Best VAT Software for Your Business

Best VAT software includes Zoho Books, QuickBooks, Sage Business Cloud Accounting, SASH Software Services, and Oracle ERP. This VAT accounting and billing software help companies manage all their tax compliance requirements in an automated manner without the help of an accountant.

No Cost Personal Advisor

List of 20 Best VAT Software

Category Champions | 2024

Online Accounting Software for Growing Businesses

Zoho Books is a VAT compliant accounting software. Offers receipts, inventory, get a return, find back transactions, multi-user and reporting the data. It is very modern, simple to use for users and developing the site to increase traffic on that. Read Zoho Books Reviews

Explore various Zoho Books features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Zoho Books Features- Multi Currency

- Payment Processing

- Banking Integration

- Mobile Support

- Online document storage (back-up)

- Dashboards & Analytics

- Discount & Schemes

- Sales Management

Pricing

Zoho Books Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

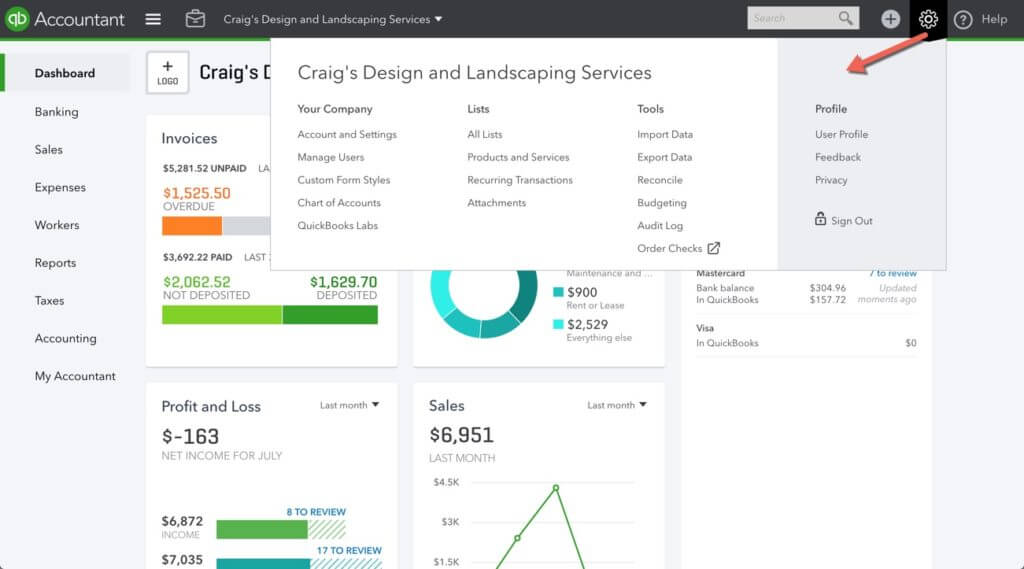

Small Business Online Accounting Software

QuickBooks is a vat accounting software for small size organizations. It's simple online vat software for business owners to make informed decisions. The added characteristics of arranging bills, track mile, receipts, and payments, allow multiple customers to use at the same time, control on payroll and analyzing all the report. Read QuickBooks Online Reviews

Explore various QuickBooks Online features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all QuickBooks Online Features- Financial Accounting

- Reporting

- Online Payment

- Multi-Currency

- Banking Integration

- Data Security & Accuracy

- Discount & Schemes

- Accounts Receivable

Pricing

Simple Start

$ 30

Per Month

Essentials

$ 60

Per Month

Plus

$ 90

Per Month

QuickBooks Online Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Leading VAT Accounting Software by Sage

The best vat accounting software for payroll and account tax filling, particularly designed for small and medium-size companies. The software is a best for speed cash flow and will be helpful in reducing the cost and filing the taxes. This vat software is helpful to maintain critical data with user security and improves communication and collaboration between all areas of business. Read Sage Accounting Reviews

Explore various Sage Accounting features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Sage Accounting Features- Accounting Integration

- Invoice

- Spend Management

- Stock Management

- Templates

- Expense Management

- Vat

- Accounts Receivable

Pricing

Start

$ 5

Per Month

Standard

$ 10

Per Month

Plus

$ 12

Per Month

Sage Accounting Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Leading VAT Accounting Software in Bahrain

A current vat accounting software for managing business applications in Bahrain. Attributes user-friendly environment, transparency, flexibility and highest speed to solve the problem. Suitable for all size of companies. Quick access at any time from anywhere. Learn more about SASH Software Services

Explore various SASH Software Services features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

- POS invoicing

- Accounting

- Tax Management

- Production Management

- Vat

- Financial Management

- Accounts Receivable

- Task Management

SASH Software Services Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Complete integrated VAT Software in Middle East

Oracle ERP is the leading VAT accounting software in UAE, it can equip your workforce with modern ERP software and empower them to higher levels of productivity. Oracle ERP Cloud is a complete, integrated, and modern cloud application suite that manages accounting, procurement, products, and projects enterprise-wide. Read Oracle Fusion Cloud ERP Reviews

Explore various Oracle Fusion Cloud ERP features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

- Cataloging / Categorization

- Workforce Management

- Budget Management

- ERP

- Version Control

- Audit Trails

- Cash Management

- Point of Sale (POS)

Oracle Fusion Cloud ERP Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Leading VAT Accounting Software in Middle East

The leading and powerful company to provide errorless VAT accounting solution throughout the Middle East that guarantees about the client's engagement and productivity for utilizing the arrangements through far-reaching training and support program. Learn more about Al Roman

Explore various Al Roman features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Al Roman Features- Inventory Management

- Purchasing

- Project Accounting

- Project Management

- Quotation & Estimates

- Production Management

- Fixed Asset Management

- Accounting

Al Roman Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Small Business Online VAT Accounting Software

A fully featured online VAT software for billing and accounting. It's a cloud-based VAT accounting management solution that offers invoicing, expense management, payment management and customer relationship management. The user can share the information by mail and promote the products estimates. Read TopNotepad Reviews

Explore various TopNotepad features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all TopNotepad Features- Spend Management

- Investment

- Tax Management

- Payroll Management

- Financial Accounting

- Task Management

- Production Management

- Payment Handling

Pricing

FREE

$ 0

Per Year

POND

$ 35

Per Year

MERE

$ 63

Per Year

TopNotepad Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Power of Simplicity

TallyPrime is India’s leading business management software for GST, accounting, inventory, banking, and payroll. TallyPrime is affordable and is one of the most popular business management software, used by nearly 20 lakh businesses worldwide. Read TallyPrime Reviews

Explore various TallyPrime features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all TallyPrime Features- Statutory Capabilities

- Accounts Receivable

- Online document storage (back-up)

- Purchasing & Receiving

- Bonus

- Loan & Advances Management

- Reports

- Financial Management

TallyPrime Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

VAT Software Solution in GCC

RealSoft ERP is a fully integrated VAT accounting software in UAE and other Middle East countries for ERP solutions. This VAT software includes attributes like trading solutions provided to industries, integrated accounts, flexible run on all the devices. Read RealSoft ERP Reviews

Explore various RealSoft ERP features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all RealSoft ERP Features- Purchase Order

- Work order management

- Bill of materials (BoM)

- Financial Accounting

- Manufacturing

- Employee Data Base

- Invoicing

- Inventory control

RealSoft ERP Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Advanced VAT Software in GCC

An advanced VAT compliant accounting software that can manage automate end to end tax filing, suite, calculation, return filing, document management to thousands of customers accurately calculate sales and use taxes based on up-to-date tax data. Read Avalara Reviews

Explore various Avalara features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Avalara Features- MIS Reports

- Email Integration

- Vat

- Warehouse Management

- Revenue Management

- Inventory Management

- Taxation Management

- Bonus

Avalara Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

VAT Software Compliant by VAT IT

One of the best VAT software that gives 100% transparency on reclaiming/refunding your VAT return. Also, provide real-time online reporting system. Aside from the distinctive VAT rules that can apply in a various regional language of the country, from where you are asserting from. Learn more about VAT IT

Explore various VAT IT features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

VAT IT Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

VAT Accounting Software in UAE

An unbeatable solution for VAT filling accounting software also having more than 1500 customers. It streamlines data from all over the system. Automatically check data, cross-check from reliable sources and delete duplicates and easily submits and follows up on your recovery. On the off chance that confirmation is absent for any of your organization's VAT returns. Learn more about VATBox

Explore various VATBox features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

VATBox Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Cloud Accounting Software Making Billing Painless

This bookkeeping software makes your accounting tasks easy, fast and secure. Start sending invoices, tracking time, and capturing expenses in minutes. We uphold a longstanding tradition of providing extraordinary customer service and building a product that helps save you time because we know you went into business to pursue your passion and serve your customers - not to learn to account. Read FreshBooks Reviews

Explore various FreshBooks features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all FreshBooks Features- Late Fee Calculation

- ACH Payment Processing

- ACH Check Transactions

- Customizable invoices

- Invoice

- Time Tracking

- Workflow Management

- Billing & Invoicing

Pricing

Lite

$ 19

Per Month

Plus

$ 33

Per Month

Premium

$ 60

Per Month

FreshBooks Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

The next generation Online Accounting Software

ProfitBooks is a simple and fastest business accounting software for small businesses. It lets you create beautiful invoices, track expenses and manage inventory without any accounting background. Read ProfitBooks Reviews

Explore various ProfitBooks features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all ProfitBooks Features- Multi Layer Security

- Payments

- Multi Currency Support

- Notification via SMS and Email

- Taxation Management

- Inventory Management

- Online Banking Integration

- Manage Customers and Suppliers

Pricing

Professional Plan

$ 83

Per Year

SMB Plan

$ 125

Per Year

ProfitBooks Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

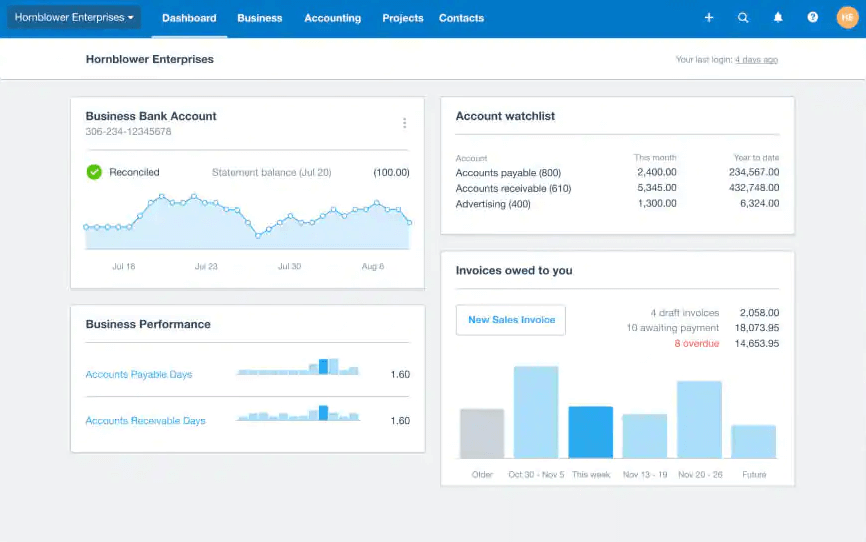

Software by Xero Limited

Xero is a web-based VAT accounting software for SMEs business. It makes a smooth process either is generate statement, inventory, attach with data, make a list of buyer orders, manage payment, runs on ios and Android mobile applications and safety for users private data. Read Xero Accounting Reviews

Explore various Xero Accounting features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Xero Accounting Features- Loan & Advances Management

- Banking Integration

- Bonus

- Multi Currency

- HR & Payroll

- Task Management

- Inventory Management

- Time Tracking

Pricing

Starter

$ 9

Per Month

Standard

$ 30

Per Month

Premium

$ 60

Per Month

Xero Accounting Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Software by Sage

Sage offers a complete desktop accounting software that helps you spend less time managing your accounts and more time developing your business. With its easy to use interface, Sage 50cloud Accounting has aided small businesses and entrepreneurs to operate efficiently and effectively. Special Offer: 40% off Sage 50cloud annual subscriptions | Coupon Code: D-1929-0020. Read Sage 50cloud Reviews

Explore various Sage 50cloud features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Sage 50cloud Features- Nonprofits

- Project Accounting

- Mobile Payments

- Billing & Invoicing

- Contact Database

- Customizable invoices

- Payment Processing

- Online invoicing

Pricing

Pro Accounting

$ 51

Per Month

Premium Accounting

$ 78

Per Month

Quantum Accounting

$ 198

Per Month

Sage 50cloud Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Open Source Alternative to SAP

ERPNext is a critical foundation of your business and we believe that you should have the freedom and control over your ERP software. This means that you have the choice to select your hosting provider, or host it on your own. ERPNext is one of the open erp available in the market. Read ERPNext Reviews

Explore various ERPNext features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all ERPNext Features- Asset Planning

- Multi-Location

- Multi-Company

- Invoicing

- Financial Management

- Accounting

- Customizable Templates

- Inventory Valuation

Pricing

Open Source

$ 0

Free forever

Cloud

$ 11

Site/Month

Enterprise

$ 1181

Site/Month

ERPNext Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

BUSINESS SOLUTION

PACT ERP software enables companies of all sizes to run their business in a professionally organized manner. It automates and manages all key operations in a single, integrated system for the ease of use. The system takes control of financial management, inventory control, sales management, budgeting, and more. Read PACT ERP Reviews

Explore various PACT ERP features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all PACT ERP Features- Accounts Receivable

- Sales Quotes

- Financial Management

- Electronic funds transfer (EFT)

- Invoicing

- Electronic data interchange (EDI) connectors

- Dispatching

- Document Management

PACT ERP Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Streamline Your Business Processes with FirstBit E

End-to-end ERP for growing CONTRACTING & CONSTRUCTION in the UAE: Real-time reporting, BOQ, Estimation, Quotation, Approvals, Project cost control, Project revenue & cost analysis, Purchasing, Tendering, Labor cost, overheads allocation, and many more. Read FirstBit ERP Contracting & Construction Reviews

Explore various FirstBit ERP Contracting & Construction features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

- Order Fulfillment

- Warehouse Management

- Reminders

- Accounting

- Invoicing

- Estimating

- Project Tracking

- Multi Lingual

FirstBit ERP Contracting & Construction Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Software by KashFlow Software Ltd

KashFlow is designed to help make running small business (and larger companies) easy, without you needing any accounting or bookkeeping knowledge. So you’ll be able to pick it up quickly. Read Kashflow Reviews

Explore various Kashflow features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Kashflow Features- Expense Management

- Leave Management

- HR & Payroll

- Reimbursement Management

- Recruitment Management

- Project Management

- Inventory Management

- Performance Management

Pricing

Starter

$ 9

Per Month

Business

$ 18

Per Month

Kashflow Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

What Is VAT Software?

Software for managing value-added tax in a business is called VAT software. It is a kind of accounting software that aids companies in calculating, documenting, and submitting their VAT reports. Many of the routinely involved manual activities in VAT management are automated by VAT software. It can assist companies in maintaining compliance with VAT regulations, avoiding fines, and improving compliance in general.

What Role Does VAT Software Have?

VAT software, such as a VAT program, VAT filing software, online VAT software, VAT reporting software, or VAT calculation software, is a specialized accountancy software that helps businesses file their VAT returns accurately and on time. It can also help businesses reclaim any overpaid VAT and keep track of their VAT liability.

It helps businesses to efficiently meet their VAT obligations by reducing the likelihood of errors, saving time, and allowing them to manage their VAT compliance demands independently, without relying on the assistance of an accountant.

By streamlining the VAT compliance process, VAT software is vital in ensuring that businesses meet their legal obligations and avoid costly penalties and fines.

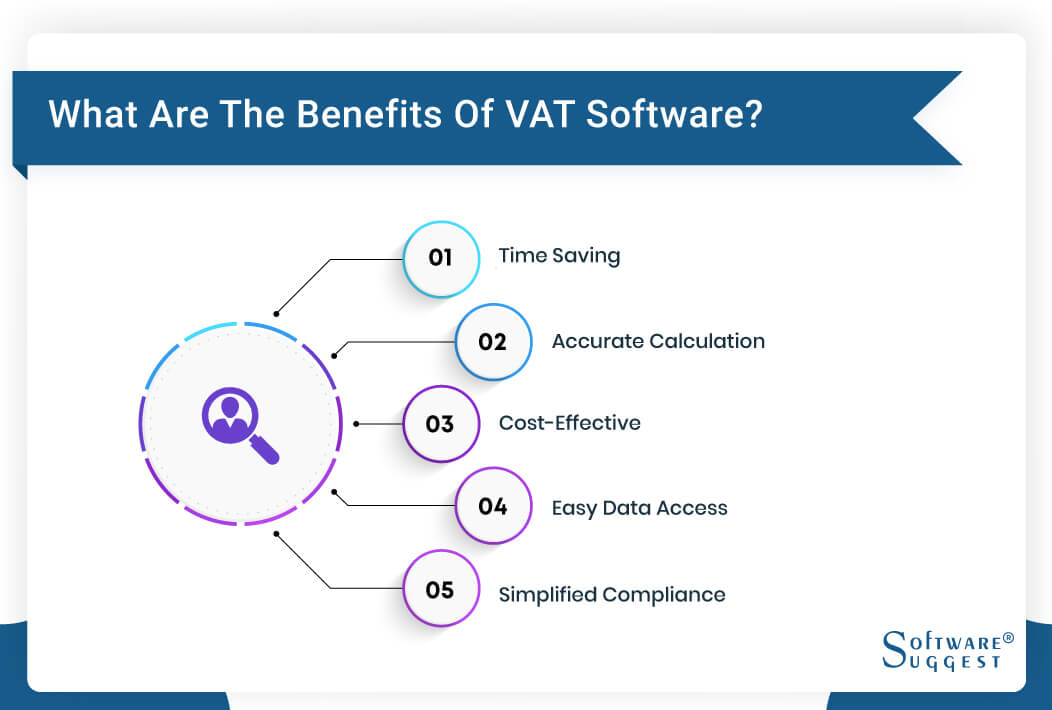

What Are the Benefits of VAT Software?

Below are the main benefits of using VAT software:

-

Time-saving - Automating the data input and calculation processes using VAT software can save businesses a lot of time. The software can quickly create reports, complete complicated computations, and file tax returns with appropriate authorities.

-

Accurate Calculation - VAT software aids in reducing the possibility of human calculation errors, which can result in expensive blunders. The program ensures that all transactions are logged precisely, and that VAT is computed appropriately.

-

Cost-Effective - By limiting the need for human work, avoiding costly errors, and lowering the possibility of fines for non-compliance, VAT software can help firms save money.

-

Easy Data Access - VAT software's real-time access to financial data enables businesses to track sales, purchases, and VAT returns more easily. This aids organizations in making informed decisions and managing their budgets.

-

Simplified Compliance - Automating the submission of VAT returns, ensuring that all data is correct and current, and reducing the risk of penalties for non-compliance, VAT software assists businesses in remaining compliant with tax requirements.

Why Is VAT Software Important?

VAT software is important for small businesses because:

-

It reduces paperwork and streamlines the entire process.

-

Compliance with VAT rules and regulations is guaranteed, eliminating the risk of errors.

-

Automated calculations make complex VAT returns simpler and more accurate.

-

Helpful reminders keep business owners aware of looming deadlines and prevent costly fines.

-

Real-time tax data enables better business decisions and a competitive edge.

What Are the Common Features of VAT Software?

Before choosing any VAT software, you must look out for the features that it offers. This can help you determine whether it’s the right tool for your business or not. Most VAT software includes the following features:

-

Automated VAT Calculation

-

Automated VAT Return Filing

-

VAT Registration Management

-

Sales and Purchase Data Management

-

Real-time Access to Financial Data

-

Invoice Management

-

Inventory Management

-

Multi-Currency Support

-

Compliance Reporting

How to Choose the Right VAT Software for Your Organization?

It might be challenging to choose the best VAT software, but the following factors can help you make an informed decision:

-

Identify your requirements for your business and decide which features are crucial.

-

Pick a VAT program that will grow with your company as it expands.

-

Accounting software or ERP systems are examples of current systems that can be integrated with VAT software.

-

Pick a VAT software that is simple to use and quick for your staff to pick up.

-

Take into account the price of the VAT software, as well as any other charges like implementation or training costs.

The 5 Best VAT Software Solutions

Value-added tax (VAT) software is a beneficial tool for all types of businesses, as it simplifies tax procedures and aids in complying with VAT rules. To assist with choosing the right option, here are five of the top VAT software solutions:

1. Xero

Xero offers small businesses and accounting practices a comprehensive cloud-based platform that combines core accounting solutions, payroll, workforce management, expenses, and projects, along with a vast ecosystem of connected apps and bank connections. With automated data entry, smart bank reconciliation, online billing, and real-time business dashboards, Xero enable businesses to streamline their financial management and make informed decisions.

Additionally, accounting and bookkeeping practices gain access to smart compliance tools, practice management software, and a single accounting ledger for every client in one place. With Xero, small businesses and accounting practices can save time and focus on what they do best – growing their business and serving their clients.

Features

- Automatic data entry

- Bank connections

- Smart bank reconciliation

- Online billing

- Automated financial reporting

- Business dashboards

- Integration with other apps

Pros

- Saves time and reduces errors in bookkeeping

- Provides real-time insights into business performance

- Can streamline business operations and management through integration with other apps

- Online access from anywhere with an internet connection

Cons

- It may not be suitable for all types of businesses

- Cost can add up, especially for advanced features and app integrations

- Security and reliability may be a concern for some businesses

- Customer support may not be sufficient for all users

- May not integrate well with all third-party apps or software

Pricing

- The starter plan starts at $14.50/month.

- The standard plan is priced at $29.50/month

- The premium plan starts at $38/month.

2. QuickBooks Online

QuickBooks Online Advanced is the all-in-one accounting solution for mid-size and growing businesses, offering deep financial insights, customizable dashboards, and automated workflows to save you time and reduce costs.

With a customizable user role for up to 25 users, real-time data access across multiple locations, and 24/7 US-based technical support, QuickBooks Online Advanced gives you the peace of mind to focus on making critical business decisions and taking your business to the next level.

Features

- Invoicing and payment processing

- Bank reconciliation

- Expense tracking

- Inventory management

- Time tracking

- Payroll management

- Financial reporting

Pros

- User-friendly interface

- Mobile app for on-the-go access

- Time-saving automation features

- Accurate VAT calculations and filing

- Excellent customer support

- Customizable reports and dashboards

Cons

- Limited customization options

- Some features are only available in higher pricing plans

- The mobile app lacks some features available on the web version

- Limited integration options for non-US-based businesses

Pricing

- Simple Start Pan costs $20 per month.

- Essential Plan costs $40 per month.

- Plus Plan costs $70 per month.

3. Sage

Sage is a comprehensive VAT software solution that simplifies the process of VAT filing and allows businesses to manage their finances more efficiently. You can quickly manage and send invoices with its powerful features, monitor your cash flow, and even figure out and submit VAT returns.

For startups and sole proprietors that need to work on their businesses without worrying about challenging accounting tasks, the program is user-friendly and simple to use. To simplify your payroll process, you may also use the Payroll add-on.

Features

- HR & Payroll management

- Inventory management

- Invoicing with customizable templates

- Mobile app access

- Automated VAT calculations and submission

- Accounts Payable management

- Stock management with reorder points

- Self Assessment tax return submission (UK only)

Pros

- Easy to use

- Customizable

- Automated bookkeeping

- Multi-currency support

Cons

- Limited features

- Customer support can be slow and unresponsive

Pricing

- Sage Accounting Start Plan costs $10 per month.

- Sage Accounting Plan costs $25 per month.

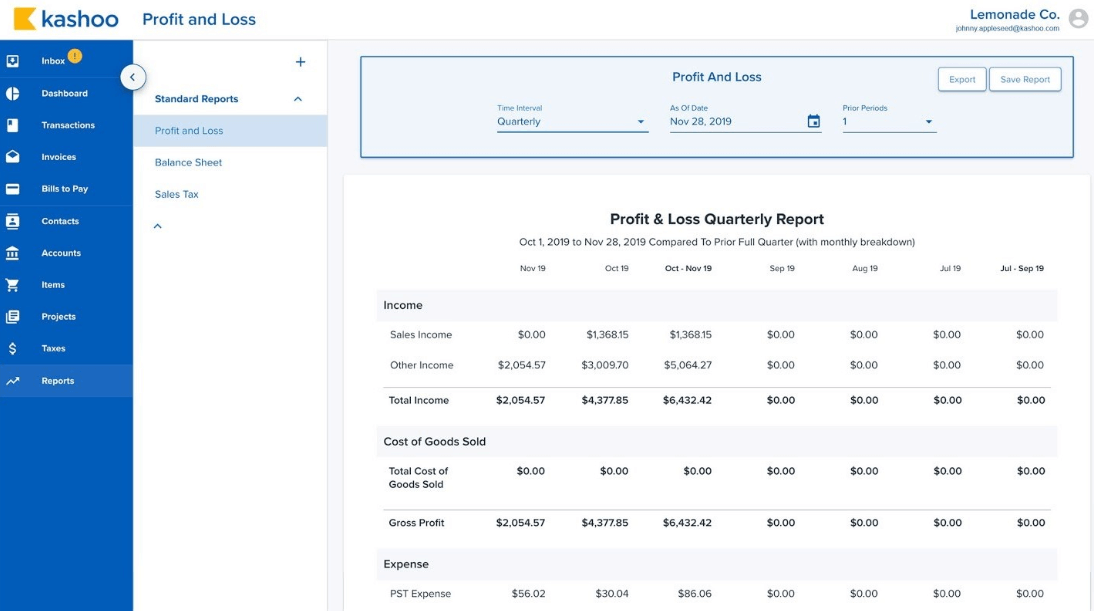

4. Kashoo

Kashoo is your go-to solution for all your accounting needs! Designed with small businesses in mind, Kashoo streamlines accounting processes and frees up time for businesses to focus on their core activities.

With various reports available, including Cash flow, Accounts Receivables & Payable, Income Statement & Balance Sheet, users can easily access all the financial information they need in real-time.

In addition, Kashoo allows for easy payment collection by providing payment links with invoices and the ability to add convenience fees to cover expenses. Every transaction is automatically categorized for easy tracking, and new client information is generated automatically, making it easy to stay organized.

Features

- Import or export information

- Automated sync with financial institutions

- Invoicing, monitoring expenses, and creating budgets

- Reports and financial statements

- Multi-currency support

Pros

- The software from Kashoo is easy to use and understand because of its user-friendliness.

- It offers a free 14-day trial for users to test the software before purchasing.

- Its support team is easily accessible via email and phone.

Cons

-

Kashoo's pricing may not be competitive compared to other VAT software solutions.

Pricing

- Pricing starts at $27 per month.

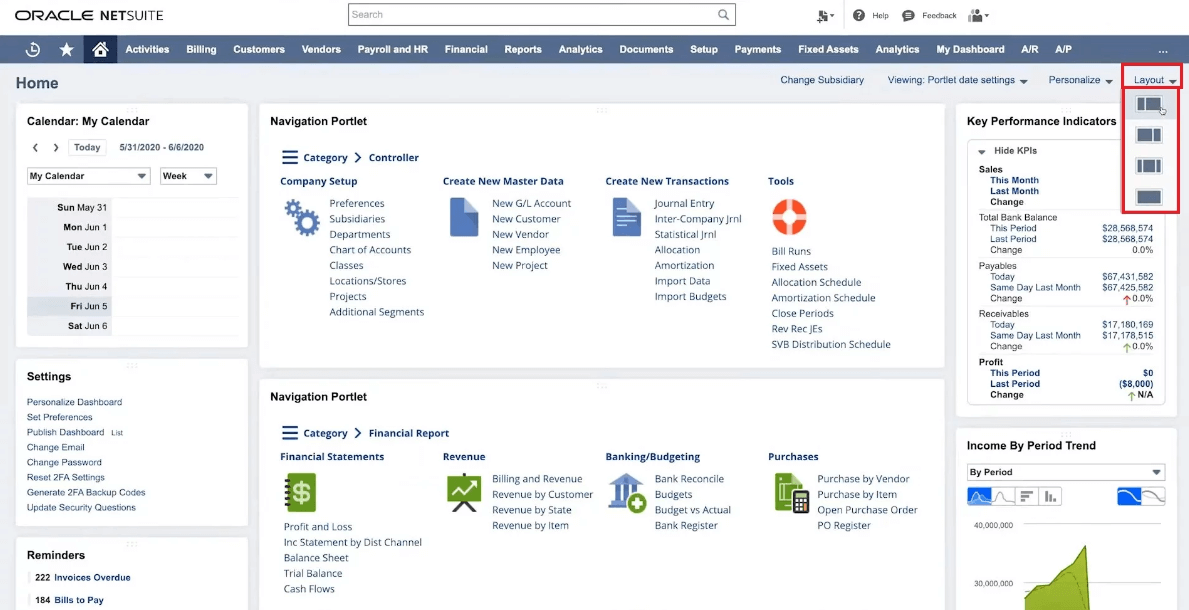

5. NetSuite

NetSuite has been the leading cloud-based ERP solution for over 20 years, empowering businesses with the visibility, control, and agility they need to succeed. Originally focused on financials and ERP, NetSuite has since expanded its integrated system to include inventory management, HR, professional services automation, and omnichannel commerce.

With over 33,000 customers across 217 countries, NetSuite is a trusted and reliable solution for businesses of all sizes. Get started with NetSuite today and experience the power of a fully integrated ERP system.

Features

- General Ledger

- Cash Management

- Accounts Receivable & Payable

- Tax Management

- Fixed Assets Management

- Automated VAT calculations

- VAT reporting

Pros

- Cloud-based ERP solution for easy accessibility

- Provides complete financial and ERP management, including inventory management and HR

- Includes features such as General Ledger, Cash Management, and Tax Management

- Offers Fixed Assets Management and Automated VAT calculations

- VAT reporting for easy compliance with tax regulations

Cons

- Lack of pricing transparency on the website

- May be too complex for small businesses with basic needs

Pricing

NetSuite does not disclose its pricing information on its website, but interested users can contact the vendor for a quote.

Steps on How to Implement a VAT Software

Implementing VAT software can be a complex process, but the following steps can help make it easier:

-

Assess your Business Demands - Identify your company's needs, the features you want in VAT software, and your spending limit.

-

Study Different VAT Software Solutions - Study various VAT software options to discover the one that most closely matches your company's needs.

-

Test the Software - Before buying VAT software, make sure it works well for you and satisfies your requirements.

-

Set Up the Software - After choosing a VAT software, configure it by entering data, establishing preferences, and connecting it with your current systems.

-

Train Staff - To guarantee that your staff is able to fully utilize the capabilities of the VAT software, train them on how to use it.

-

Monitor and Optimize - The program should be monitored to make sure it is operating as planned, and it should be optimized as needed to meet your changing company demands.

Challenges to VAT software

While VAT software can offer many benefits to businesses, there are also some challenges that businesses may encounter when implementing and using VAT software. Some of the key challenges include:

-

Complexity - Depending on the nation or location, VAT laws might be complicated. As a result, configuring and setting up VAT software to suit a business's unique requirements can be challenging.

-

Integration with existing systems - It may be necessary to connect VAT software with an organization's current accounting software, which can be labor-intensive and complicated.

-

Security - VAT software may keep private financial data that is vulnerable to attack by hackers and other online criminals.

-

Maintenance - To ensure that VAT software remains functional, it must get regular upgrades and maintenance.

-

Training - Training is a must before the program is implemented to guarantee that staff members can use the VAT software efficiently.

-

Cost - Especially for small enterprises, VAT software can be expensive.

As a result, before choosing, businesses must carefully consider the advantages and disadvantages of installing VAT software.

Measuring the success of VAT software

The measurement of VAT software's efficacy entails a comprehensive evaluation of its capabilities to facilitate the management of Value Added Tax (VAT) responsibilities by businesses.

The multifaceted evaluation encompasses diverse factors, including but not limited to the accuracy of calculations, the convenience of usage, time efficiency, and the minimization of errors and penalties. In addition, the software's compatibility with other accounting systems, the production of comprehensive reports, and the provision of sufficient and up-to-date support services could potentially impact the software's effectiveness.

Ultimately, the degree of success achieved by VAT software hinges upon its capacity to enable businesses to adhere to VAT regulations and efficiently manage their financial transactions.

Trends Related to VAT software

Value Added Tax (VAT) software has become an essential tool for businesses to manage their VAT obligations. Here are some trends related to VAT software:

-

Automation: The automation of VAT software is increasing, with many platforms now providing capabilities like automatic VAT computation and reporting, which eliminate the need for human data entry and lower the possibility of mistakes.

-

Solutions based on the cloud: For their VAT requirements, many organizations are switching from conventional, on-premise software to solutions based on the cloud. More flexibility, simpler data access, and a decrease in the demand for IT infrastructure are all benefits of cloud-based applications.

-

Integration with other systems: As accounting software and ERP softwares and other corporate systems become more widely used, data management and reporting processes for VAT software are becoming more efficient.

-

Local law and regulatory compliance: As nations throughout the world continue to change their VAT legislation, VAT software suppliers are trying to make sure their solutions continue to be compatible with local laws and regulations.

-

Data analytics: With the growing inclusion of data analytics functions in VAT software, businesses may study their VAT data to spot patterns and trends and make wise decisions.

-

Mobile usability: With the advent of mobile applications, and several platforms for VAT software, businesses may now manage their VAT responsibilities while on the go.

Conclusion

By leveraging the right VAT software, you can streamline your tax processes and simplify VAT compliance. These five top-rated VAT software solutions offer a range of features, from automated invoice processing to real-time reporting, and will help enhance productivity and efficiency in tax management.

For better convenience, it's crucial to choose a dependable solution that offers comprehensive functionality and integrates seamlessly with existing systems. By selecting any of these options, you can take charge of your tax processes without any inconvenience or difficulty!

By Countries

By Industries

.png)