Best Insurance Software

Best insurance software companies in India are Eclipse, insureEdge, BrokerEdge, insureCRM, BindHQ, CRMNEXT, SohamLife, and Artivatic. These Insurance agent software streamlines workflows, improve customer service, enhance data security, and provide insights and analytics.

No Cost Personal Advisor

List of 20 Best Insurance Software

Category Champions | 2024

End-to-End Insurance Software to Grow Your Agency

InsureEdge is a unified policy administration and claim management software that empowers insurers with increased operational productivity through easy management of critical processes across customer onboarding, policy administration, claims processing and reinsurance. Read InsureEdge Reviews

Explore various InsureEdge features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all InsureEdge Features- Commission management

- Feedback Collection

- Quotes / Estimates

- Employee Database

- Carrier Upload

- Underwriting Management

- HIPAA Compliant

- Co-Pay & Deductible Tracking

InsureEdge Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

A universe of composable enterprise solutions

BUSINESSNEXT is a universe of composable enterprise solutions with a focus on banks and financial services globally. Powering 1 million+ users and managing 1 billion end customers worldwide. Read BUSINESSNEXT Reviews

Explore various BUSINESSNEXT features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all BUSINESSNEXT Features- CRM & Sales Dashboards

- Product Database

- Mass Email

- Developer API

- Contact Manager

- Inventory Management

- Mobile App

- Sales Force Automation

Pricing

SoHo

$ 15

User/Month/Billed Annually

SMB

$ 35

User/Month/Billed Annually

Enterprise

$ 65

User/Month/Billed Annually

BUSINESSNEXT Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Software by Azentio Software Pvt Ltd

3i Infotech offers insurance organizations an array of powerful solution accelerators and software that enable efficient end-to-end management of insurance software and business processes. With cutting-edge automation capabilities and quick-to-deploy solution. Read Premia Reviews

Explore various Premia features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Premia Features- Claims Tracking

- Claim Resolution Tracking

- Broker / Agent Portal

- Commission management

- Claims Management

Premia Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Cost Effective Software Products and Services For

We provide differently and cost effective software products and services for P&C Insurance and financial business client. We provide Insurance software, project management and consultant service too. Learn more about Insurance Software

Explore various Insurance Software features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Pricing

Regular

$ 1000

Onetime

Insurance Software Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

AI First Insurtech & Healthcare Platform

Artivatic is an Insurtech and Health-tech Platform that provides on-boarding, risk assessment, distribution, sales, underwriting, claims automation, fraud detection, consumer profiling and micro insurance. Learn more about Artivatic

Explore various Artivatic features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Artivatic Features- Policy Administration

- Budgeting & Forecasting

- Life & Health

- Policy Generation

- Digital Signature

- Rules-Based Workflow

- Patient Registration

- Cohort Analysis

Pricing

Pay as You Go

$ 0

Per API Call

Licensing

$ 500000

Per Year

Subscription

$ 100000

Per Month

Artivatic Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Case Management System for Health Insurance Claim

Claimbook helps hospitals by accelerating overall discharge process of insurance patients, enhances Hospital revenue collection by increasing effective bed care days in hospitals for new admissions and preventing revenue leakages in payment collections from TPA/Insurance companies. One of the best Insurance software provider Read Attune ClaimBook Reviews

Explore various Attune ClaimBook features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Attune ClaimBook Features- Expense Tracking

- Opticals)

- PACS Support

- Accounting Management

- Insurance Rating

- Patient Discharge

- Analyze Claim Trends

- Billing & Revenue Cycle Management

Attune ClaimBook Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Smart Healthcare IT Solutions

Medical Insurance companies, across the globe, face several challenges in processing claims, as the documents are transferred physically and then approved. We have created an Insurance ERP, which simplifies the process and significantly cuts down the operational costs. Learn more about Pwave Insurance

Explore various Pwave Insurance features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Pwave Insurance Features- Contact Management

- Policy Generation

- Patient Management

- Marketing Automation

- Physician Management

- Reinsurance Administration

- Cancellation Tracking

- Medical History Record

Pwave Insurance Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Software by Dream Tekis Software Pvt Ltd

SohamLife is a fully featured Insurance Software designed to serve Agencies, SMEs. SohamLife provides end-to-end solutions designed for Windows. This online Insurance system offers Claims Management, Quote Management, Policy Management, Document Management, Contact Management at one place. Learn more about SohamLife

Explore various SohamLife features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all SohamLife Features- Commission management

- Contact Management

- Document Management

- Policy Management

- Claims Management

- Quote Management

SohamLife Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Auto Insurance Claim Tracking and Management Softw

KAEM - AICTMS Auto Insurance Claim Tracking and Management Software: This Software tracks all stages of an Auto Insurance Claim including payment due with reminder emails after TAT. Customization is also possible. Learn more about KAEM-Auto Insurance Claim Tracking

Explore various KAEM-Auto Insurance Claim Tracking features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

- Banking Integration

- Excise Reports

- Process Simulation

- Service Management

- Cancellation Tracking

- Document Management

- Fund accounting

- Process Modeling & Design

Pricing

One time Pay

$ 295

One Time

KAEM-Auto Insurance Claim Tracking Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

A High-tech Insurance Management System

Eclipse is an excellent software used by insurance companies. This all-inclusive tool has a real-time interface and offers useful features such as ledger accounting, accounts payable, accounts receivable, advanced reporting, carrier downloads, and much more. Read Eclipse Reviews

Explore various Eclipse features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Eclipse Features- Document Management

- Commission management

- Contact Management

- Policy Management

- Claims Management

- Quote Management

Eclipse Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

The Most Reliable Insurance Agency Software

Jenesis Agency Management is a robust insurance management system that adds functionality and elegance to your insurance website. This affordable software is ideal for digitally transforming your business. It also offers online support during business hours. Read Jenesis Insurance Reviews

Explore various Jenesis Insurance features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Jenesis Insurance Features- Policy Processing

- Document Management

- Claims Tracking

- Contact Management

- Policy Management

- Claims Management

- Reinstatement Tracking

- Rating Engine

Jenesis Insurance Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

A Cloud-based Insurance Software System.

Applied Epic is a web-based insurance agency software designed to automate your workflow and manage customer relationships. This cloud-based software also helps you manage your sales and financial accounting processes seamlessly. Sign up now for a free demo. Learn more about Applied Epic

Explore various Applied Epic features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Applied Epic Features- Contact Management

- Policy Management

- Property & Casualty

- Document Management

- Insurance Rating

- Quote Management

- Commission management

- Life & Health

Applied Epic Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Helps Insurance Agencies to Grow Faster

Partner XE is an insurance software highly preferred by insurance agencies for its affordability & ease of use. This robust tool comes with powerful contact/commission/document, & policy management features. It also offers support during business hours. Learn more about Partner XE

Explore various Partner XE features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Partner XE Features- Claims Tracking

- Policy Generation

- Policy Processing

Partner XE Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

A Reasonably Priced Insurance Software Solutions

NowCerts is counted amongst the most intuitive insurance software solutions available in the industry. This intelligent software comes with a host of AI-powered features to automate your workflow. It also has an amazing tech team that offers 24/7 live support. Learn more about NowCerts

Explore various NowCerts features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all NowCerts Features- Policy Management

- Document Management

- Contact Management

- Quote Management

- Claims Management

- Insurance Rating

- Property & Casualty

- Commission management

NowCerts Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

A Feature-Packed Insurance Broker Software

AgencyBloc is an insurance software that helps you manage your agency in a better way. This tool helps you create automated marketing campaigns to enhance client relationships. Its real-time data analyzation feature helps you make smart business decisions. Learn more about AgencyBloc

Explore various AgencyBloc features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all AgencyBloc Features- Workflow Management

- Campaign Management

- Product Database

- Project Management

- Team Management

- Email Marketing / SMS Marketing

- CRM Analytics

- Dashboard

Pricing

Agency Management

$ 59

Per Month

Plus Commissions

$ 158

Per Month

AgencyBloc Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

A Robust Insurance Policy Management Software

HawkSoft is a promising insurance management system highly preferred by insurance agencies. This software is also intuitive and easy to use. It helps you keep track of your clients’ data, signature forms, images, and much more without the slightest hassle. Learn more about HawkSoft CMS

Explore various HawkSoft CMS features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all HawkSoft CMS Features- Claims Management

- Insurance Rating

- Policy Management

- Quote Management

- Contact Management

- Document Management

- Commission management

HawkSoft CMS Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

A Highly Advanced Platform for Insurance Policy Management

EZlynx is an insurance policy management software built for independent insurance agencies. This application is highly preferred by insurance agencies for acquiring new businesses & retaining existing customers. Offers training via webinars & documentation. Learn more about EZLynx

Explore various EZLynx features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all EZLynx Features- Insurance Rating

- Document Management

- Quotes / Estimates

- Policy Management

- Broker / Agent Portal

- Employee Database

- Commission management

- Customer Portal

EZLynx Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

The Most-Preferred Software Used by Insurance Companies

Applied Rater is one of the best cloud-based insurance agency management systems. This highly intuitive and easy-to-use software comes with automated quoting, contact management, and pricing management modules to automate your tasks. Learn more about Applied Rater

Explore various Applied Rater features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Applied Rater Features- Automated Quoting

- Pricing Management

- Customer Portal

- Quote Management

- Broker / Agent Portal

- Comparative Insurance Rating

- For Personal Insurance

- Insurance Rating

Applied Rater Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

The Most Powerful Insurance Agency Management Platform

Insly is a dependable insurance software for insurers, brokers, and agents. This simple yet robust tool is easy to use and understand. It offers billing/accounting/debt/contact management and reporting features. Also lets you create & manage policies. Learn more about Insly

Explore various Insly features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Insly Features- Policy Management

- Cancellation Tracking

- Claims Management

- Policy Processing

- Quote Management

- Document Management

- Policy Issuance

- Quotes / Estimates

Insly Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

An Efficient Tool for Insurance Agency Management

NextAgency is the best insurance software in India, known for saving time and money. This highly secure software allows you to keep your clients’ financial and insurance data safe and secure. Sign up to request a free software demo or a free trial period. Learn more about NextAgency Insurance

Explore various NextAgency Insurance features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

- Quote Management

- Contact Management

- Document Management

- Commission management

- Life & Health

NextAgency Insurance Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Understanding insurance can be confusing, but thanks to advanced insurance software, things have become easier. This software has greatly changed the insurance industry, making it more convenient for everyone.

A report from Statista predicts that the worldwide insurance market will grow to a huge $8.3 trillion by 2026. This shows just how much digital tools are changing the way insurance works.

Keep reading to find out about the top insurance software that can make your tasks smoother, give customers a better experience, and in the end, help you make more money using these new technologies.

What Is Insurance Software?

Insurance software is a powerful tool that simplifies insurance processes for everyone involved. It handles tasks like managing policies, processing claims, assessing risks, maintaining customer relationships, and overseeing insurance operations.

Additionally, this technology streamlines complex tasks and ensures compliance with regulations, allowing insurers to focus on their core mission of providing protection.

But it's not just beneficial for insurance companies. For policyholders, it acts as a personal guide, making it easier to file claims and navigate the sometimes confusing world of insurance.

In short, insurance software is a game-changer that makes insurance more accessible, efficient, and user-friendly by combining technology, insurance management, and convenience into one solution.

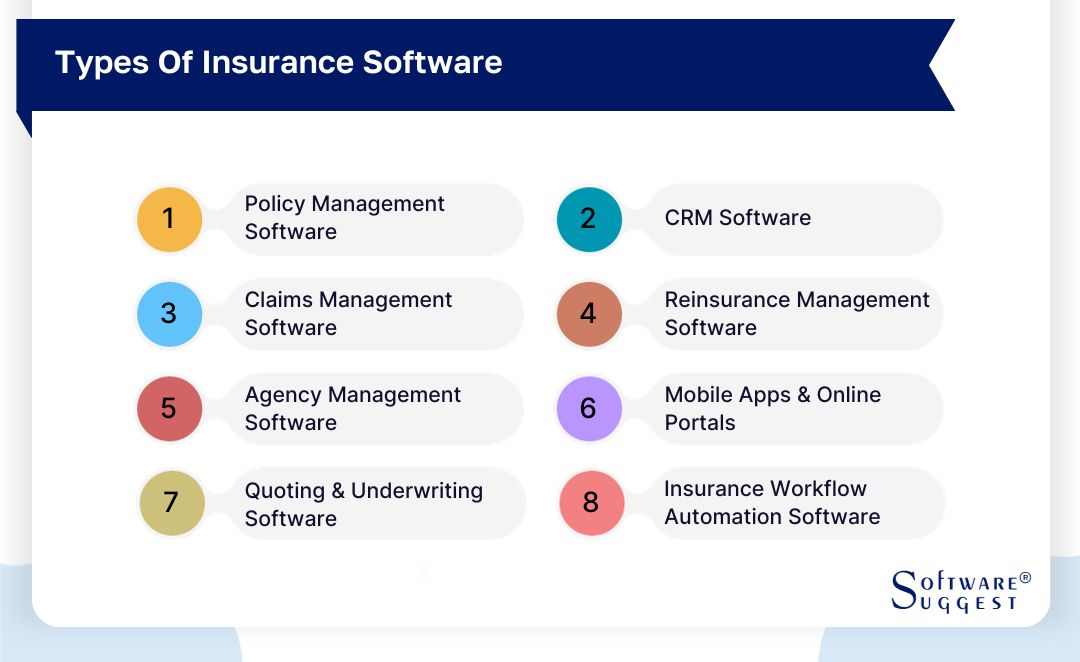

Different Types of Insurance Software

There are various types of insurance software, each designed for specific tasks and features. Let's explore each type and find out what they're used for.

-

Policy management software

Policy Management Software is like a conductor for insurance policies. It takes care of everything from the start to the finish, making sure everything runs smoothly every time.

-

Customer Relationship Management (CRM) software

CRM Software helps insurance companies keep track of customer interactions and understand their needs. With a simple tap or swipe, CRM in insurance makes it easy to turn potential problems into happy endings.

-

Claims management software

Claims Management Software carefully checks every insurance claim for accuracy. Claim management software simplifies the complicated claims process, making it easier for everyone and improving efficiency and customer satisfaction.

-

Reinsurance management software

Reinsurance Management Software is like a safety net for insurance companies. It helps them manage risks and protect themselves from big financial problems. This software brings a sense of security to the ever-changing world of insurance.

-

Agency management software

Agency Management Software is the go-to tool for managing an insurance agency efficiently. It handles everything, from clients to commissions, all in one place. It's the key to boosting productivity and growing your business with fewer agents.

-

Mobile apps and online portals

Mobile Apps and Online Portals offer a "touch-and-go" experience, making insurance policy management almost as easy as ordering a takeaway. Commercial insurance software brings convenience and efficiency to insurance, making it accessible from your fingertips.

-

Quoting and underwriting software

Quoting and Underwriting Software are like virtual math wizards. They calculate risks and premiums with incredible accuracy, helping insurers make informed decisions quickly.

-

Insurance workflow automation software

Insurance Workflow Automation Software makes administrative work smooth and efficient. It organizes data sharing, task assignments, and communication seamlessly.

What Are the Benefits of Insurance Software Solutions?

Using insurance software doesn't just simplify insurance processes; it also brings many advantages. Let's explore these benefits and see how they can improve your insurance business.

-

Improved operational efficiency

Insurance software products play a pivotal role in significantly accelerating business processes. They eliminate bottlenecks and inefficiencies, transforming complex tasks into manageable ones. This optimization results in streamlined workflows and a substantial increase in overall productivity. With the assistance of these software solutions, you can operate your insurance business more efficiently than ever before.

-

Better regulatory compliance

Insurance software solutions function as diligent digital compliance officers for your organization. They meticulously monitor and ensure your strict adherence to regulatory norms with precision. This digital oversight eliminates concerns about regulatory penalties and enables you to conduct your insurance operations stress-free while remaining fully compliant.

-

Fewer breakdowns in communication

Insurance software platforms act as digital mediators, seamlessly connecting different segments of an organization. They provide advanced communication tools, enabling teams to collaborate effectively. This minimizes misunderstandings and prevents communication bottlenecks, fostering a more cohesive and productive work environment.

-

Enhanced sales and marketing

Insurance software solutions are powerful tools for sales and marketing automation. They offer sophisticated analytics and targeting capabilities, allowing businesses to fine-tune their campaigns. This results in highly personalized and effective outreach to potential customers.

-

Saves Time and Money

An advanced insurance software system is easy to use and helps save considerable time to help insurance agencies function smoothly. It automates the claim process and enables your team members to work competently. Since the software automates your manual tasks, it also helps reduce the extra hours of operation, which in turn, minimizes the operational costs to a great extent.

-

Detects Counterfeit Claims

The software used by insurance companies is capable of detecting fraudulent claims. It also helps in accelerating the process of investigation. Soon after detecting deviations, it sends multi-level notifications to alert you about any impending danger.

-

Securely Stores Data

Insurance policy management software stores your financial and customer-related data safely and securely. Insurance software solutions adhere to strong encryption policies to save your data from malicious attacks. Moreover, only authorized individuals are allowed to access sensitive data by using their unique ID and password.

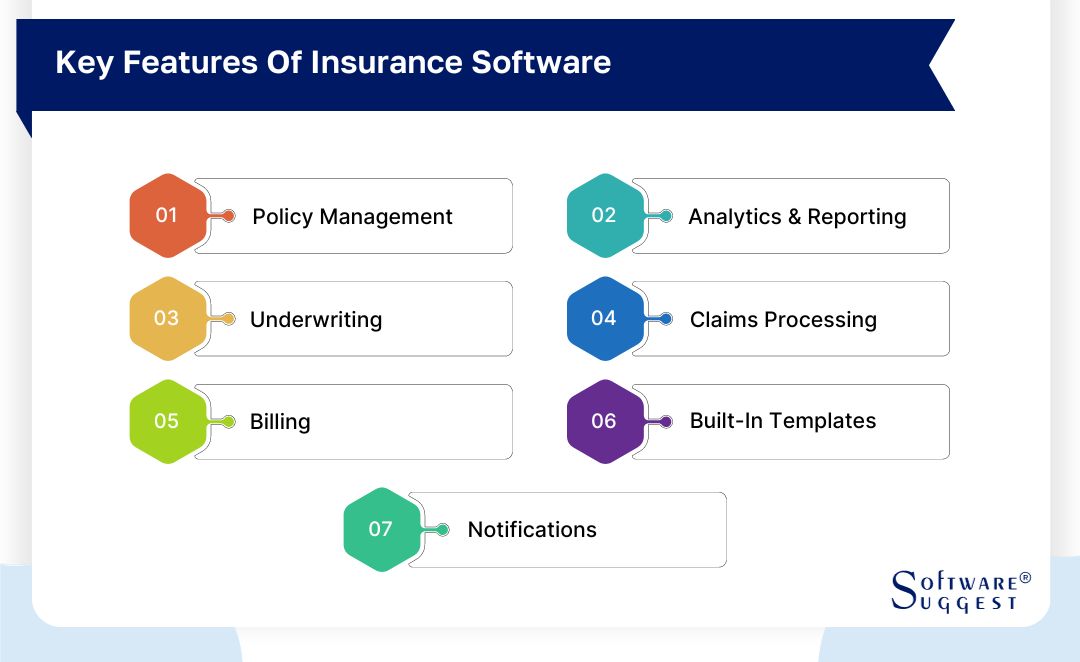

What Are the Features of Insurance Software?

Insurance software is brimming with dynamic features designed to streamline your business operations. Picture a high-tech toolkit packed with digital devices that transform complexity into simplicity and challenges into opportunities. Let's delve into the features of insurance software and unleash its full potential.

-

Policy management

This feature acts as a digital translator, simplifying complex insurance jargon into plain language. It provides a clear, user-friendly map of insurance policies, enhancing transparency and ensuring that customers fully understand their coverage, terms, and conditions.

-

Analytics and reporting

Insurance analytics software dives deep into your data to uncover valuable insights. It helps you identify patterns, trends, and opportunities within your business operations. This data-driven approach enables you to make well-informed decisions, optimize strategies, and enhance overall efficiency.

-

Underwriting

Think of underwriting as the intelligent engine behind your insurance operations. It efficiently evaluates complex risk factors, helping to determine appropriate premium rates and maintain a balanced portfolio. This feature injects logic and precision into the heart of your business insurance management, ensuring sustainable profitability.

-

Claims processing

This is your digital ally in times of crisis. Claims processing software streamlines the entire claims journey, from filing to payout. It ensures a smooth, hassle-free experience for both the insurance company and the client, combining efficiency and empathy to transform potentially stressful situations into reassuring interactions.

-

Billing

Billing software serves as a virtual financial expert. It effortlessly generates invoices, tracks payments, and maintains financial records with exceptional accuracy. This feature simplifies financial operations, making tasks that could be tedious and error-prone straightforward and reliable.

-

Built-in Templates

The insurance agency software system comes with multiple built-in templates for creating invoices, contracts, insurance applications, etc. This feature helps you generate essential documents when required.

-

Notifications

Insurance software systems also generate text messages, alerts, and automated emails to keep your clients informed about scheduled visits, new policies and claims, renewing service agreements, payment for services rendered, and much more. The notification feature offered by insurance software plays a key role in enhancing customer retention and satisfaction. Furthermore, since email / SMS alert software facilitates the rapid exchange of critical information between team members, it also helps you manage crises more efficiently.

Key Considerations When Selecting the Right Insurance Software

Choosing the right insurance software may feel like finding your way through a complex digital maze. With so many options available, it can be overwhelming. This guide, along with some insurance rating software, will assist you in sifting through the numerous features and making an informed decision.

The important factors we'll discuss are crucial in helping you find a solution that matches your insurance business's uniqueness and efficiency. Let's find the software that perfectly suits your insurance brokers.

Here are a few aspects to think about when picking the ideal insurance software:

-

Understanding your business needs

Chart your business's unique challenges, goals, and essential system requirements. This process is akin to creating a treasure map tailored to your specific needs and objectives.

-

Cloud-based or on-premise

Decide between the convenience of cloud-based accessibility, which allows you to work from anywhere with an internet connection or the hands-on control and customization offered by on-premise solutions.

-

Features and functionality

Choose insurance software with versatile, multifunctional features that can automate tasks, process data effectively, and facilitate seamless communication. These features are the digital workhorses of your operation, shaping efficiency and effectiveness.

-

Cost and ROI

View your software investment through the lens of cost and return on investment (ROI). It's like balancing a digital scale, weighing initial expenses against future gains to make financially wise choices that lead to profitability.

-

Data migration and implementation

This step involves transferring and integrating data into your new systems. Ensuring a seamless transition is vital for optimizing business operations and enhancing productivity. Choose an experienced team and reliable technology to ensure success in this area.

-

Security compliance

Protecting sensitive data is paramount. Compliance with industry regulations ensures that your organization is safeguarded against unauthorized access and potential data breaches. This step offers essential assurance in the digital age, building trust with clients and partners.

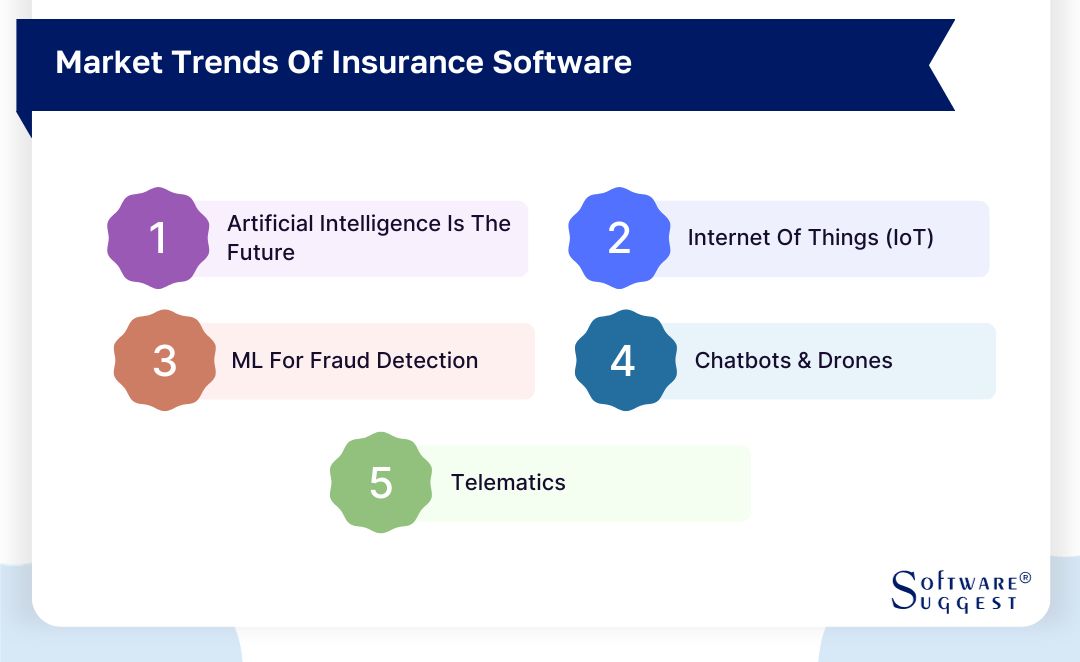

Latest Insurance Software Trends in 2024

If you do not want your insurance agency to fall behind, pick a high-performance insurance tool right away and gear up to reap the benefits of ultimate efficiency.

-

Artificial Intelligence (AI) is the Future

In the coming times, businesses will be integrated with AI enabling insurance agencies to create unparalleled experiences to offer personalized experiences and cater to the prompt demands of Millennial consumers.

With AI-powered insurance platforms, insurers will be able to access data and generate reports more precisely in a shorter time. AI-powered insurance tools will also improve the claims processing cycle and transform underwriting processes.

-

IoT will Transform the Insurance Industry

The Millennial customer is keen on sharing additional personal data only if it helps them save money on their insurance policies. The Internet of Things, popularly known as the IoT, will automate the process of data sharing. The day is not far when insurance agents will be able to derive useful data from IoT-enabled devices to reduce risks and settle insurance rates. One can use IoT software for the same.

-

Machine Learning (ML) will Help Detect Fraud

The insurance industry is currently facing the problem of fraudulent insurance claims. To combat this issue, insurance companies are relying heavily on ML. Machine Learning software helps insurers detect fraud patterns by identifying deviations. It also notifies insurance agencies about every potential fraud so that the insurers can take immediate action.

-

Chatbots and Drones will Steal the Show

The role of chatbots and drones in the insurance industry is currently a hot topic. Chatbots powered by AI and machine learning will help insurance agencies interact with their customers effortlessly, thereby saving a lot of time.

Moreover, chatbots can also walk your customers through the claims process and policy application, besides simplifying back-end operations and customer service.

Similarly, drones are also emerging as a game-changer for the insurance industry. Insurers have already started utilizing unmanned drones for accumulating data, evaluating damages, detecting insurance frauds, and estimating risks before policy issuance.

Moreover, drones facilitate faster, safer, and easier inspection of steep and damaged rooftops, farmer’s crops, and flood or earthquake-affected areas through powerful cameras that capture high-resolution images.

-

Telematics is Making its Way into the Insurance Sector

Last but not least, telematics will also provide numerous benefits to automotive insurers as well as the insured. Telematics leverages GPS software-enabled black boxes for accumulating useful customer data that cannot be manipulated. The black box analyses different aspects of customers’ driving and disseminates the data to the insurer.

Insurance agencies across the globe are leveraging telematics to comprehend risks, understand customer behavior in a better manner, and multiply the frequency of interaction with customers.

These are the latest insurance software trends that are disrupting the insurance industry. With technological advancements, conventional insurance companies are now gearing up to embrace robust technology-based business models to accumulate critical data and take their business to the next level.

If you do not want to lag behind in the competitive insurance market, you should also consider investing in feature-packed insurance broker software to achieve new heights of success. However, before making the final decision, make sure you purchase the software from a reputed vendor to avoid post-purchase regret.

What Is the Cost of Insurance Software?

The cost of insurance software can vary a lot. It depends on how complicated the software is, what changes you need to make to it, and how big your business is. On average, you might have to pay between $50 and $500 for each person using the software every month.

But don't be scared by the price. Paying a good amount of money upfront could save you time and make your work more accurate in the long run. Investing in good insurance software could help your business grow and run better. It's like spending money to make more money.

Remember, the most expensive software isn't always the best, and the cheapest isn't always the worst. You should choose based on what your business needs and how much the software can help you.

Conclusion

Selecting the right insurance software is like picking the perfect dance partner. It needs to sync with your business, keep up with its speed, and grasp its unique details. Every software option has its own moves, including CRM, policy management, and data analytics features.

The trick is to choose one that improves your efficiency and fits your budget. Although the upfront cost might seem high, consider the elegance and smoothness it adds to your operations over time. This will help your business grow and enhance customer experience, engagement, and satisfaction.

FAQs

Yes, it's generally secure because it's built with strong protections to keep your data safe from online threats. However, like any online service, it's not completely immune to cyber-attacks. So, it's essential to regularly update its security and be cautious when using it.

Insurance suite software is like a digital toolbox that helps insurance agencies and agents work better. It manages policies, handles claims efficiently, and does advanced underwriting. It also provides valuable data to make smart business decisions.

There are five main parts of insurance:

-

Policyholder: The person or entity who owns the insurance policy and pays for it.

-

Insured: The person or property protected by the insurance policy.

-

Insurer: The company that provides and manages the policy.

-

Premium: The money paid by the policyholder to the insurer for coverage.

-

Coverage: What the insurance policy protects against, like specific risks or damages.

By Countries

By Industries