Best Loan Management Systems & Software

Best loan management Systems are SimpleNexus Mortgage Platform, Sofi, Loansifter, Floify, and Total Expert. All the loan management software helps automate the entire loan management process process.

No Cost Personal Advisor

List of 20 Best Loan Management Software

Contenders | 2024

Process-driven CRM for marketing, sales, service.

Creatio is the global supplier of no-code platform for industry workflows automation and CRM. Creatio’s customers enjoy the freedom to own their automation. Freedom is provided through unlimited customization, the ability to build apps without a line of code and a universe of ready-to-use templates and connectors. Read Creatio Reviews

Explore various Creatio features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Creatio Features- Accounting

- Inquiry Management

- Customization

- Email Marketing / SMS Marketing

- CRM & Sales Reports

- Customer DataBase

- Private Cloud

- Omnichannel Communication

Creatio Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Core Banking Solution for banks of all sizes and types

FinCraft is a loan management software that allows banks to provide a wide range of banking services to its customers. This loan management system India provides features like Payment Systems, analytics, Tele-Banking System, and Data Quality Solutions. Learn more about FinCraft

Explore various FinCraft features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all FinCraft Features- Securities Management

- Online Banking

- Multi-Branch

- Risk Management

- Compliance Tracking

- ATM Management

- Retail Banking

- Transaction Monitoring

FinCraft Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Advanced and comprehensive bank loan management system

FinnOne is an advanced loan collection software that is used to improve the overall quality and service for end-customers. It is one of the best loan management software for banks to allow efficiency, transparency agility, and in money lending solutions. Learn more about FinnOne Neo

Explore various FinnOne Neo features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all FinnOne Neo Features- Fee Management

- Risk Management

- Business Loans

- Collateral Tracking

- Retail Banking

- Mortgages

- Accounting Management

- Loan Consolidation

FinnOne Neo Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

A Complete Loan Management Software

CloudBankIN is the SaaS Banking Engine, which has the functionality of Savings, Deposits, Shares, Loan Management System, Collections, Accounting, Internet Banking and Mobile Banking. This software will be widely used by Banks, NBFC, MFI. Read CloudBankIN Reviews

Explore various CloudBankIN features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all CloudBankIN Features- Audit Trail

- Loan Processing

- Loan Portfolio Management

- Loan Servicing

- Loan Submission Control

- Mortgages

- Closing Documents

- Loan Origination

CloudBankIN Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Web-based loan servicing & mortgage software for businesses

The Mortgage Office is a loan management system software that is used by businesses of all sizes for services like loan origination & servicing and mortgage pool servicing. This loan management software also provides trust accounting and escrow administration. Learn more about The Mortgage Office

Explore various The Mortgage Office features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

- Fee Management

- Auto Loans

- Government Loans

- Construction Loans

- Student Loans

- Closing Documents

- Loan Servicing

- Credit Reporting

The Mortgage Office Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Loan servicing software for financial & banking institutes

AutoPal is a cloud-based loan management system India that is designed for banking and financial institutes for recording payments and tracking loan payments. This software offers website customization, SMS alerts, customer portals, and email notifications. Learn more about AutoPal Software

Explore various AutoPal Software features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all AutoPal Software Features- Auto Loans

- Compliance Management

- Accounting Management

- Collections Management

- Amortization Schedule

- Automatic Funds Distribution

- Fee Management

- Customer DataBase

AutoPal Software Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

On-premise loan servicing system for enterprise lenders

Nortridge is a cloud-based online loan management system used by government organizations and branch-based & branch-based lender. Key features of this loan collection software include enterprise-grade security, loan automation, and granular configuration. Learn more about Nortridge

Explore various Nortridge features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Nortridge Features- Amortization Schedule

- Auto Loans

- Pipeline Management

- Exposure Management

- Asset Management

- Risk Management

- Complex Debt Structures

- Multi-Branch

Nortridge Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Loan servicing software for private & public companies

Margill Loan Manager is one of the best loan management software used by agencies, governments, lenders, and companies. It provides features like accounting management, loan processing, collections management, business loans, and amortization schedule. Read Margill Loan Manager Reviews

Explore various Margill Loan Manager features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Margill Loan Manager Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Flexible loan servicing system for small-mid size lenders

The Loan Office is one of the widely used loan management solutions by consumer finance lenders, hard-money lenders, and mortgage lenders. This loan management system software allows tracking of advances & loan charges and documentation of records of payments. Learn more about The Loan Office

Explore various The Loan Office features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all The Loan Office Features- Auto Loans

- Fee Management

- Customer DataBase

- Compliance Management

- Construction Loans

- Loan Processing

- Collateral Tracking

- Investor Management

The Loan Office Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

High Performer | 2024

Unified Lending Technology

Introducing AllCloud's Unified Lending Technology, tailored to effortlessly manage and service multiple loan products. Unleash unmatched ease and control in your lending operations. Offered as a SaaS that is highly Secure & Super Scalable. Read AllCloud Reviews

Explore various AllCloud features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all AllCloud Features- Credit Risk Management

- Mortgages

- Risk Assessment

- Loan Origination and Underwriting

- Customer DataBase

- Risk Management

- Loan Servicing and Collections

- Loan Approval Workflow

AllCloud Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Cloud-based loan servicing platform for industry leaders

Calyx Software is a cloud-based loan management software that is equipped with various tools like Portfolio Producer, Calyx Network, and WebCaster. This software also provides SaaS pricing, prospect database, pipeline management, and sales and loan checklists. Learn more about Calyx Software

Explore various Calyx Software features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Calyx Software Features- Amortization Schedule

- Pre-Qualification

- Loan Origination

- Credit Reporting

- Loan Consolidation

- Loan Processing

- Audit Trail

- Loan Submission Control

Calyx Software Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Full-service lending management platform for organizations

LoanPro is a loan management system India which is used for the creation, service, and collection of loans. This online loan management system provides custom online application forms, advanced communication features, and automatic payments. Read LoanPro Reviews

Explore various LoanPro features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all LoanPro Features- Amortization Schedule

- Compliance Management

- Automatic Funds Distribution

- Collateral Tracking

- Loan Processing

- Business Loans

- Application Management

- Collections Management

LoanPro Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Loan origination software for financial firms of all sizes

LOAN SERVICING SOFT is a cloud-based loan collection software that provides on-premise loan origination solutions to financial institutions of all sizes. Other features of this software are web applications, point and click entry screens, and automated emails. Learn more about LOAN SERVICING SOFT

Explore various LOAN SERVICING SOFT features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

- Loan Processing

- Contact Management

- Construction Loans

- Commercial Mortgages

- Pre-Qualification

- Government Loans

- Electronic Applications

- Accounting Management

LOAN SERVICING SOFT Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Online lending system for loan organization and servicing

Turnkey Lender is one of the best loan management software for lending loans online for payday, p2p, and micro & retail loans. It is one of the widely used loan management solutions for loan origination & servicing, debt collection, and underwriting. Learn more about TurnKey Lender

Explore various TurnKey Lender features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all TurnKey Lender Features- Web Testing

- Compensation Plan Modeling

- Marketing Management

- Fraud detection

- Call Center Management

- ATM Management

- Case Management

- Sublease Management

TurnKey Lender Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Loan servicing for construction & renovation companies

Construction Loan Manager is a cloud-based loan management system India designed exclusively for construction and renovation companies of all sizes. This loan collection software offers pipeline loan management, budget tracking, and accounting management. Learn more about Construction Loan Manager

Explore various Construction Loan Manager features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Construction Loan Manager Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Loan servicing software for banks and third-party services

LA Pro is one of the best loan management software for lenders of all types and sizes. LA Pro is one of the most popular loan management solutions and provides billing, daily accruals, management reports, standard reports, and custom reports and queries. Learn more about LA Pro

Explore various LA Pro features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all LA Pro Features- Collateral Tracking

- Auto Loans

- Collections Management

- Investor Management

- Amortization Schedule

- Fee Management

- Accounting Management

- Loan Processing

LA Pro Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Banking Made Easy

Finflux is a SaaS-based banking platform that offers all banking needs at one place, needs like LOS, LMS, financial accounting, marketplace integration, app-based lending, credit scoring, reporting & analytics. Read FINFLUX Reviews

Explore various FINFLUX features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all FINFLUX Features- Collateral Tracking

- Fee Management

- Risk Management

- Portfolio Management

- Loan Servicing

- Rules-Based Workflow

- Loan Processing

- Accounting Management

Pricing

Starter Plan

$ 694

Per Month

Growth Plan

$ 1389

Per Month

FINFLUX Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Loan Management Software for Streamlined Lending

LoansNeo is a lending management software developed for Banks and NBFCs. It comes with custom workflows, visual analytics, and AI-based recommendation features and can simplify loan origination, journey management, scheduling, payment tracking, and other activities. Read LoansNeo Reviews

Explore various LoansNeo features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all LoansNeo Features- Activity Tracking

- Application Management

- Loan Processing

- Marketing Management

- Pipeline Management

LoansNeo Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

loan software,

Intelligrow is an API driven web and mobile based loan management system powered by cloud. Provides Loan origination system, loan collection system, enabled with enach integration, sms, credit bureau, payout and many more Read Intelligrow Reviews

Explore various Intelligrow features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Intelligrow Features- Closing Documents

- Dashboard

- Business Loans

- Accounting Management

- Application Management

- Activity Tracking

- Loan Processing

- Auto Loans

Intelligrow Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Loan Management Software

Easy to use SaaS cloud-based Loan management software solution. Simple user interface and flexible for various business use cases. Various analytical reporting and customer notifications. Read Advance Loan Manager Reviews

Explore various Advance Loan Manager features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

- Student Loans

- Transaction management

- Investor Management

- Commercial Mortgages

- Audit Trail

- Application Management

- Document Management

- Loan Submission Control

Pricing

Basic Plan

$ 42

Full License

Advanced Plan

$ 56

Full License

Advance Loan Manager Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

What is Loan Management Software?

Loan management software is a computerized platform that helps automate every loan lifecycle stage.

Taking a loan is a major decision for customers – it could be for a new house, education, or personal reasons. Today, the modern customer wants to feel reassured that when they take a loan, it will be handled with the utmost efficiency and care by the organization. Investing in a loan management system is definitely the best way to improve the overall quality, turnaround time, and support for end customers who are taking a loan from your company.

Loan origination software is a set of revolutionary tools that enhance the agility, speed, and transparency of an organization’s holistic lending solutions for customers. It enables financial organizations and banks to completely automate critical loan management processes to achieve a high level of cost savings and provide a better experience to valued customers.

Today, the market is flooded with a host of loan management software suites that provide a comprehensive range of features that can increase the performance of loan management procedures in organizations. Loan management system software is the best way to make sure that your organization handles loans with a great deal of flexibility, and is the best platform for mortgage companies, commercial lending firms, banking institutions, and private and institutional lenders.

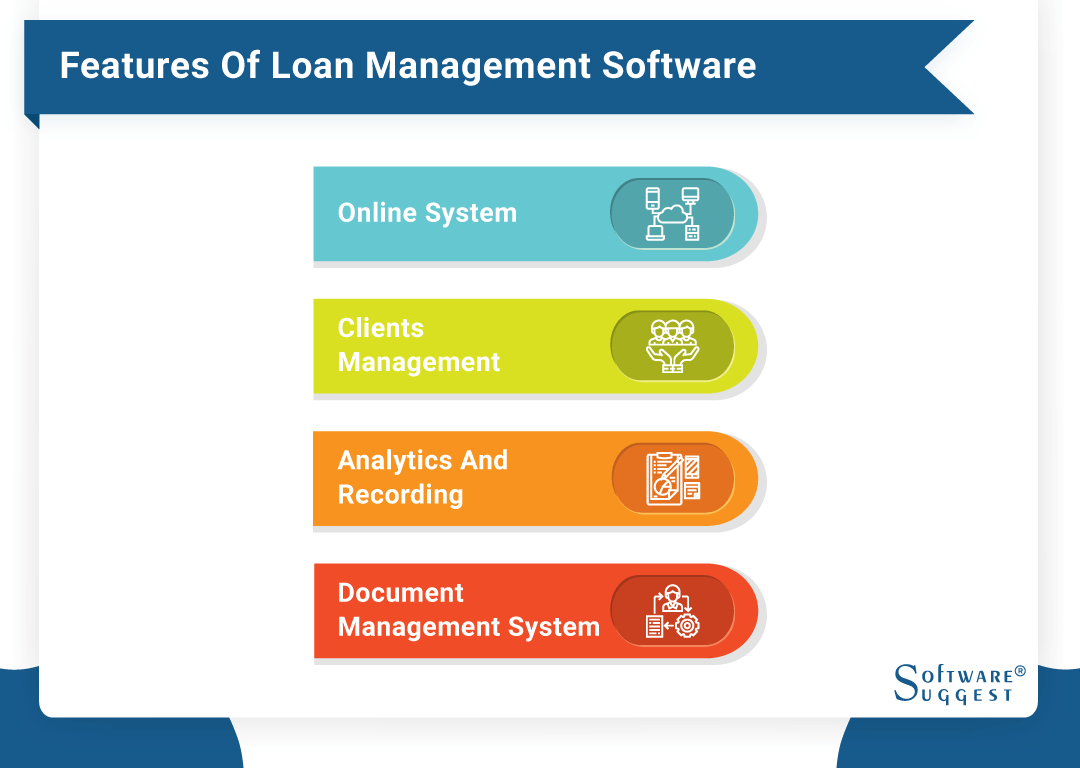

What are the Important Features of Loan Management System Software?

It is essential to make sure that your loan origination software has some features that will make it work smoothly and effectively. Here is a list of some features that your loan software should definitely possess:

1. Online Loan Management System

This is a highly helpful feature as your loan software system should have the ability to service a loan application online so that the borrower’s overall experience can be increased. Loan servicing software should make it possible for borrowers to make online payments so that they can remain self-sufficient and have the facility of convenience at their fingertips.

So make sure that your organization computerizes loan billing and payment, organizes collections management and financial accounting under a robust, streamlined, and secure online loan management system software.

2. Clients Management

One of the biggest challenges for organizations that give out loans is to keep a structured and up-to-date record of their client base. The loan origination system is a perfect solution because the novel client management feature makes sure that you can store, edit, and manage essential client-related data. It automatically enables your company to conduct complete client checks and manage due diligence in determining the creditworthiness of a potential client.

This is highly helpful as it allows your organization to assess the viability of a borrower so that your clients do not default on payments later. The latest loan management software suites also act as customer relationship tools, as they keep a complete record of customer interaction, record client notes, and help your forge lifelong relationships with your clients.

3. Analytics and Recording

It is important for a good online loan management system to give out useful reports so that critical business decisions can be taken with the right information at hand. Your loan origination system should be able to utilize current and real-time data to generate reports, tables, pie-charts, and other visual graphics so that the information can be viewed and analyzed by the management. An analytics dashboard is a useful tool as it is capable of displaying all essential loan-related information and can give a holistic overview to the team members at a quick glance!

4. Document Management System

Making sure that your loans are effectively managed is surely a complex task that involves a whole lot of documents and files. Well, the best part about getting loan management software for your organization is that you don’t have to worry about misplaced or lost documentation anymore. The document management feature is an innovative way of managing all the loan-related paperwork and keeping all your client files organized so that you have all the important data within reach any time of the day!

So make sure that that your loan origination software system contains all these amazing features as it will surely transform your bottom line results and help your company achieve great heights!

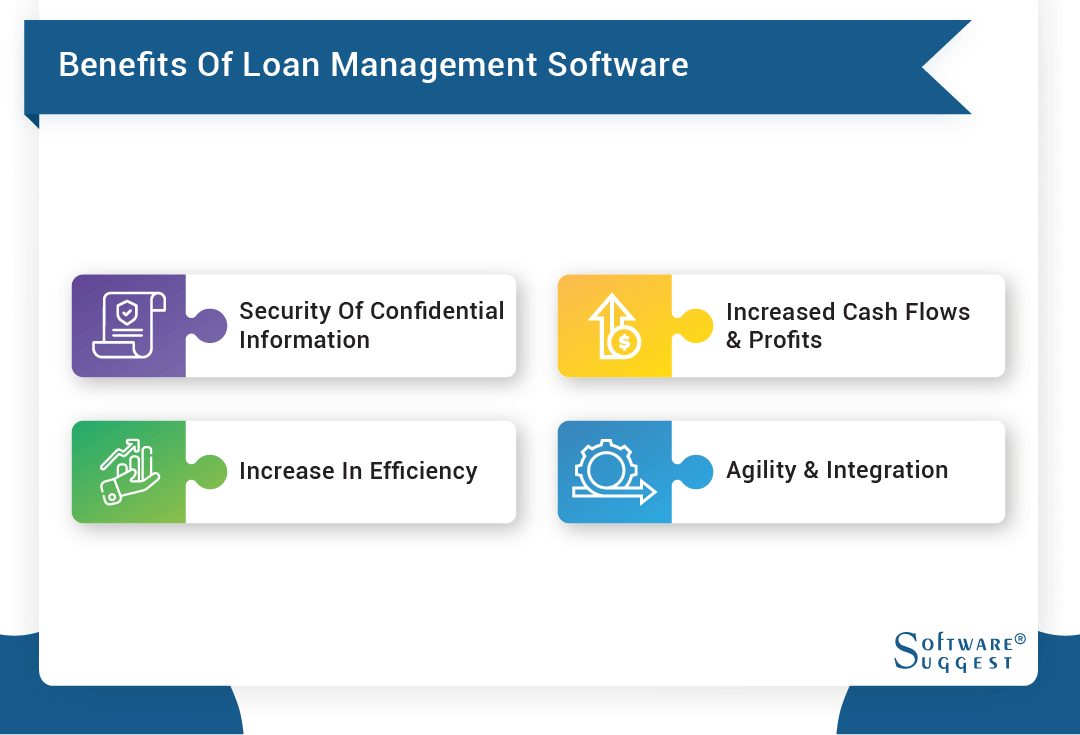

What are the Various Benefits of Loan Management System Software?

If you are still not convinced that your company needs a bank loan management system suite, then go through these great advantages that any organization can instantaneously gain through loan software:

1. Security of Confidential Information

Organizations need to be highly careful about client data and have to make sure that sensitive loan-related information is not misplaced or tampered with. Loan origination software has strong security through inbuilt firewalls and encryption, which makes sure that all your confidential loan documents and data remain safe and are not misused for personal gain by any third party.

2. Increase in Efficiency

Loan software plays an important role in boosting up the productivity levels of organizations, as it largely reduces the time and effort taken to process a loan. The turnaround takes place at a much higher rate and there are fewer chances of error, as most of the processes are highly automated. So, loan origination software is definitely the way to go if you want to escalate your organization’s output levels to unprecedented heights!

3. Increased Cash Flows and Profits

If you implement a loan management system, there will be a sudden and tremendous increase in your overall cash flows and profits. This is because of cutting off days or weeks from your loan collection cycle – thereby streamlining business operations with a faster turnaround, fewer staff members, and better administration. So don’t wait to invest in loan management software if you want to intensify your end results at a quick and rapid pace!

4. Agility and Integration

Web-based loan origination software has the capability to get integrated with your existing systems and can be customized to your exact organizational requirements. This makes your organization highly agile and responsive – lending a more consistent experience to your customers across multiple channels.

These benefits are the prime reason that organizations all over the globe are moving towards implementing loan management system software and benefiting from a gigantic growth in productivity and overall performance!

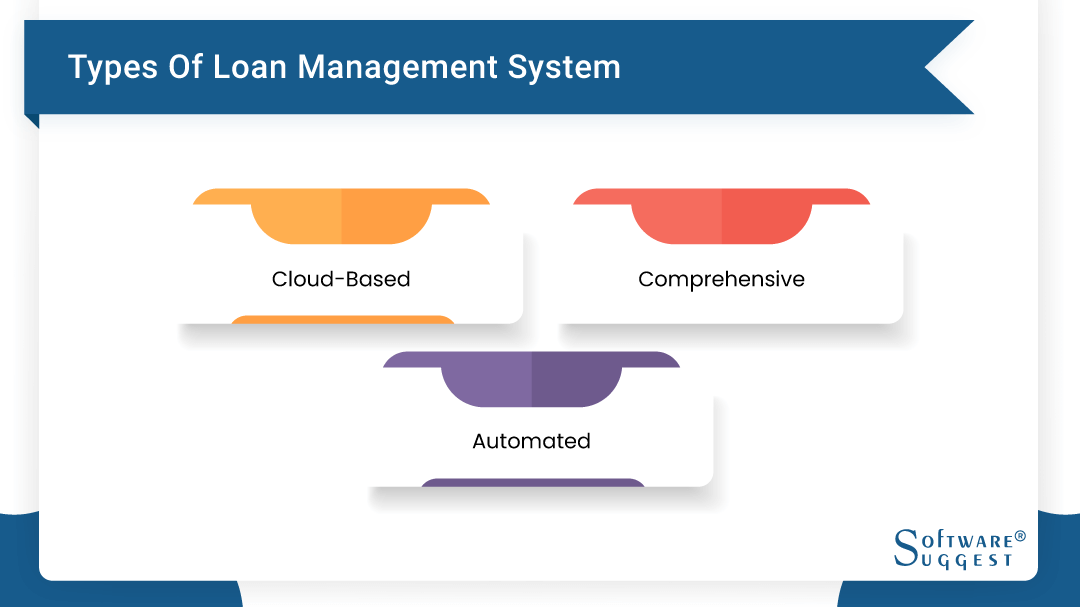

Types of Loan Management Software

Loan management software is a tool that is used to perform all the activities that are included in a loan or money lending process. These activities or steps include services like eKYC process, compatibility, Mobile application, versatility, GPS-based location mapping, collateral management, Multiple disbursals, and many more.

Loan management systems are mostly cloud-based and automated and are used to ensure that the loan process is smoothly executed, and the collection is appropriately facilitated. Different types of loan management software are available in the market, and all offer different benefits and features. Before understanding the ideal kind of software for your business, you need to understand the various types of them, and what features do they offer.

1. Cloud-Based / On-Premise System

Many small or medium-sized lenders don't have a dedicated IT department that can help them develop and manage a landing software with advanced IT functionalities. To overcome this problem, SaaS has gained popularity in the loan management software industry. These SaaS platforms are hosted from various remote locations and are equipped with a high level of cybersecurity and redundant backup systems. This type of LMS provides 24/7 uptime and a high level of security.

2. Comprehensive Loan Management System

In the field of technology, change is always constant. And to keep up with the rapidly changing technology, you need a lending software that adapts with any new changes or inventions in the lending software space. Comprehensive LMS offers the users an integrated integration along with flexibility and functionality. One thing to consider while selecting a comprehensive LMS is to find an LMS that provides a menu of individual modules. This way, you can choose the list of options and features you need for now and can retain the rest later on.

3. Automated Loan Management System

As the name suggests, automated LMS automates multiple tasks to carry out a smooth loan origination & servicing. If you don't want to pay a lot of attention to features and functions, but all that matters to you is revenues and profits, automated LMS can be a good option for you. Automated LMS offers a clean interface and allows you to integrate with multiple vendors. While choosing an automated LMS, make sure you look for advanced vendor integration as this feature can save you a significant amount of energy and time.

What Type Of Loan Management System Your Business Needs?

The type of loan management system your business needs depends upon the type and requirements of your business. If you are a small vendor in your initial stages, you might not need advanced vendor integration and comprehensive functionality. There are few free and open source loan management system options for those just starting out in business. On the other hand, if you are a large vendor, an LMS with limited functionality and features might not satisfy your business needs. Therefore, here are a few points to consider while selecting an ideal LMS for your business. There are a few free and open source loan management software options for those just starting out in business.

1. Broader Coverage

It is essential to choose an LMS that offers broader coverage. An ideal LMS provides complete assistance when it comes to tasks like mortgage documentation and asset financing. Additionally, it should be capable of delivering performance in activities like consumer loans or commercial leasing.

2. User-Friendly

One of the vital considerations, especially if you are a newbie vendor, is the ease of use. Not only does a complicated system makes it hard for the business to process its needs, but it also makes it challenging for the customers as well. Therefore, you should look for a system that simple to set up and configure as per your business requirements.

3. Speed & Agility

Speed, performance, and agility are essential for a loan management system, especially if you have a large business. The sanctioning of the loan should be fast and streamlined to make it easy for the users to request and receive the loan without any technical obstacles. This agility not only makes the work process more effective but also attracts more customers.

4. Customer Service and Technology Support

Another crucial factor to consider while selecting an LMS for your business is the quality of customer service and technical support. The software can have problems at multiple stages, and you should find a loan management system that has dedicated customer support for its users. Similarly, the LMS should provide adequate technical assistance to help you upgrade your systems with newer technologies.

5. Web And Mobile Compatibility

Unlike a decade ago when the desktop was the heart of technology, application-based services have gained decent popularity and for good reasons. In the lending industry, mobile applications can come in handy and can be used to fulfill a variety of functions. Therefore, you should choose an LMS that is supported by mobile and offers life software support.

Related Articles:

By Countries

By Industries