Best Payroll Software for Accountants

Best Payroll accounting software platforms are greytHR, QuickBooks, Sage 50Cloud, Patriot Payroll, PayWheel, and BusinessCore. These systems have an intuitive interface, advanced features, and security issues.

No Cost Personal Advisor

List of 20 Best Payroll Accounting Software

Contenders | 2024

Software by Paychex Inc

Paychex Flex is a web-based human management need and access traffic of customers if they have a heavy rush on the product. In this system, only one user can use the system at a time no more users can log in that time. That's why it is a very short time wasting. It includes some characteristics like ATS, HRIS, payroll and cheap. Read Paychex Flex Reviews

Explore various Paychex Flex features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Paychex Flex Features- HR & Payroll

- Time Clock

- Training Management

- On-Boarding

- Time & Attendance Management

- FSA Administration

- Leave Management

- Performance Management

Paychex Flex Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Software by Papaya Global

Papaya Global is a fully featured Payroll Software designed to serve Enterprises, SMEs and StartUps. Papaya Global provides end-to-end solutions designed for Web App and Android. This online Payroll system offers Document Storage, Cap Table Management, Financial Modeling, Compliance Management, Reporting/Analytics, Scheduling, Self Service Portal, Vacation/Leave Tracking, Benefits Management, Direct Deposit, Document Management, Multi-Country and Multi-State at one place. Read Papaya Global Reviews

Explore various Papaya Global features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Papaya Global Features- Time Off Requests

- Benefits Management

- Payroll Reporting and Analytics

- Vacation/Leave Tracking

- Multi-State

- Reporting/Analytics

- Financial Modeling

- Employee Self-Service Portal

Pricing

Papaya Global Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Cloud Accounting Software Making Billing Painless

This bookkeeping software makes your accounting tasks easy, fast and secure. Start sending invoices, tracking time, and capturing expenses in minutes. We uphold a longstanding tradition of providing extraordinary customer service and building a product that helps save you time because we know you went into business to pursue your passion and serve your customers - not to learn to account. Read FreshBooks Reviews

Explore various FreshBooks features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all FreshBooks Features- Bookkeeping

- Billing & Invoicing

- Customizable invoices

- Credit Bureau Reporting

- Stock Management

- Mobile Support

- VAT / CST / GST Reports

- Recurring invoice

Pricing

FreshBooks Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

For your business to grow, your people must grow

The greytHR Platform offers productivity tools for better people management, simpler HR processes, and professional delivery of HR services. 20,000+ compaines, 2 million+ employees and available in 250+ Cities across India, 20+ countries - UAE, Saudi Arabia, Kuwait, Qatar etc., rely on greytHR. Best for large, medium & small business HR software. Read greytHR Reviews

Explore various greytHR features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all greytHR Features- Self-onboarding

- Onboarding

- Expense Claims

- Data Security

- Employee Data Base

- Expense Management

- Employee Self Service Management

- Payroll Management

Pricing

Starter

$ 0

Per Month for maximum 25 Employees

Essential

$ 49

Per Month for 50 Employees, INR 30 PEPM

Growth

$ 76

Per Month for 50 Employees, INR 60 PEPM

greytHR Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Software by OnPay, Inc

OnPay is among the most powerful payroll software available in the market. It is working from the last 30 years to help small business enterprises. It integrates with Xero, QuickBooks, etc. Read OnPay Reviews

Explore various OnPay features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all OnPay Features- Payroll Management

- Data Imports/Exports

- Expense Management

- Shift Management

- Document Management

- Time & Attendance Management

- Pay Slip

Pricing

Basic

$ 40

User/Month

OnPay Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Making Modern Businesses GST friendly

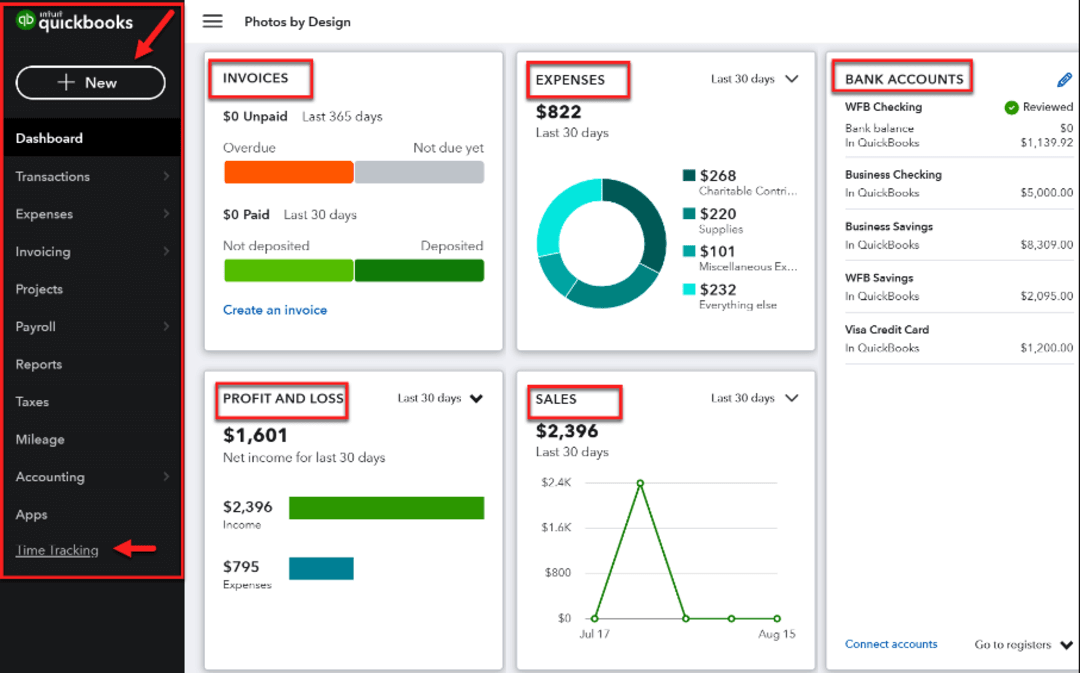

QuickBooks is an online accounting software for business owners to make stay on top of their finances. Easy to use interface, 100% data security and features such as Online bank connect and Whatsapp integration helps business owners to focus on growing their business. Read QuickBooks Online Reviews

Explore various QuickBooks Online features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all QuickBooks Online Features- Discount Management

- Cashflow

- Mobile Support

- Multi-Currency

- Manage Customers and Suppliers

- Partial Payments

- Invoice Processing

- Fast Search

Pricing

Simple Start

$ 30

Per Month

Essentials

$ 60

Per Month

Plus

$ 90

Per Month

QuickBooks Online Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Software by SurePayroll

Surepayroll(Mobile Paycheck) is a one-stop solution for payroll needs. It helps in better tax filling, provides you with two-days processing time for transactions, calculates payroll automatically once you set it up, etc. Learn more about SurePayroll

Explore various SurePayroll features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all SurePayroll Features- Eligibility Management

- Leave Management

- Expense Management

- Document Management

- Time & Attendance Management

- Payroll Management

SurePayroll Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Software by Xero Limited

Xero is award-winning web-based accounting software for small business owners and their accountants. It is beautifully designed and easy to use online bookkeeping for expense management. Read Xero Accounting Reviews

Explore various Xero Accounting features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Xero Accounting Features- Multi Currency

- Product Database

- Task Management

- Loan & Advances Management

- Supplier and Purchase Order Management

- Banking Integration

- Time Tracking

- Invoice

Pricing

Starter

$ 9

Per Month

Standard

$ 30

Per Month

Premium

$ 60

Per Month

Xero Accounting Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Keep your time and money

Our secure online payroll system, paying your employees has never been easier. We’ll help you get started by setting up your payroll, employees, payroll tax information, etc. Read Patriot Payroll Reviews

Explore various Patriot Payroll features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Patriot Payroll Features- Payslips

- Formula Defined Salary Calculation

- W-2/1099 Preparation

- Data Security

- ACH Check Transactions

- Retirement Plan Management

- Tax Management

- Excel Import

Pricing

Basic Payroll

$ 17

Per Month

Full Service Payroll

$ 37

Per Month

Patriot Payroll Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Software by Rippling

Rippling is a fully featured HR Software designed to serve Agencies, Enterprises. Rippling provides end-to-end solutions designed for Macintosh. This online HR system offers E-Verify/I-9 Forms, Multi-Country, Employee Database, Recruitment Management, Employee Lifecycle Management at one place. Read Rippling Reviews

Explore various Rippling features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Rippling Features- Health Insurance Administration

- Policy Management

- COBRA Administration

- Single Sign On

- Reporting/Analytics

- Time & Attendance Management

- Task Management

- Recruitment Management

Rippling Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Software by KashFlow Software Ltd

KashFlow is designed to help make running small business (and larger companies) easy, without you needing any accounting or bookkeeping knowledge. So you’ll be able to pick it up quickly. Read Kashflow Reviews

Explore various Kashflow features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Kashflow Features- HR & Payroll

- Email Integration

- Inventory Management

- Payroll Management

- Billing & Invoicing

- Project Management

- Invoice

- Workflow Management

Pricing

Starter

$ 9

Per Month

Business

$ 18

Per Month

Kashflow Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Software by Sage

Sage offers a complete desktop accounting software that helps you spend less time managing your accounts and more time developing your business. With its easy to use interface, Sage 50cloud Accounting has aided small businesses and entrepreneurs to operate efficiently and effectively. Special Offer: 40% off Sage 50cloud annual subscriptions | Coupon Code: D-1929-0020. Read Sage 50cloud Reviews

Explore various Sage 50cloud features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Sage 50cloud Features- Online payments

- Hourly billing

- Spend Management

- Tax Management

- Project Accounting

- Multi-Currency

- Expense Tracking

- Payment Processing

Pricing

Pro Accounting

$ 51

Per Month

Premium Accounting

$ 78

Per Month

Quantum Accounting

$ 198

Per Month

Sage 50cloud Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Software by Workday, Inc

workday Professional Service Automation System is a cloud-based software that gives resource management, portfolio manage and project leader, and secure data & financial data. It is to manage fully workforce automation lifecycle in a system and an easy links unstaffed job opening requisitions for external fulfillment in the software. Read Workday HCM Reviews

Explore various Workday HCM features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Workday HCM Features- Bonus Management

- Time & Expense Tracking

- Calendar Management

- Email Integration

- Document Management

- Project Management

- Sales Management

- Reporting

Workday HCM Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Software by Paycom

Paycom is an online Payroll Management software that able to make automate Payroll process of your organization. Can create a dashboard to integrate with accounting software to manage expense, calculate salary, incentive, and deduction. Learn more about Paycom

Explore various Paycom features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Paycom Features- Talent Management

- Time & Attendance Management

- Performance Management

- Compensation Management

- Labor Projection

- Wage Garnishment

- Talent Acquisition

- Attendance management

Paycom Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

factoHR - HR Solution for Growth

factoHR is an award-winning Best HR Platform trusted by 3500 Companies & 2.6 million employees, which includes Tata Steel BSL, DENSO, Cycle Agarbatti, BSE, Murugappa, & many others who have improved their productivity by more than 70 % Read factoHR Reviews

Explore various factoHR features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all factoHR Features- Project Management

- Shift Management

- Salary Information & History

- Resume Parsing

- Facial Recognition Attendance

- Feedback Management

- Roster Management

- Scheduling

factoHR Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Software by Thesaurus Software Ltd.

BrightPay gives visual priority to the most common payroll tasks, and shows or hides various features only as they become relevant. When payroll is straightforward, BrightPay keeps it simple. When payroll gets complicated, BrightPay makes it easy. Read Brightpay Reviews

Explore various Brightpay features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Brightpay Features- Time & Attendance Management

- Employee Data Base

- Dashboard

- Attendance Tracking

- Leave Management

- Payroll Management

- Tax Management

- Taxation Management

Pricing

Standard

$ 131

One Time

Bureau

$ 303

One Time

Brightpay Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

All-in-One Platform to Run Your Business.

Deskera All-in-One is an integrated cloud software for all your business needs. Move your business to the cloud in a few minutes. Get a real-time view of your business with a dashboard to visualize all aspects of your business at a glance. Read Deskera Reviews

Explore various Deskera features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Deskera Features- HR & Payroll

- Automated Scheduling

- Expense Tracking

- 401(k) Tracking

- Barcode Integration

- Order Management

- Check Processing

- Multi Currency

Pricing

Professional

$ 83

User/Month

Startup

$ 17

User/Month

Essential

$ 42

User/Month

Deskera Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

A dependable partner for your People & Business

SBS is one of the most sought-out Payroll service providers globally loved by small, medium, and large businesses. We have helped various businesses across the glob in automating their payroll, staying compliant, and delighting their People. Read SBS HR Reviews

Explore various SBS HR features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all SBS HR Features- Pay Slip

- Multiuser Login & Role-based access control

- Exit Management & Seperation Management

- Recruitment Management

- Leave Management

- Employee Self Service Management

- PF/ESIS Calculation

- Employee Lifecycle Management

Pricing

Standard

$ 97

Upto 100 Employees

SBS HR Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

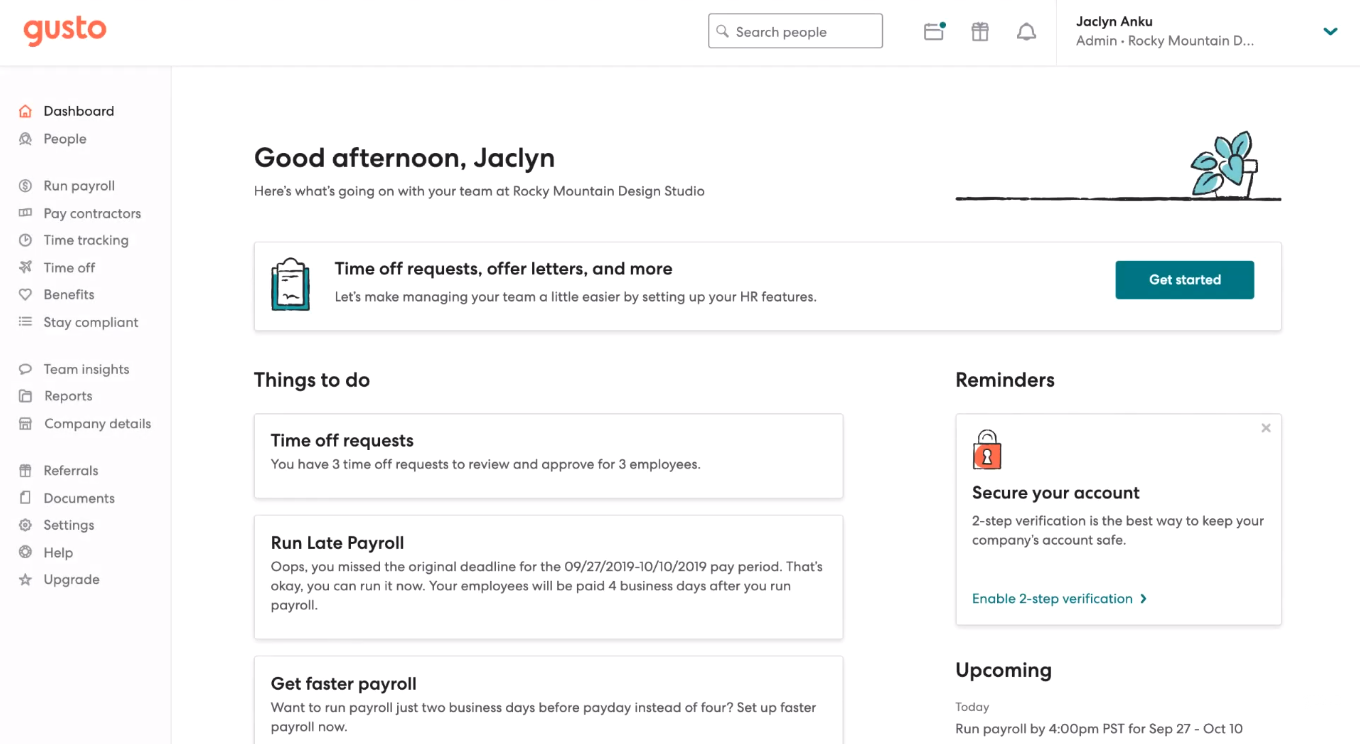

Payroll Management Software for Small Businesses

Gusto is the employee onboarding platform, offering payroll, benefits, HR tools, and world-class support for small businesses. With Gusto, it’s easy to take care of your team and grow your business all in one place. Read Gusto Reviews

Explore various Gusto features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Gusto Features- Back Office Assistance

- HR & Payroll

- Taxation Management

- Events & Reminders

- Document Management

- Payroll Management

- Self-onboarding

- Data Security

Pricing

Simple

$ 40

Per Month

Plus

$ 80

Per Month

Gusto Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Software by Peninsula Software

PenSoft has been developing payroll software since 1983. Our payroll knowledge and programming expertise make PenSoft Payroll sophisticated & packed with features, yet easy enough for a novice to use. Read PenSoft Payroll Reviews

Explore various PenSoft Payroll features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all PenSoft Payroll Features- Time & Attendance Management

- Pay Slip

- Compatibility with Swap Card

- Taxation Management

- Bonus

- Leave Management

- Attendance management

- PF/ESIS Calculation

PenSoft Payroll Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

If there is one thing that is certain about 2024, it is that nothing about it is certain at all. This is the year when nobody can predict the market and its future. It is also the year when businesses will have to improvise as they go. Remote working has become a mainstream reality, and countries all over the world are introducing various reforms to their statutory and regulatory laws to cope with the new ‘normal.’

It has become more important now than ever to adopt technology to adapt to this new environment and function seamlessly. One example of such technology is payroll accounting software.

There are a variety of payroll accounting software solutions available in the market that can make payroll management easy for the accounting teams of various organizations and enable them to pay salaries correctly and on time. In this article, we will talk about some of the best payroll software for accountants in 2024.

What is Payroll Accounting Software?

Payroll accounting software is a solution that automates the process of computing and handling employee payrolls, taxes, and other deductions.

By keeping track of employee hours, figuring payroll taxes, producing paychecks and direct deposit payments, giving reports, and ensuring compliance with legal requirements, it aids businesses in managing their payroll operations. Additionally, the software can automate the payment of taxes and other deductions.

A payroll system can be coupled with other HR platforms for performance management, benefits administration, and employee onboarding. Payroll software for bookkeepers enables businesses to have a comprehensive and unified HR system, improving the accuracy and efficiency of the HR and payroll processes.

Overall, payroll accounting software saves businesses time and money by automating time-consuming, repetitive operations, lowering the possibility of errors, and assuring regulatory compliance. This enables businesses to concentrate on other crucial HR and business processes.

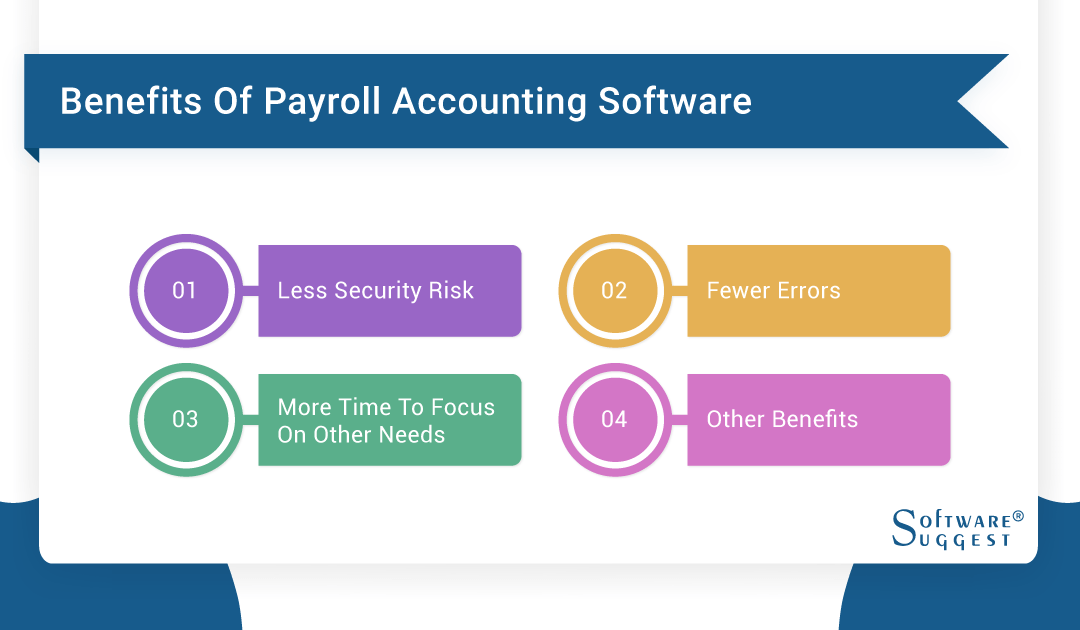

Benefits of Payroll Software For Accountants

Payroll software for accountants provides many benefits to a business that can help them improve accuracy and saves a lot of time and effort by automating manual tasks and reducing human efforts.

-

Less security risk

Payroll accounting software helps in reducing security risk by offering secure and encrypted storage of sensitive employee and financial information, reducing the risk of data breaches and unauthorized access.

The software can also automate many of the manual processes and tasks involved in payroll accounting, reducing the chance of errors and improving accuracy.

Moreover, many payroll and accounting software come with built-in security features, such as password protection and audit trails, to help ensure the safety and integrity of sensitive data.

-

Fewer errors

The ability of payroll accounting software to considerably lower the risk of errors in payroll processing is one of its advantages. The software automates many tedious calculations and procedures in payroll accounting, lowering the possibility of human error. The software can also be configured to enforce compliance with tax rules and regulations, lowering the likelihood of compliance mistakes.

Due to the software's ability to produce thorough reports and audits of payroll activities, using this software can also make it simpler to spot and reduces the problems of payroll accounting software.

All things considered, using accounting software with payroll can assist assure accurate and effective payroll processing while lowering the danger of errors and expensive blunders.

-

More time to focus on other needs

Businesses can use the extra time they have with payroll accounting software to focus on other crucial facets of their operations.

The program liberates significant time and resources that can be used to focus on other priorities like employee development, customer service, and business growth by automating the manual tasks involved in payroll processing.

Businesses can concentrate on their core strengths and objectives thanks to this greater efficiency, which will ultimately result in higher output.

-

Other benefits

Compliance enforcement: The risk of compliance errors can be decreased by programming the software to enforce compliance with tax rules and regulations.

Secure data storage: Sensitive financial and staff data are securely stored using the program, lowering the possibility of data breaches and unwanted access.

Detailed reporting: The software can offer thorough audits and reports of payroll transactions, making finding and fixing mistakes simpler.

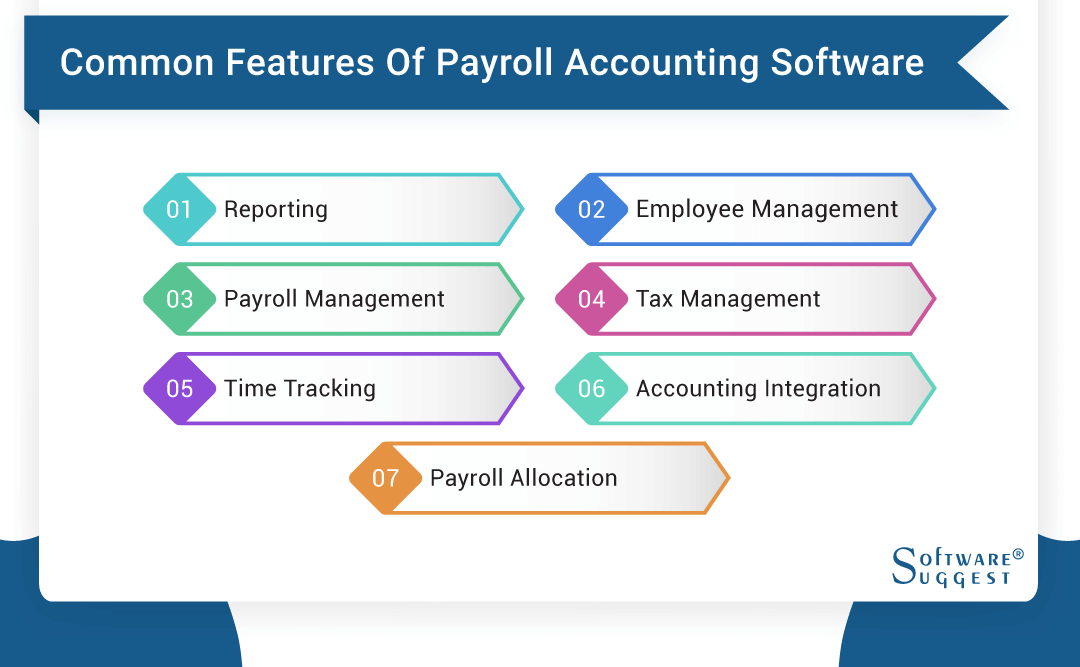

Common Features Of Payroll Accounting Software

Before selecting any payroll software for accountants, you need to analyze which features you require for your business. Below are the main features of advanced payroll solutions for accountants.

-

Reporting

Software for payroll accounting generally includes reporting capabilities. Businesses may generate thorough reports on payroll activities, including payroll reports, employee earnings reports, tax reports, and other relevant data, because of the reporting features of accounting payroll software.

These reports can aid with compliance and tax reporting obligations as well as significant insights into payroll data, such as employee salaries and deductions. Additionally, the software frequently offers configurable reporting capabilities, enabling companies to design reports that precisely suit their requirements.

The reporting function can assist companies in locating patterns, inefficiencies, and mistakes, facilitating the use of data-driven decisions and the enhancement of payroll procedures.

-

Employee management

Another typical function of payroll accounting software is employee management. This component often consists of instruments for managing and monitoring employee data, including personal and salary data, time off requests, and benefit details.

Tools for managing and automating the payroll process, including the determination of payroll taxes, deductions, and benefits, may also be provided by the software. The capability for generating and maintaining employee schedules, monitoring attendance, and handling time off requests can all be included in the personnel management module.

The software can assist in streamlining and simplifying the payroll process by centralizing and automating many of the duties associated with employee management while offering insightful information about employee data.

-

Payroll management

Payroll accounting software enables businesses to run their payroll efficiently and accurately. It automates the calculation of employee salaries, taxes, and benefits based on predefined payroll rules and regulations.

The software also offers direct deposit as a payment option and automatically calculates and files taxes according to local, state, and federal laws. Additionally, the software supports payroll processing in multiple currencies and allows for the automatic deduction of court-ordered garnishments and other authorized deductions from employee paychecks.

The software also provides a comprehensive payroll history and the ability to generate and customize payroll reports based on specific business needs. The integration with time and attendance systems ensures that hours worked are accurately calculated for payroll purposes. Overall, accounting payroll software streamlines the payroll process, reducing errors and saving businesses time and resources.

-

Tax management

Using payroll and accounting software greatly simplifies tax management, a critical component of payroll accounting. The payroll accounting software program ensures that businesses comply with tax laws by automatically calculating and filing taxes in accordance with local, state, and federal legislation.

Additionally, the software enables the handling of numerous tax documents, including W-2s and 1099s, and computes payroll taxes such as the federal income tax, Social Security tax, and Medicare tax automatically.

In order to ensure proper tax calculation, the program can also manage multiple payroll tax tables and give up-to-date tax information. Businesses may readily monitor their tax liabilities and make educated decisions if they have the ability to generate tax reports. In general, payroll accounting software makes tax management simpler and aids in keeping firms in compliance with tax laws.

-

Time tracking

Time tracking is a common feature found in payroll accounting software. Employers can use this tool to track and record the duration of each employee's shift, including lunch breaks, overtime, and start and end hours. The total number of hours worked is then determined using this data, and each employee's paycheck is generated correctly.

Additionally, time monitoring can assist businesses in adhering to labor rules and regulations, such as those governing minimum wage and overtime pay. Employees can clock in and out using a time clock or a mobile app because many accounting payroll software solutions interact with time and attendance systems. This simplified method of timekeeping reduces errors and guarantees precise payroll computations.

-

Accounting integration

Accounting integration is another common feature found in payroll accounting software. This function enables smooth integration with an organization's current accounting software, such as QuickBooks or Xero.

Companies can increase the accuracy of financial reporting, streamline their financial procedures, and lower the risk of data duplication and error by connecting their payroll and accounting software.

Accounting integration enables the general ledger to be automatically updated with payroll information, such as employee salaries and deductions, which eliminates the need for human entry and saves time.

Furthermore, many payroll software for accountants export payroll information straight into the company's accounting system, eliminating the need for manual data entry and enhancing the accuracy of financial reports. Organizations are now able to see all of their financial data in one place and make well-informed business decisions.

-

Payroll allocation

Payroll allocation is a useful feature found in many payroll accounting software solutions. Organizations can use this tool to distribute payroll costs to particular projects, cost centers, or departments. This makes it easier for businesses to deploy resources wisely and track and understand the costs related to their payroll.

Payroll allocation enables businesses to better understand their labor expenditures and make budgetary and staffing decisions. By precisely tracking and reporting payroll expenses, this function can also assist organizations in adhering to rules and reporting specifications.

Numerous payroll software for accountant alternatives includes adaptable payroll allocation options, enabling businesses to divide costs in accordance with pre-established formulas, user-defined criteria, or personalized settings. With the aid of this tool, businesses can more precisely distribute their payroll expenses, enhancing their financial planning and administration procedures.

Considerations While Selecting Payroll Software For Accountants

There are many aspects that organizations need to consider before investing in a payroll accounting system. Below are the factors you need to consider when selecting payroll software for accountants.

-

Do you need full-service payroll?

One of the most important considerations while selecting payroll accounting software is whether full-service payroll is required. Full-service payroll means the software provider takes care of all aspects of payroll processing, including tax calculation and filing, direct deposit, and other payroll-related tasks.

This can be convenient for small businesses that do not have the resources to handle payroll in-house, but it may also come at a higher cost. On the other hand, if a business has the resources to handle some payroll tasks in-house, self-service payroll software may be a more cost-effective option.

-

Pay attention to the UI and workflow

Another important consideration while selecting payroll accounting software is the user interface (UI) and workflow. The software should have an intuitive and easy-to-use interface that allows you to quickly and efficiently process payroll. A well-designed UI and workflow can also help reduce errors and improve overall efficiency.

Additionally, it's important to ensure that the software integrates well with your existing accounting and HR systems, if you have any, for seamless data transfer and minimal manual effort. Before making a decision, take advantage of free trials or demos to test the software and see how it fits your business needs and processes.

-

Look for highly integrable solutions

Seamless integrations make work easier. Not all payroll software solutions might contain all the modules you need to run your business. For example, if you want a project management system along with an HR management and accounting module, it may be difficult to get a solution that can specifically handle all three functions.

This will ensure that all your software systems use a common database and there is a seamless flow of information among them. You will be able to manage various activities, such as tracking the status of various projects, monitoring the logs of your employees, and accounting for the payments received from customers effortlessly on a single platform.

-

Ask an expert

Seeking advice from an expert is also an important consideration when selecting the best software. An accountant, software consultant, or payroll expert is an example of this. They can help you find the ideal solution for your company's needs by offering insightful information about the features and capabilities of various software solutions.

They can also offer advice on crucial issues, including compliance, security, and data protection. You can make an informed choice and ensure that the software you select will satisfy your current and future payroll requirements by asking an expert for advice.

Top 5 Payroll Software For Accountants

|

Name

|

Free Trial

|

Demo

|

Pricing

|

|---|---|---|---|

|

30 Days |

Yes |

$36/month | |

|

30 Days |

Yes |

$45/month |

|

|

30 Days |

Yes |

$45/month |

|

|

Yes |

Yes |

$45/month |

|

|

90 Days |

Yes |

$39.99/month |

We have picked out the five best payroll software for accountants to simplify your decision process. You can compare the platforms based on their features, pros and cons, and pricing.

1. OnPay

OnPay is one of the best payroll software for accounting firms. It provides a complete solution for payroll processing, including tax calculation and filing, direct deposit, and other payroll-related tasks. The software offers a user-friendly interface and intuitive workflow, making it easy to process payroll and manage employee information.

- Payroll Processing

- Time Tracking

- Tools to manage employee benefits

- Employee self-service portal

- Compliant with federal and state payroll regulations

- Integrates with popular software

- User-friendly interface

- User-friendly interface

- Comprehensive payroll management

- Affordable pricing

- Integration with other systems

- Limited features

- Limited support options

- Occasional system outages

Pricing

- Small Business Plan: $36 per month plus $4 per employee per month

- Growing Business Plan: $72 per month plus $4 per employee per month

- Enterprise Plan: Customize pricing

2. QuickBooks Payroll

QuickBooks Payroll is a comprehensive and user-friendly payroll software for accountants that can help streamline their payroll processes and improve efficiency. Intuit, the maker of QuickBooks accounting software, offers the solution. It is designed to help small businesses simplify and streamline their payroll processes.

- Payroll processing

- Tax compliance

- Integration with QuickBooks

- Employee self-service

- Affordable pricing

- Easy integration

- Tax compliance

- Limited support options

- Occasional software bugs

- Dependence on QuickBooks

Pricing

- Core Plan: $45 per month plus $4 per employee per month

- Premium Plan:$75 per month plus $8 per employee per month

- Elite Plan: $125 per month plus $10 per employee per month

3. Gusto

Gusto is a cloud-based best payroll software for accountants and small business owners. Gusto provides a comprehensive range of payroll services, including payroll processing, tax compliance, and employee benefits management.

- Payroll processing

- Benefits management

- HR management

- Tax filing

- Time tracking

- Access to mobile app

- 24/7 customer support

- Simple and intuitive interface

- Automated processes

- Compliance assistance

- Integration with other apps

- Limited customization

- Expensive than some other payroll solutions

- Limited international coverage

- Limited HR features

- Technical issues

Pricing

- Basic Plan: $45 per month plus $6 per employee per month

- Complete Plan: $39 per month plus $12 per employee per month

- Concierge Plan: Customized pricing

4. RUN Powered by ADP

RUN Powered by ADP is a cloud-based payroll and HR platform designed specifically for small businesses. The platform is part of ADP, a leading human capital management solutions provider. It is also highly automated, reducing the time and effort required to manage payroll and HR tasks.

- Payroll Processing

- HR Management

- Automated tax filing

- Employee self-service

- Access to mobile app

- Provides 24/7 support via phone, email, and live chat

- User-friendly and intuitive interface

- Automated Processes

- Compliance assistance

- Employee self-service

- Access to mobile app

- Limited customization

- Expensive than some other payroll

- Limited international coverage

- Limited HR features

- Technical issues

Pricing

- Basic Plan: $45 per month plus $4 per employee per month

- Enhanced Plan: $70 per month plus $8 per employee per month

- Full Service Plan: Customized Pricing

5. SurePayroll

SurePayroll is a cloud-based online payroll software for accountants and small businesses. It provides an easy-to-use platform for businesses to manage their payroll processes, including tax calculations, direct deposit, and compliance with HR regulations.

- Payroll Processing

- Automates tax filing and payment

- Employee self-service

- HR management tools

- Access mobile app

- Customer support

- User-friendly interface

- Automated processes

- Compliance assistance

- Employee self-service

- Limited customization available

- Expensive than some other payroll solutions

- Technical issues

- Limited HR features

Pricing

- Basic Plan:$39.99 per month plus $4 per employee per month

- Full-Service Plan: $109.99 per month plus $4 per employee per month

Cost of Payroll Accounting Software

Cost is an important consideration that organizations need to keep in mind before investing in payroll accounting software.

The payroll accounting software cost varies depending on the features, size of the company, and the number of employees. Some payroll software providers offer free or low-cost solutions for small businesses, while more comprehensive solutions for larger businesses can be more expensive.

Conclusion

So, basically, payroll software for accountants are software systems designed to help businesses manage their employees' payroll and related expenses. These solutions automate many of the time-consuming and repetitive tasks associated with payroll, such as calculating paychecks, withholding taxes, and filing payroll tax returns

.png)