Best Payment Processing Software in 2024

Best payment processing software are MinDBODY, Sage Payment Solutions, Zoho Checkout, Braintree, and Wild Apricot. These online payment processing software solutions provide businesses with the means to process multiple business-to-business (B2B) payments.

No Cost Personal Advisor

List of 20 Best Payment Processing Software

Category Champions | 2024

Cloud Accounting Software Making Billing Painless

This bookkeeping software makes your accounting tasks easy, fast and secure. Start sending invoices, tracking time, and capturing expenses in minutes. We uphold a longstanding tradition of providing extraordinary customer service and building a product that helps save you time because we know you went into business to pursue your passion and serve your customers - not to learn to account. Read FreshBooks Reviews

Explore various FreshBooks features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all FreshBooks Features- Credit Bureau Reporting

- Accounts Receivable

- Multi Currency

- VAT / CST / GST Reports

- Billable Hours Tracking

- Dashboard

- Accounting Management

- Mobile Support

Pricing

FreshBooks Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Software by Veem

Veem is a modern global bank-to-bank payments service that provides businesses with the easiest way to pay and get paid. It lets you track your payments with its real-time payment tracker; thus, ensuring transparency. With Veem’s robust encryption and fraud prevention technology, you can set a new standard for international and domestic money transfers. Read Veem Reviews

Explore various Veem features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Veem Features- Pay Services

- Payment Analytics

- Invoices

- Receipt Printing

- MIS Reports

- Invoice Management

- Invoice Payments

- Online Payment

Veem Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Software by Amazon Payments Inc

We all are familiar with the present buzz-word amazon Pay app. It has easy modules which help you add money, view your receipts and payment statement, add & send gift cards, easily recharge mobile, and so on. Read Amazon Pay Reviews

Explore various Amazon Pay features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Amazon Pay Features- MIS Reports

- Recurring Billing

- Customer Communication

- Multiple Payment Options

- Online Payment

- Invoice Payments

- Payment Processing

- Debit Card Support

Amazon Pay Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Software by GoCardless

GoCardless is a fully featured Billing & Invoicing Software designed to serve Startups, Enterprises. GoCardless provides end-to-end solutions designed for Web App. This online Billing & Invoicing system offers Online payments, Recurring/Subscription Billing, Payment Processing, Project billing, Recurring Billing at one place. Learn more about GoCardless

Explore various GoCardless features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all GoCardless Features- Recurring/Subscription Billing

- Multi-Currency

- Payment Processing

- Project billing

- Recurring Billing

- Online payments

Pricing

Standard

$ 0

Per Month

Plus

$ 64

Per Month

Pro

$ 254

Per Month

GoCardless Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Everything you Need to Run Your Business

If you are looking for software to revolutionize your small business communication Thryv is the right choice for you. It helps you to manage customer and contacts sending them fast text messages and Emails. Read Thryv Reviews

Explore various Thryv features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Thryv Features- Scheduling

- Online Reviews

- Workflow Management

- AI Recommendations

- Quotes/Estimates

- Performance Management

- Payment Processing

- Scheduling & Appointments

Pricing

Basic

$ 0

Per Month

Plus

$ 20

Seat/Month

Professional

$ 30

Seat/Month

Thryv Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Software by PayPal, Inc

Venmo is a payment gateway software created by PayPal. It acts as your digital wallet. You can directly link your bank accounts to this app and transfer money through Venmo account. Learn more about Venmo

Explore various Venmo features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Venmo Features- Transaction Data Management

- Invoices

- Invoice Payments

- Secured server

- No Paperwork

- Multiple Payment Types

- Transaction Alerts

- Zero Setup Cost

Venmo Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Free Accounts Payable software for US businesses

Melio is a free Accounts Payable software for small businesses. It allows companies to pay vendors using free bank transfers or credit/debit cards, while the vendors get paid via a bank transfer or check. Read Melio Reviews

Explore various Melio features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Melio Features- Mobile Payments

- Billing Portal

- Duplicate Payment Alert

- ACH Payment Processing

- Billing Management

- Import / Export Management

- Approval Process Control

- Check Processing

Pricing

Free

$ 0

Forever

Melio Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Software by PayPal, Inc

Paypal will prove to be your digital wallet with the best built-in features. It comes with 180-day refund window, free return shipping, top-notch protection to your financial details, one-touch login, and so on. Read Paypal Reviews

Explore various Paypal features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Paypal Features- Payment Analytics

- Payment Processing

- Debit Card Support

- Invoice Payments

- Receipt Printing

Pricing

PayPal Payments Pro

$ 30

month

Paypal Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Scalable subscription billing software

Zoho Subscriptions is end-to-end subscription billing software, tailored for growing businesses to handle the customer subscription lifecycle. Right from signup to payment, Zoho Subscriptions helps you stay on top of your subscription business at all times. Read Zoho Billing Reviews

Explore various Zoho Billing features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Zoho Billing Features- Vat

- Integrations

- Payment Handling

- Collections

- Taxation Management

- Recurring Donations

- Delayed Billing

- Multiuser Login & Role-based access control

Pricing

Free Edition

$ 0

Forever

Basic Edition

$ 14

Organization/Month billed annually

Standard Edition

$ 28

Organization/Month billed annually

Zoho Billing Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Software by Square, Inc

This is the best POS system for retail stores that automatically creates customers' profile, tracks the customer information, and purchase history. Square Retail Point of Sale system is cloud-based that manage your sales, send invoices, and accepts the payment from any mode. Read Square POS System Reviews

Explore various Square POS System features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Square POS System Features- Reporting

- Tax Management

- Retail Management

- Barcode Scanning

- Inventory Management

- Dashboard

- Stock Management

- Restaurant POS

Pricing

Basic

$ 60

Per Location

Square POS System Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Payment Gateway Powering 6M Businesses in India

Instamojo is a multi-channel payment gateway for India collect payments via SMS, email, Whatsapp, facebook, website and more. Accept Credit/Debit cards, wallets, net banking, UPI, NEFT, and EMI options. Read Instamojo Reviews

Explore various Instamojo features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Instamojo Features- Zero Setup Cost

- Start in Minute

- Multiple Payment Options

- Transaction Data Management

- Multiple Bank Connection

- Dynamic Event Notification

- Secured server

- Multiple Payment Types

Pricing

NEFT/ RTGS/ Bank Transfer

$ 0

For All Transactions

Cards, Net Banking, Wallets, UPI

$ 0

Per Transaction

Digital Products & Files

$ 0

Per Transaction

Instamojo Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Software by MoonClerk

MoonClerk is a fully featured Billing & Invoicing Software designed to serve Agencies, Enterprises. MoonClerk provides end-to-end solutions designed for Web App. This online Billing & Invoicing system offers Payment Processing, Self Service Portal, Fundraising Management, Online payments, Donation Management at one place. Learn more about MoonClerk

Explore various MoonClerk features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all MoonClerk Features- Debit Card Support

- Dues Management

- Online payments

- POS Transactions

- Multi-Period Recurring Billing

- Recurring Invoicing

- Self Service Portal

- Payment Processing

Pricing

Standard

$ 15

Per Month

MoonClerk Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

A System Designed to Handle End to End Payments

Razorpay is the most integrated and world-class payment gateway. Its futuristic features handle end to end the transaction in a matter of minutes. An intuitive payment gateway software to streamline transactions. Read Razorpay Reviews

Explore various Razorpay features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Razorpay Features- Secured server

- Debit Card Support

- Payment Processing

- Simplified Integration

- Start in Minute

- Multicurrency payment processing

- Flat Transaction Fee

- Multiple Merchant Numbers

Pricing

Payment Gateway

$ 0

User/Month

Razorpay Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

All-in-one CRM for independent business owners

HoneyBook is a fully featured Billing & Invoicing Software designed to serve Agencies, Startups. HoneyBook provides end-to-end solutions designed for Windows. This online Billing & Invoicing system offers Contact Database, Mobile Payments, Online invoicing, Multi-Currency, Payment Processing at one place. Read HoneyBook Reviews

Explore various HoneyBook features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all HoneyBook Features- Custom Rate Plans

- Social Media Metrics

- Data Collection

- Energy Price Analysis

- Policy Management

- Invoice Processing

- Dynamic content

- Network Monitoring

Pricing

Starter

$ 19

Per Month

Essentials

$ 39

Per Month

Premium

$ 79

Per Month

HoneyBook Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Software by Adyen

Adyen is a fully featured Payment Processing Software designed to serve Startups, SMEs. Adyen provides end-to-end solutions designed for Windows. This online Payment Processing system offers Online Payments, Debit Card Support, POS Transactions, Receipt Printing, Mobile Payments at one place. Read Adyen Reviews

Explore various Adyen features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Adyen Features- Mobile Payments

- Gift Card Management

- Recurring Billing

- Online payments

- ACH Check Transactions

- Debit Card Support

- Receipt Printing

- POS Transactions

Adyen Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Software by Chargebee

Simplify your account logs by using this recurring billing software which has made it easier to handle subscriptions. Make payments using Chargebee to generate timely invoices. It provides recurring billing solutions to handle billing smoothly. Learn more about Chargebee

Explore various Chargebee features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Chargebee Features- Multi-Period Recurring Billing

- Recurring Donations

- Delayed Billing

- Multi-Currency

- Customer Portal

- Dunning Management

- Invoice history

- Subscription Billing

Pricing

Go

$ 99

Per Month

Rise

$ 299

Per Month

Scale

$ 599

Per Month

Chargebee Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Software by Stripe

Stripe is one of the best payment software, which helps you run an internet business. It provides you most powerful and flexible tools for Internet commerce. Stripe’s designed API’s helps you to create the best product for your users while creating a subscription service, an on-demand marketplace, an e-commerce store. Read Stripe Reviews

Explore various Stripe features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Stripe Features- Multiple Payment Options

- Debit Card Support

- ACH Check Transactions

- Discount Management

- Online Payment

- Payment Processing

- Event Triggers and Webhooks

- Third Party Integration

Stripe Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Software by Payoneer

Payoneer is a payment management software which helps you get paid by multiple ways online from any corner of the world. It is boon to industries involved in consumers situated at distance. Read Payoneer Reviews

Explore various Payoneer features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Payoneer Features- Invoice Management

- Invoices

- Payment Processing

- Secure Data Management

- Generate Comprehensive Reports

- Transfer Key Information to Banks

- Receipt Printing

- MIS Reports

Payoneer Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Software by Fivestars

Upgrade your business rewards points system and connect automatically with your customers by using the multi-dimensional customer loyalty software, Fivestars. Customer acquisition, loyalty building, and local business marketing is like a cake walk with it. Learn more about Fivestars

Explore various Fivestars features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Fivestars Features- User Management

- Member Portal

- Membership Management

- CRM

- Rewards Management

- Corporate Memberships

- Gift Card Management

- Referral Tracking

Fivestars Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Software by Elavon Inc

Elavon is a fully featured Payment Processing Software designed to serve Agencies, Enterprises. Elavon provides end-to-end solutions. This online Payment Processing System offers In-Person Payments, Online Payment Processing, Debit/Credit Card Processing, Mobile Payments at one place. Learn more about Elavon

Explore various Elavon features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Elavon Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

What Is Payment Processing Software?

Payment processing software facilitates the transfer of funds from one party to another. It allows you to accept payments via a credit card, debit card, e-check, and other digital payment methods.

The software also offers automated reconciliation and real-time analytics features to help you track your customer and financial data. Plus, you can enjoy the benefits of subscription management tools for recurring billing services or integrated marketing tools for content campaigns. Moreover, the integration of payment processing tools with financial management software lets automating the whole financial system of your business.

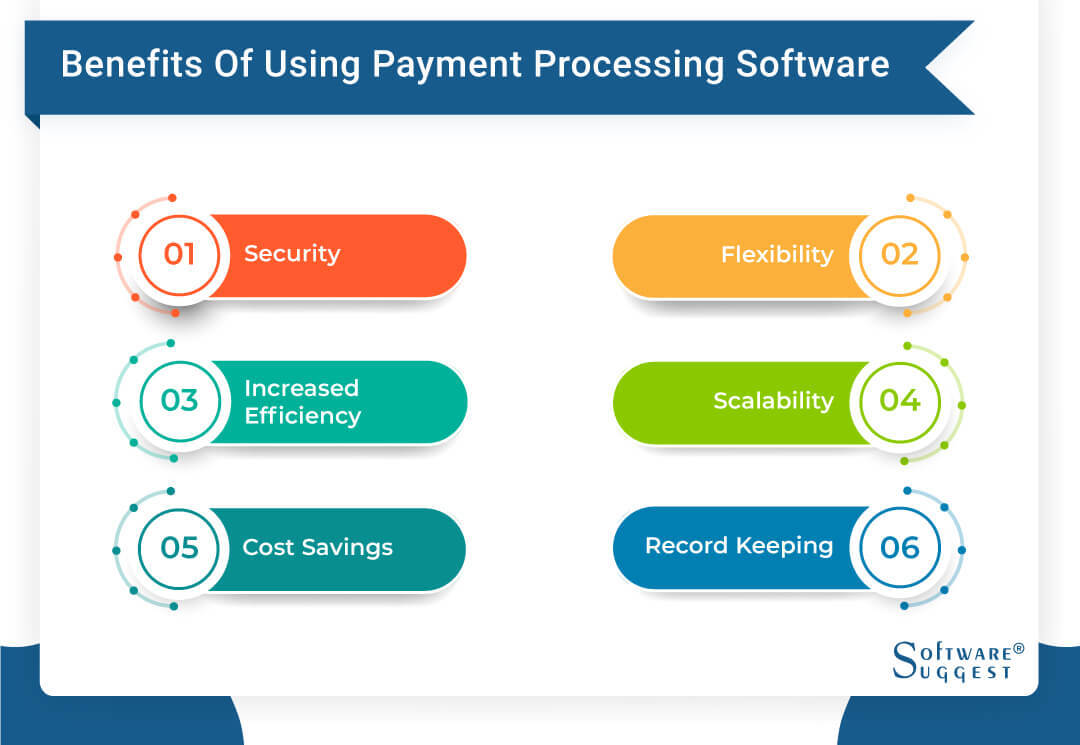

Benefits of Using Payment Processing Software

Payment solutions software has been around for decades and is used by businesses of all sizes. Here are some of the benefits of using the software.

-

Security

Payment processing tools use encryption technology to encrypt sensitive customer data during the online transaction process. They also employ several layers of authentication, such as biometric authentication or PIN codes, to confirm a customer’s identity before allowing them to complete their purchase.

-

Flexibility

The software allows you to set up different payment methods tailored to your needs. You can also enable customers to pay with various currencies or even cryptocurrencies like Bitcoin. With these features, you can expand your customer base beyond your local market and accept payments from all over the world.

-

Increased Efficiency

Online payment processing software makes it easy to manage banking information, streamline customer payment options, and design customized invoices that can be processed online. With the software, you can create automated payment options for customers and track customer spending habits in real-time, thus increasing efficiency.

-

Scalability

The system allows you to increase the number of online transactions you can handle without investing in additional hardware or personnel. If demand falls off, you can also reduce your setup without spending money on unneeded resources. .

-

Cost Savings

By automating payments, you can reduce manual labor costs. You also don’t have to worry about purchasing additional software since most payment processing software companies offer a cloud-based system.

What’s more, these solutions often offer discounts on transaction fees, which helps you cut down on overhead costs and maximize profits.

-

Record Keeping

When you use the best payment processing software, you can maintain updated records of your expenses and revenue. The software also generates reports to give you insights into your expenditure trends. With these functions, you’ll be able to create more accurate budgets on where you need to invest or cut costs.

Users of Payment Processing Software

Payment processing software is used by a wide range of user profiles, from small business organizations to large international corporations.

-

eCommerce Businesses

Payment processing is perfect for the eCommerce business. Not only does it speed up the purchase process but also helps ensure customer security. The software encrypts customer data and simplifies the checkout process by allowing customers to make direct payments without entering any extra information or forms.

-

B2B Businesses

Business-to-business (B2B) companies are turning to payment processing solutions because they simplify billing and invoicing processes. With the software, you can automatically notify customers when payment is due, issue receipts, and generate invoices through a drag-and-drop function.

-

Healthcare Providers

Healthcare providers benefit from the use of payment processing software in many ways. It automates patient billing and collections by allowing users to accept credit cards, e-checks, and other forms of payment.

The software also allows patients to make payments online or through an automated phone system without waiting in line or filling out paperwork.

-

Educational Institutions

The best payment software program allows educational institutions to securely accept payments for tuition, fees, or other related expenses. These tools typically feature an automated interface that simplifies the process of collecting payments from students and ensures accuracy when it comes to deposits into the institution's bank account. .

-

Nonprofits

With payment processing software, nonprofit organizations can generate detailed reports on donors and expenses. They can use these reports as evidence when filing taxes or other documents. Additionally, the software comes with fraud detection features, which help protect donors’ information from becoming compromised by malicious actors.

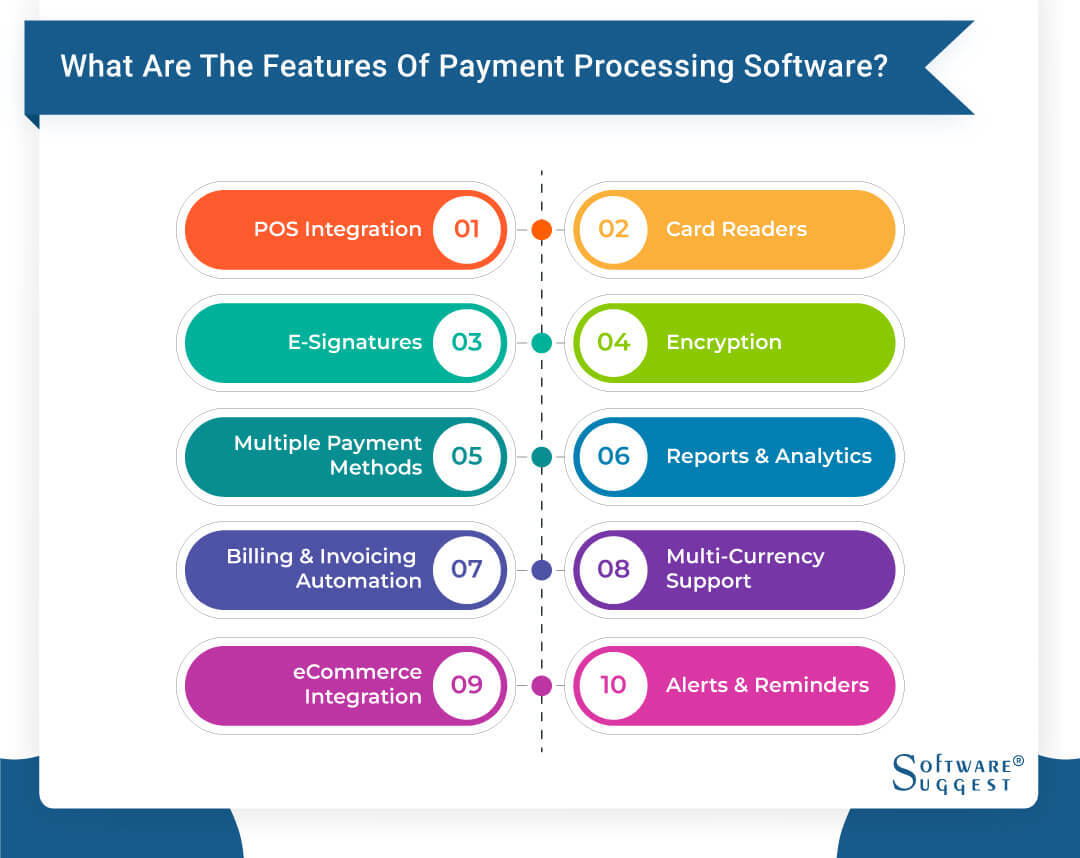

What Are The Features of Payment Processing Software?

Payment processing systems provide various features that help you streamline your entire payment process.

-

POS Integration

Allows you to accept payments through physical and virtual point of sale (POS) systems, such as a mobile device and traditional credit card terminal. It also eliminates the need for multiple merchant accounts since all online transactions are processed through one account.

-

Card Readers

Enables customers to pay for goods or services with their debit card, credit card, or mobile wallet. The card reader feature can also detect when a customer’s device is placed within proximity.

Once detected, the device can securely transmit data between two points without physically swiping the card—making it easier for customers to pay in-store.

-

E-signatures

Allows you and your customers to sign documents without posting or emailing them. This process also ensures all documents are legally binding by verifying the identity of both parties involved in the transaction. This can be done by using digital certificates or other authentication technologies, such as biometrics, passwords, or PINs.

-

Encryption

Works by transforming plain text data into an unreadable code before sending it over the internet. The encrypted information can only be decoded using a special key or password known only to the sender and receiver of the transaction.

With this feature, you can ensure that third parties are unable to access any sensitive information involved in the payment process.

-

Multiple Payment Methods

Allows you to provide several payment options, such as credit cards, debit cards, Paypal, and Apple Pay. This makes it easy for customers to make purchases without using cash or checks, thus increasing customer satisfaction.

-

Reports and Analytics

With this feature, you can determine how much money you’re making from sales, track the progress of transactions, identify potential problems before they become costly blunders, and get a better understanding of your customers’ spending habits. You can also access transaction histories and monthly spending reports.

-

Billing and Invoicing Automation

Allows you to customize billing cycles. For example, you can set up recurring billing payments so customers can make one-time payments online. You may also schedule automatic reminders for customers who have overdue balances.

-

Multi-Currency Support

This feature provides a simple way to offer international customers more convenient payment methods and reduce frustration when dealing with complex payment processes across different countries. You can also ensure you’re receiving the full amount owed without worrying about changes in exchange rates affecting your profits.

-

eCommerce Integration

Simplifies the entire checkout process by synchronizing customer and payment information from your website into your payment processor’s system. With this feature, customers can complete their purchases using saved payment methods.

The integration also helps reduce fraud by enabling third-party authentication services like Verified by Visa or MasterCard SecureCode to double-check customer identities before approving payments.

-

Alerts and Reminders

Allows you to easily receive notifications about any payments due or overdue and any upcoming bills or services that require payment. You can also automate your alerts each time a new invoice is generated or received.

Considerations In Selecting A Payment Processing Software

When considering what payment processing software to choose, there are a few key things you should take into account.

-

User Interface (UI)

The user interface should be intuitive and straightforward so customers feel confident when entering their details on the checkout page. It should also have a good design with clearly-labeled menus and buttons and an organized layout that makes navigation simple.

-

Ease of Use

A good payment processor will have a streamlined system that allows customers to make contactless payments without any complications. As a merchant, you should also be able to reconcile payments with minimal effort.

-

Cost

When calculating costs for payment processing software, you should compare features and the monthly subscription fee from different providers. You should also read through any contracts carefully before signing anything. Plus, be sure to look at the transaction fees or any hidden charges.

-

Customer Support

Excellent customer support will ensure that customers can access help in case there are any issues with their payments or transactions. It also helps build trust between the customers and your business, enhancing the overall consumer experience.

-

Integrations

An online payment processing system should be able to integrate with other solutions like accounting software, shopping carts, and customer management tools. With this ability, you won’t have to switch to another merchant account provider if you need additional features down the line.

-

Value for Money

When evaluating value for money, look at what types of payments can be processed. You also need to make sure that any chosen system will be compatible with your existing technology. Most importantly, calculate how much it will cost in terms of setup fees, monthly fees, and transaction fees.

-

Compliance with Regulations

Your software must be compliant with PCI, DSS or GDPR. You should be able to protect customer information and adhere to best-practice security protocols when you process payments. Additionally, you must ensure you’re familiar with any local, regional, or global rules that may apply to your business operations.

Top 5 Payment Processing Software with Pricing, Pros & Cons

|

Name

|

Free Trial

|

Demo

|

Pricing

|

Visit

|

|---|---|---|---|---|

|

Amazon Pay |

Yes |

No |

Transaction Based | |

|

PayPal |

Yes |

No | Transaction Based | |

|

GoCardless |

Yes |

No |

1% on Transaction | |

|

Stripe |

Yes |

No |

1% on Transaction | |

|

Square |

Yes |

No |

Custom Pricing Packages |

There are many payment processing software options available in today's market. However, not all of them offer the same level of features and services that meet the needs of every business.

Here are some of the best payment software solutions that you need to know about.

- Amazon Pay: Best for High-Growth eCommerce Companies

- PayPal: Best for Startups and Freelancers

- GoCardless: Best for Accounting and Marketing Professionals

- Stripe: Best for Online Retail Stores

- Square: Best for Small Business Organizations

1. Amazon Pay

Amazon Pay is the best payment processing software for high-growth eCommerce businesses. It offers advanced fraud protection technology. And it provides exclusive discounts and promotions for users.

Key Features

- Debit card payments and credit card processing

- Global payments

- Payment fraud prevention

- Online and mobile payment gateways

Pros

- Fast transaction speed

- Doesn’t have any extra processing fee

- Cash back reward on every payment

Cons

- Limited Amazon Pay wallet features

- It can’t be used as a standalone app—you need to access it via the Amazon app

Pricing

- Amazon Pay’s pricing is transaction-based.

2. PayPal

PayPal is the most popular online payment platform for startups and freelancers. You can use it to pay bills, shop online, or transfer funds on the go. The software also allows the linking of multiple bank accounts and credit cards. Plus, it has fraud detection tools to keep users’ personal information safe at all times.

Key Features

- Access control/permissions

- Anomaly detection and machine learning models

- Customizable invoices

- Marketing reports and promotions management

Pros

- Gives a gift reward to every user

- Ease in depositing and withdrawing money either on the web or app

- Easy integration with other websites

Cons

- IPN and API are sometimes unstable

- Transaction fees can be so high

Pricing

- PayPal’s pricing is charged per transaction. A free plan is available.

3. GoCardless

GoCardless is the most reliable and best payment processing software for financial institutions and marketing professionals. It automates your recurring payment processes. It has direct debit capabilities in multiple countries and currencies. And the platform comes with a user-friendly dashboard.

Key Features

- Electronic and online payments

- Recurring/subscription billing and status tracking

- Multi-currency

- Accounting integration

Pros

- Simple interface with good integrations

- Allows for manually keyed transactions

- Competitive rates compared to other providers

Cons

- Doesn’t integrate with Xero well

- Customer service operates on a European business day

Pricing

- GoCardless offers free and two paid monthly subscription fees—Standard ($60/month) and Pro ($238/month).

- A free trial is available.

4. Stripe

Stripe is the most popular payment gateway for online retail businesses. It’s easy to use. It allows you to accept payments from multiple sources. And the software is also easy to integrate with your existing systems.

Key Features

- Cryptocurrency processing

- Partial payments

- Point of Sale (POS) software

- Self Service Portal

Pros

- Safely stores customer information

- An impressive wallet that allows users to store and exchange money or cryptography

- Works with any other payment collector for online businesses

Cons

- Fees for same-country payments are too high

- Could be very costly if you’re in a business with a high dispute rate

Pricing

- Starts at $0.30 per successful card charge

5. Square

Square is the best payment processing system for small business owners. It has a user-friendly interface. Its pricing model has no hidden fees or long-term contracts. And the system enables you to track sales data and create invoices with ease.

Key Features

- Electronic signature

- Gift card management

- ACH payment processing and in person payments

- Mobile card reader

Pros

- Simple yet meaningful reporting capabilities

- Saves your preferences, easy backup

- Easy to integrate into your website or appointment bookings

Cons

-

The card reader functionality doesn’t work well sometimes

Pricing

- Square's pricing varies. Contact their team for custom pricing packages.

- A free plan is available.

Trends Related to Payment Processing Software

As technology advances, so do the trends related to payment processing software.

-

Cryptocurrency

The user interface should be intuitive and straightforward so customers feel confident when entering their details on the checkout page. It should also have a good design with clearly-labeled menus and buttons and an organized layout that makes navigation simple.

-

Mobile Payments

A good payment processor will have a streamlined system that allows customers to make contactless payments without any complications. As a merchant, you should also be able to reconcile payments with minimal effort.

-

Digital Wallets

When calculating costs for payment processing software, you should compare features and the monthly subscription fee from different providers. You should also read through any contracts carefully before signing anything. Plus, be sure to look at the transaction fees or any hidden charges.

-

Shift toward Subscription-Based Models

Excellent customer support will ensure that customers can access help in case there are any issues with their payments or transactions. It also helps build trust between the customers and your business, enhancing the overall consumer experience.

-

Enhanced Security

An online payment processing system should be able to integrate with other solutions like accounting software, shopping carts, and customer management tools. With this ability, you won’t have to switch to another merchant account provider if you need additional features down the line.

Integration of Payment Processing Software

By integrating payment processing systems with other business-related solutions, you can ensure your customers’ payments are securely processed while improving your overall efficiency.

-

eCommerce Platform

With an eCommerce platform integration, you can quickly receive and process payments from customers within a few minutes. You can also offer multiple payment options, such as PayPal, Apple Pay, and Google Pay.

-

Payment Gateways

This provides a secure connection between merchants and customers, allowing for easy acceptance of online payments. With integrated payment gateways, you can also automate the entire process, from customer checkout to invoicing and reconciliation.

-

Payment Analytics

Integrating payment analytics helps you evaluate customer purchase patterns and understand which payment methods are the most effective at driving revenue. With this information, you can adjust your pricing strategies and marketing campaigns.

-

POS Systems

The integration of POS systems enables you to manage sales transactions, track customer purchases, and store information about promotions or loyalty programs. It also allows you to create customized receipts that contain important information, such as product descriptions, prices, and discounts applied at checkout.

Pricing for Payment Processing Software

Payment solutions can be priced in several different ways. Some solutions offer pay-as-you-go models with no long-term contracts or minimum fees required. Meanwhile, others may include a one-time setup fee plus a flat rate pricing structure or per transaction fee.

Depending on the merchant account provider and product, additional fees, such as PCI compliance fees and merchant account setup costs, might also apply.

Conclusion

Selecting the best payment processing software for your business can be a tricky decision. There’s a range of options to choose from, so you should do your research and find the one that works best for you.

Our buyer’s guide has laid out the key features and considerations when making this choice. Now that you know what to look for, it’s time to start comparing different software packages and make an informed decision.

By Countries

By Industries