Best Lease Accounting Software

Lease accounting software is used by lessors to manage their leased assets' accounting and administrative components. Tasks like leasing, financial planning, budgeting, and amortization task management are all automated with this program.

No Cost Personal Advisor

List of 20 Best Lease Accounting Software

Category Champions | 2024

Online Accounting Software for Growing Businesses

Zoho Books is one of the best lease accounting software solutions and easy-to-use for small businesses to manage finances and help you manage accounts online. You can download a 14-day free trial of Zoho books. Read Zoho Books Reviews

Explore various Zoho Books features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Zoho Books Features- GST audit report

- TDS / TCS

- Multi Currency

- Time Tracking

- Quotation & Estimates

- Accounting Management

- Barcode Integration

- Vendor Management

Pricing

Zoho Books Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Cloud Accounting Software Making Billing Painless

This lease accounting software makes your accounting tasks easy, fast, and secure. Start sending invoices, tracking time, and capturing expenses in minutes. We uphold a longstanding tradition of providing extraordinary customer service and building a product that helps save you time because we know you went into business to pursue your passion and serve your customers - not to learn to account. Read FreshBooks Reviews

Explore various FreshBooks features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all FreshBooks Features- Warehouse Management

- Billing & Invoicing

- Stock Management

- Electronic Receipts

- Work order management

- Inventory Tracking

- Invoice Management

- Retainer Billing

Pricing

FreshBooks Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Lease Lifecycle Automation

LeaseAccelerator is an equipment lease accounting software that provides automated, end-to-end lease management across equipment and real estate. It helps to improve cash flow and productivity while streamlining compliance. Learn more about LeaseAccelerator

Explore various LeaseAccelerator features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all LeaseAccelerator Features- Payment Tracking

- Commercial Leases

- For Equipment Leases

- Residential Leases

- Capitalization Reporting

- Lease Classification

- Budgeting & Forecasting

- Contact Management

LeaseAccelerator Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Software by Real Asset Management

RAM is the best lease accounting software recommended by experts to manage leases. It can easily prepare a report of the lease on the balance sheet. In addition, it has compliance with FAS 13, ASC 842, and IFRS 16 regulations. Learn more about RAM Lease Accounting

Explore various RAM Lease Accounting features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

- Purchase Orders

- Amortization Schedule

- Asset Management

- Portfolio Management

- Project Accounting

- Capitalization Reporting

- For Equipment Leases

- Critical Date Alerts

RAM Lease Accounting Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Software by Aptitude Software Limited

Aptitude is a GAAP lease accounting software that provides enterprise-level lease accounting. It can be used whenever complex accounting is needed, such as sub-lease, multiple asset leasing, multi-GAAP, etc. Learn more about Aptitude Software

Explore various Aptitude Software features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Aptitude Software Features- Tax Management

- Project Accounting

- Critical Date Alerts

- Amortization Schedule

- Billing & Invoicing

- For Real Estate

- For Equipment Leases

- Budgeting & Forecasting

Aptitude Software Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Software by CoStar Realty Information, Inc

CoStar is a lease software that helps to eliminate all lease accounting errors. It is a cloud-based software that is CPA tested and provides FASB and IASB compliance. It also offers top-notch security to data. Learn more about CoStar

Explore various CoStar features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all CoStar Features- Billing & Invoicing

- Project Accounting

- Critical Date Alerts

- For Equipment Leases

- Contact Management

- Amortization Schedule

- Budgeting & Forecasting

- Payment Tracking

CoStar Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Software by PowerPlan

PowerPlan is comprehensive, affordable, secure, proven, and compliant lease accounting software. It has compliance with FASB, IASB, GASB, GAAP, IFRS, and FERC standards. It has been working for the last 16 years. Learn more about PowerPlan

Explore various PowerPlan features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all PowerPlan Features- Billing & Invoicing

- Contact Management

- Project Accounting

- Tax Management

- Payment Tracking

- Budgeting & Forecasting

- Asset Management

- For Real Estate

PowerPlan Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Software by Leasequery

LeaseQuery is a cloud-based lease accounting software. It is a leading brand trusted by over 500 companies to manage their lease accounting. It supports the GAAP, IFRS 16 and ASC 842 lease accounting standards. Learn more about LeaseQuery

Explore various LeaseQuery features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all LeaseQuery Features- Budgeting

- Project Accounting

- Billing & Invoicing

- For Real Estate

- Sublease Management

- Asset Management

- Amortization Schedule

- Portfolio Management

LeaseQuery Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Software by Tango

Tango is a lease accounting software that provides you with end-to-end lease accounting and management. It can check the entire lifecycle of all leases, loans, and asset types. It is a flexible yet powerful software. Learn more about Tango

Explore various Tango features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Tango Features- For Real Estate

- For Equipment Leases

- Contact Management

- Project Accounting

- Budgeting & Forecasting

- Tax Management

- Asset Management

- Accounts payable

Tango Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Software by Visual Lease

VisualLease is a lease software that provides you with end-to-end lease accounting that you can trust. It integrates seamlessly with more than 50 GL/ERP platforms. It has been serving for more than 20 years. Learn more about Visual Lease

Explore various Visual Lease features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Visual Lease Features- Tax Management

- Critical Date Alerts

- Sublease Management

- Portfolio Management

- Contact Management

- Purchase Orders

- Budgeting & Forecasting

- Amortization Schedule

Pricing

Yearly Plan

$ 5000

Per Year

Visual Lease Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Software by Lease Harbor LLC

Lease Harbor is a lease accounting software that adds automation to your lease accounting business. It has got used in over 850 satisfied organizations. It can manage lease accounts with leases ranging from 100 to 40,000. Learn more about Lease Harbor

Explore various Lease Harbor features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Lease Harbor Features- Portfolio Management

- Expense Tracking

- Budgeting & Forecasting

- Commercial Leases

- Contact Management

- Critical Date Alerts

- For Real Estate

- Billing & Invoicing

Pricing

Basic

$ 300

Per Month

Lease Harbor Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Fast, simple compliance

EZLease provides simple, fast, and easy equipment lease accounting software that ensures long-term compliance for real estate and equipment leases for lessees and lessors. Learn more about EZLease

Explore various EZLease features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all EZLease Features- Accounts payable

- Amortization Schedule

- Budgeting & Forecasting

- Project Accounting

- Critical Date Alerts

- For Equipment Leases

- Lease Classification

- Asset Management

Pricing

Business

$ 1499

Per Month

Essential

$ 0

Per Month

EZLease Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Software by Nomos One

Nomos One is a cloud-based lease software for accountants, which helps you overcome your daily lease accounting challenges. It complies with IFRS 16 standards and is designed to automatically calculate PVFMLP. Learn more about Nomos One

Explore various Nomos One features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Nomos One Features- Project Accounting

- Tax Management

- Portfolio Management

- Expense Tracking

- Commercial Leases

- For Real Estate

- Amortization Schedule

- For Equipment Leases

Nomos One Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Software by Better Programs, Inc

TURBO-Lease is a vehicle lease accounting software that helps to gain control over all your lease accounting needs for servicing equipment and vehicles. This software can handle both the consumer lease and the commercial lease. Learn more about TURBO-Lease

Explore various TURBO-Lease features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all TURBO-Lease Features- Project Accounting

- Budgeting & Forecasting

- Commercial Leases

- Asset Management

- Contact Management

- Billing & Invoicing

- Portfolio Management

- Purchase Orders

Pricing

One Time Payment

$ 1250

One Time

TURBO-Lease Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Software by LeaseCrunch

LeaseCrunch is recommended by all CPA firms worldwide for streamlining the accounting process. It is a top lease accounting software that can handle any number of leases and comes with a custom branding option. Learn more about LeaseCrunch

Explore various LeaseCrunch features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all LeaseCrunch Features- Contact Management

- Capitalization Reporting

- Critical Date Alerts

- Asset Management

- For Equipment Leases

- Amortization Schedule

- Payment Tracking

- Portfolio Management

LeaseCrunch Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Software by Sage

Sage is the best lease accounting software that offers complete desktop accounting software that helps you spend less time managing your accounts and more time developing your business. With its easy-to-use interface, Sage 50cloud Accounting has aided small businesses and entrepreneurs to operate efficiently and effectively. Special Offer: 40% off Sage 50cloud annual subscriptions | Coupon Code: D-1929-0020. Read Sage 50cloud Reviews

Explore various Sage 50cloud features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Sage 50cloud Features- Tax Management

- Expense Tracking

- Project billing

- Payment Processing

- Bank Reconciliation

- Billing Portal

- Tax Calculator

- General Ledger

Pricing

Pro Accounting

$ 51

Per Month

Premium Accounting

$ 78

Per Month

Quantum Accounting

$ 198

Per Month

Sage 50cloud Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Software by Odessa

Odessa Platform is a fully-featured Banking Industry Software designed to serve Agencies, Startups. Odessa Platform provides end-to-end solutions designed for Windows. This online Banking Industry system offers Contact Management, Retail Leases, Compliance Tracking, Multi-Branch, Sublease Management at one place. Read Odessa Reviews

Explore various Odessa features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Odessa Features- Contact Management

- For Equipment Leases

- Property Management

- Billing & Invoicing

- Risk Management

- Retail Leases

- Compliance Tracking

- Portfolio Management

Odessa Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Software by KingStreetLabs, LLC

FormSwift makes lease accounting a hassle-free job by offering more than 500 free templates, comprehensive PDF editor, and free legal document generation help to its end users. One can generate a bill of sale and power of attorney easily. Learn more about FormSwift

Explore various FormSwift features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all FormSwift Features- Sublease Management

- Payment Tracking

- Portfolio Management

- Accounts payable

- Tax Management

- Retail Leases

- Billing & Invoicing

- Project Accounting

FormSwift Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Software by Deloitte

LeasePoint is a fully featured Lease Accounting Software designed to serve SMEs, Agencies. LeasePoint provides end-to-end solutions designed for Web App. This online Lease Accounting system offers Portfolio Management at one place. Learn more about LeasePoint

Explore various LeasePoint features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all LeasePoint Features- Portfolio Management

LeasePoint Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Software by Nakisa

Nakisa Lease Administration is a fully featured lease accounting software designed to serve Enterprises, Agencies. Nakisa Lease Administration provides end-to-end solutions designed for Web App. This online Lease Accounting system offers Critical Date Alerts, Portfolio Management, For Equipment Leases, Asset Management, and Payment Tracking in one place. Learn more about Nakisa Lease Administration

Explore various Nakisa Lease Administration features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

- Critical Date Alerts

- For Equipment Leases

- Payment Tracking

- Billing & Invoicing

- For Real Estate

- Asset Management

- Portfolio Management

- Amortization Schedule

Nakisa Lease Administration Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Lease accounting software automates the process of tracking and reporting leases, making it easier for companies to comply with the new standards and provide more accurate financial statements.

It can also help companies identify and manage lease obligations, reducing the risk of financial penalties for non-compliance.

Keep reading to gain better insights into lease accounting and get a list of the 5 best lease accounting solutions.

What Is Lease Accounting Software?

Lease accounting software helps businesses manage and account for their leases, which are agreements to rent property, equipment, or other assets. It also provides calculations to meet the financial reporting requirements for lease contracts.

Typical lease accounting software capabilities include managing rent payments, tracking leases, and accounting for lease-related transactions. Additionally, it can assist businesses in adhering to IFRS 16 and ASC 842, two examples of accounting rules.

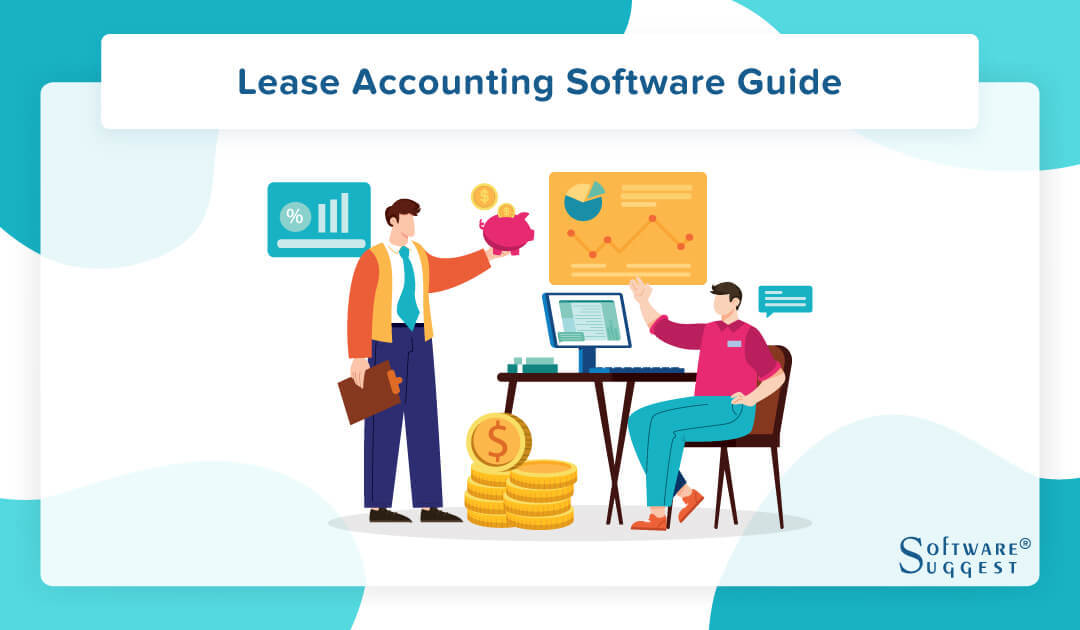

6 Benefits of Lease Accounting Software

Lease accounting programs offer several benefits for small businesses and enterprise companies looking to manage and track their leases more effectively. Some of the key benefits include -

-

Automation

A lot of the manual activities involved in lease accounting, such as figuring up rent payments and keeping track of lease expiration dates, are automated by the lease accounting platform.

-

Compliance

The software aids organizations in adhering to accounting regulations like ASC 842 and IFRS 16, which were put in place to increase comparability and transparency in lease accounting.

-

Better Accuracy

By automatically computing rent payments and some other lease-related expenses, the technology helps in assuring the accuracy of lease-related transactions.

-

Better Data Visibility and Reporting

Lease accounting software provides real-time visibility into lease-related data, allowing businesses to generate reports easily and track key performance indicators.

-

Enhanced Efficiency

The software can help enterprises save time and money by automating some tedious chores associated with lease accounting, enabling them to focus on more critical and essential operations of the company.

-

Easier To Manage

With all lease information in one place and clear tracking of payments, lease accounting software makes it easy to manage your leases, and you can easily identify any issues or concerns.

Typical Features of Lease Accounting Software

Lease accounting software provides a variety of features to help companies manage and track their leases more effectively. Below is the list of key features of lease accounting software -

-

Lease Tracking

Businesses can manage and keep track of their leases in one place thanks to lease tracking. The lease agreement, start and end dates, rent payments, and any other pertinent information can all be entered and stored using this tool.

Additionally, it aids in keeping track of important lease indicators like rent reductions and lease payments. The ability to handle and track all of a company's leases in one location rather than having to manually keep track of each lease makes this feature very helpful for businesses with many leases.

-

Management of Rent Payments

With lease accounting software, you can easily track and manage all your rent payment associated with the lease. You can store rent information such as the payment due, its due date, and the payment status of past transactions.

Moreover, you can also set up automated rent payment reminders and notifications to ensure that rent payments are made on time.

-

Accounting for lease-related transactions

The software collects and records lease payments in the general ledger and calculates depreciation to account for lease-related activities.

This can help you keep track of all your past transactions and help you manage every activity in a better way.

-

Accounting Standard Adherence

Lease accounting software helps companies adhere to accounting standards by providing the tools and functionality needed to record and report lease transactions accurately. These tools include the ability to classify leases as finance or operating leases, calculate lease assets and liabilities, and generate reports that comply with ASC 842, IFRS 16, and GASB 87 accounting standards.

For example, with lease accounting software, companies can automatically calculate and record lease assets and liabilities on the balance sheet per standard requirements. It can also provide the necessary information to disclose lease-related information in the financial statement footnotes, including information on lease terms, lease payments, and other relevant details.

-

Alerts And Reminders

Traditionally, a company's IT department or IT professionals are responsible for developing, monitoring, and maintaining its web infrastructure.

If there is a performance problem, the IT people should be first informed as they possess the necessary skill to find the solution.

Data from the web monitoring tools is thus valuable for IT departments to understand and strive towards improved customer experience.

Additionally, user tracking features help organizations gain a better understanding of their audience and their unique association with the brand.

-

Reports Generation

Companies can generate various reports and analyze their lease-related information with lease accounting software. With this information, companies can study their portfolio and make better decisions.

For instance, you can generate reports on lease payments, rent concessions and abatements, lease liabilities and expiration dates.

-

Cloud-Based or On-Premises

The majority of cloud-based lease accounting software is subscription-based, meaning users must pay a monthly or yearly charge to access it. Users of this kind of software can access it from any device with an internet connection, and it is often simple to set up. Software for lease accounting in the cloud is scalable and accessible by several users at once.

On the other hand, on-premise lease accounting software is software that is installed and run on a business's own computer or server. Usually, this kind of software must be bought outright and just once. It has the advantage of being able to keep sensitive data within the organization's own infrastructure and can be tailored to the particular demands of a company. However, it also needs IT support for upkeep and updates, which is typically more expensive over time.

-

Easy Integration

Some lease accounting software easily gets integrated with other tools like Customer Relationship Management (CRM) software, ERP, document management software, Excel sheets, and payment processing software, and it provides a seamless experience by reducing manual work and data entry errors

List of Top 5 Lease Accounting Software

If you are looking to invest in a lease accounting platform, you can check out the list of top 5 tools and compare them based on the features, pros and cons, and pricing.

1. Freshbooks

Freshbooks is one of the most preferred lease accounting software. Businesses can handle billing effectively and efficiently thanks to FreshBooks. Its user interface is straightforward and easy to use.

As a result, accountants can easily pick up using it for lease accounting activities. Professional financial papers can be produced with this digital accounting tool. It may also automatically do duties like billing, tracking accounting periods, and organizing expenses. Additionally, FreshBooks enables quick and effective client follow-up.

Features

- FreshBooks allows users to create and send professional-looking invoices, including recurring invoices and estimates.

- You can track and categorize expenses and attach receipts for easy record-keeping.

- Track time spent on projects, making bill clients for hourly work easy.

- FreshBooks has the ability to accept online payments such as credit card and ACH payments.

- Provides tools for managing projects and tasks and for collaborating with team members.

- Generates various reports, including income and expense reports, and sales tax reports.

Pricing

- Lite: $1.50 per month, 5 billable clients

- Plus: $3 per month, 50 billable clients

- Premium: $5.50 per month, unlimited billable clients

- Select: Custom pricing

2. FMIS Asset Management

In order to maintain compliance with the most recent IFRS 16 accounting standard simpler, FMIS Lease Accounting Software offers a tried-and-true lease management solution.

Lessee finance experts throughout the public sector and publicly traded corporations rely on FMIS to centralize their lease data, track and automate lease accounting operations, and support IFRS 16 compliance.

With the help of our lease management software, your team can successfully manage your financing leases and operating leases for equipment and real estate assets without the use of spreadsheets.

Features

- Recording and tracking lease liabilities and assets as per ASC 842, GASB 87 and IFRS 16.

- Automated lease abstracting, lease data extraction, and lease data loading.

- Management of lease files, lease expirations, rent escalations and other lease-related obligations.

- Track and manage leased assets and liabilities across a portfolio of properties.

- Generate reports to support compliance with lease accounting regulations.

Pricing

$4500 per user/one-time payment

3. LeaseMate

LeaseMate is a lease accounting software that helps companies to manage their lease portfolio, comply with accounting standards and improve decision-making. It is designed to automate and simplify the process of accounting for leases under ASC 842 and IFRS 16.

The software provides tools for lease abstraction, lease calculations, lease amortization and lease accounting journal entries and also allows users to create customized lease reports and manage lease data in a centralized location. Additionally, it has the option to integrate with other systems, such as ERP and general ledger systems.

Features

- Manage different portfolios of properties.

- Generate various reports to stay compliant with lease accounting regulations.

- Efficiently manage expirations of lease and rent escalations.

- Integrate with other platforms to create streamlined processes.

Pricing

$29 per user per month.

4. Cradle

Not only are the new lease accounting requirements challenging, but they also significantly impact your financial statements. While adhering to stringent financial reporting rules, lease accounting includes massive volumes of data from multiple sources, inconsistent processes and controls, and a tremendous amount of manual work.

This can be resolved by using Cradle, the best lease accounting software for all business sizes. Cradle can handle any combination of leases. It has been designed to deal with extreme lease accounting situations.

Features

- The user-friendly design of Cradle makes lease accounting simpler than ever.

- Financial reports and disclosures are generated by Cradle, and they can be requested for any period range.

- When you make a modification, Cradle completes the accounting in accordance with the relevant standard.

- Log all changes to the lease portfolio so that every user can see what has changed.

- Cradle takes care of the rest while you upload the currency rates.

Pricing

- Small plan: $99 per month

- Regular plan: $100 per month

- Enterprise plan: Custom pricing

5. Leasequery

LeaseQuery is one of the top lease accounting software that offers a range of features to help companies manage their lease portfolio, including lease abstraction, lease calculations, lease amortization and lease accounting journal entries.

It also allows users to create customized lease reports and manage lease data in a centralized location. The software also provides a lease vs. buy analysis, enabling companies to decide whether to lease or purchase assets.

Additionally, it has the option to integrate with other systems, such as ERP and general ledger systems.

Features

- Interactive and attractive data visualization and dashboards.

- Automated journal entries to help companies to stay compliant with lease accounting regulations.

- Managing lease files and other important documents.

- Lease portfolio management for different properties.

Pricing

Custom pricing.

The Cost of Lease Accounting Software for Small Businesses

Lease accounting software pricing is based on the features it provides and how advanced it is compared to other tools.

Some lease accounting software providers offer a monthly subscription model, while others may charge a one-time fee or a combination. Additionally, the cost may also depend on the number of users and the number of leases that need to be managed. The cost of lease accounting software ranges between $20 to $250.

There are two types of offers usually, a free trial for a few days for the user to experience the software or a basic version with limited features that is available at no cost, while others may offer a range of pricing plans based on the size of the company or the number of leases that need to be managed.

While making a choice, it is recommended to enquire well about the vendor's pricing options and to compare them to those of alternative software.

Trends Related to Lease Accounting Software

Lease accounting software is a specialized tool that helps businesses comply with the new lease accounting standards set forth by the Financial Accounting Standards Board (FASB) and the International Accounting Standards Board (IASB). Some trends related to lease accounting software include:

-

Increased Adoption

With the implementation of the new lease accounting standards, more and more companies are looking for lease accounting software to assist them in adhering to the new regulations.

-

Cloud-Based Options

Many companies prefer lease accounting software that can be accessed and used collaboratively from any location.

-

Integration

Some lease accounting software easily gets integrated with other tools like Customer Relationship Management (CRM), ERP, and other accounting software and provides a seamless experience by reducing manual work and data entry errors.

-

Automation And Machine Learning

As technology advances, lease accounting software is becoming more automated and using machine learning to improve efficiency and accuracy.

-

Mobile Accessibility

With the increasing usage of mobile devices, many software providers are developing mobile apps to allow lease accounting information to be accessed on the go.

-

Compliance With Global Standards

As more and more companies operate globally, lease accounting software providers are developing solutions that are compliant with both IFRS and US GAAP standards.

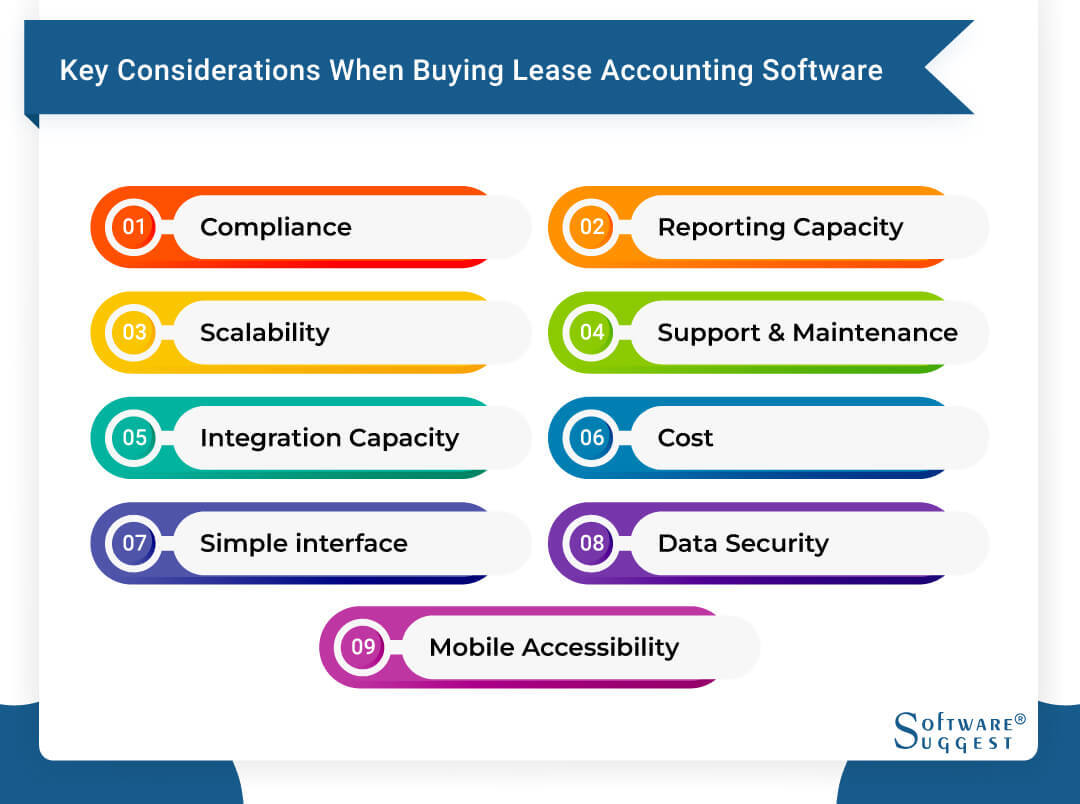

Key Considerations When Buying Lease Accounting Software

When buying lease accounting software, there are several key considerations to keep in mind

-

Compliance

Ensure that the software is compliant with the new lease accounting standards set forth by the FASB and IASB to ensure compliance management.

-

Scalability

Consider the size of your business and ensure that the software can accommodate your current and future needs and requirements.

-

Integration Capacity

Check whether the software can easily integrate with the other existing softwares you are using to avoid the repetition of data entry and to enhance the business efficiency.

-

Simple interface

Check whether the software is easy to use and navigate for your team to use and whether it requires excessive training sessions for your team to use it.

-

Reporting Capacity

Take assurance that the software can generate all the insightful and important reports you need, such as balance sheet and income statement reports.

-

Support and maintenance

Consider the level of support and maintenance provided by the software provider, including training, upgrades, and customer service.

-

Cost

Evaluate the total cost of ownership, including the initial cost of the software, ongoing maintenance fees, and the cost of any additional services or support required.

-

Data Security

Look for software that meets the data security standards, and is compliant with the regulations like GDPR, HIPAA, SOC 2 etc.

-

Mobile Accessibility

If your employees are on the move, consider a software that is mobile-friendly and allows remote access.

By considering these factors, you will be able to choose a lease accounting software solution that best meets your business needs and helps you comply with the new accounting standards

Which Platforms Can Integrate with Lease Accounting Software?

There are many software platforms that can integrate with lease accounting software for a seamless flow of processes.

-

Enterprise Resource Planning (ERP) Software

Lease accounting systems can be combined with enterprise resource planning (ERP) software to provide a comprehensive picture of a business's financial and operational data.

-

Accounting Software

By integrating accounting software with lease accounting software, accounting transactions and financial data may be sent between the two systems more easily and without fuss.

-

Property Management Software

In order to offer information on the premises that a company rents as well as the tenants who inhabit them, property management software type of software can be integrated with lease accounting software.

-

Document Management Software

Leasing-related paperwork can be stored in one location thanks to the integration of document management and lease accounting software.

-

Analytics And Reporting Software

Software for advanced reporting and analytics can be integrated with lease accounting software to offer features like the ability to design unique reports and conduct in-depth data analysis.

What are the Disadvantages of Lease Accounting Software?

-

Lack of integration with other systems

It can be challenging to guarantee that data is correct and current if the lease accounting software is not coupled with other systems, such as ERP or accounting software.

-

Difficulty in tracking leases

It can be challenging to monitor the status of leases and make sure that all lease-related duties are being satisfied without a robust system in place.

-

Difficulty in reporting

Keeping up with lease accounting standards can be challenging for businesses without the capacity to quickly generate reports.

-

Difficulty in identifying lease-related data

It can be challenging to distinguish between items that are leases and those that are not without an appropriate system in place, which can result in accounting problems.

-

Lack of Data Extraction

Making educated decisions on lease accounting becomes challenging in the absence of an effective mechanism for data extraction and analysis.

Final Thoughts

In conclusion, lease accounting software is valuable for any company that leases assets. This makes it easier for companies to provide more accurate financial statements and reduces the risk of financial penalties for non-compliance.

So, compare different lease accounting tools based on their features and pricing and make an informed decision for your business.