. Each business possesses distinct needs, thus, ascertain whether basic invoice creation suffices or if advanced functionalities like auto-reconciliation, multi-currency capabilities, or integration with tax compliance systems are necessary. Grasping your business's invoicing process and regulatory responsibilities is vital in choosing software that matches your specific demands.

-

Consider Scalability

As your business expands, your invoicing requirements will probably change. Select GST e-invoicing software capable of adapting to your business growth. Verify that the software can manage a growing number of invoices and accommodate extra users or locations as needed. Scalability is crucial to avoid the inconvenience of shifting to a new system later on.

-

Generate E-Invoices Instantly

Efficiency is a key consideration. It should provide customizable templates, support for various document formats, and the ability to add necessary details such as your business logo and payment terms. The capability to generate invoices instantly can save time and enhance your professional image.

-

Upload Bulk Invoices

If your business frequently deals with a large number of invoices, ensure that the software offers bulk invoicing capabilities. This feature enables you to upload multiple invoices simultaneously, reducing manual data entry and streamlining the process. Bulk invoicing is particularly beneficial for businesses with high transaction volumes, as it improves productivity and reduces the risk of errors.

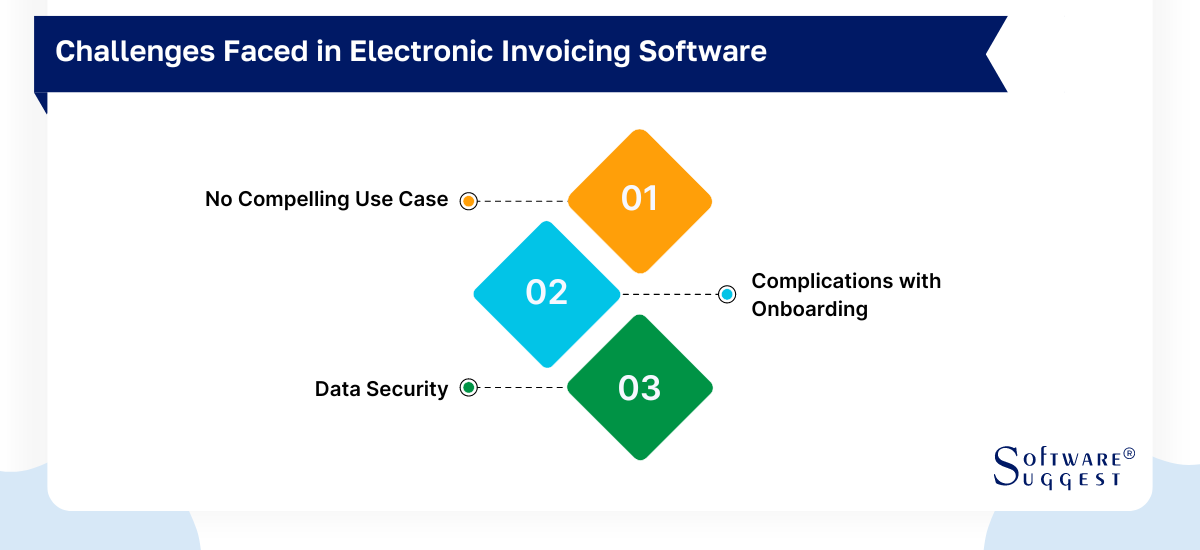

What are the Challenges Faced in Electronic Invoicing Software?

Electronic invoicing software offers many advantages, but it also comes with its set of challenges that businesses need to address -

-

No Compelling Use Case

One common challenge is the lack of a compelling use case. Some businesses may struggle to see the immediate benefits of transitioning to electronic invoicing, especially if their current invoicing processes are well-established. Demonstrating the cost savings, efficiency improvements, and compliance benefits of e-invoicing can be essential to overcome this challenge and motivate adoption.

-

Complications with Onboarding

Shifting to electronic invoicing might pose challenges, especially for businesses accustomed to manual or paper invoices. Introducing employees and suppliers to the new software and procedures can be tough, requiring training, adjustment to fresh workflows, and addressing resistance to change. Successful implementation necessitates effective change management strategies to overcome these obstacles.

-

Data Security

Data security remains a pivotal aspect of electronic invoicing. Dealing with confidential financial details and personal information in digital formats exposes businesses to potential cyber threats. It is imperative to prioritize safeguarding data during transmission, storage, and access. Employing encryption, robust access controls, and conducting routine security audits becomes crucial to prevent data breaches and unauthorized entry.

Future Trends of E-Invoicing System

The global e-invoicing market is projected to reach $15.5 billion by 2027, up from $4.84 billion in 2019. Here are the top three trends that will boost the growth of e-invoicing systems.

-

Big Data Will Be Implemented in the E-Invoicing System

As of October 2020, about 2.4 million e-invoices were being generated every day. That too when only businesses with a turnover of more than 500 crores were using e-invoices. The number is likely to be more than double now.

However, most invoices are available in an unstructured format. But with better technology implementation, businesses are likely to use big data to manage their invoices better, reduce tax fraud, and get a holistic picture of their payables and receivables.

-

Real-Time Economy Will Soon Become a Reality

Not only in India but invoicing software is used by small business, medium, and larger businesses globally. Since e-invoicing software offers real-time access to your invoices, it will help the government to get a better understanding of the economy.

For instance, most tax agencies in Southern America are already using real-time data flows in e-invoices for business validation and reporting purposes. In the coming years, we can even expect real-time tax applications to be facilitated by tax agencies.

-

Businesses Will Leverage the Blockchain

Blockchain technology enables businesses to record and distribute digital information. However, once recorded, it cannot be edited. Another benefit of blockchain is that it makes cash flow management smoother at all phases of the e-invoicing process.

For instance, companies will be able to send and pay invoices using both fiat and digital currencies. Blockchain will also mitigate the risks of fraudulent activity by verifying the details of incoming and outgoing invoices.

With e-invoice already being implemented for businesses with a turnover of $50 crores and above, it has become a necessity to have the best e-invoicing software that will help you generate electronic invoices.

FAQs

Not every business qualifies for e-invoicing. Typically, small businesses with a turnover under a specific threshold, which can differ based on the country, might not be mandated to adopt e-invoicing. It's crucial to review local tax regulations to ascertain eligibility.

The threshold for e-invoicing under the Goods and Services Tax (GST) system differs from country to country. In numerous instances, businesses surpassing a specific annual turnover are obligated to adopt e-invoicing. As the exact threshold may vary, it's crucial to confirm the specific GST regulations in your country.

When considering the ideal e-invoicing software for your business, ensuring compatibility with your accounts payable processes is essential. Popular choices such as QuickBooks, Zoho Invoice, and Xero offer robust invoicing solution. It's crucial to opt for software that not only meets your invoicing needs but also seamlessly integrates with your accounting system and adheres to local tax regulations.

Utilizing e-invoice software is both legally permissible and strongly endorsed by tax authorities for enhancing invoicing efficiency and bolstering tax compliance. Nevertheless, it's imperative for businesses to employ software that complies with local tax laws and regulations concerning invoices and compliance documents to steer clear of potential legal complications.

By Countries

.png)

.jpg)

.png)