Best GST Billing Software

Explore top GST billing software options, such as EasyGST, CaptainBiz, Swipe, Swipez Billing, GO GST BILL, and HostBooks GST. These GST invoicing and billing tools offer outstanding features for personalized invoices and accurate GST billing.

No Cost Personal Advisor

List of 20 Best GST Billing Software

Category Champions | 2024

#1 GST billing software

myBillBook is India's #1 invoicing, GST billing, accounting & inventory management software for small & medium businesses. Grow your business with the best invoicing software. Paid plans start from Rs.34 per month. Read myBillBook Reviews

Explore various myBillBook features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all myBillBook Features- Integration with GSTN Portal

- Billing Portal

- Quotation & Estimates

- Inventory control

- Billing Estimates

- Billing System

- Barcode Generation

- Retail POS

Pricing

Silver Plan

$ 0

Per Month

Diamond Plan

$ 3

Per Month

Platinum Plan

$ 3

Per Month

myBillBook Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

A Businessman's Best Friend

Vyapar is a GST-compatible invoicing and accounting solution for small businesses. You can use it to create GST bills, fulfill orders, generate GSTR reports, track payments/expenses, and manage your inventory. Besides, you can use it to customize invoices and collect payments online. Read Vyapar Reviews

Explore various Vyapar features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Vyapar Features- Barcoding

- Multi-Branch

- Data Synchronization

- Customizable Catalogs

- Sales Management

- GST Tax Invoice

- Account Management

- Native App

Pricing

Silver- Desktop (1 year)

$ 40

Device/Year

Silver- Desktop + Mobile (1 year)

$ 47

Device/Year

Silver- Desktop (3 years)

$ 92

Device/ 3 Years

Vyapar Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Best GST invoice software in India

Swipe billing software and the app helps you to create sales/purchase invoices, quotations, manage inventory, save customers & vendors and be in control of your business. Create GST compliant invoices & share them with customers easily. Read Swipe - Billing Reviews

Explore various Swipe - Billing features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Swipe - Billing Features- Online Accounting

- Accounts Receivable

- Multi-Currency

- Payment Handling

- Mobile Access

- Invoice

- Sales Tracking

- Quotation & Estimates

Pricing

Swipe PRO Plan

$ 21

Per Year

Swipe JET Plan

$ 39

Per Year

Swipe RISE Plan

$ 49

Swipe RISE Plan

Swipe - Billing Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Online GST billing software in India

EasyGST is the Best software for GST Return filing, Invoice and ITC Reconciliation in India. EasyGST Software is Trusted by Thousands of Chartered Accountants, Tax Professionals and Corporates users. Download free EasyGST Software. Read EASYGST - GST Return Filing & Reconciliation Reviews

Explore various EASYGST - GST Return Filing & Reconciliation features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

- Importing tax data from previous years

- GST Tax Invoice

- Customizable Reports and Dashboards

- Online GST Portal

- Fast Search

- Electronic filing (e-filing)

- Tax deadline reminders

- Permission Management

Pricing

EasyGST (Light)

$ 40

Per Installation

EasyGST (Professional)

$ 111

Per Installation

EasyGST (Poplular)

$ 54

Per Installation

EASYGST - GST Return Filing & Reconciliation Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Popular online GST invoice software

CaptainBiz is a simple-to-use software solution to manage your business hassle-free. Generate tax invoices, track inventory in real-time, manage customers & suppliers, and monitor cash & bank transactions, all in one place, over PC or mobile. Endorsed by GST govt. of India as an affordable and easy-to-use solution for both GST and non-GST companies. Read CaptainBiz Reviews

Explore various CaptainBiz features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all CaptainBiz Features- Data Security & Accuracy

- GST Ready

- Sales Management

- GST audit report

- SMS Integration

- Financial Management

- Billing & Invoicing

- Email Integration

CaptainBiz Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

GST e invoice system in India

Go GST Bill is cloud-based, simple, and powerful GST billing software that helps you simplify your daily billing needs. With Go GST Bill's Lifetime free plan you can start your billing without paying anything. Read GO GST BILL Reviews

Explore various GO GST BILL features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all GO GST BILL Features- Online Accounting

- Quotation & Estimates

- Invoice Designer

- Profit & Loss Statement

- GST Tax Invoice

- Import/Export & Print

- Reporting

- Invoice

Pricing

Lifetime Free

$ 0

Onetime

Premium Membership

$ 21

Per Year

GO GST BILL Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Online GST billing software for small business

ClearTax is providing a complete solution and free trial of taxation with expert support and freelancer for the business to guide how to save money and time. Income tax return e-filing, GST, GST compliance software, etc modules are inbuilt. ClearTax is a leading invoicing and billing software that lets you create business invoices compliant with GST regulations. It even lets you file GST returns with a single click. ClearTax also identifies errors in documents before uploading them to the GSTN portal. Thus, reducing penalties while filing taxes. Read ClearTax Reviews

Explore various ClearTax features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all ClearTax Features- E-Way Bill Generation

- Dashboard

- Data Import/Export

- Records of E-Way Bills

- Audit Trail

- Reporting

- Inventory Management

- Email and SMS Alerts

ClearTax Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Best online GST billing software

Simple, easy-to-use business accounting system to help you manage your accounts online. You can download 14 days free trial of Zoho books. Zoho Books is an easy-to-use, online accounting software for small businesses to manage their finances and stay on top of their cash flow. Read Zoho Books Reviews

Explore various Zoho Books features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Zoho Books Features- Online invoicing

- Online Banking Integration

- Purchase Orders

- Accounts Receivable

- Discount & Schemes

- Multi-currency

- Financial Accounting

- Product Database

Pricing

Standard

$ 10

Organisation/Month Billed Annually

Professional

$ 21

Organisation/Month Billed Annually

Premium

$ 42

Organisation/Month Billed Annually

Zoho Books Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

High Performer | 2024

The next generation Online Accounting Software

ProfitBooks is a simple and fastest business accounting software for small businesses. It lets you create beautiful invoices, track expenses and manage inventory without any accounting background. Read ProfitBooks Reviews

Explore various ProfitBooks features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all ProfitBooks Features- Manage Customers and Suppliers

- Payments

- Multiuser Login & Role-based access control

- Cashflow

- Inventory Management

- Online Banking Integration

- Invoicing

- Multi Currency Support

Pricing

Professional Plan

$ 83

Per Year

SMB Plan

$ 125

Per Year

ProfitBooks Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Best GST invoice software in India

SalesBabu GST is a fully featured GST Billing software designed to serve SMEs, Startup, Agencies, Enterprises. SalesBabu GST provides end-to-end solutions designed for Web App. This GST Billing software offers Sales invoices, Purchase invoices, Refund vouchers, Advance payments/ receipts at one place. Learn more about SalesBabu GST

Explore various SalesBabu GST features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

SalesBabu GST Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Software by Easy Accountax

Easy GST is an online accounting software to manage your accounting, inventory and to file your GST returns with ease. Sign up for a free trial. We at Easy believe that Accounting can be made very easy and powerful using the latest technology at a very affordable price. Read Easy GST - GST Ready Accounting Reviews

Explore various Easy GST - GST Ready Accounting features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

- Dashboard

- Email Integration

- Data Security & Accuracy

- Profit & Loss Statement

- Expense Management

- Stock Take and Monitoring

- Sales Management

- Reporting

Pricing

Starter

$ 11

Yearly

Easy GST - GST Ready Accounting Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

The Language of Business

HostBooks GST simplifies the process of working on GST with the effortless filing of returns & easy reconciliation of the mismatches. It reduces the compliance time by at least 50% and cuts down the cost by half. Hence, HostBooks enhances your efficiency by leaps and bounds. Read HostBooks GST Reviews

Explore various HostBooks GST features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all HostBooks GST Features- Taxation Management

- VAT / CST / GST Reports

- GST Compliance

- Multi-Currency

- Billing & Invoicing

- GST returns

- Invoice

- GST Tax Invoice

Pricing

All in One Single sign up

$ 56

Per Year

HostBooks GST Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Smaket makes your Complex business Simple

Smaket is One of the super easy GST Compatible online billing & accounting software for small and medium businesses. You can enroll for our 14 days free trial. You don't need prior accounting knowledge to use our software, generate several reports including GST report. Read Smaket Reviews

Explore various Smaket features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Smaket Features- VAT / CST / GST Reports

- Expense Management

- Inventory Management

- Payment Plans

- Payment Handling

- Item Management

- Mobile App

- Custom Rate Plans

Pricing

Premium

$ 33

Yearly License / Single User

Gold

$ 72

Yearly License / Single User

Smaket Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Making Modern Businesses GST friendly

QuickBooks is an online accounting software for business owners to make stay on top of their finances. Easy to use interface, 100% data security and features such as Online bank connect and Whatsapp integration helps business owners to focus on growing their business. Read QuickBooks Online Reviews

Explore various QuickBooks Online features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all QuickBooks Online Features- Employee Data Base

- Online Accounting

- Multi Currency Support

- Payment Processing

- GST Compliance

- Customizable invoices

- Online Payment Processing

- Purchase Order

Pricing

Simple Start

$ 30

Per Month

Essentials

$ 60

Per Month

Plus

$ 90

Per Month

QuickBooks Online Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Full Invoicing solution designed for Indian SMBs

Sleek Bill is one of the fastest billing and invoicing software solutions which designed for Indian small businesses. It offers tax management, multiple invoice templates, stock and much more. It easily creates invoices, quotations, proformas and challans. Read Sleek Bill Reviews

Explore various Sleek Bill features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Sleek Bill Features- Invoice

- Payment Handling

- Product Database

- Taxation Management

- Supplier and Purchase Order Management

- Invoice Designer

- Vat

- Inventory Management

Pricing

Offline Free

$ 0

One time

Offline Premium

$ 28

Per Year

Offline Premium + Inventory

$ 44

Per Year

Sleek Bill Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Bill presentment and online payment collections

Swipe invoicing software is an online cloud-based solution. Using Swipez you can collect payments faster, organize company expenses, automate vendor payouts & perform e-invoicing GST filing. Automate your company billing using Swipez free billing software. Read Swipez Billing Reviews

Explore various Swipez Billing features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Swipez Billing Features- Payment Gateway Integration

- Invoice

- Online payments

- Invoice Management

- Banking Integration

- Online Payment Processing

- Invoice Designer

- Recurring Invoicing

Pricing

Free

$ 0

Per Year

Startup

$ 83

Per Year

Growth

$ 167

Per Year

Swipez Billing Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Most preferred GST Software in India

Marg GST software is useful for every business be it retail, distribution or manufacturing. It makes GST billing and filing, generation of E-way bills for transportation business, invoices & 1000's of reports, management of accounts, reconciliation of bank statement easy. Read Marg GST Software Reviews

Explore various Marg GST Software features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Marg GST Software Features- Collaborate

- Dashboard

- Sales Management

- Inventory Management

- Financial Management

- Fixed assets

- Monthly GST Report

- GST Tax Invoice

Pricing

Basic Edition

$ 113

Full licence/ Single User

Silver Edition

$ 175

Full licence/Single User

Gold Edition

$ 350

Full Licence/ Multi-User

Marg GST Software Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Easy GST Compliance for Small Businesses

Gen GST Software is a complete package for e-filing, e-invoicing, billing and e waybill which comes with many high-end features and functionality, intended for generating GST bills, the smoother filing of GST, storing data along attractive UI. Read Gen GST Software Reviews

Explore various Gen GST Software features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Gen GST Software Features- Import/Export & Print

- Mobile App

- General Ledger

- Document Printing

- Tax Management

- Returns Management

- Compliance Tracking

- Import and Export Data Capabilities

Pricing

Gen GST Software Desktop Variant

$ 69

Per Year

Gen GST Cloud Plan

$ 139

Per Year

Gen GST Software Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Best GST invoice software for Professional CA

GSTrobo is an E Way bill Software that caters all the e-bill requirements of consigners, transporters and consignee with the same ease. you can upload bulk invoices at a time. Learn more about GSTrobo

Explore various GSTrobo features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all GSTrobo Features- Email and SMS Alerts

- Data Validation Check

- E-Way Bill Consolidation

- E-Way Bill Generation

- Collaboration

- Records of E-Way Bills

- Maintain Transporter Data

- Data Import/Export

GSTrobo Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Accounting software with Barcode billing

Accounting software with barcode billing POS. Free demo available, Design own barcode, print on any printer and start invoicing. Offline billing software with accounting feature, barcode billing make faster billing. Read InventoryPlus Reviews

Explore various InventoryPlus features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all InventoryPlus Features- Accounting

- Barcode Integration

- Billing & Invoicing

- Quotation & Estimates

- Product Database

- Collections

- Inventory Management

- Email Integration

Pricing

Premium

$ 28

Per Year

Advanced

$ 14

Per Year

InventoryPlus Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

If you're running an establishment in India, you must be aware of the Goods and Services Tax (GST) regime that came into effect in 2017. Service Tax, VAT, and Central Excise Duty have all been replaced by GST, a comprehensive indirect tax imposed on the sale of goods and services.

GST has made invoicing and billing a critical aspect of any enterprise operation. It is crucial to ensure that your establishment is using reliable and efficient GST billing software to comply with the GST rules and regulations.

But with so many options available in the market, choosing the right GST billing software can be a daunting task. That's why we've compiled a list of the best GST billing software in India that you can consider for your establishment needs. These software solutions are easy to use, accurate, and comply with all GST norms. So, if you're looking for the best GST billing software for your business, read on!

What Is GST Billing Software?

GST billing software is an essential tool for businesses operating in India under the Goods and Services Tax (GST) regime. Since GST replaced multiple indirect taxes like VAT, Service Tax, and Central Excise Duty, it has become critical for businesses to ensure that their invoicing and billing practices comply with GST rules and regulations.

Invoicing and billing are simplified using GST billing software. It automates every step of the procedure, including the generation of GST-compliant reports and the creation of invoices, transactions, and records. Businesses can easily produce invoices with a professional appearance thanks to the software, which saves them time and effort. Additionally, it makes it simple for businesses to manage payments, track inventory, and reconcile accounts.

Businesses must take into account a number of aspects while selecting GST billing software, including the software's usability, security, scalability, and cost. To stay current with changes in GST rules and regulations, it's also critical to select a software provider that provides dependable customer service and frequent upgrades.

Why Do Businesses Need GST Billing Software?

A comprehensive set of regulations must now be followed by businesses as a result of the GST implementation in India. The regulations cover the charging and billing for products and services.

Several indirect taxes, including Service Tax, Central Excise Duty, and VAT, have been replaced by GST. It is essential for businesses to make sure that their billing and invoicing procedures adhere to the new set of rules. The main explanations for why GST software is essential are listed below.

-

Automation

Automation is one of the key benefits of using GST billing software. By automating operations like invoice creation, transaction tracking, and report generation, the program streamlines the entire billing and invoicing process. Due to the time and effort savings provided by automation, firms can concentrate on other important facets of their operations.

-

Compliant invoicing

The use of GST billing software guarantees that invoices adhere to GST rules. The software creates invoices with all the facts required by GST, including the GSTIN, invoice number, date, and buyer and seller information. This assists companies in avoiding mistakes and fines that could result from disregarding GST regulations.

-

Ease of use

Most GST billing software is designed to be user-friendly, making it easy for businesses to use. The software typically includes features such as templates for invoices, automatic calculation of taxes, and the ability to customize invoices as per the business's requirements. This ease of use enables businesses to create professional-looking invoices quickly and efficiently.

-

Reports and analysis

Establishments can also generate a number of reports using GST billing software to analyze their invoicing and billing information. Businesses can gain important insights into their operations through the reports that the program can generate, including sales reports, purchase reports, and tax reports. These studies can aid companies in making defensible choices about pricing, inventory control, and overall business strategy.

-

Improved cash flow management

The use of GST billing software can also improve cash flow management for firms. Thanks to the program, businesses can trace payments and unpaid invoices, lowering the risk of payment delays and enhancing cash flow management. Customers can receive payment reminders through the program, which lowers the need for manual follow-up and increases the chances that payments will be made on time.

-

Reduced errors and penalties

Businesses can prevent mistakes and fines associated with non-compliance with GST requirements by using GST billing software. The program guarantees that invoices are correct, compliant, and current, lowering the possibility of mistakes and fines. Not only does this assist businesses monetarily and time-wise, but it also aids in preserving their spotless reputations and gaining the confidence of their clientele.

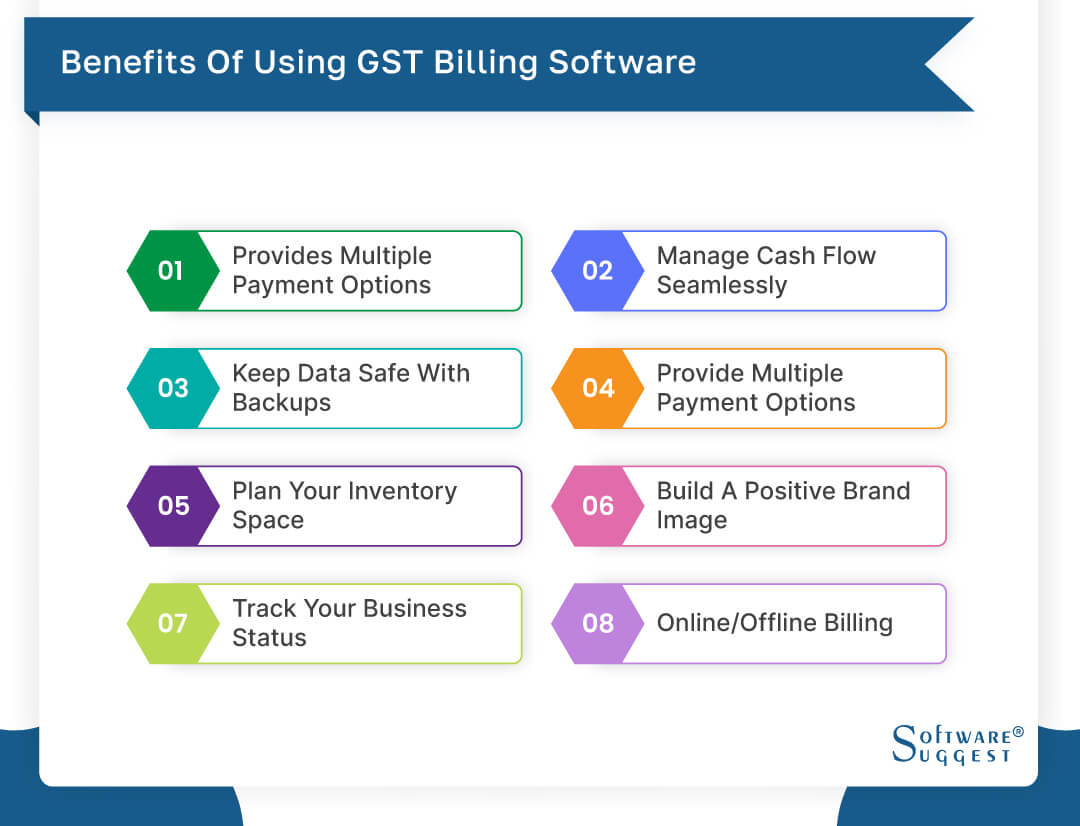

Benefits Of Using GST Billing Software For Your Business

It is crucial to adopt new technology that can improve your operations, save you time, and ultimately increase your bottom line in the quickly evolving business environment of today. GST billing software is one such technology that has increased in popularity over the past few years. In this post, we'll look at a few advantages of employing GST billing software in your company.

-

Provides multiple payment options

The benefit of providing multiple payment options is that it allows customers to choose the payment method that is most convenient and accessible for them. With the wide variety of digital payment modes available today, businesses that offer only one or a few payment options may miss out on potential sales, especially from customers who prefer specific payment modes above others or those who do not have access to traditional payment channels.

By providing clients with a number of different payment options, businesses have the opportunity to raise the level of customer satisfaction as well as reduce the number of uncompleted purchases caused by abandoned shopping carts. -

Manage cash flow seamlessly

Managing cash flow can be challenging but is essential for any business. This is where GST billing software can come in handy. When you use the program, you won't have any problems making invoices for your clients, and you won't have any problems sending those invoices to your clients on time too.

By tracking your payments with GST billing software, you can see how long it takes customers to pay their bills. It can help you decide if you need to adjust your payment terms or follow up with customers who are slow to pay. Additionally, you can use the software to determine how much credit you can offer customers based on their payment history. It can help to lower the risk of bad debts and improve the financial health of your establishment. -

Keep data safe with backups

Data safety is a paramount concern for businesses, especially when it comes to financial data. GST billing software comes with options to back up your data regularly. This means you can save your essential financial and customer data securely in cloud servers, reducing the risk of data loss due to physical device damage or loss.

Cloud backups also ensure that your data is available to you at all times, even if your physical device is damaged or compromised in some way. Additionally, you can restrict access to your cloud backups, ensuring that only authorized personnel can access confidential financial data. -

Provide multiple payment options

When it comes to payments, customers expect flexibility, and Customers may finish their transactions more easily since the GST billing software offers them a variety of payment choices. Customers can choose to pay using credit/debit cards, net banking, mobile wallets, and other digital payment modes.

Moreover, digital payments are more secure than traditional cash transactions, as they leave an electronic trail that is easy to track and reconcile. GST billing software can automatically reconcile all inbound payments, making it easier to reconcile your accounts and generate accurate financial reports. -

Plan your inventory space

Any business must manage inventories properly in order to function. You must have the right amount of stock at the right time in order to meet customer demands and prevent having an excessive amount of additional inventory that is lying around unsold.

Making the most of the space you have while providing enough room for easy access and product mobility should be your main goals when planning your inventory space.

To keep proper track of inventory levels and prevent misunderstanding, you should also think about developing clear labeling and organizational systems. Utilizing an inventory management software program is another efficient technique to organize your storage space for inventory.

You can use this software to create thorough inventory reports, automatically reorder products when stock is running low, and track inventory levels in real-time. -

Build a positive brand image

If you want to draw clients and keep up with the competition in your business, developing a strong brand image is vital. A strong brand reputation can help your establishment stand out from the competition. Also, win over more repeat work, and boost consumer loyalty. You should concentrate on developing a distinctive identity that connects with your target audience to enhance a positive brand image.

This requires coming up with a catchy brand name, logo, and tagline that succinctly sum up the values and goods your company sells. Concentrating on providing outstanding client experiences is one strategy for creating a positive brand perception.

This can entail offering individualized service, prompt replies to consumer questions, and proactive responses to customer needs. You might also think about utilizing social media and other digital marketing tools to establish a powerful online presence and showcase the knowledge and thought leadership of your business. -

Track your business status

If you want to optimize your financial operations and make data-driven decisions, keeping an eye on your establishment's health is crucial. You can identify areas for improvement by monitoring crucial business data, including revenue, costs, profitability, and cash flow. You can also take action to address any problems now before they worsen.

Using accounting software is one way to keep tabs on the state of your company. The financial health of your company can be quickly understood thanks to the real-time reporting, automated financial transactions, and in-depth analyses provided by many accounting software packages. Aim to assess your company's performance against industry norms on a regular basis to find opportunities to streamline processes and raise profits. -

Online/offline billing

Offering customers both online and offline billing options can help increase revenue and improve customer satisfaction. Online billing allows for easy and convenient payment processing, while offline billing options like paper invoices and check payments provide an alternative for customers who prefer more traditional payment methods.

If a corporation gives its patrons the option to choose between two distinct payment modes, it can cater to a broader range of customer preferences. This, in turn, may lead to a reduction in the number of abandoned transactions and an increase in revenue. Moreover, enabling customers to choose the payment method that best suits them can enhance their satisfaction levels and foster brand loyalty.

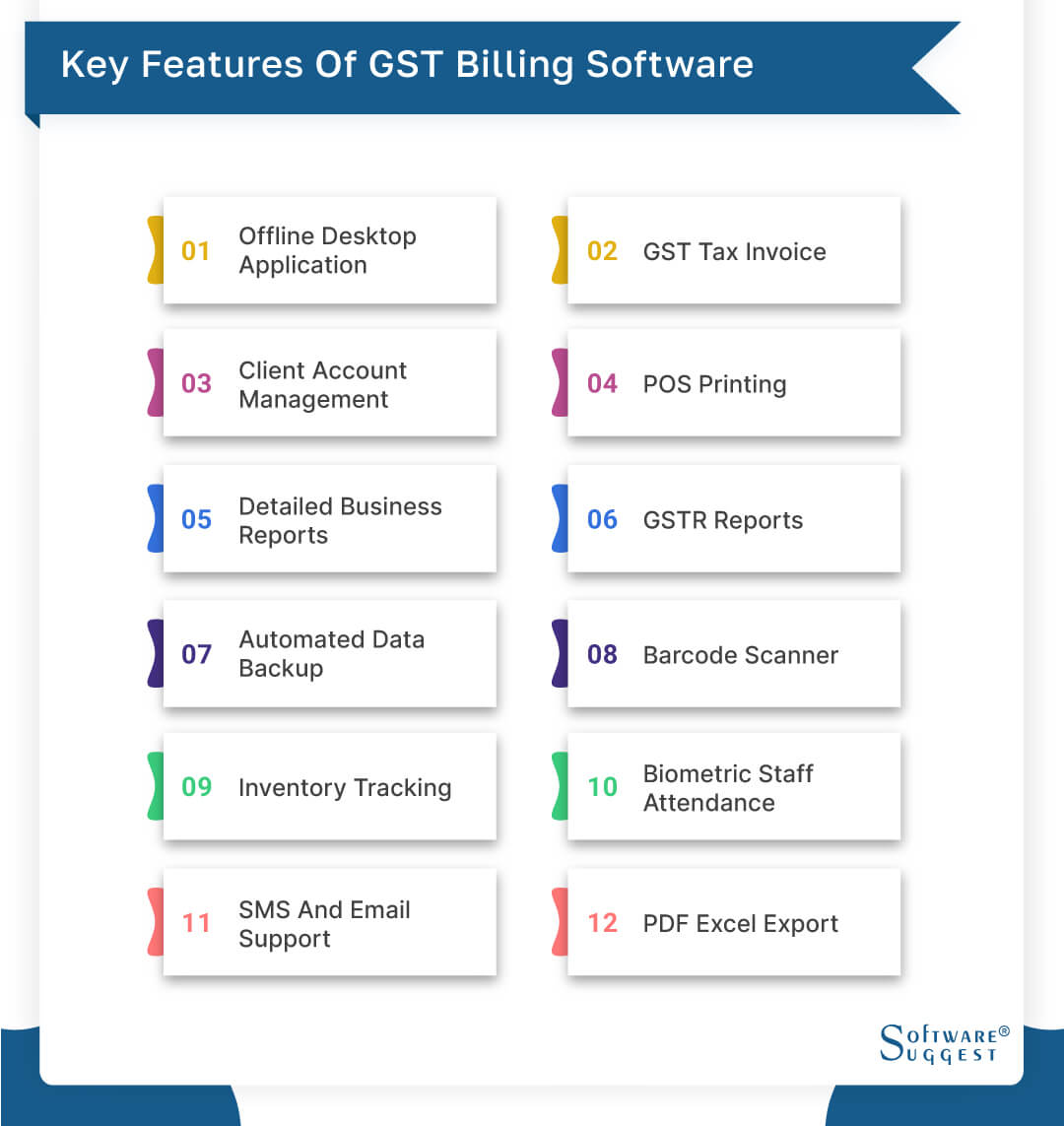

Key Features Of GST Billing Software

GST billing software is an absolute necessity for any organization that values its ability to effectively manage its taxation and billing processes. Here we will discuss the key features of GST invoice software and how they can benefit businesses.

-

Offline desktop application

An offline desktop application in the context of software refers to a program that can be installed and run on a desktop computer without requiring an internet connection to function. This is an essential feature for GST billing software, as businesses may not always have access to a stable internet connection.

By enabling the software to function offline, businesses can continue to manage their invoicing and billing data regardless of their internet connectivity. An offline desktop application provides added security as data is stored locally on the device, reducing the risk of losing data in the event of technical failures or security breaches. -

GST tax invoice

The GST tax invoice feature in billing software is designed to simplify the process of generating tax invoices in compliance with GST regulations. The Goods and Services Tax, also abbreviated as GST and referred to in certain circles as just the GST, is a detailed tax that is levied on the provision of products and services in India.

Also, it should include the recipient's name and address, GST identification numbers, the description and value of goods or services supplied, and the applicable GST tax rates. -

Client account management

Effective client account management is critical for any business looking to manage its billing and invoicing processes efficiently. GST billing software allows businesses to manage their client accounts effectively by creating and maintaining client profiles, tracking client payments and outstanding balances, generating client statements, and initiating automatic reminders for overdue payments.

This feature helps businesses maintain accurate and up-to-date client information, which is essential for effective billing and invoicing. By keeping track of client accounts, businesses can quickly identify unpaid or overdue balances, take appropriate actions for collections, and maintain a healthy cash flow. -

POS printing

Point of Sale (POS) printing is an essential component for any business that requires physical receipts for their transactions. Pos printers enable businesses to generate physical receipts for payments made by customers in-store or online. The billing process can be accelerated and made more effective using GST billing software that works with POS printers by streamlining the printing procedure and lowering the possibility of errors.

The ability to print receipts using a POS printer is especially important for businesses that operate in industries such as retail, healthcare, hospitality, and others. With the support of GST billing software, establishments can configure their printers and print receipts containing information. Information examples can be the total cost, GST tax amount, and other necessary details to provide a professional and reliable service to their customers. -

Detailed business reports

Business reports are crucial for analyzing and understanding the financial performance of a business. In the context of GST billing software, these reports provide detailed insights into the asset and liability categories that make up a business's revenue streams. Establishments are able to make educated decisions with the help of these reports since the data are presented in a manner that is both clear and simple.

In particular, the profit and loss report is a common financial statement generated by GST billing software. It presents an overview of the complete earnings, costs, and profit that a corporation produces throughout a specified period.

When scrutinized diligently, an establishment's statement of cash flows and financial statement can furnish a complete depiction of the current financial condition of the enterprise. -

GSTR reports

GST Return or GSTR is a tax return filed by businesses. It is a monthly or quarterly statement of outward supplies and inward supplies that are subject to Goods and Services Tax. In India, businesses that have a turnover of more than 20 lakhs per annum are required to file GSTR returns. GST billing software that provides this feature enables businesses to generate accurate GSTR reports quickly and efficiently.

GSTR-1 reports are generated by businesses that supply goods or services to their customers. It is a report that contains the details of all outward supplies and sales made during a given period. The GSTR-3B report is also filed by GST-registered taxpayers.

It is a tax return that is filed on a monthly basis and provides a summary of all tax responsibilities, as well as outgoing and incoming taxable supplies. By automating and generating GSTR reports using GST billing software, businesses can ensure compliance with tax regulations and avoid the risk of penalties or fines. -

Automated data backup

Automated data backup is an essential feature of GST billing software that ensures that valuable business data is not lost due to technical failures or human error. By automatically backing up data files or entire databases at regular intervals, businesses can protect themselves from data loss and minimize downtime in case of an unplanned outage.

In particular, firms that rely heavily on various forms of electronic data storage should prioritize the implementation of automated data backup systems. The GST billing software that supports automated data backup can ensure that all data remains safe and secure no matter what happens. Data backup software can be customized according to the specific requirements of a business, such as the frequency of backups and the type of backup (full or incremental). -

Barcode scanner

Barcode scanners provide an efficient and reliable way to scan products in a GST billing environment. When establishments utilize barcode scanners, they are able to scan the items that are sold in a quick and accurate manner, which reduces the amount of time needed to produce an invoice for a customer.

Additionally, barcode scanners lower the chances of errors or discrepancies that could occur when manually entering item codes or details. -

Inventory tracking

A comprehensive view of inventory levels can be obtained by using a GST billing system equipped with inventory tracking capabilities. This software can assist establishments in making well-informed decisions regarding stock management, purchases, and sales. Real-time monitoring of stock levels is made possible by this feature, which lowers the likelihood of stock shortages or excess inventory.

The inventory tracking feature can be tailored to meet the specific requirements of various types of establishments. For instance, those with multiple locations or those with frequently changing inventories. By utilizing this feature, establishments can optimize resource utilization and minimize the risks associated with lost, stolen, or damaged inventory. -

Biometric staff attendance

The ability to track staff attendance in a secure and precise manner using biometric technology is a crucial component of contemporary corporate performance management systems. Establishments can guarantee that the attendance data is accurate, unchangeable, and easily accessible for analysis and reporting by utilizing biometric technology, such as fingerprint or facial recognition systems.

Implementing biometric staff attendance systems can result in significant improvements in workforce management and productivity.

The technology helps to identify and address absenteeism and punctuality issues, lowering the risk of time fraud and the associated costs. Additionally, it can improve employee engagement by making attendance tracking more convenient and less prone to error. -

SMS and email support

Features in company management systems that support SMS and email allow firms to easily and effectively connect with their clients and customers. Businesses can enhance their levels of customer service and create enduring relationships with their clients by offering a simple and practical means for customers to interact with them.

Features for SMS and email assistance can be altered to match the unique requirements of various enterprises. By automating communication procedures, these tools can help firms save time and effort during normal customer encounters. Additionally, they can assist companies in providing proactive customer care by delivering reminders, alerts, and notifications at the appropriate times. -

PDF excel export

Business management systems offer easy and effective ways for establishments to create and share reports, summaries, and data tables in PDF and Excel formats. Establishments can provide information in various formats, standardizing and organizing it to make it easier to analyze and share.

Features for exporting data to PDF and Excel can be altered to fit the particular requirements of various enterprises. Establishments may be able to use these features to generate reports on demand, monitor inventory levels, and carry out sophisticated data analysis. By offering standardized reports and summaries, they can also assist firms in adhering to legal and industry norms.

How Does GST Billing Software Work?

GST billing software connects with a company's current inventory, financial, and customer relationship management systems to offer a complete method of controlling every facet of the billing procedure. When a business generates an invoice or receives a purchase order, the software automatically calculates the applicable GST rates and adds taxes to the final amount.

The software then creates a billing statement with all the relevant information, including the Goods and Services Tax registration number, invoice number, date, and the total cost incurred. The customer is then asked to pay this statement.

The GST invoicing program also manages payments, generates reports, and completes GST filings. An establishment can gain insightful information about its financial status, spot development prospects, and optimize the billing system to increase productivity by using cutting-edge software.

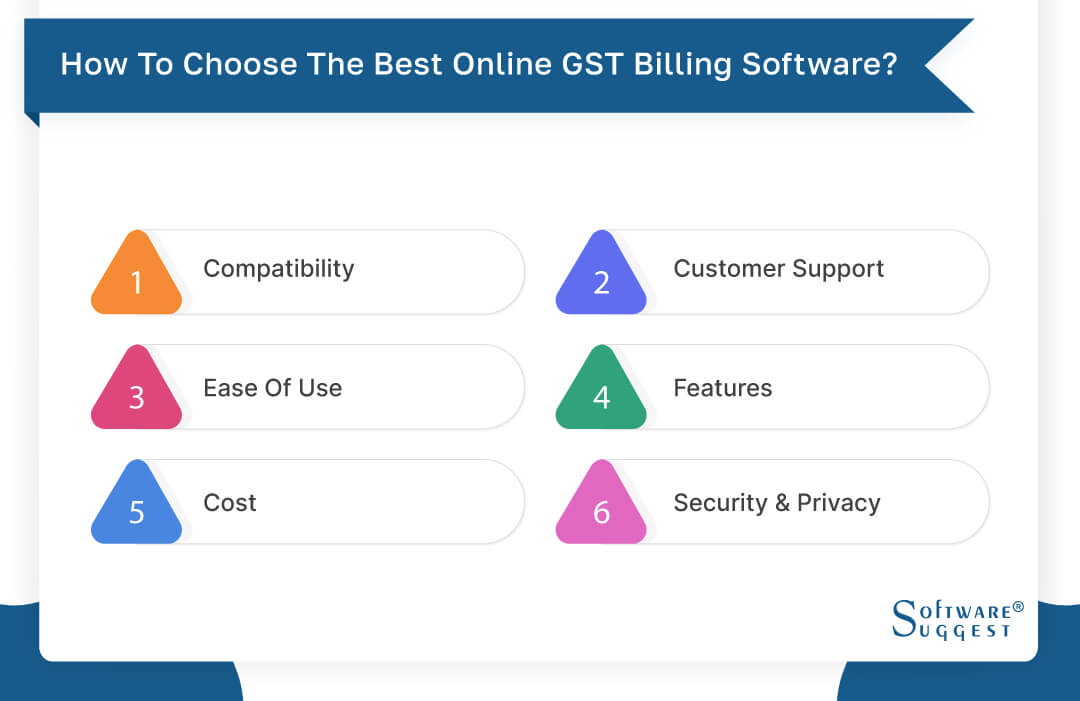

How to Choose the Best Online GST Billing Software?

Choosing the best online GST billing tool might be crucial for managing your company's finances. When choosing the best choice, keep the following points in mind:

-

Compatibility

Make sure the software is compatible with your current systems when choosing an online GST billing solution. This compatibility includes ensuring the software can work with your operating system, accounting software, and other relevant systems. Before the product can be used effectively, certain software suppliers have specified conditions that must be satisfied.

It's important to check these requirements and make sure that your current setup meets them. Additionally, if you plan to expand your business or add more employees, you should make sure the software can scale accordingly. -

Customer support

A critical component of any program is customer assistance. Make sure a software program for online GST billing offers dependable customer service. A good software provider should offer multiple support channels, including email, phone, chat, and knowledge base. A timely and efficient customer service department should be provided by the business. You can also check user reviews to understand how responsive and helpful the company's customer support team is.

-

Ease of use

It is essential to take into consideration how user-friendly a piece of online GST billing software is before making a purchase. A dependable piece of software should come equipped with an intuitive user interface that is easy to maneuver.

Even anyone with a basic understanding of technology should be able to comprehend and use it without too much difficulty. The software should make it easy to customize so that it can fulfill the criteria that are unique to your company.

In addition, it needs to be capable of functions such as data importation and exportation, billing, and inventory management. To determine the ease of use, you can check user reviews or request a free software trial. -

Features

When selecting an online GST billing software, it's important to consider the features offered by the software. Look for software that offers features such as easy invoicing, automatic taxes calculation, inventory management, estimate creation, and financial reporting.

The software should allow you to customize invoices to meet your unique establishment needs and should also offer integration with accounting software to streamline the billing process. Additionally, look for GST accounting software that offers mobile compatibility, allowing you to generate invoices and track expenses on the go. -

Cost

Particularly for small enterprises, the cost of the online GST invoicing software is a significant consideration. The majority of billing software companies provide monthly, quarterly, or annual subscriptions, and GST bills often vary based on the features or the user count.

Software with customizable price options that can be adjusted to your company's demands is what you should be looking for. Consider the ongoing expenses associated with utilizing the software, such as renewal costs or extra fees for supplemental capabilities. Don't forget to check pricing with different software vendors to get the most for your money. -

Security & privacy

Security and privacy are important factors to take into account when choosing billing software. To safeguard sensitive information such as client data, financial information, and passwords, look for software suppliers who offer encryption. In case of an emergency, the supplier should also have data backup protocols and safe data storage systems.

Additionally, the best GST invoice software must adhere to pertinent data protection laws like the CCPA and GDPR. Before registering, make sure to read the software provider's privacy policy to secure the privacy of your data.

Top 5 GST Billing Software: Comparison

There are several solutions available if you're seeking the best GST billing software for your company. We've produced a list of the Best GST billing software in India to make your search easier. These solutions each offer distinctive features and advantages to satisfy the requirements of enterprises of various sizes.

|

Name

|

Free Trial

|

Demo

|

Starting Price

|

|---|---|---|---|

Zoho Books |

14 Days |

Yes |

INR 749/org/month |

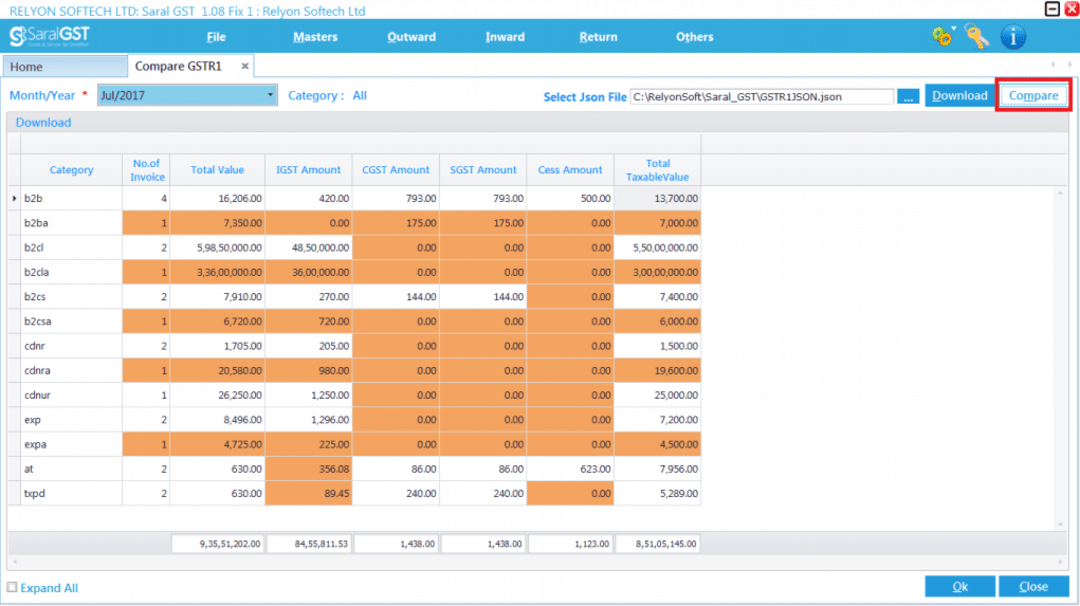

Saral GST |

7 Days |

Yes | INR 6900/user |

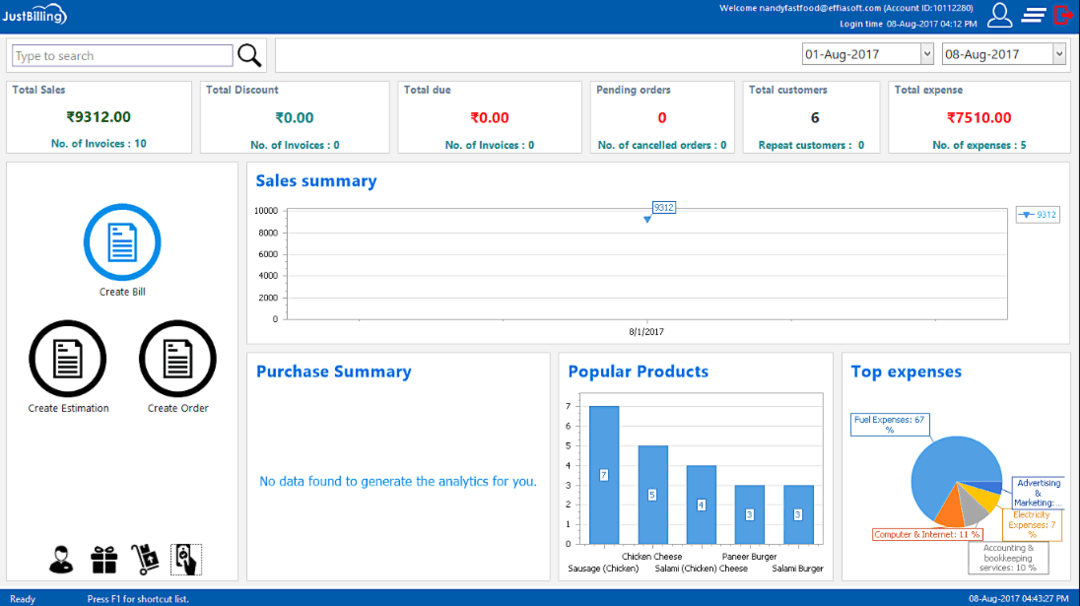

Just Billing |

15 Days |

Yes |

INR 14,160: Windows |

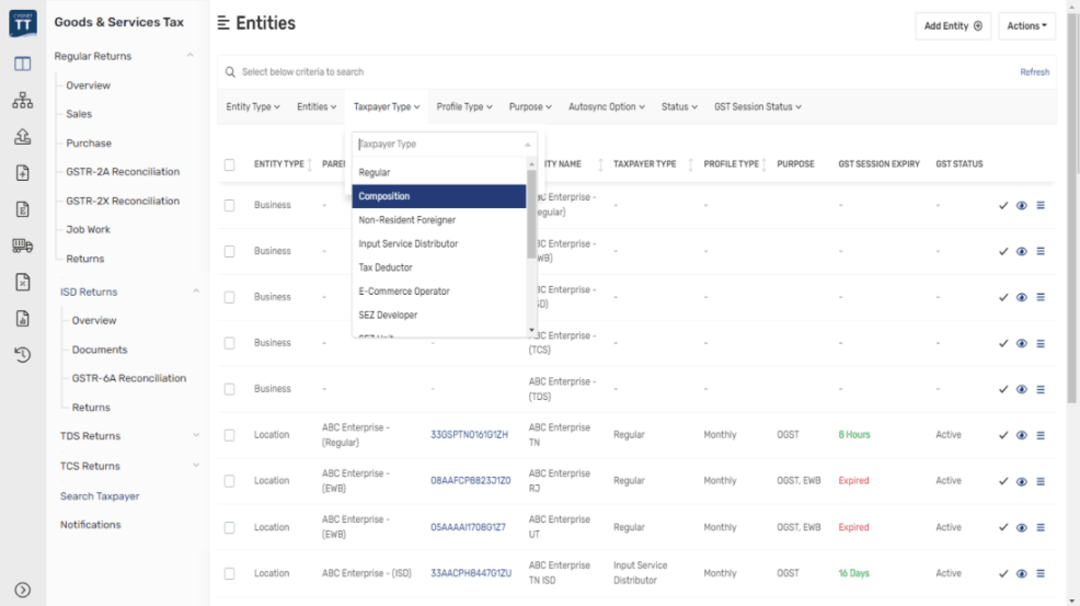

Cygnet GSP |

14 Days |

Yes |

Custom pricing |

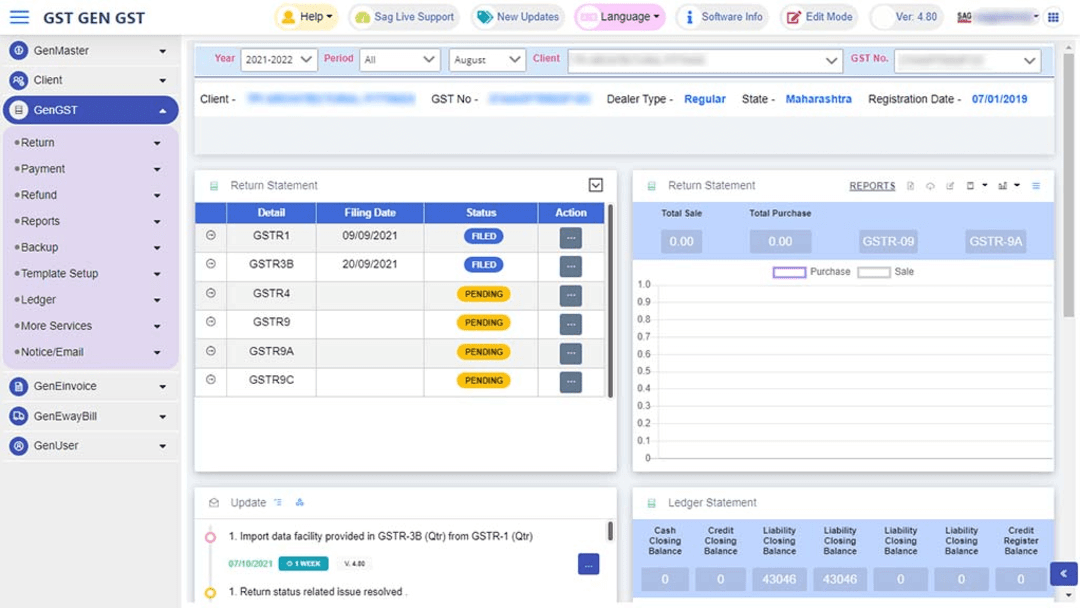

Gen-GST |

15 Days |

Yes |

INR 7000: GSTe-filing |

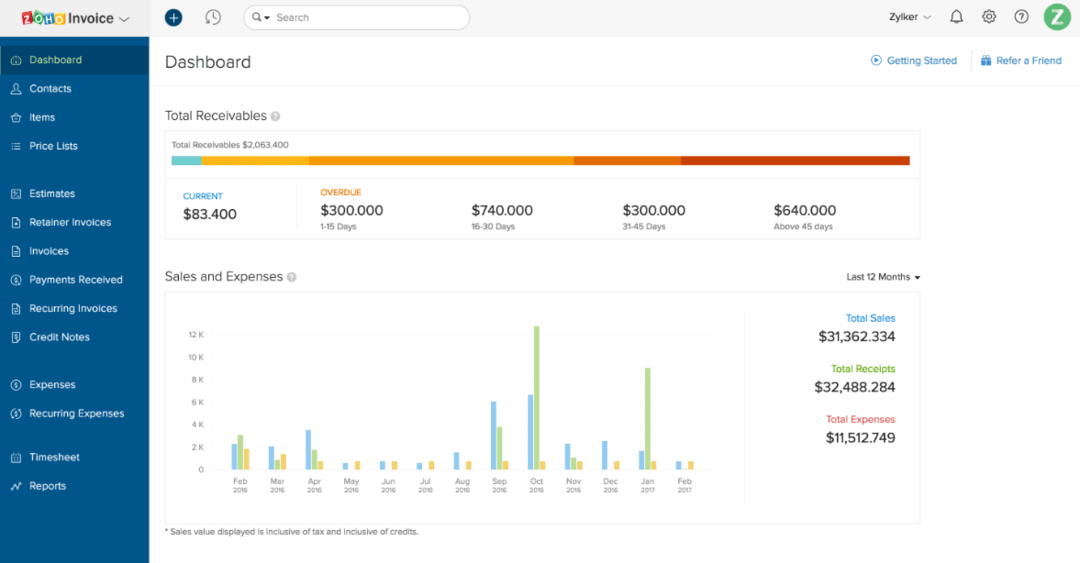

1. Zoho Books

Zoho Books is a web-based accounting program created for small and medium-sized enterprises. It was launched in 2011 by Zoho Corporation, an Indian IT solutions and web-based business tools development company.

Zoho Books enables establishments to handle their finances, generate and dispatch invoices, monitor expenses, and manage stock, among other tasks.

Features

- Customizable invoices with your company logo and colors

- Automated bank feeds for real-time updates on your financials

- Inventory management to track products, SKUs, and pricing

- Financial reports, including profit and loss statements and balance sheets

- Multi-currency support for international transactions

Pros

- Affordable pricing for businesses of all sizes

- Ability to integrate with other Zoho apps for a complete business management solution

- User-friendly interface and easy-to-use mobile app

- It provides free GST billing software for businesses whose turnover is less than 25 lakhs

- Multiple payment gateway integrations for seamless payment processing

Cons

- Limited integration options with third-party apps outside of the Zoho ecosystem

- Limited options for customization beyond basic branding and logos

Pricing

- Standard-INR749 per organization per month

- Professional- INR 1,499 per organization per month

- Premium- INR2,999 per organization per month

- Elite- INR4,999 per organization per month

- Ultimate- INR 7,999 per organization per month

2. Saral GST

Saral GST is a cloud-based GST compliance software that helps establishments to comply with the Goods and Services Tax (GST) regulations in India. It was established in 2017 by Relyon Softech Ltd., a software firm based in Bangalore.

The GST compliance process is automated by Saral GST, including creating e-way bills, managing invoices, and data reconciliation with the GST portal. Establishments in India have praised Saral GST for its accessibility, usability, and extensive GST compliance options.

Features

- GST return filling and submission

- Comprehensive data import and export features

- Offline capability allowing users to work without an internet connection

- Customizable invoice templates

- Integration with tax department tools for seamless compliance

Pros

- User-friendly interface and robust customer support

- Offline capability for users who need to work while on-the-go

- Comprehensive features, including invoicing, inventory management, and tax calculation

Cons

- Limited customization options beyond basic invoice templates

- Some users have reported occasional glitches and bugs

Pricing

- Saral GST standard- INR6900 for a single user

- Saral Billing- INR10,000 for a single user

- Saral Accounts- INR12,000 for a single user

3. Just Billing

Just billing was launched in 2016, and since then, it has gained popularity among small business owners in India and other countries. An Indian technology business called EffiaSoft Private Limited created the billing and invoicing program known as Just Billing.

Small and medium-sized firms may automate their billing and inventory management operations thanks to the software, which is made to meet their demands. Both a desktop and mobile version of Just Billing is accessible, and both different payment options and currencies are supported.

Features

- Create customized invoices, including logos, business details, and payment terms

- Multi-location support for businesses with multiple branches

- Comprehensive reports on sales, purchases, expenses, and inventory

- It offers a mobile app that enables businesses to manage their operations on the go

Pros

- User-friendly interface, is easy to navigate, even for non-technical users

- Customizable invoices with an automated invoicing feature

- Multi-location support for businesses with multiple branches

- Comprehensive reporting for insights into business performance

Cons

- Limited integration options with other software

- Limited features compared to other advanced inventory and billing software

Pricing

- Windows subscription- INR 14,160

- Android subscription- INR 14,160

- iOS Windows Subscription- INR 14,160

4. Cygnet GSP

Cygnet GSP is a GST Suvidha Provider (GSP) in India that offers end-to-end GST compliance solutions to establishments. The business offers a number of GST-related services, including e-invoicing, GST registration, and filing GST returns.

Their offerings are made to make the difficult process of GST compliance simpler and to assist companies in adhering to Indian GST legislation. A group of specialists with backgrounds in technology, banking, and taxation launched Cygnet GSP in 2017. The organization was founded with the goal of giving businesses a seamless and hassle-free experience while assisting them in navigating the complexity of the Indian GST law.

Features

- Manage financial transactions and records

- Automate the process of matching transactions

- Ensure compliance with various regulations and laws

- Online GST Portal: A comprehensive portal for all your GST compliance needs

- Generate audit reports for your GST transactions

- File GST returns accurately and on time

Pros

- Comprehensive GST compliance solutions

- Real-time visibility into GST data

- Secure and scalable platform for sensitive data

- Easy integration with existing systems

Cons

- Limited customization options

- It may be expensive for small bus

Pricing

- Custom pricing.

5. Gen-GST

Gen-GST was established in 2017 by a team of professionals who possess expertise in the fields of technology, finance, and taxation. The primary objective of the organization's inception was to provide Indian firms with a convenient and hassle-free experience.

Furthermore, the establishment aimed to guide these businesses through the complexities of the GST system. Since its establishment, Gen-GST has supported several Indian establishments in fulfilling their GST compliance requirements. The GST invoice billing software is purposefully designed to simplify the GST regulations in India for businesses by rendering the GST compliance process more efficient.

Features

- It is available in both desktop and online versions

- E-way bill rejection & cancellation

- The software is well-versed with all government terms and regulations

- IRN generation option

- It provides a secure and reliable platform for GST e-filing and billing

Pros

- Gen GST software simplifies the GST return filing process

- User-friendly interface with easy navigation

- It offers HSN/SAC code mapping and auto-reconciliation features

- It provides accurate and error-free invoicing

- It offers a cost-effective solution for GST compliance

Cons

- The software may have limited features

- Customer support may not be available 24/7

Pricing

- Online GST e-filing- INR7000

- Online all-in-one GST- INR10,000

- Online GST e-invoice- INR7000

- Online GST e-way bill- INR70

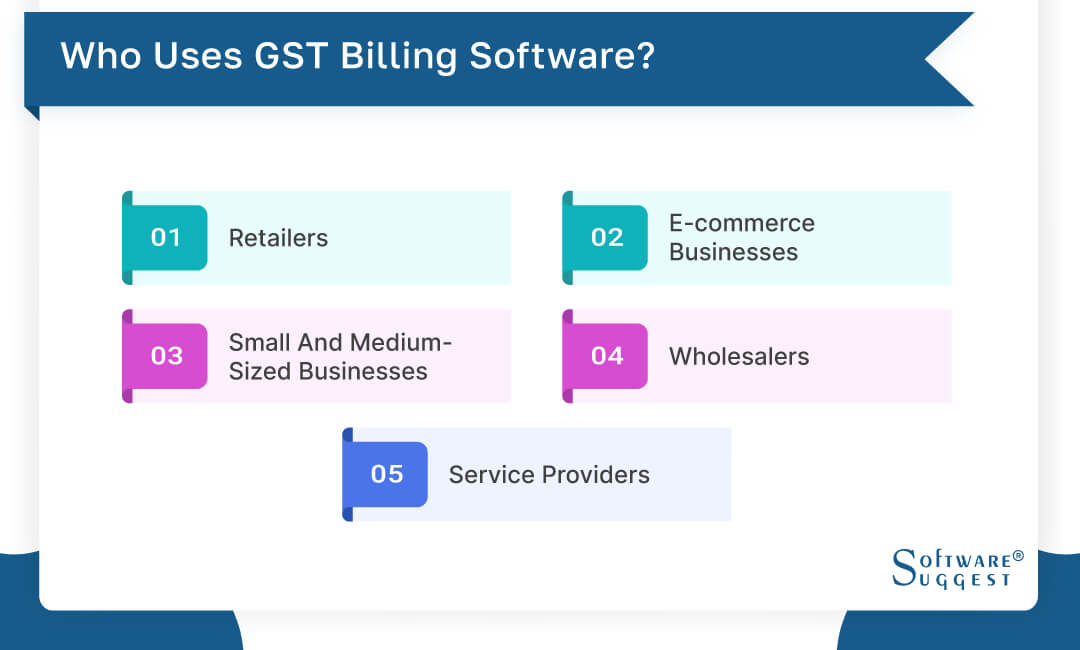

Who Uses GST Billing Software?

GST billing software is a popular tool used by various types of businesses for efficient invoicing, inventory management, and tax compliance. From small retail shops to large e-commerce platforms, these software solutions can streamline the process of managing financial transactions and staying compliant with GST regulations.

-

Retailers

GST billing software can be useful for retailers of all sizes. These solutions can help them manage inventory, generate invoices, and keep track of sales data for accurate financial reporting. The software can also help them keep track of the GST they are paying and receiving, which is crucial for maintaining compliance with tax regulations.

-

E-commerce businesses

E-commerce establishments are increasingly relying on GST billing software to manage their financial transactions. These businesses often deal with high volumes of transactions, and GST billing software can help them keep track of sales, inventory, and taxes across multiple channels. Additionally, the software can help them generate invoices for orders and manage payments from various payment gateways.

-

Small and medium-sized businesses

Small and medium-sized businesses Small and medium-sized businesses (SMBs) in various industries can benefit from the use of GST billing software for small businesses. These businesses may not have the resources to hire a full-time accountant or financial professional, and GST billing software can help streamline their financial management without the need for extensive accounting knowledge. Additionally, these solutions may assist SMBs in maintaining GST compliance and avoiding fines for non-compliance.

-

Wholesalers

Wholesalers can use GST billing software to manage their inventory, generate invoices, and track sales data for multiple customers. Many wholesale establishments deal with large volumes of inventory and sales, and having a centralized software solution can make their operations more efficient and streamlined. The software can also help them stay compliant with GST regulations by managing taxes on their transactions.

-

Service providers

GST billing software can be used to create invoices and manage finances for service providers like consultants and independent contractors. These tools can support service providers in tracking spending, managing client billing and payments, and generating reports for precise financial tracking. Additionally, GST billing software can assist service providers in adhering to GST requirements and timely and effectively filing their taxes.

Conclusion

After reviewing the various options available, it's clear that there are some top GST billing software solutions on the market. The first and most important stage is to determine which alternative meets not only your own criteria but also the limits that you have placed on your budget. It is vital to give careful consideration to important aspects such as the features that are offered, the simplicity of the user interface, the price, and the degree of quality in the customer service that is offered.

Some of the top GST billing solutions include Zoho Books, Saral GST, Just Billing, Cygnet GSP, and, Gen-GST. Each of these options provides unique features and benefits that can help streamline your business operations and ensure GST compliance. Ultimately, the most fitting GST billing mechanism for your requirements will vary depending on your distinct criteria. These prerequisites can be found in the GST guide. However, by considering the primary alternatives accessible to you, you will be heading in the correct direction toward achieving the most suitable solution.

.png)