Best Fund Accounting Software

Best fund accounting software are Zoho Books, Sage Intacct, Aplos, QuickBooks, and Traverse Distribution. With these, you can easily track different funds and their utility.

No Cost Personal Advisor

List of 20 Best Fund Accounting Software

Contenders | 2024

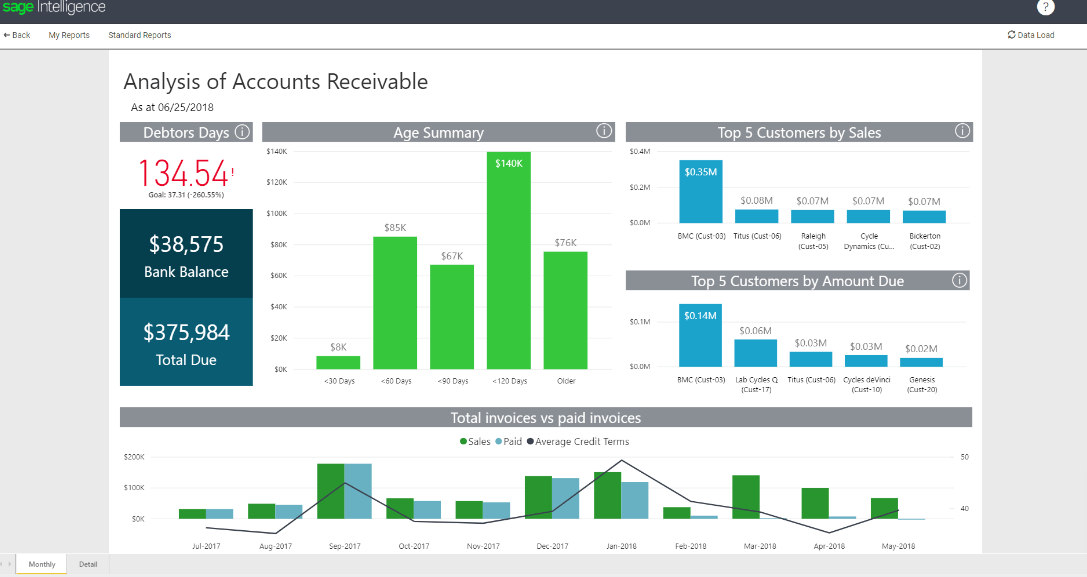

Speeds up your close time by 70%

Close a deal on a positive note and impress your investors with AICPA preferred financial management solutions rendered by Sage Intacct. With a minimum learning curve, this fund accounting software is ready-to-work as soon as you implement it. Read Sage Intacct Reviews

Explore various Sage Intacct features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Sage Intacct Features- Project Accounting

- Multi-Department/Project

- Billing & Invoicing

- Fixed assets

- Financial Reporting

- Revenue Management

- Recurring/Subscription Billing

- Online invoicing

Sage Intacct Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Online Accounting Software for Growing Businesses

Simple, easy-to-use business accounting system to help you manage your accounts online. You can download 14 days free trial of Zoho books. Zoho Books is an easy-to-use, online accounting software for small businesses to manage their finances and stay on top of their cash flow. Read Zoho Books Reviews

Explore various Zoho Books features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Zoho Books Features- Accounts payable

- GST Tax Invoice

- Print Or Email Invoices

- Data Security & Accuracy

- Recurring invoice

- GST Ready

- Online Banking Integration

- Project billing

Pricing

Zoho Books Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Cloud Accounting Software Making Billing Painless

This bookkeeping software makes your accounting tasks easy, fast and secure. Start sending invoices, tracking time, and capturing expenses in minutes. We uphold a longstanding tradition of providing extraordinary customer service and building a product that helps save you time because we know you went into business to pursue your passion and serve your customers - not to learn to account. Read FreshBooks Reviews

Explore various FreshBooks features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all FreshBooks Features- Retainer Billing

- Receipt Management

- Account Tracking

- Invoice Processing

- Dashboard

- Time Tracking

- Accounting Management

- Reminders

Pricing

FreshBooks Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Instant donation reporting details

Serenic software, powered by Microsoft D365 Business Central develops and delivers comprehensive cloud based ERP solutions to public service organisations. The company's focus, integrity and commitment sets them apart from others in the business. Learn more about Aplos Church

Explore various Aplos Church features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Aplos Church Features- Multi-Site Management

- Online Donations

- Membership Management

- Budgeting & Forecasting

- Bank Reconciliation

- Payroll Management

- Member Portal

- Accounts payable

Aplos Church Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Quickbooks-The new age GST accounting software

Choose Quickbooks for your business and not just organise your data but do much more like create and send invoice, track sales and know exactly how your business is performing. And what more, it does not even require any special accounting expertise. Read QuickBooks Online Reviews

Explore various QuickBooks Online features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all QuickBooks Online Features- Data Security & Accuracy

- Multi-Period Recurring Billing

- Budgeting & Forecasting

- Print Or Email Invoices

- Income Statements

- Inventory Tracking

- Collections

- Reorder Management

Pricing

Simple Start

$ 30

Per Month

Essentials

$ 60

Per Month

Plus

$ 90

Per Month

QuickBooks Online Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Use intelligent applications & make smart decisions

Digitally transform your business with Dynamics 365. It is where technology and modern business applications work on the same platform. And lets you use next generation business applications with data and intelligence to have better business outcomes. Read Microsoft Accounting Reviews

Explore various Microsoft Accounting features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

- Financial Accounting

- Production Management

- Task Management

- Billing & Invoicing

- Fixed Asset Management

- Collections

- Cash Management

- Project Accounting

Pricing

Dynamics 365 Plan

$ 210

per user/month

Unified Operations Plan

$ 190

per user/month

Customer Engagement Plan

$ 115

per user/month

Microsoft Accounting Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Complete ERP powered accounting

Traverse Distribution offers smart and pocket-friendly ways to channelize your fund management from ground level. This fund accounting software offers complete software integration diligently crafted for all sorts of the ecosystem. Learn more about Traverse Distribution

Explore various Traverse Distribution features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

- Receipt Management

- Shipping Management

- Returns Management

- Forecasting

- Warehouse Management

- Check Processing

- Performance Tracking

- Sales Order Management

Traverse Distribution Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Empowering 30,000+ organizations across the globe

Abila provides scalable and result-oriented fund management solutions for all sorts of the business ecosystem. With its cloud-based integration, this fund accounting software let you share, edit and create data on virtual space without any fear of loss/theft. Learn more about Abila

Explore various Abila features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Abila Features- Document Printing

- Expense Management

- Bills of Material

- Project Management

- Project Accounting

- Accounting

- Task Management

- Purchasing

Abila Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

ERP solutions that you can trust for your business

Serenic software, powered by Microsoft D365 Business Central develops and delivers comprehensive cloud based ERP solutions to public service organisations. The company's focus, integrity and commitment set them apart from others in the business. Read Serenic Navigator Reviews

Explore various Serenic Navigator features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Serenic Navigator Features- Activity Tracking

- Budgeting & Forecasting

- Accounts Receivable

- Purchasing & Receiving

- Accounts payable

- Accounting

- Compliance Management

- Fundraising Management

Serenic Navigator Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Power of Simplicity

TallyPrime is India’s leading business management software for GST, accounting, inventory, banking, and payroll. TallyPrime is affordable and is one of the most popular business management software, used by nearly 20 lakh businesses worldwide. Read TallyPrime Reviews

Explore various TallyPrime features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all TallyPrime Features- Data Exchange Capabilities

- Sales Management

- Integrate Different Payment Gateways

- Quotation & Estimates

- Checks & Controls

- Budgeting & Forecasting

- Job Work

- Mobile Access

TallyPrime Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Makes accounting easy and affordable

Conduct your accounting operations from any device and leverage them at every vertical by using FUND E-Z. With the power of the cloud, this fund accounting software gathers all your business data at a centralized place and helps you raise funds easily. Learn more about FUND E-Z

Explore various FUND E-Z features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all FUND E-Z Features- Accounts payable

- Accounts Receivable

- Fund accounting

- Expense Tracking

- Government

- General Ledger

- Activity Tracking

- Bank Reconciliation

FUND E-Z Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

OpenPro-more than just ERP solutions

Let OpenPro take care of more than just ERP solutions. It is a comprehensive solution for Accounting and Financial Reports, CRM, E-commerce software and payroll HRMS time card for your company. Read OpenPro Reviews

Explore various OpenPro features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

OpenPro Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Fund accounting, raising and Payroll with Araize

Get cloud based solutions with FastFund Online Non-profit software solutions. It is an easy and affordable solution that will save your time and money. You can choose to buy different modules seamlessly or together. Read FastFund Reviews

Explore various FastFund features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all FastFund Features- Activity Tracking

- General Ledger

- Bank Reconciliation

- Budgeting & Forecasting

- Asset Management

- Accounts payable

- Accounts Receivable

- Payroll Management

Pricing

Standard

$ 42

Per Month

Premium

$ 94

Per Month

FastFund Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Software by LOGOS Church Management and Accounting Software

Logos Fund Accounting is a fully featured Church Accounting Software designed to serve Enterprises, Agencies. Logos Fund Accounting provides end-to-end solutions designed for Windows. This online Church Accounting system offers General Ledger, Accounts Payable, Asset Management, Budgeting & Forecasting, Activity Tracking at one place. Learn more about Logos Fund Accounting

Explore various Logos Fund Accounting features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

- Budgeting & Forecasting

- Accounts Receivable

- General Ledger

- Accounts payable

- Activity Tracking

- Asset Management

Logos Fund Accounting Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Software by Xero Limited

Xero is award-winning web-based accounting software for small business owners and their accountants. It is beautifully designed and easy to use online bookkeeping for expense management. Read Xero Accounting Reviews

Explore various Xero Accounting features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Xero Accounting Features- Invoice

- Multi Currency

- Taxation Management

- Time Tracking

- Banking Integration

- Loan & Advances Management

- Task Management

- Bonus

Pricing

Starter

$ 9

Per Month

Standard

$ 30

Per Month

Premium

$ 60

Per Month

Xero Accounting Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Software by Sage

Sage offers a complete desktop accounting software that helps you spend less time managing your accounts and more time developing your business. With its easy to use interface, Sage 50cloud Accounting has aided small businesses and entrepreneurs to operate efficiently and effectively. Special Offer: 40% off Sage 50cloud annual subscriptions | Coupon Code: D-1929-0020. Read Sage 50cloud Reviews

Explore various Sage 50cloud features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Sage 50cloud Features- Billing Portal

- Fund accounting

- Spend Management

- Accounts payable

- Multi-Currency

- Recurring/Subscription Billing

- Accounts Receivable

- Payroll Management

Pricing

Pro Accounting

$ 51

Per Month

Premium Accounting

$ 78

Per Month

Quantum Accounting

$ 198

Per Month

Sage 50cloud Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Software by MYOB Technology Pty. Ltd.

MYOB POS is like a digital cash register, performing all the operations a register would, but on a computer or mobile device. Most POS software also incorporates tools for running nearly every aspect of your business such as inventory, store management, CRM, reporting etc, all in an easy-to-use and intuitive software suite. Read MYOB Reviews

Explore various MYOB features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all MYOB Features- Refunds and Store Credits

- Transaction Processing

- Warehouse Management

- Stock Management

- Ecommerce Integration

- Inventory Management & Consumption Tracking

- Loyalty Management

- Multi Currency

Pricing

Payroll for One

$ 35

Per Month

Unlimited Payroll

$ 45

Per Month

Plus

$ 85

Per Month

MYOB Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Software by Community Brands

MIP Fund Accounting is a fully featured Accounting Software designed to serve Agencies, SMEs. MIP Fund Accounting provides end-to-end solutions designed for Web App. This online Accounting system offers Accounts Receivable, Accounts Receivable, General Ledger, Asset Management, Donation Tracking at one place. Read MIP Fund Accounting Reviews

Explore various MIP Fund Accounting features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

- Accounts Receivable

- Fund accounting

- Bank Reconciliation

- Asset Management

- Project Accounting

- Accounts payable

- Donation Tracking

- General Ledger

MIP Fund Accounting Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Software by Miles Software

Miles Software offers MoneyWare Portfolio management software offer highly competitive environment. Those who wish to maintain a competitive advantage have been obliged to develop and implement innovative investment strategies. Learn more about Miles Software

Explore various Miles Software features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Miles Software Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Software by Blackbaud

Blackbaud is a low-cost alumni management platform that can be a part of any ecosystem easily. With a cloud-native contact management system, this alumni management software leverages the alumni association process and makes it easily accessible. Learn more about Blackbaud

Explore various Blackbaud features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Blackbaud Features- Donor Management

- Calendar Management

- Customer Management

- Dashboard

- Fundraising Management

- Customer DataBase

- Email Marketing

Blackbaud Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

What is Fund Accounting Software?

Fund accounting system is a technical type of accounting program designed for handling different financial operations of nonprofits, charities, and other businesses that use a fund-based funding system.

Unlike standard for-profit business accounting systems, fund accounting emphasizes accountability and proper stewardship of funds. Fund accounting differs from standard for-profit business accounting systems that track money on one ledger.

On the other hand, fund accounting isolates funds so that donors or external sources can report and monitor them accurately.

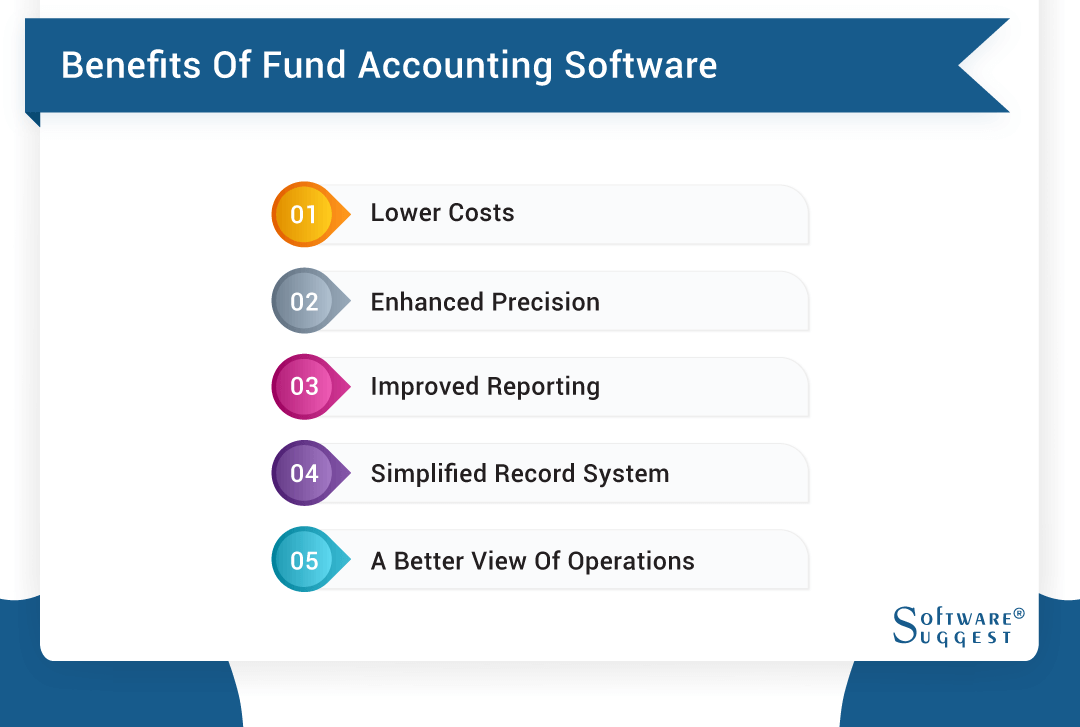

Benefits of Fund Accounting Software

Fund accounting software offers companies several advantages, including:

-

Lower Costs

As automating fund accounting eliminates the need for staff members to manually enter data into spreadsheets and organize documents, it reduces labor costs. The financial management of a nonprofit organization requires fewer people, which allows other staff members to focus on more valuable activities like grant writing and fundraising.

-

Enhanced Precision

In government and non-profit organizations, mutual fund accounting software provides a fast and efficient way of tracking and managing financial data. As a result, financial records are kept up-to-date and accurate at all times, eliminating the potential for errors in data entry and calculations.

-

Improved Reporting

Detailed reports generated by mutual fund accounting software can be used to analyze an organization's funds, which can be used to identify areas of opportunity or challenges and take appropriate steps in a timely manner. A variety of reports are available, including a budget summary, a balance sheet, an income statement, a cash flow analysis, a grant tracking report, etc.

-

Simplified Record System

Keeping track of accounts and transactions is simplified with fund accounting software. There is no need for manual records or paper filing systems. The information can be accessed and updated easily in a centralized location where authorized personnel can easily access it.

-

A Better View of Operations

The use of fund accounting software allows organizations to comply with a variety of regulations such as state laws governing non-profits and donor requirements that require transparency when it comes to the use of funds. By delivering clear financial statements regularly, institutions remain compliant with various regulations.

As a result, board members have greater oversight capabilities over management decisions relating to finances within an organization because they can review grant expenditures at any time.

What Type of Fund Accounting Software Does Your Organization Need?

There are several types of accounting solutions, including ones that manage funds and grants and those that include back-end accounting features like accounts payable and general ledgers.

-

Current Users Preferring Extended Functionality

As fund accounting solutions grow in popularity, users may look to expand on existing features. You'll need strong IT support and security as you handle more funds, something that's not available with a basic package. All these are great reasons to take a closer look at your software solution and determine if it meets your needs now and in the future.

-

Small Businesses & Prospective Buyers

The fund accounting functionality of complete accounting software may be sufficient for very small organizations, but for growing nonprofits, separate software may be necessary.

-

Large Corporations

Last but not least, larger organizations may have a few legal entities they record within their systems, or even dozens of programs, projects, locations, etc., each with its funds for a variety of causes. Those organizations with a large number of funds are likely to have even more funds as they continue to operate, so they'll need a scalable solution.

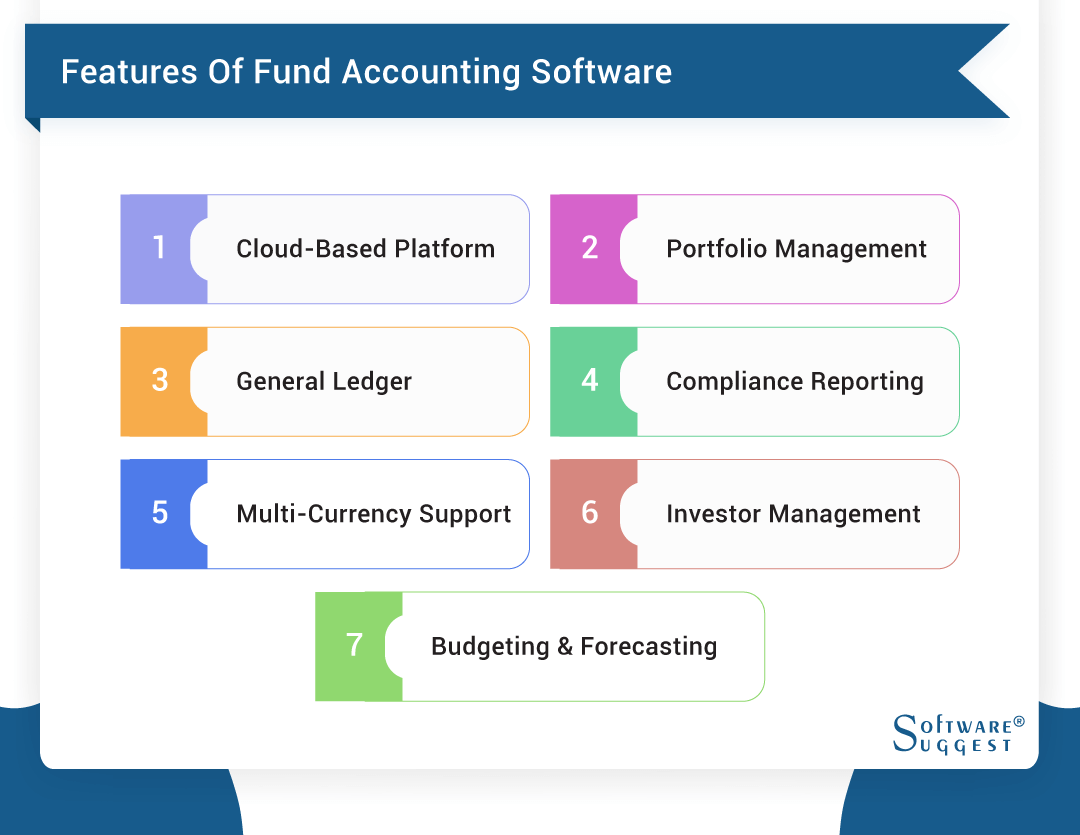

Key Features of Fund Accounting Software

Below are the most prominent features of fund accounting software:

-

Cloud-Based Platform

There are many fund accounting solutions available as cloud-based platforms that allow fund managers to access financial data and generate reports from anywhere with an internet connection.

-

Portfolio Management

The use of fund accounting software can help managers manage a wide range of investments, including tracking performance metrics such as total return, risk-adjusted returns, and portfolio diversification. Furthermore, it can provide insight into industry trends and asset allocation.

-

General Ledger

In addition to tracking and documenting all financial trades associated with a fund, General ledger lets users develop financial reports, such as balance sheets and revenue statements, quickly and easily.

-

Compliance Reporting

The ability to meet regulatory requirements accurately and in a timely fashion is a crucial part of fund management, and this feature provides the tools necessary to achieve this. The system allows users to prepare and submit periodic compliance reports to state agencies.

-

Multi-Currency Support

As a result of this feature, users are able to record and track financial transactions in multiple currencies, making sure that funds are converted correctly into local currencies for reporting or taxation requirements.

-

Investor Management

An investor management module is typically included in fund accounting software, which allows investors to track current investors, process new applications, schedule contributions, and more. In addition, this investment fund accounting software gives investors access to detailed information about their investment portfolios through secure portals.

-

Budgeting & Forecasting

In this feature, users can compare real-time financial data with their desired goals or projections, allowing fund managers to identify additional opportunities for revenue growth or cost optimization.

How to Select the Right Fund Accounting Software?

Keep in mind the following points to pick the suitable fund accounting software for your business:

-

Consider your business requirements and budget.

-

Firstly, assess your organization's current financial processes and how they will need to change if you switch to new software, and take into account any additional features or integrations you may need to comply with industry standards or regulations.

-

Make sure to pay special attention to the features that are included as well as any optional add-ons that may be available in the fund accounting software you're considering.

-

Several factors should be considered, including ease of use, scalability, reporting capabilities, security measures, and customer support.

-

In addition, you should compare the costs associated with each option. For example, comparing the price of individual licenses vs. enterprise licenses for multiple users, analyzing the costs associated with installation and maintenance, evaluating the potential savings associated with automating manual processes, and calculating the return on investment (ROI) from using the software.

5 Best Fund Accounting Software

A fund accounting software program enables organizations to keep track of project funding and expenditures in order to create valid reports. Here are the top five fund accounting software programs.

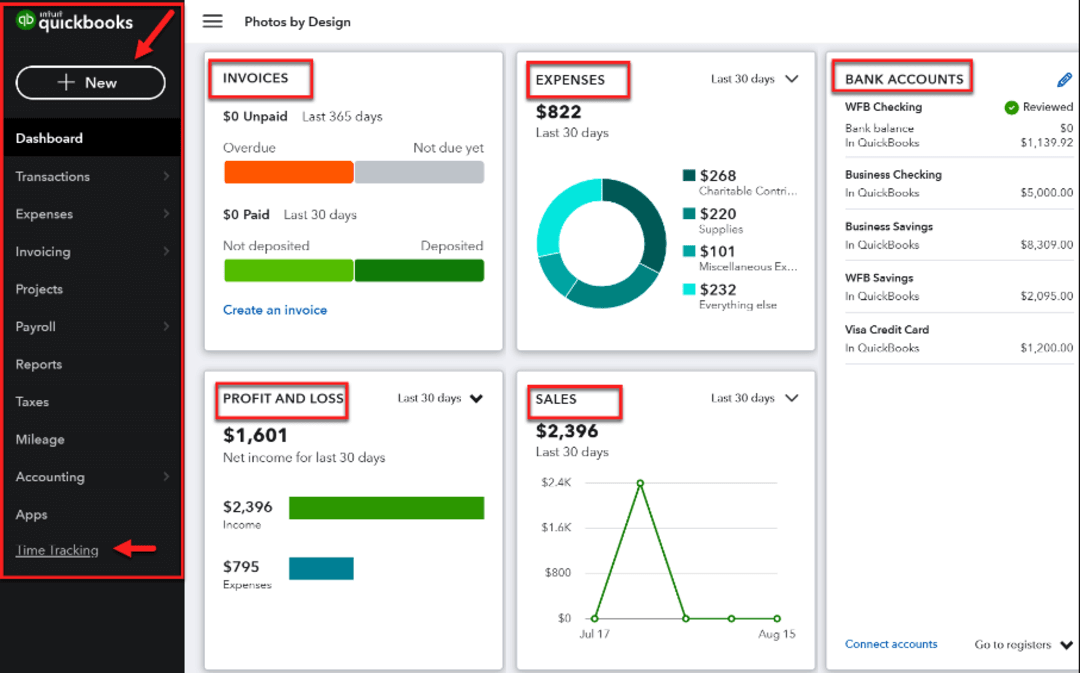

1. QuickBooks Online

Cloud-based accounting solution QuickBooks Online helps small businesses manage their financial records, income, expenses, payroll, and more. Using QuickBooks Online, multiple users can view detailed reports and accounts of company finances from one single dashboard that automatically syncs a complete business finance profile. All trade, profit, and loss sheets, as well as invoices and billing solutions, are mobile-friendly and print-friendly on the platform.

Key Features

- Online Banking

- Accounting Reports

- Cash Flow Management

- Time Tracking

- Accounting Reports

Pros

- It is effortless to send invoices

- QuickBooks online is fairly easy to use and user-friendly

- Easy to use reports for taxes at the end of the year

- Transparency is ensured by enabling accountants and auditors to access the data at any time

Cons

- QuickBooks online is slow to resolve tech issues

- Customer service needs improvement

- While the premise of bookkeeping cleanup is excellent, the implementation is terrible

Pricing

- Self-Employed - $15 per month

- Simple Start - $25 per month

- Plus - $75 per month

2. Fast Fund Software Suite

An all-in-one solution for all your management needs, Fast Fund Online provides nonprofit fund accounting, donor management, automatic fund accounting, and payroll all under one system. In addition to helping you work more efficiently, Fast Fund provides you with more detailed information needed to manage programs, be prepared for audits, and provide management with better and more accurate information.

Key Features

- General Ledger

- Accounting

- Expense Tracking

- Financial Reporting

- Recurring/Subscription Billing

Pros

- Fast Fund allows you to save a lot of time in accounting

- Track particular donations allocated to specific programs

- The customer service delivered is outstanding

- Excellent webinars are available for tutoring online

Cons

- The implementation of the software was rough

- The reports aren't super intuitive

- Some elements are not user-friendly (report generators)

Pricing

-

Starting from $42 - $94 /month.

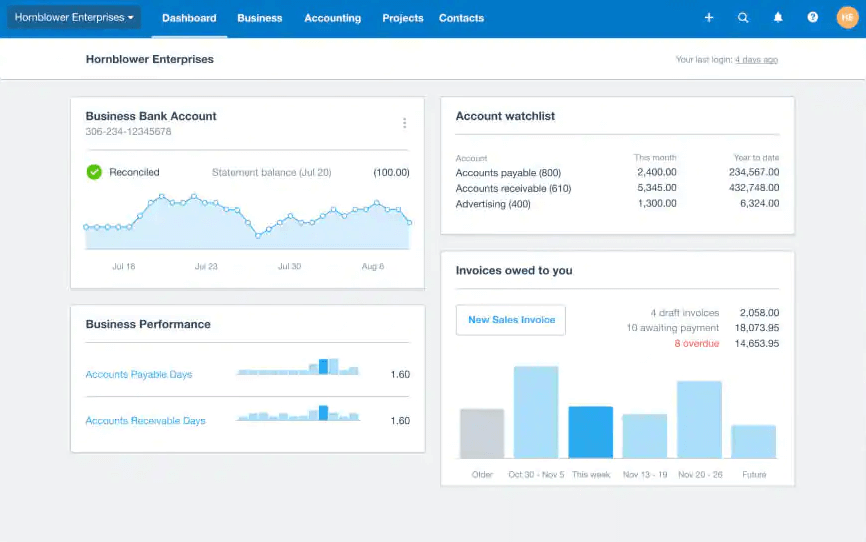

3. Xero

The Xero accounting system has been specifically designed for not-for-profit organizations and growing businesses. A web-based tool, Xero provides business owners with instant insight into their financial position.

It is available from any device with a web connection and connects small businesses with trusted advisors. Accounting software such as Xero lets small businesses monitor their cash flows, transactions, and account details from anywhere, automatically importing and coding bank transactions.

Key Features

- Send invoices

- Bank reconciliation

- Accept payments

- Track projects

- GST returns

Pros

- Xero has an easy and simple UI

- It has an effortless flow and terminologies

- Xero stores all payslips and leaves information in an easily accessible way

- Seamless transactions and translate financials into various currencies

Cons

- Constant disconnection of bank feeds

- The reporting function can be improved

- No integration and visibility to different payroll platforms

Pricing

- Early - $11 per month

- Growing - $32 per month

- Established - $62 per month

4. FUND EZ

The Fund EZ accounting software allows you to create and track budgets across fiscal years by giving you complete visibility into your organization's finances. Fund EZ gives you all the information you need to make informed decisions, regardless of whether you are managing multiple projects, grants, or different funding sources.

Key Features

- Built-in accounting

- Expense tracking

- Accounts payable

- Accounts receivable

- Bank reconciliation

Pros

- The reporting capabilities make it easy to provide reports

- FUND EZ is a great & all-in-one solution with a user-friendly interface

- You can customize your chart of accounts and reports completely

- You can also easily and quickly generate financial reports

Cons

- Financial report customization is time-consuming and labor-intensive

- The budgeting module is difficult to navigate

- The customer service needs improvement

Pricing

-

Starts from $170.00 /month

5. Sage Intacct

Sage Intacct is one of the best fund accounting software and is a top choice for growing and midsize businesses. For businesses to scale, Sage Intacct offers innovative technology, powerful automation, and integrated cloud architecture.

Sage Intacct covers a wide range of accounting applications, such as general ledgers, payables, receivables, private equity funds, cash management, and order management. Sage Intacct has built-in reporting and dashboards, project accounting, revenue administration, time and payment management, and more.

Key Features

- Accounts payable and receivable

- Cash management

- Built-In reporting

- Dashboards

- Collaboration tools

Pros

- Sage Intacct is easy to navigate & user-friendly

- Creating customized reports for specific viewers

- Seamless integration with other systems

- The capacity to attach EHRs, tickets, and other documents

Cons

- The UI needs improvement

- Too many system updates

- There are glitches in data at times

Pricing

-

Custom pricing

Who Uses Fund Accounting Software?

Fund accounting software is used mostly by the following -

-

Charitable Foundations

Fund accounts software program is heavily used by foundations to keep track of donations received from individuals and grants given by corporations and government agencies. This software aims to provide comprehensive oversight over these types of transactions while ensuring accountability for the funds distributed.

-

Government Agencies

The use of a fund accounting system encourages compliance with rigid financial reporting requirements set by regulatory bodies for public sector entities such as local municipalities and government departments. Using it, different users can easily access budgets and gain visibility into how tax dollars are used.

-

Healthcare Facilities

Hospitals, nursing houses, labs, and other healthcare providers need fund accounting software to facilitate financial processes and ensure industry regulations compliance. Grant management capabilities are particularly helpful in this field.

-

Nonprofit Organization

Keeping track of donations, grants, and other funding sources requires special software, as does managing complex accounting processes. The software will help nonprofit organizations keep accurate records of donations, grants, and other funding sources.

-

Educational Institutions

Fund accounting software helps schools and colleges to manage tuition and student aid payments, endowments, research funds, and capital project funding.

Trends Related to Fund Accounting Software

Here are the trends related to investment fund accounting software:

-

Improved Automation

With more sophisticated features in fund accounting software, tracking financials and making transactions can be streamlined more quickly and efficiently. By lowering errors, users can finish their tasks effortlessly and efficiently.

-

Enhanced Protection

A key benefit of technology advancements is that fund accounting solutions are much more secure than they used to be. As a result, fund accounting software now offers the highest level of security, ensuring users' financial data is protected from potential threats such as hackers or cyberpunks.

-

Increased Flexibility

In terms of managing their finances, fund accounting software allows users to customize the program to suit their needs, allowing them to tailor the system to meet specific requirements.

-

Detailed Reporting

Using this private equity fund accounting software, users can easily identify trends and make informed decisions about their finances by being able to see their finances in a comprehensive manner. Users can also use powerful reporting tools to predict future spending patterns more accurately

Pricing for Fund Accounting Software

The fund accounting process costs may vary greatly depending on the type and scale of fund accounting software. For example, an entry-level software package for records and reporting may cost only a few hundred dollars annually.

On the other hand, a more complex system with advanced features can cost tens or hundreds of thousands of dollars to install and sustain, plus extra annual fees for maintenance and updating. Therefore, when evaluating fund accounting software pricing, you need to consider your specific needs since there are no one-size-fits-all solutions.

A budget for this private equity fund accounting software purchase should be based on factors such as complexity and several users, reporting requirements, asset types tracked, and integration capabilities. In addition, using third-party services, such as cloud-hosted solutions, supplies accounting firms with advanced protection and scalability without needing large upfront investments.

Conclusion

Through improved visibility into finances, fund accounting software allows organizations to maximize their resources while staying compliant with applicable regulations. By doing so, they can decide the most effective way to allocate funds towards their mission.

For instance, with the help of a fund accounting module, churches can track their member contributions with a church governance suite. Fund accounting packages deliver a self-contained, self-balancing ledger precisely designed for a particular project or donation.

.png)

.png)