Best Online Payroll Software

Best Online payroll software platforms are Saral Payback, Pocket HRMS, QuickBooks, Zoho Payroll, Beehive HRMS, Patriot Payroll, Gusto, and SumoPayroll. With these, you can efficiently process and manage the payroll of your employees easily.

No Cost Personal Advisor

List of 20 Best Online Payroll Software

Contenders | 2024

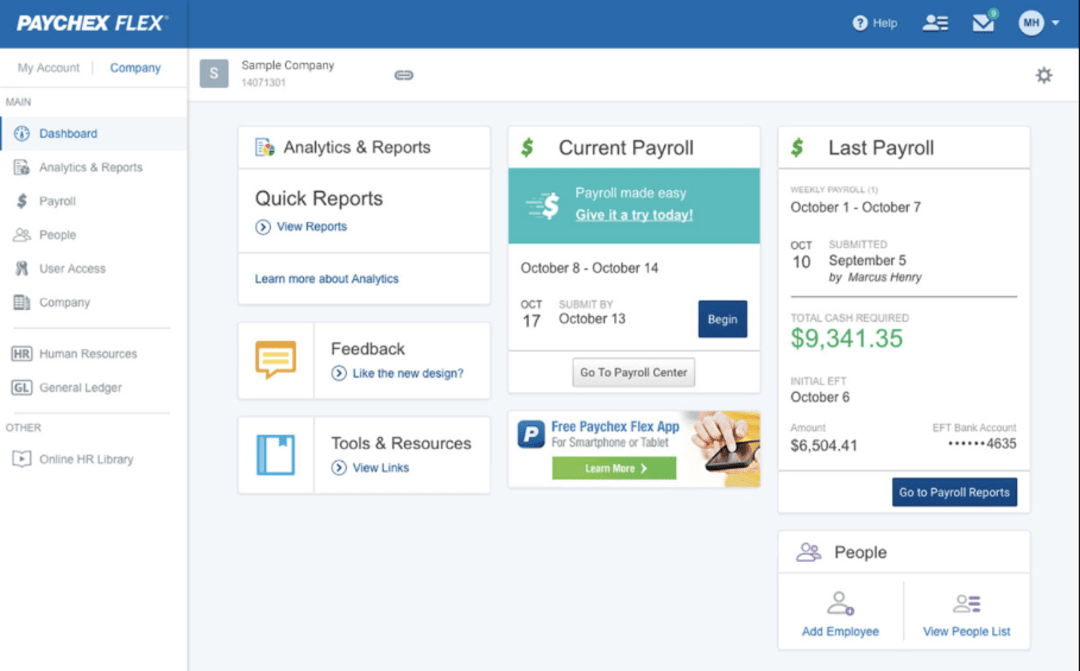

Software by Paychex Inc

Paychex Flex is a robust and intelligent cloud-based payroll solution for accurate and effortless payroll management. It helps you calculate, file, and pay taxes with a few clicks from your desktop or mobile, easing the payroll burden. It has different packages for small, medium, and big enterprises for you to choose from. Read Paychex Flex Reviews

Explore various Paychex Flex features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Paychex Flex Features- Payroll Tax Reporting

- Performance Appraisal

- Appraisal Management

- Leave Management

- HR & Payroll

- Employee Self Service Management

- Attendance management

- Benefits Administration

Paychex Flex Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Software by Papaya Global

Papaya Global is a highly affordable and reliable cloud-based payroll solution that provides global payroll management services supporting multiple currencies. This enterprise-grade software features AI-based engines for enhanced security, accuracy, and compliance. Papaya Global also provides accurate insights to create transparency in your payroll, finance, and HR processes. Read Papaya Global Reviews

Explore various Papaya Global features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Papaya Global Features- Payroll Reporting and Analytics

- Multi-Country

- Benefits Management

- Self Service Portal

- HR analytics and reporting

- Workforce Management

- Multi-State

- Payroll Management

Pricing

Papaya Global Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

factoHR - HR Solution for Growth

factoHR is the best online payroll system for streamlining your entire payroll process. Its wizard-driven approach and a single data source simplify payroll management tasks, whereas its minimal human intervention technology ensures highly accurate data output. Manage your payroll in time every time with factoHR’s payroll automation software. Read factoHR Reviews

Explore various factoHR features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all factoHR Features- Organizational Charting

- Travel Planning

- Project Management

- Bonus

- TDS Calculation

- Time & Attendance

- Scheduling

- Payroll Integration

factoHR Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

The Complete Payroll Solution

Saral PayPack is a comprehensive online payroll software for all your payroll management needs. The software offers many features and capabilities to help you manage everything from salary computation to payslip generation and more. It offers state-of-the-art security features to ensure the safety of your data and a flexible approach to customize the software as per the needs of your business. Read Saral PayPack Reviews

Explore various Saral PayPack features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Saral PayPack Features- Reimbursement Management

- Compensation Management

- Salary Information & History

- Income Tax & Deductions

- Letter generation

- Customizable Templates

- Shift Management

- MIS Reports

Pricing

Standard

$ 746

Onetime

Corporate

$ 1608

Onetime

Saral PayPack Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

2Grow HR Business Payroll

2Grow HR is a web-based payroll software that simplifies payroll management. The software helps unlock employee productivity and work efficiency by streamlining and automating HR & payroll processes for your company. 2Grow HR offers features like time and attendance management, expense management, bonus and deduction management, etc., to help companies pay employees on time and save hours on payroll management. Read 2Grow HR Reviews

Explore various 2Grow HR features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all 2Grow HR Features- Excel Import

- Attendance Reporting

- Reimbursement Management

- Variable Workforce

- Appraisal Management

- Employee Management

- Taxation Management

- Employee Profile

2Grow HR Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Simple, Reliable

Perk Payroll is the best online payroll management software offering simple and reliable solutions for Indian businesses. This secure, scalable, and maintenance-free software ensures employees receive timely and accurate paychecks. Perk Payroll is feature-packed with solutions for employee management, time and attendance management, tax management, reimbursements, loan management, and more. Read Perk Payroll Reviews

Explore various Perk Payroll features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Perk Payroll Features- Payroll Management

- Record Keeping

- Leave Management

- Data Security

- Exit Management & Seperation Management

- Formula Defined Salary Calculation

- Attendance management

- Multi Company

Pricing

Basic

$ 14

Per Month

Perk Payroll Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

India's Leading HR & Payroll Management Software

SumoPayroll is a leading cloud-based online payroll software that saves you monthly hours on payroll processing. Its fast and intuitive payroll system helps run the payroll process with just one click. SumoPayroll is ideal for payroll automation in companies of small and medium size. Read SumoPayroll Reviews

Explore various SumoPayroll features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all SumoPayroll Features- Performance Appraisal

- Benefits Management

- Employee field customization

- Employee Self Service Management

- PF/ESIS Calculation

- Time & Attendance Management

- Payroll Management

- Geo tracking

Pricing

Monthly Plan

$ 18

Per Month

SumoPayroll Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Payroll crafted for building a better workplace

Zoho Payroll is one of the best payroll programs for federal and state tax compliance. It makes your workplace better with its simplified payroll system that helps with automatic payroll calculation, salary structure management, statutory compliance, seamless collaboration, and more. Zoho Payroll uncomplicates payroll processes with its one-click payroll run, custom deductions, automated loan management, employee exit management, etc. Read Zoho Payroll Reviews

Explore various Zoho Payroll features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Zoho Payroll Features- Mobile Support

- Salary Information & History

- TDS Calculation

- PF/ESIS Calculation

- Employee Self Service Management

- On-Boarding

- Reimbursement Management

- HR & Payroll

Pricing

Free

$ 0

Free forever

Standard

$ 1

Employee/Month

Professional

$ 1

Employee/Month

Zoho Payroll Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

For your business to grow, your people must grow

greytHR is a cloud-based HRMS and online payroll system that simplifies payroll management and improves employee productivity. It is the most reliable solution for faster payroll processing and accurate payouts. With greytHR as your payroll partner, you can expect 100% statutory compliance, on-time disbursements, zero computation errors, and stress-free month ends. Read greytHR Reviews

Explore various greytHR features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all greytHR Features- Employee Lifecycle Management

- Arrears Calculation

- Salary Information & History

- Multi-Location

- Document Management

- Expense Reporting

- Reimbursement Management

- Leave Management

Pricing

Starter

$ 0

Per Month for maximum 25 Employees

Essential

$ 49

Per Month for 50 Employees, INR 30 PEPM

Growth

$ 76

Per Month for 50 Employees, INR 60 PEPM

greytHR Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

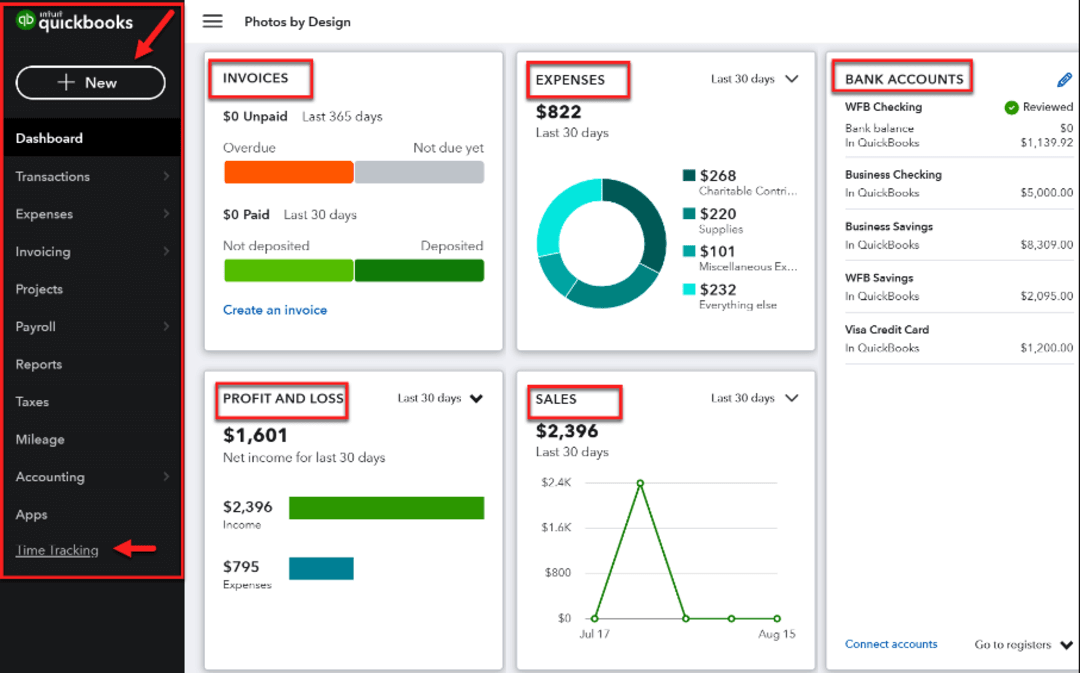

Making Modern Businesses GST friendly

QuickBooks offers affordable and secure online payroll services for small businesses. It helps manage and access payroll tools and services seamlessly and provides real-time automated payroll reports. QuickBooks helps with tax penalty protection, tax filing, time tracking, contractor payments, health benefits, hiring and management, HR management, paychecks and pay stubs management, etc. Read QuickBooks Online Reviews

Explore various QuickBooks Online features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all QuickBooks Online Features- Vat

- Discount & Schemes

- Payments

- MIS Reports

- e-Payment

- Vendor Management

- Real Time Reporting

- Time Tracking

Pricing

Simple Start

$ 30

Per Month

Essentials

$ 60

Per Month

Plus

$ 90

Per Month

QuickBooks Online Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

India’s Most Popular HR & Payroll Software

HROne is a smart web-based payroll software known for making the most complex payroll operations simple. It offers integrated and simplified solutions to satisfy employees with timely salary credits. HROne payroll management software can help you manage salary structure, salary verification, payroll queries, statutory compliances, employee service, and payroll insights. Read HROne Reviews

Explore various HROne features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all HROne Features- Workflow Management

- Overtime Tracking

- Salary Information & History

- IP Restriction on Attendance

- Email Integration

- Employee Reward Programs

- Mobile Support

- Time & Attendance Management

Pricing

Basic

$ 1

User/Month

Professional

$ 2

User/Month

HROne Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

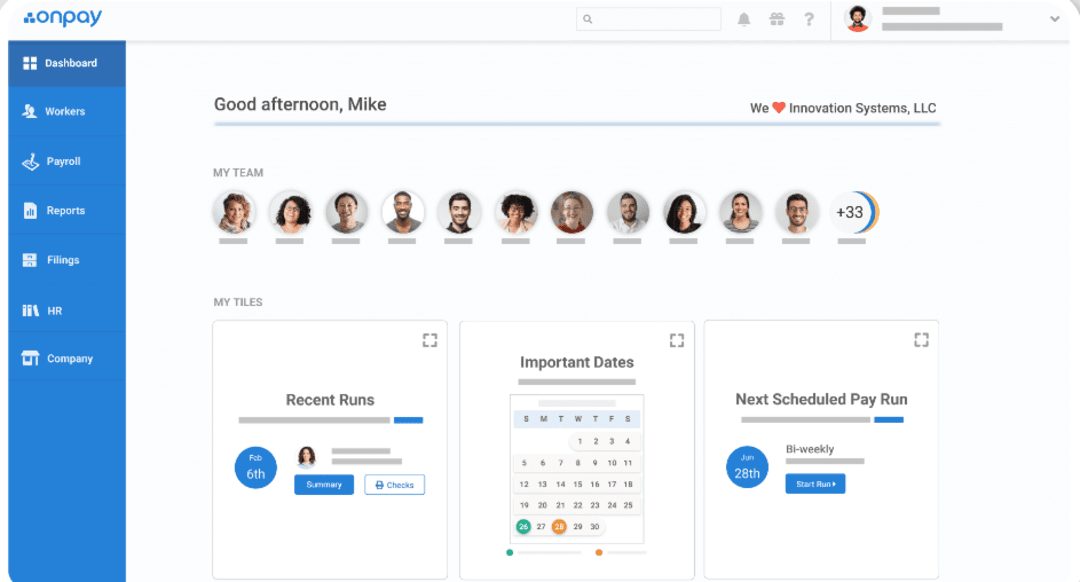

Software by OnPay, Inc

OnPay provides fast and robust online payroll solutions for small businesses like startups, entrepreneurs, non-profits, etc., to help them accelerate their growth. It is an all-in-one payroll software that helps with automatic tax payments, payroll insights, statutory compliance, and more. OnPay easily integrates with popular HRMS tools to simplify payroll management. Read OnPay Reviews

Explore various OnPay features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all OnPay Features- Payroll Management

- Shift Management

- Expense Management

- Pay Slip

- Time & Attendance Management

- Document Management

- Data Imports/Exports

Pricing

Basic

$ 40

User/Month

OnPay Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Keep your time and money

Patriot Payroll helps with accurate, timely, and compliant payroll processing. It offers the best online payroll services for payroll tax filing, tax deposits, paycheck generation, time and attendance tracking, and more. Patriot Payroll provides free and easy onboarding and setup and demands no long-term contracts. Read Patriot Payroll Reviews

Explore various Patriot Payroll features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Patriot Payroll Features- Salary Adjustment

- Vacation / Leave Tracking

- Vacation/Leave Tracking

- Time Tracking by Client

- Bonus

- Taxation Management

- Salary Information & History

- Dashboard

Pricing

Basic Payroll

$ 17

Per Month

Full Service Payroll

$ 37

Per Month

Patriot Payroll Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

A dependable partner for your People & Business

SBS HR offers the best online payroll services to help you effortlessly run payroll on time every month. The software offers a range of payroll management services, including an employee self-service portal, time and attendance management, leave management, digital document management, F&F settlement process, tax verification, 24Q & Form 16 generation, statutory and labor compliance, helpdesk with escalation matrix, etc. Read SBS HR Reviews

Explore various SBS HR features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all SBS HR Features- Statutory Compliances

- Mobile Support

- Tax Management

- Time Off Requests

- Workflow Management

- Formula Defined Salary Calculation

- Vacation/Leave Tracking

- Compliance Management

Pricing

Standard

$ 97

Upto 100 Employees

SBS HR Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Software by SurePayroll

Surepayroll is one of the cost-effective online payroll solutions. This easy-to-set-up and fast-to-learn software can run full-service payroll for you at half the cost. Surepayroll offers tax calculation and filing services, automated payroll runs, easy direct deposit setup, and more to simplify payroll management. Learn more about SurePayroll

Explore various SurePayroll features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all SurePayroll Features- Eligibility Management

- Leave Management

- Time & Attendance Management

- Expense Management

- Payroll Management

- Document Management

SurePayroll Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

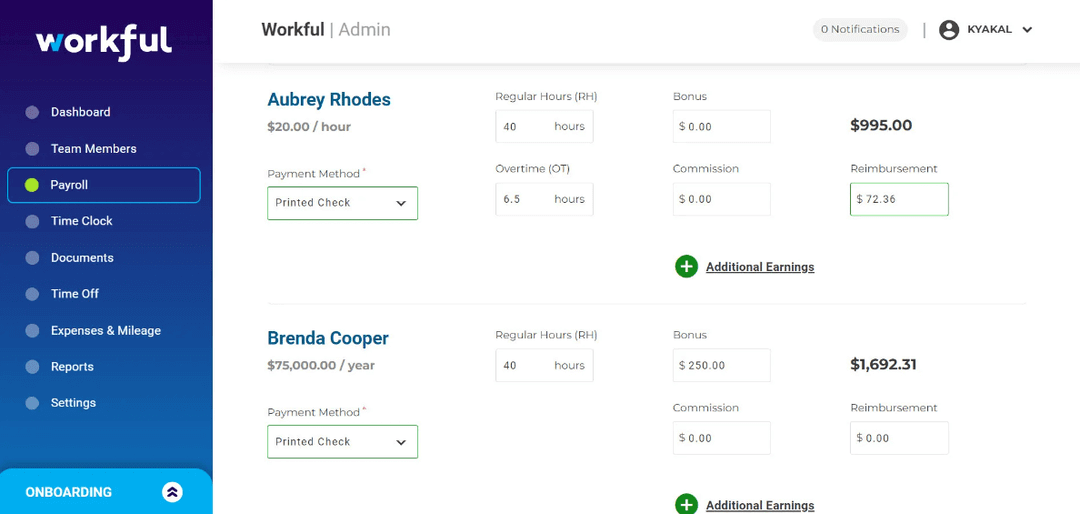

Software by Workful

Workful is the best online payroll software for small businesses. It simplifies payroll management through its extensive payroll management capabilities, like payroll processing, payslip generation, statutory compliance, incentive management, salary revision, loan disbursements, and much more. Workful also offers automated reporting and analytics to help you make data-backed decisions. Learn more about Workful

Explore various Workful features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Workful Features- Check Printing

- Vacation/Leave Tracking

- W-2/1099 Preparation

- Wage Garnishment

- Direct Deposit

- Multi-State

- Tax Management

- Self Service Portal

Workful Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Software by Paycom

Paycom offers the best online payroll services with comprehensive payroll management tools. The software ensures stress-free payroll, boosts employee experience, and mitigates your risk of penalties and lawsuits through automated payroll management. Paycom also helps with talent acquisition, talent management, HR management, and time and labor management. Learn more about Paycom

Explore various Paycom features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Paycom Features- Recruitment Management

- Employee Self Service Management

- Onboarding

- Salary Information & History

- Appraisal Management

- Tax Management

- Document Management

- Wage Garnishment

Paycom Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Best HR and Payroll Software for Digital HR

Pocket HRMS is a market-leading online payroll system that empowers businesses to leverage the power of automation and artificial intelligence in payroll management. Its fast and error-free payroll system gives you the freedom from spreadsheets, whereas its simplified analytics and interactive dashboards make it easier for you to make employee-focused decisions. Read Pocket HRMS Reviews

Explore various Pocket HRMS features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Pocket HRMS Features- Performance Management

- Employee Self Service Management

- Mobile App

- Formula Defined Salary Calculation

- Payroll Management

- Arrears Calculation

- Compliance Management

- Training Management

Pricing

Premium

$ 69

Up to 100 employees

Standard

$ 21

Per Month

Professional

$ 35

Per Month

Pocket HRMS Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Tomorrow's HR Tech, Delivered Today

Zimyo is a top-ranked online payroll software that offers swift and accurate payroll processing in minutes. The software ends your month-end payroll complications with its full suite of features, including tax compliance, expense management, salary disbursement, payroll automation, etc. Zimyo’s seamless integration of popular HRMS platforms simplifies your daily operations by bringing all your data into one place. Read Zimyo Reviews

Explore various Zimyo features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Zimyo Features- Automated Scheduling

- Built-in ATS

- Employee Scheduling

- Expense Reporting

- Employer Accounts

- Automatic Time Capture

- Document Management

- Shift Swapping

Pricing

Basic

$ 1

Per Month

Standard

$ 2

Per Month

Enterprise

$ 3

Per Month

Zimyo Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Next Gen Human Capital Management System

Beehive HRMS is an excellent web-based payroll software that eliminates cumbersome payroll processes with its top-notch payroll and compensation solutions. Trusted by leading organizations, this software streamlines payroll calculations, employee benefits, and statutory for accurate employee compensation. Beehive’s intuitive and user-friendly engine saves time and ensures timely remuneration. Read Beehive HRMS Reviews

Explore various Beehive HRMS features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Beehive HRMS Features- Multiuser Login & Role-based access control

- Employee field customization

- Travel Management

- 360 Degree Feedback

- Recruitment Management

- Project Planning

- Talent Management

- Workflow Management

Beehive HRMS Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

What is Online Payroll Software?

A cloud-based solution called online payroll software aids organizations in managing employee payroll and related duties. It automates tasks associated with payroll, such as determining employee salaries, deducting taxes, producing pay stubs, and transferring money into employee accounts.

Online payroll software can be integrated with other HR management systems and is often accessed through a web-based application or mobile app. It lets companies track time and attendance, manage employee data, and automate tax filings.

By using online payroll solutions, businesses can increase accuracy, decrease errors, save time, and streamline payroll procedures. In-depth analytics and reports are also provided by the program to aid with regulatory compliance and personnel decision-making for firms.

How Does Online Payroll Software Work?

Online payroll software often automates payroll processes, including tax filing and employee salary calculation.

A payroll system can be easily configured by entering important data such as employee information, benefits, pay rates, and tax details. This enables you to create a centralized database in your online payroll system.

Moreover, you can also record employees’ working hours and leaves, and calculate their pay based on the work done. With the best online payroll services, you can stay compliant with the tax and regulations imposed by the government.

Lastly, with this software, payroll taxes can be filed automatically, and payments can be made directly to federal entities. This helps in saving time and improves overall productivity.

What Type of Buyer Are You?

It's crucial to consider the buying style when picking online payroll software. Small firms with less than 50 people, mid-sized businesses with between 50 and 1000 employees, and major corporations with more than 1000 employees all have various needs.

Payroll software features and capacities may vary according to the type of buyer.

-

Basic Payroll Needs

For small firms with straightforward payroll requirements, basic payroll software is suitable. This software frequently has functions like withholding taxes, creating pay stubs, and calculating employee hours.

Payroll software that is more basic is less expensive than more complex software. It is a good option for companies that don't need sophisticated services like benefits administration or time and attendance tracking.

-

Payroll and Accounting Software

Payroll and accounting software is designed for businesses that need to manage payroll and track financial transactions. This type of software typically includes advanced features such as budgeting, forecasting, and tax planning tools.

Payroll and accounting software is a good choice for businesses that need to manage both payroll and financial operations and want to integrate these processes into a single system.

-

Complete HR Suites

Complete HR suites are designed for mid-sized and large businesses that need a comprehensive HR management system.

This software integrates various HR functions, including payroll, benefits administration, time and attendance tracking, recruiting, and performance management.

Complete HR suites typically have the most advanced features and functionality, such as customized reporting and analytics, compliance monitoring, and employee self-service portals. Complete HR suites are a good choice for businesses that want to manage all aspects of HR in a single system.

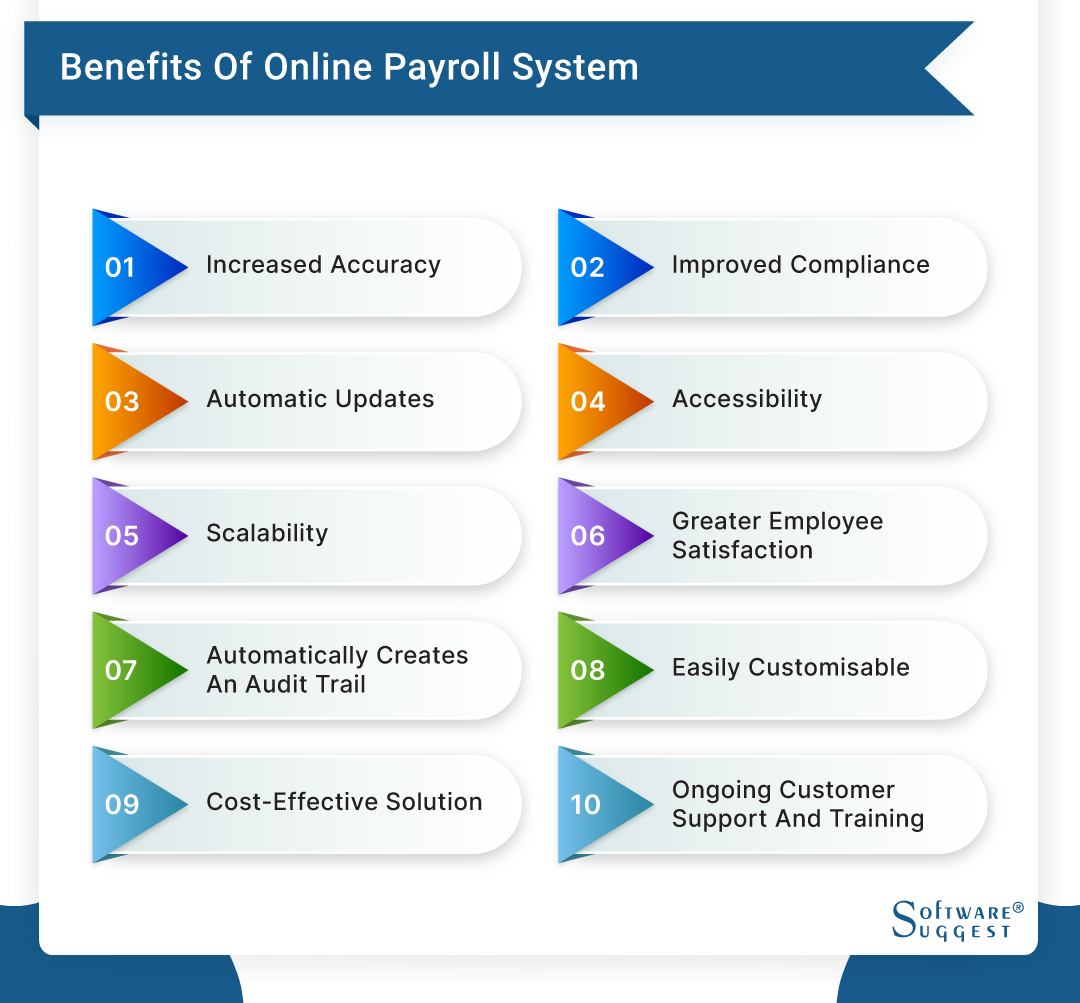

Top Benefits of Online Payroll System

An online payroll system is developed to streamline companies' entire payroll process. From employee management to salary processing, it can help in every task. Below are the main benefits of an online payroll system.

-

Increased Accuracy

Online payroll systems aid firms in increasing accuracy and reducing payroll errors. Automatic payroll, tax, and benefit computations can reduce or even eliminate the potential for human error, and the system can notify users of any errors or problems.

-

Improved Compliance

This software ensures that tax and payroll laws are followed. Businesses can avoid fines and penalties for non-compliance by using the system, which will automatically compute taxes, make deductions, and file payroll taxes on time.

-

Automatic Updates

The most recent tax and payroll rules are immediately updated in online payroll systems, ensuring that firms adhere to the law. These automatic upgrades can reduce businesses' workloads, guaranteeing they stay current with regulatory changes.

-

Accessibility

Web-based payroll software provides businesses access to their payroll data from anywhere with an internet connection. This accessibility can help businesses manage their payroll processes remotely, such as when employees work remotely or on business trips.

-

Scalability

Online payroll systems can scale with businesses as they grow. The system can handle more employees and transactions without sacrificing performance, allowing businesses to expand without investing additional resources.

-

Greater Employee Satisfaction

This software offer self-service portals for employees, allowing them to access their payroll information easily and quickly. This can improve employee satisfaction and reduce the workload for HR departments.

-

Automatically Creates an Audit Trail

Online payroll systems automatically create an audit trail, making tracking changes and maintaining compliance easier. This audit trail can help businesses to identify potential errors or issues quickly and reduce the risk of fraud or mismanagement.

-

Easily Customisable

Online payroll solutions can be customized to suit the specific needs of a business, allowing them to tailor their payroll processes and systems. This customization can improve efficiency and reduce administrative costs.

-

Cost-Effective Solution

Online payroll systems are cost-effective compared to traditional ones, as they reduce the need for manual processes, data entry, and paper-based systems. This cost-saving can benefit businesses of all sizes.

-

Ongoing Customer Support and Training

This software also offers users ongoing customer support and training, ensuring they can utilize the system effectively. This support can help businesses to maximize the benefits of their online payroll system and avoid potential issues or errors.

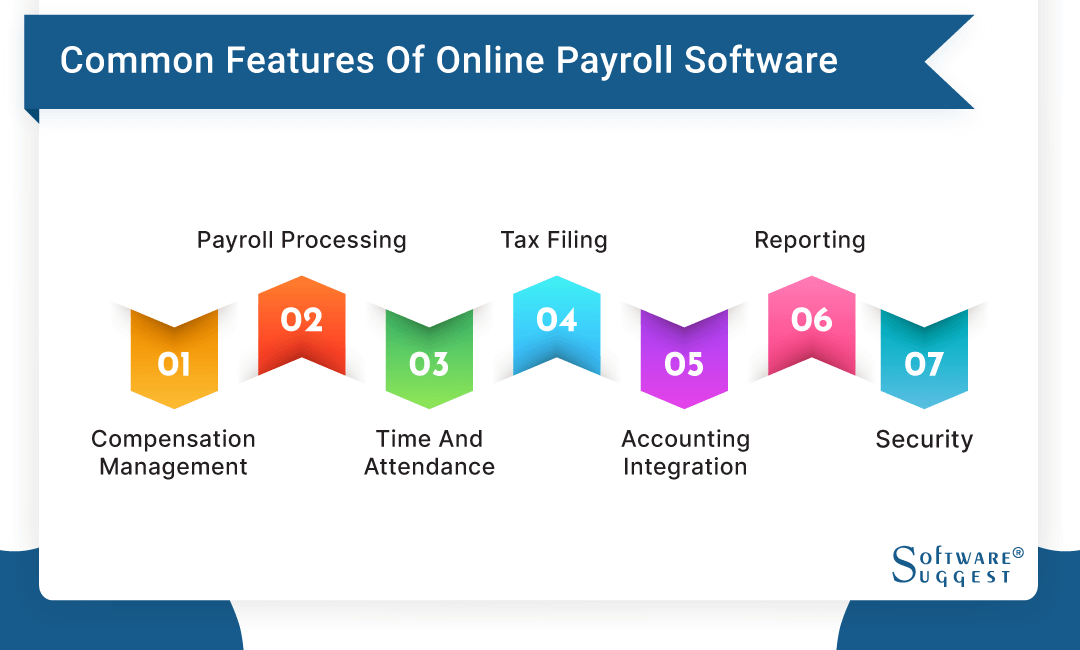

Key Features of Best Online Payroll Software

Online payroll software has become essential for businesses of all sizes to manage their payroll processing and employee management needs.

These software systems have various features designed to streamline payroll operations, increase accuracy, and improve compliance with government regulations. Some of the common features of the best online payroll services include:

-

Compensation Management

Online payroll software frequently includes a function called compensation management that enables employers to control employee compensation and benefits. Regular and overtime pay calculations and processing, handling employee deductions, including taxes and benefits, and year-end reporting and tax filings are all included in this function.

-

Payroll Processing

Cloud-based payroll solution's core functionality is payroll processing, which enables organizations to control employee pay and payroll records. All employee payroll processing, sending paychecks and producing reports outlining payroll expenses are all included in this service.

-

Time and Attendance

Time and attendance tracking is a critical feature of online payroll software, allowing businesses to manage employee schedules, track time worked, and manage employee absences. This feature includes tracking employee time and attendance, monitoring employee schedules, and generating reports detailing employee time and attendance records.

-

Tax Filing

Tax filing is a crucial feature of online payroll software, allowing businesses to calculate and file payroll taxes accurately and on time. This feature includes managing employee tax withholdings, calculating payroll taxes, and generating tax reports.

-

Accounting Integration

Integration with accounting software is a common feature of this software, allowing businesses to manage their financial records and payroll data in one place. This feature includes integrating payroll data with accounting software, automatically transferring payroll data to accounting records, and generating financial reports.

-

Reporting

Reporting is a critical feature of online payroll software, allowing businesses to generate reports detailing payroll expenses, employee pay, and other critical payroll data. This feature includes generating standard and custom payroll reports, exporting reports to various file formats, and viewing and analyzing data from different angles.

-

Security

Security is a crucial feature of online payroll programs, ensuring the safety and confidentiality of payroll data. This feature includes using encryption technology to protect sensitive data, restricting access to payroll data to authorized personnel, and providing access controls to protect against data breaches.

Top 5 Online Payroll Software Comparison

|

Name

|

Free Trial

|

Demo

|

Pricing

|

|---|---|---|---|

|

30 Days |

Yes |

Starting price at $8.75/month |

|

|

30 Days |

Yes |

Starting price at $39/month |

|

|

14 Days |

Yes |

On Request |

|

|

14 Days |

Yes |

Starting price at $40/month |

|

|

14 Days |

Yes |

Starting price at $35/month |

Choosing the best online payroll services can be critical for businesses to ensure smooth payroll processing, accurate record-keeping, and compliance with government regulations.

Many online payroll software options are available, each with unique features and benefits. This section will overview the top five online payroll solutions.

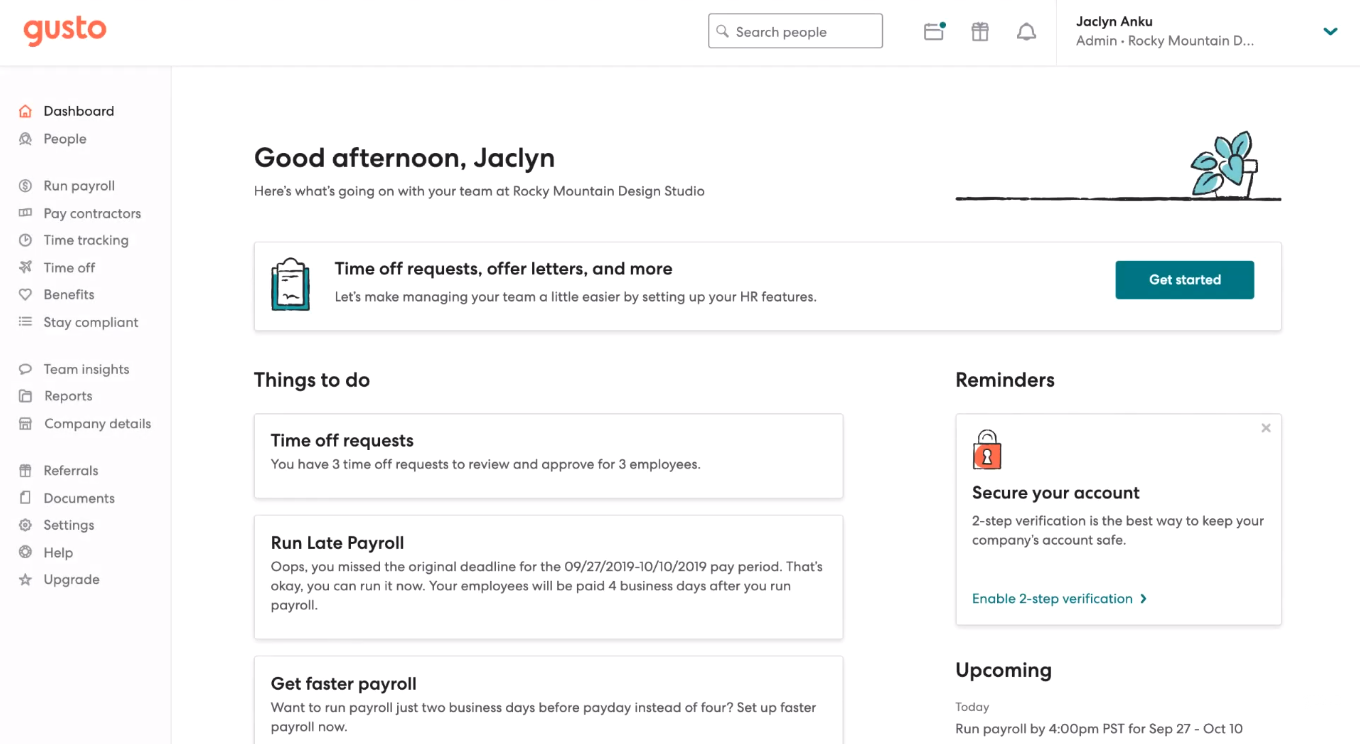

1. Gusto

Gusto is a cloud-based payroll and HR software for small and medium-sized businesses. It offers a range of features, including employee onboarding, payroll processing, benefits administration, and compliance management. Gusto also provides tools for time tracking, vacation tracking, and reporting, making it easier for businesses to manage their workforce.

With its user-friendly interface and automation features, Gusto streamlines HR and payroll processes, saving businesses time and reducing errors. The software integrates with popular accounting software and offers mobile apps for on-the-go access.

- Payroll processing

- Benefits administration

- Compliance and compensation management

- Time tracking

- Workflow management

- Employee onboarding

- Reporting

- Mobile app

- Intuitive, natively online platform

- Seamlessly integrated with QuickBooks Online

- Provide complete and file tax/compliance documents

- Payroll processing

- HR Management

- Customer Service

- No International Support

- Multiple withdrawals for payroll, employee, and employer taxes

Pricing

- Core plan: $39/month + $6/month per person

- Complete plan: $39/month + $12/month per person

- Concierge plan: $149/month + $12/month per person

2. Quickbooks

QuickBooks is a popular cloud-based payroll solution developed and marketed by Intuit. It is designed to help small and medium-sized businesses manage their financial operations more efficiently. QuickBooks offers a range of features, including invoicing, expense tracking, bank reconciliation, payroll management, inventory tracking, and financial reporting.

The software is available in desktop, online, and mobile versions, allowing users to work from anywhere. QuickBooks is known for its user-friendly interface and integration with other third-party applications. It is a popular choice for businesses looking to streamline their accounting processes and run payroll processes.

- Invoicing

- Expense tracking

- Payroll management

- Inventory management

- Financial reporting

- Time tracking

- Integration with third-party applications

- Mobile access

- User-friendly interface

- Integration with other applications

- Customizable

- Comprehensive reporting

- Time-saving features

- Limited scalability

- Limited industry-specific features

- Limited customization in some areas

- Expensive

- Customer support

Pricing

- Simple Start: $25 per month

- Essentials: $50 per month

- Plus: $80 per month

- Advanced: $180 per month

3. Paychex Flex

Paychex Flex, a human resource management program, offers various payroll and HR services. The program includes tools for managing benefits, hiring, performance review, and applicant tracking, in addition to time and attendance management.

It also offers a mobile app so users can view employee information and carry out other HR-related tasks while on the go. Paychex Flex is designed to be expandable for companies of all sizes and offers flexible pricing and support choices.

- Payroll processing

- Employee self-service

- Time and Attendance

- Benefits administration

- Hr compliance

- Mobile app

- Analytics and Reporting

- Integration

- Comprehensive solution

- User-friendly interface

- Customizable

- Mobile app

- Integration

- Cost is very high

- Customer service is unreachable at times

- Limited customization options

- Lack of international support

Pricing

-

On Request

4. OnPay

OnPay is a cloud-based payroll software for small to mid-sized businesses. The platform offers a range of features and tools, including full-service payroll processing, benefits administration, HR compliance, and employee self-service.

OnPay is customizable, affordable, and integrates with other HR and accounting software. It provides businesses with a comprehensive solution to streamline payroll and HR processes while ensuring compliance with federal and state employment laws.

- Activity dashboard and tracking

- Audit management

- Benefits management

- Collaboration tools

- Compliance management

- Document management

- Employee management

- Payroll management

- Task management

- Tax compliance

- User-friendly

- Affordable pricing

- Customizable plans

- Excellent customer support

- Comprehensive features

- Mobile app

- Limited integrations

- Limited reports

- Limited international support

- Limited features for large businesses

Pricing

- Free trial for 1 month

- Base Fee: $40 per month

5. Workful

Small firms can use the cloud-based payroll services and HR software called Workful. Payroll processing, time and attendance monitoring, HR compliance, benefits management, and employee self-service are just a few of the functions available on the platform.

Workful is reasonably priced, simple to use, and adaptable to the requirements of small enterprises. To assist businesses in adhering to federal and state employment rules, the platform also gives them access to HR tools, including job descriptions and employee handbooks.

- Compensation management

- Data import/export

- Document management

- Employee management

- Payroll reporting and management

- Policy management

- Real-time updates

- Reporting & statistics

- Tax compliance

- Timesheet management

- Vacation/leave tracking

- W-2 preparation

- User-friendly

- Affordable pricing

- Customizable plans

- Comprehensive features

- HR resources

- Limited features for large businesses

- Limited benefits options

- Technical issues

Pricing

- $35 per month

How To Set Up An Online Payroll System?

The best online payroll services can help you streamline your payroll process and save time and money. Here are some steps to follow to set up an online payroll system:

Step 1 - Research and select one that meets your business needs. Look for software that offers direct deposit alternatives, automatic tax calculations, and employee self-service capabilities.

Step 2 - Collect necessary employee information, such as full name, Social Security number, bank account details, and tax withholding forms.

Step 3 - Establish accounts on the payroll software for your company and your employees. Don't forget to enter the personnel data you've obtained into the system.

Step 4 - Decide how often your employees will be paid, such as weekly, bi-weekly, or monthly.

Step 5 - Input employee hours worked, pay rates, and any deductions or bonuses into the payroll software.

Step 6 - Check the payroll data for accuracy and make any necessary adjustments before approving the payroll.

Step 7 - Process payroll by either sending out direct deposit payments or printing checks.

Step 8 - Pay and file taxes accurately and on time using the payroll software.

Step 9 - Employees can access their pay stubs and other payroll information through the software’s self-service portal.

Step 10 - Keep accurate records of all payroll transactions and related documents.

Top Challenges in Online Payroll Solutions

Online payroll software is an excellent tool for businesses to manage their payroll process more efficiently. However, it can also present several challenges, including :

-

Administrative Issues

Online payroll software requires administrative personnel who can operate it efficiently. A lack of skilled personnel can result in errors and inefficiencies in the payroll process. Moreover, administrative issues can also arise due to complex payroll calculations, changing tax laws, and compliance requirements.

-

Organizational Challenges

Organizations often have complex payroll structures that require different pay rates, overtime rules, and benefit plans for different employee categories. Managing such structures can be challenging for online payroll providers, which may result in incorrect pay calculations and compliance issues.

-

Incompatible Software

Many organizations have existing payroll, HR, or accounting software and tools. Integrating these tools with online payroll program can be difficult due to software incompatibility issues. In such cases, organizations may need to upgrade or purchase new software, which can be costly and time-consuming.

-

Tracking Employee Absence

Online payroll software needs to track employee absences accurately, such as vacation time, sick leave, and personal days. However, tracking employee absences can be challenging for online payroll software, particularly for unanticipated or long-term absences.

-

Compliance Risks

Online payroll software must comply with various payroll, tax, and benefits regulations. Non-compliance can result in penalties and fines and damage the organization's reputation. Additionally, compliance requirements can frequently change, making it challenging for online payroll software to keep up with the latest regulations.

Latest Trends in Online Payroll Software

The trends are shaping the future of best online payroll software, making it more efficient, accurate, and user-friendly.

Businesses should consider these trends when selecting online payroll software to ensure they get the most up-to-date features and functionality. Below are some important trends in online payroll solutions:

-

Artificial Intelligence (AI) and Machine Learning (ML)

AI and ML are increasingly integrated into online payroll software to streamline processes and improve accuracy. These technologies can automate data entry, detect errors, and suggest ways to optimize payroll processes.

-

Mobile Accessibility

With the increasing use of mobile devices, online payroll software is being developed with mobile accessibility in mind. This trend allows employees to access their payroll information and change their details from their mobile devices, making it more convenient and flexible.

-

Cloud-based payroll solution for larger enterprises

Online payroll software is moving towards web-based payroll software, which can handle more data and provide more scalability. This trend is particularly useful for larger enterprises with complex payroll structures.

-

Integrations with other systems

Online payroll software is integrated with other systems such as HR, accounting, and time and attendance tracking. This trend ensures that data is consistent across systems and eliminates the need for manual data entry, saving time and reducing errors.

-

Increased focus on employee experience

Online payroll program is now being designed with an increased focus on the employee experience. This trend includes self-service portals, personalized interfaces, and user-friendly dashboards, making it easier for employees to access payroll information and manage employee benefits.

Conclusion

Online payroll software has become crucial for businesses to manage their payroll operations effectively. Many advantages include enhanced compliance, precise computations, and time-saving automation. Businesses should know the administrative issues, organizational difficulties, and compliance hazards associated with employing online payroll software.

FAQs

Online payroll software can be secure if proper security measures are in place. This software stores sensitive employee and company data, such as Social Security numbers, bank account information, and tax information, making it a target for cyber-attacks.

To ensure security, online payroll software providers typically employ several security measures, including:

- Encryption: Online payroll software should encrypt data in transit and at rest. Data is encrypted to ensure that it cannot be read by anyone who does not have the proper decryption key.

- Multi-Factor Authentication (MFA): By requiring users to submit several pieces of identity, such as a password and a verification code, MFA increases the security of online payroll software.

- Access controls: This software should have access controls limiting sensitive data access to only authorized personnel.

- Regular software updates: Online payroll software providers should update their software to address security vulnerabilities and bugs.

- Regular security audits: This software should perform regular security audits to identify and address security weaknesses in their systems.

The cost of online payroll software can vary depending on several factors, such as the size of the business, the number of employees, and the features included in the software. Here are some common pricing models for online payroll software:

- Subscription-based model: This pricing model charges a monthly or annual fee based on the number of employees or users accessing the software. The cost can range from a few dollars per employee to over $100 per month, depending on the software and the features included.

- Pay-per-use model: This pricing model charges businesses based on the number of payroll runs or times they use the software. This model is usually more suitable for smaller businesses with a few employees.

- Custom pricing: Some online payroll software providers offer custom pricing for businesses with specific needs. This pricing model can be expensive but offers tailored solutions to meet the business's unique needs.

The database for online payroll systems is typically stored on a cloud-based server that the software provider manages. This means that the database is not stored on the business's local servers but in a secure data center managed and maintained by the software provider.

By Countries

.png)