Best Trading Software

Best trading software options are Masterswift, RichLive Trade, MetaTrader 4 Software, MotiveWave, and ECG Trade. These stock trading software help in the seamless functioning of the stock trading process.

No Cost Personal Advisor

List of 20 Best Trading Software

Category Champions | 2024

Captain Biz is a sales and purchase invoice manage

CaptainBiz is a simple-to-use software solution to manage your business hassle-free. Generate tax invoices, track inventory in real-time, manage customers & suppliers, and monitor cash & bank transactions, all in one place, over PC or mobile. Endorsed by GST govt. of India as an affordable and easy-to-use solution for both GST and non-GST companies. Read CaptainBiz Reviews

Explore various CaptainBiz features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all CaptainBiz Features- Inventory Management

- Customer tracking

- Data Security & Accuracy

- Financial Management

- Print Or Email Invoices

- GST Compliance

- Reporting

- GST audit report

CaptainBiz Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Software by AutoFxPro

Autofxpro is a professional trading automation tool used for trading automated, targetting on traders' need and comes with very user-friendly design and usage. Custom modification would be done as per your requirement for free. Read AutoFxPro Reviews

Explore various AutoFxPro features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

AutoFxPro Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Software by Source Edge Software Technologies Pvt Ltd

EnTrade is the ideal software for trading and distribution organizations, that helps you carry out the day-to-day business and provides the flexibility of maintaining your sales, inventory, purchase and accounts data. Read EnTrade Reviews

Explore various EnTrade features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all EnTrade Features- Purchasing

- Sales Order Management

- Performance Tracking

- Shipping Management

- Sales Forecasting

- Order Management

EnTrade Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Software by N T Soft Technologies

Hosiery Care is a trading management software manages all possible needs of hosiery agencies owners. Hosiery Care is an inventory & accounting software for hosiery agencies. Learn more about Hosiery Care

Explore various Hosiery Care features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Hosiery Care Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Software by N T Soft Technologies

SilkSol-Gold is a saree trading management software manages all possible needs of saree trader's & manufacturers. Silksol-Gold is an inventory & accounting software of saree trade concern. Learn more about SilkSol-Gold

Explore various SilkSol-Gold features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all SilkSol-Gold Features- Balance Sheet

- Inventory Tracking

- Invoicing

- Financial Management

- Budgeting

- Transfer Management

- Accounting Integration

- Multi-Location

SilkSol-Gold Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Software by N T Soft Technologies

A Supply Chain Management Software manages all possible needs of Distribution Agencies Owners. DistributorCare is a Inventory & Accounting Software for FMCG Agencies. With DistributorCare you can manage all day to day problems of Agencies. Learn more about FMCG Trading Management Software

Explore various FMCG Trading Management Software features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

- Order Management

- Reports

- Inventory Management

- Billing & Invoicing

- Stock Management

FMCG Trading Management Software Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Software by FSL Software Technologies Ltd

Frontline ERP is a product for manufacturing, exporting, and trading organizations. Keep track of every activity from order to cash; through integrated modules namely Procurement, Sales and order Management, Stock Management, Production Planning and Control, Financial and Cost Accounting, HR and Payroll, etc. Learn more about Frontline ERP

Explore various Frontline ERP features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Frontline ERP Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

500+Centers for Training & Support, 6 Lakh+ Users

MARG Trading Software for distribution or Supply Chain is designed to handle all the needs in most efficient, effective & accurate way. We are committed to provide the best supporting system for FMCG Business Read MARG ERP 9+ Trading Software Reviews

Explore various MARG ERP 9+ Trading Software features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

MARG ERP 9+ Trading Software Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

High Performer | 2024

HDPOS smart for your business

HDPOS smart is a feature rich, easy to use retail POS billing and inventory management software that is available to you at a very low cost in India. Retail POS software has full control on your business even if you are physically not in shop. Read HDPOS Smart Reviews

Explore various HDPOS Smart features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all HDPOS Smart Features- Import/Export DataBase

- Auto Discount

- Multiple Language

- Warehouse Management

- Tax Management

- Promotions Management

- Gift Card Management

- Returns Management

Pricing

HDPOS for single computer

$ 180

Per Annum

HDPOS Client-Server

$ 347

Per Annum

HDPOS cloud based subscription

$ 69

Per Month

HDPOS Smart Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Billing & Accounting Software for Traders

Trade plus is a proven quality accounting and inventory management software package used by several organizations. It is a single user package with features such as multiple financial years, VAT computations, cess on VAT calculations, multiple price rates, etc. Read Integra Trade Plus Reviews

Explore various Integra Trade Plus features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Integra Trade Plus Features- Accounting

- Taxation Management

- Expense Management

- Payment Handling

- Time Tracking

- Supplier and Purchase Order Management

- Invoice

- Customer Management

Pricing

Basic

$ 56

Onetime

Integra Trade Plus Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

High Performer | 2024

GST Billing software with Inventory & Accounts

Simple Billing software with complete inventory and accounts modules. It's fast, reliable and easy to maintain. Ideal for businesses that have a large number of invoices and deals in 100's of SKU's. Typically used by distributors, retailers and small manufacturers. Read Horizon ERP Reviews

Explore various Horizon ERP features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Horizon ERP Features- Grocery POS

- Purchasing & Receiving

- Multi-Location

- Account Management

- Multi-Office

- Expense Management

- Barcode Integration

- VAT / CST / GST Reports

Pricing

SINGLE PC License

$ 192

One Time

THREE PC License

$ 384

One Time

EIGHT PC License

$ 746

One Time

Horizon ERP Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Accelerate | Innovate | Compete

An all-in-one cloud ERP that provides real-time visibility and automation of fundamental company operations for operational excellence. AI and machine-learning-driven statistics, predictive analytics, and forecasting are all available. Read Focus ERP Reviews

Explore various Focus ERP features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Focus ERP Features- Material requirements planning (MRP)

- Quality Management

- Cloud Computing

- Forecasting

- Import & Export Data

- Client Statements

- Historical Reporting

- Corrective Actions (CAPA)

Focus ERP Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Most Affordable ERP Software

It is the best ERP solution designed to grow seamlessly with your business. CREST will accommodate additional business process and functionalities as your business scale over time. CREST is a fully integrated ERP product. Read CREST ERP Reviews

Explore various CREST ERP features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all CREST ERP Features- Bank Reconciliation

- Financial Management

- Time Tracking

- Distribution Management

- Business intelligence (BI)

- Budgeting

- Credit card processing interface

- Bookkeeping

CREST ERP Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Portfolio Management Solution

MProfit is India’s leading portfolio management solution catering to investors, wealth managers, family offices, brokers, and chartered accountants. Read MProfit Reviews

Explore various MProfit features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all MProfit Features- Asset Management

- Portfolio Management

- Asset Allocation

- For Investors & Traders

- Tax Management

- For Investment Advisors

- For Investors

Pricing

MProfit Free

$ 0

Free to get started

MProfit Lite

$ 33

Everything in Free, and...

MProfit Plus

$ 83

Everything in Lite, and...

MProfit Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

orion-erp

ORION Enterprise is a dynamic enterprise resource planning solution that allows organizations to smoothly integrate disparate teams, functions, processes, and systems. 3i Infotech is a global Information Technology company committed to Empowering Business Transformation. Read ORION ERP Reviews

Explore various ORION ERP features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all ORION ERP Features- Bank Reconciliation

- Financial Reports

- Purchase Order

- Transportation Management

- Collections Management

- Mobile Access

- Subcontractor Management

- Equipment Management

ORION ERP Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Software by RAY TECH

The Ray Tech Trade ERP system is a collection of tools, highly advanced business functional tools, to which many other modules can be attached or extended. It has several components (mandatory and optional), which can be installed as required. Thus Trade ERP provides easy expandability of the whole system. Read Ray Tech Trade ERP Reviews

Explore various Ray Tech Trade ERP features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Ray Tech Trade ERP Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

For Retail Stores & Chains

RetailGraph is a reliable Retail management software for Small & mid-market Retailers. Manage Retail billing, inventory, accounting, GST filling, POS system & more. Get real-time updates from Multi-stores. Multiple reports to analyze business performance. Read RetailGraph Software Reviews

Explore various RetailGraph Software features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

- Customer Management

- Payroll Management

- For Restaurants

- GST Compliance

- Purchasing & Receiving

- Catalog Management

- Customizable Catalogs

- Customer Purchase History

Pricing

Composition Addition

$ 139

Full License/Single User/Single Location

GST Addition

$ 208

Full License/Single User/Single Location

RetailGraph Software Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Billing, accounting and inventory software

Acme Insight is comprehensive software, specifically made for the Retailers, Wholesalers, and Distributors by considering all the complexities of their business. Varied types of useful reports and customer relationship management modules that leads your business growth. Best for electric industry tools. Read Acme Insight Reviews

Explore various Acme Insight features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Acme Insight Features- Retail Management

- Multi-Company

- Barcode Support

- CRM

- Sales Reports

- Cash Management

- Graphs & Charts

- GST Ready

Acme Insight Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Simplify your Quotations with Intellistant

IntelliStant is a CRM and business management software which helps you keep track of your customer and customer related activities. Packed with all essential modules from Lead generation to Quotation / Invoice / Payment management with a smart product catalog and a full Read Intellistant CRM Reviews

Explore various Intellistant CRM features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Intellistant CRM Features- Expense Management

- Marketing Analytics

- CRM & Sales Dashboards

- Product Database

- Sales Tracking

- On-Demand (SaaS)

- Manage Quotations

- Access Monitoring

Pricing

Intellistant CRM

$ 20

1

Intellistant CRM Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Software by C-Square Info-Solutions Ltd

Medical distribution software - PharmAssist comes with a complete solution, with the fastest billing, most organized and scientific stock arrangement which helps faster stock removal and delivery. Read PharmAssist Reviews

Explore various PharmAssist features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all PharmAssist Features- Bill of materials (BoM)

- Sales Management

- Distribution Management

- HR & Payroll

- Sales and Distribution

- Accounts payable

- Sales Quotes

- Purchase Order

PharmAssist Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

With the adoption of new-age technologies, trading and retail participation in the stock market has significantly improved. Trading has become one of the fastest-growing methods to accumulate wealth in a short period of time. However, it is necessary for traders to know about trading platforms and trading software comprehensively.

What is Trading Software?

Trading platforms are software systems that offer investors and traders certain financial institutions like banks and brokerages. Here, traders and investors can place trades and monitor their accounts.

A trading platform executes trade stocks in a networked environment using computer software. It allows investors to manage, open, and close market positions through financial intermediaries like online brokers.

Traders and investors can conduct limited security trades and maintain funded accounts on multiple markets.

Trading software enables the technical analysis and trading of financial products like options, stocks, currencies, or futures. It can be launched or downloaded from a mobile device or desktop.

As the commission costs have fallen over a decade, the investors and traders must conduct technical analysis and trading using self-directed trading accounts. So, the demand for software that provides trading capabilities, research, and information resources has increased.

The application programming interface (API) management system has helped charge up the trading industry. It is because API allows users to access the benefits of numerous software pieces.

Auto trading tools provide users with particular order types, charts, technical analysis tools, statistics, chat rooms, asset pricing information, and other proprietary functions that help software developers and brokers draw traders to the service.

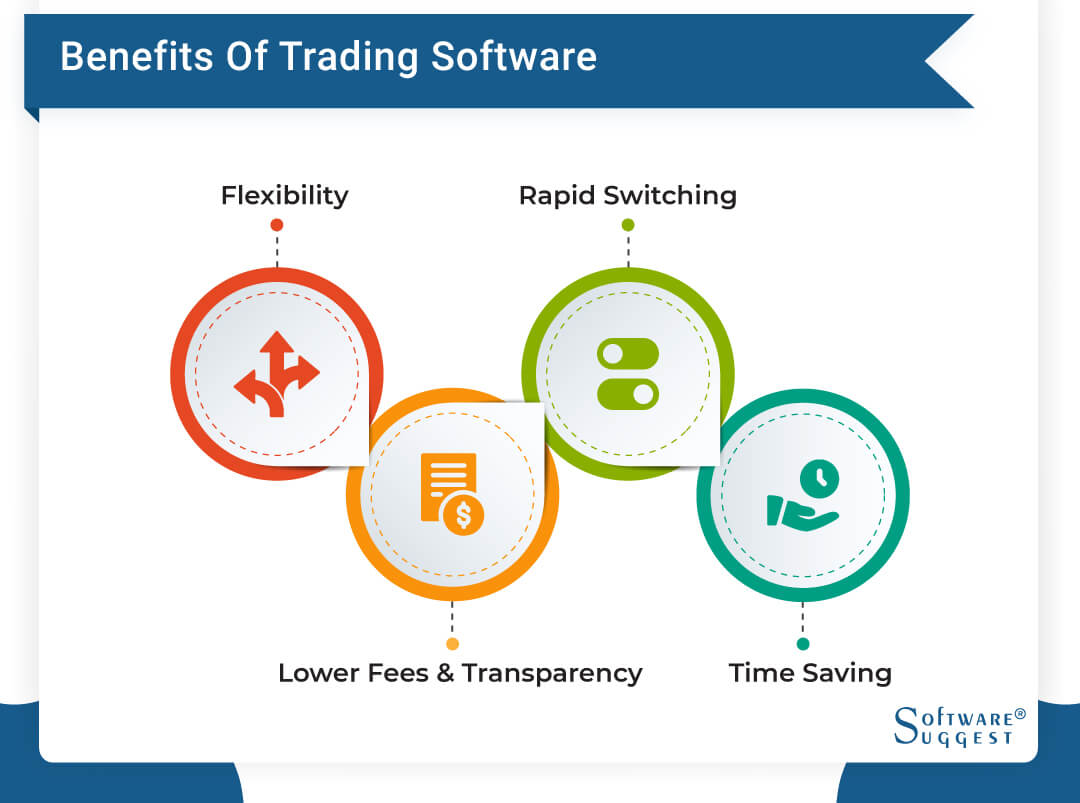

Benefits of Trading Software

-

Flexibility

Trading platforms are flexible. Customization on multiple items like resistance lines, sector comparisons, indicators, and others is available. Users can save the customizations and edit them accordingly.

Several trading platforms have app-based platforms that help investors get access directly with the help of laptops, smartphones, and other devices. With the introduction of e-trade, keeping track of online brokers, stocks and exchanges became easier.

-

Rapid Switching

With an online trading system, computer switching between stocks becomes easier and faster. Using a website that promises similar services may take time to flick through multiple stocks simultaneously because users will need to download separate web pages for each stock. Switching between stocks is crucial while using swing or day trading software.

-

Lower Fees and Transparency

Investors spend more money on traditional trading than on online stock trading tools. If an investor trades in large volumes and invests via reliable online brokers, it is feasible to negotiate the broker's fees in online trading.

The online stock trading software offers transparency as well. The shared details from the investor's online trading account display the extra charges like taxes, brokerage platform charges, and many others added to every transaction from their account. As a result, the investors get more clarity on the calculations for their day trading.

-

Time-Saving

The stock trading software saves users time compared to using a website. With the stock trading software, users realize the profits of the stock market. It also provides essential trading signals. For example, it recommends selling or purchasing foreign currency based on specific factors.

Moreover, the option "stop order" automatically stops selling stocks when the price charts drop below a set value in auto trading software. The trader must distinguish the opportunities provided by such a stock trading system to maximize his profit.

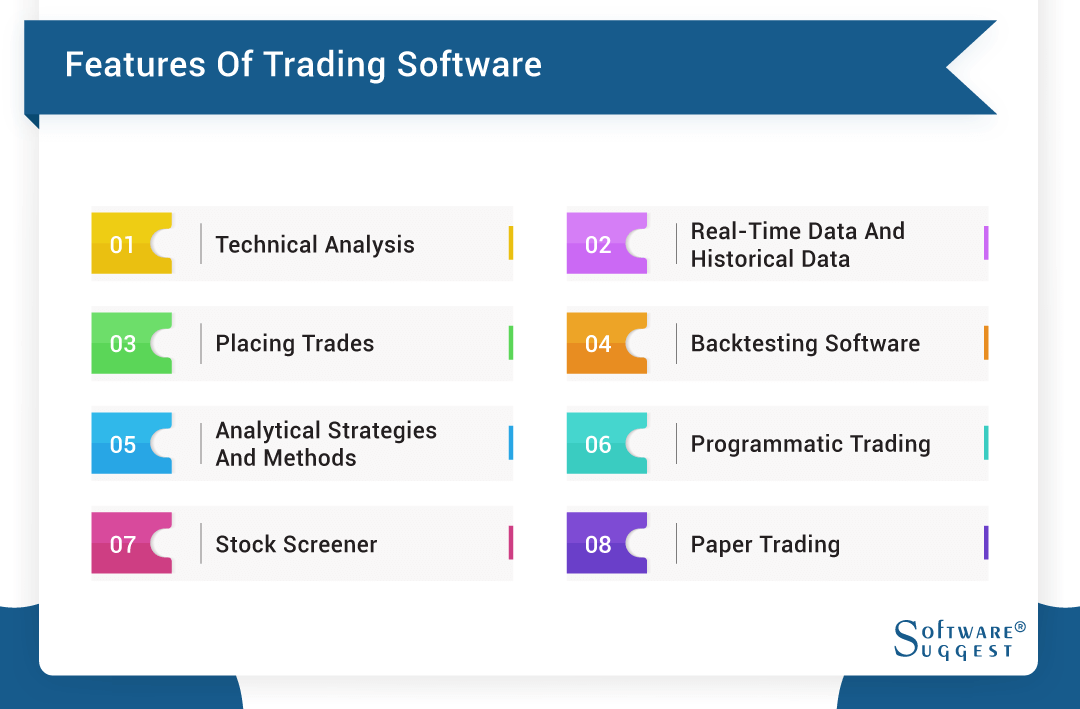

Features of Trading Software

-

Technical Analysis

The trading software offers users various tools to check stocks and trends in security movements, like classic chart patterns, technical indicators, and interactive charting.

-

Real-Time Data and Historical Data

Real-time market data is essential for traders to keep a check on short-term price movements. A slight variance between the actual price and the quote of the security may lead to profit, or users can even lose money.

Historical data also plays a crucial role as the price of security moves in identifiable trends and patterns that repeat over time.

-

Placing Trades

Many auto trading software can place trades like limit orders, market orders, and other advanced charting order types. Placing trades also allows you to view real-time data and the Level 2 order book.

-

Backtesting Software

Using historical data feeds allows testing of a given trading strategy that serves as a step of verifying the effectiveness of the process. It simulates the trading strategy within a specific period and analyzes the results from the perspective of return and risk.

-

Analytical Strategies and Methods

In active trading, traders use various strategies, including swing and day trading. In swing trading, users hold security for one to several days in a bid to profit when the price charts change. In day trading, the position closes within the same day.

Swing traders use to set rules based on technical analysis and fundamental analysis.

-

Programmatic Trading

Traders develop trading systems using advanced software that executes automatically rather than clicking any manual button. The software solutions also offer backtesting functionality that allows traders to test their automated trading software's performance when given specific commands.

-

Stock Screener

Stock screeners are trading tools traders use to filter stocks based on specific user-defined criteria.

-

Paper Trading

Paper trading is a virtual money trading functionality with no substantial risk. It does not require actual money trades. So users do not lose money. In paper trading, users can test their skills and abilities with virtual money and e-trade rather than indulging in actual capital. It is a common feature among brokers in the forex trading market.

Types of Trading Platforms

- Commercial Platforms

- Proprietary Platforms

-

Commercial Platforms

Commercial platforms are for retail investors and day traders. The commercial platforms come with multiple helpful features like live interactive charts, survey tools, educational content, international news feeds, and real-time quotes.

-

Proprietary Platforms

Proprietary platforms are designed by large brokerage account businesses and other financial institutions for their personal and active trading activities. Proprietary platforms imitate the requirements and trading styles of electronic brokerage services. The proprietary platform trading privileges are not available to the public.

How are Trading Platforms Useful?

Within the network-based environment, active traders can electronically negotiate offers based on transaction parameters and multiple other terms and conditions to satisfy both parties.

A trading platform offers functions and advanced features that make real-time interaction with trading partners possible.

Mostly, the platforms have numerous additional features like premium research information, real-time data quotes, and charting tools to enable real-time availability of trading strategies or news feeds and warrant smooth negotiation between and among traders.

Moreover, it also offers customization to suit the unique needs of particular market data like currencies, futures, and forex, data feeds, stocks, and options trading.

Trading system platforms also offer plenty of choices for managing and executing trade ideas by providing capabilities that suit each market data's needs. Moreover, professional traders can utilize trading platforms for free or at a discount, depending on the financial intermediary.

Trading privileges subject investors to buy and sell shares quickly at one place according to their convenience. It also offers an easy-to-use interface with immediate order entry screens for beginning investors.

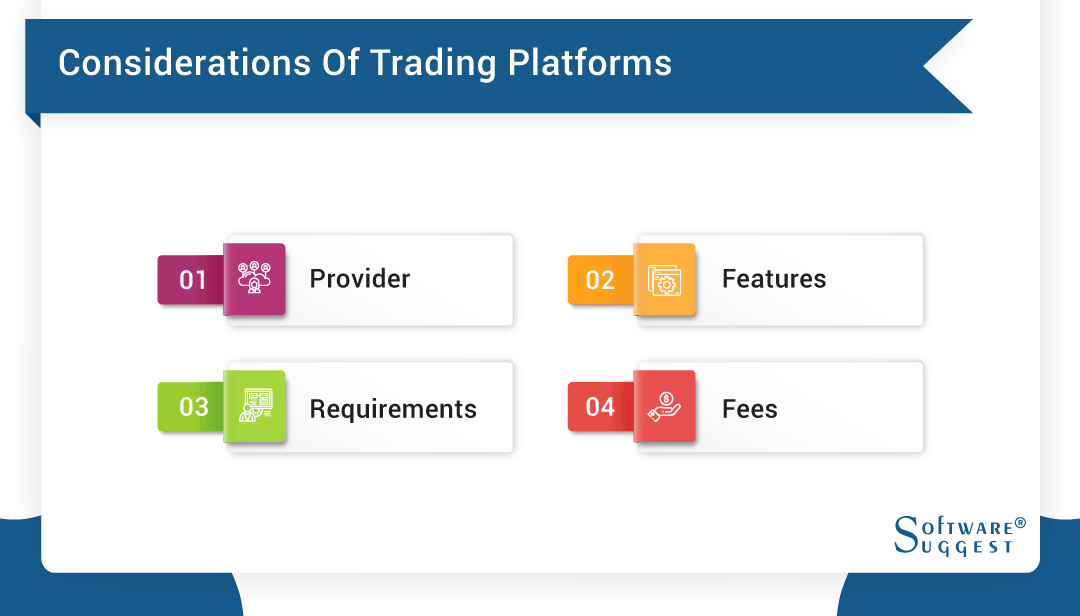

Key Considerations While Selecting Trading Platforms

-

Provider

Some trading system platforms are not connected to a specific broker. Similarly, some trading systems are available when investors work with a particular broker. So, investors must ensure the reputation of the typical broker or intermediary before committing to an advanced platform to manage accounts and execute trade ideas.

A provider must back the past performance and stand solidly behind everything a platform offers.

-

Features

Features are essential when choosing a trading system platform. Investors and traders must ensure that the platform's features meet their trading ideas. Short-term and day traders may require features like a subscription-based model providing real-time access to the NASDAQ order book, also known as Level 2.

Day trading may also require features that offer access to market-depth information like order size, price levels, and volume to assist them in timing their orders. Day trading may also need technical analysis tools like life charts offering a range of technical indicators. Finally, the pattern day trader will need tools mainly developed to help them analyze, research, and test their trading strategies.

-

Requirements

The online trading platform has specific requirements to open an account and trade. For example, day trading system platforms may require that the traders have a minimum of $30,000 in equity to be approved for margin account trading.

The options trading may require the traders to be approved of multiple options before using the trading system platform.

-

Fees

When choosing a trading system platform, fees are also essential. For example, if traders employ scalping as a trading strategy, they will gravitate towards platforms with low costs. Though low fees are always preferable, there can be trade-offs to consider. For example, low costs will not benefit situations with fewer or less powerful features.

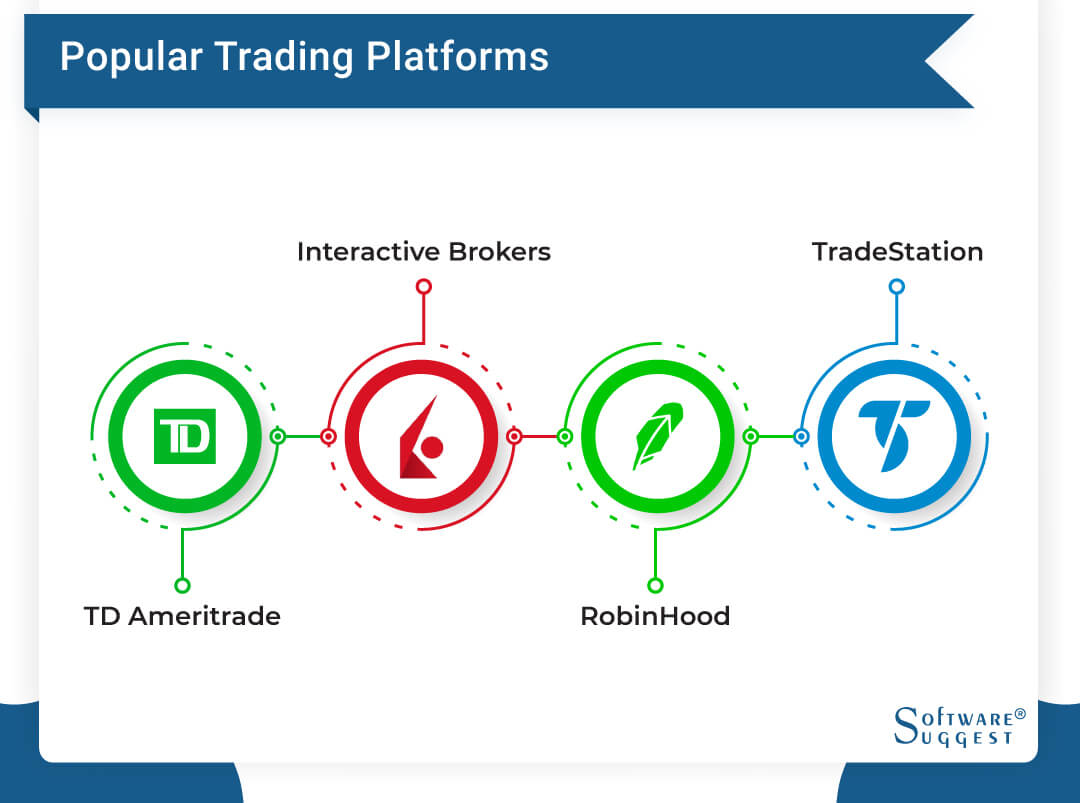

What are Some Popular Trading Software Platforms?

-

TD Ameritrade

TD Ameritrade offers the best online stock trading for long-term investing and retirement planning. TD Ameritrade is a famous brokerage account for both investors and traders that falls under the Charles Schwab Corporation. TD Ameritrade is now known as Charles Schwab futures and Forex LLC.

-

Interactive Brokers

Interactive Brokers ranks among one the top ta in the online broker's review. It is one of the best trading platforms for professional e-trade. It has low fees and access to numerous markets around the globe. Interactive Brokers are best for global stocks.

-

RobinHood

RobinHood is mostly a commission-free trading system platform. It started as a mobile trading app but now has a web interface. RobinHood is one of the best stock trading software for beginners. The platform makes money by selling order flow to large brokerages, from interest on cash in its accounts and multiple other sources.

-

TradeStation

TradeStation is a popular platform for algorithmic trading that executes trading strategies using automated scripts developed with EasyLanguage.

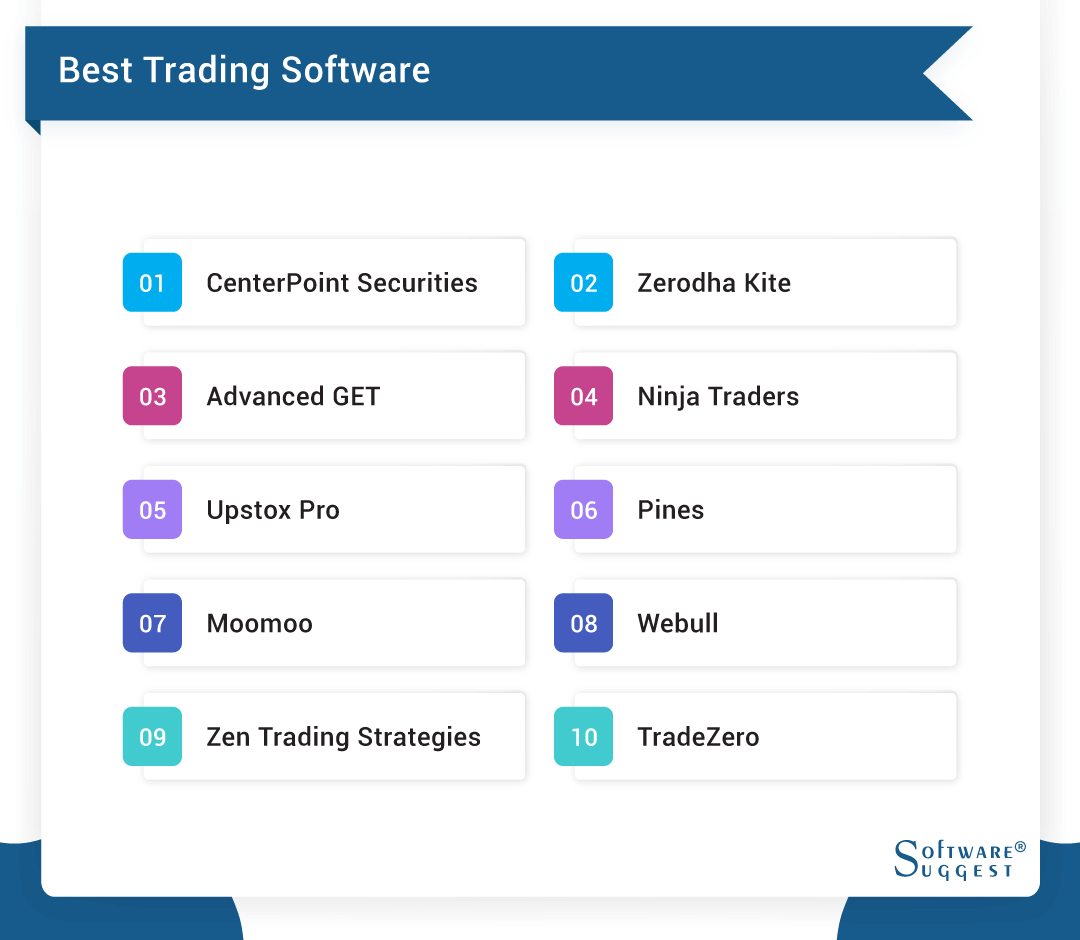

10 Best Trading Software for Professional Traders

Brokerages offer free trading systems and also discounted ones. In addition, it is sometimes offered as an incentive to elicit a certain amount in trading volumes.

The best stock trading is not limited to technical analysis, screeners, spreads, and in-depth research tools. The best-performing online stock brokerages are necessary for advanced traders to make the best trades.

While there is numerous online trading software available in the market, some of the best options for trading software include:

- CenterPoint Securities

- Zerodha Kite

- Advanced GET

- Ninja Traders

- Upstox Pro

- Pines

- Moomoo

- Webull

- Zen Trading Strategies

- TradeZero

-

CenterPoint Securities

With CenterPoint Securities, traders get direct market access and powerful online trading software for high-volume, short, momentum, and advanced traders. In addition, it offers advanced charting, advanced order routing, level 2 order management, custom alerts, and built-in scanners.

-

Zerodha Kite

Zerodha Kite is the best trading software in India. It uses next-gen technology and offers a wide variety of features like data widgets and integration with third-party provider apps to make trading simple and fast. It is the best software for the Indian stock market. It also tops among the online broker review rankings.

-

Advanced GET

Advanced GET has full access to trending technical analysis tools and is used by professional traders in over 5O countries. Advanced GET trading software price is $4,214 for one-time use. Advanced GET software is a good option whether you trade on penny stocks, mutual funds, or particular stocks.

-

Ninja Traders

Ninja Traders is the best trading software for PC. It can access forex trades, stocks, futures, options trades, and contracts for differences (CFD). It is also a good option for equity trading.

-

Upstox Pro

Upstox Pro is considered one of the best trading software in India among investors and traders. Trade execution with this app is easier and faster. It is automated and free to use when users have trade ideas and are ready to place a trade.

What is the Cost of Trading Software?

The cost of auto trading software varies from one to another. However, to estimate the development and costs of auto trading, the following points are crucial:

- Research and discovery

- Development approach formulation

- User interface design

- Development process

- Maintenance, testing, and delivery

The development costs are usually estimated by the software's complexity, analytical tools, features set, cloud services, technical tools, etc.

Creating an auto trading for mobile takes 5-10 months. Considering all the factors, the total price of a share market trading can be around US$25,000 or US$300,000. And the total cost for developing mobile high-frequency trading software can be around US$55,000.

Investing VS Trading

Investing is a long-term approach to gradually earning wealth over time using schemes like mutual funds, buying and selling a portfolio of bonds, a basket of stocks, etc.

On the other hand, trading is a short-term process involving frequent transactions based on current trends and market volatility.

It depends on the user whether he wants to invest or trade. Trading involves more risk than investing as it is a short-term approach. Though both have profits, traders earn more profit than investors when the market scanner finds actionable chart patterns and performs accordingly.

FAQs

To use trading software, you must place trades, monitor accounts, order trades, and execute market positions.

Automated trading is a way of participating in financial markets using a program with pre-set rules for entering and exiting trades. Auto trading software uses computer programs to follow an investment strategy to sell and buy orders on stock markets and other exchanges.

To start automated trading, you need to follow the below steps:

- Choose the platform and set your own indicators for the trading strategy

- Use your trading experience to set rules and conditions.

- The custom algorithm applies the criteria and places trade on your behalf.

Day traders are market operators who are involved in day trading. Using day trading software, day traders buy and sell stocks and securities in a single day with the hope of making a profit on short-term activity.

By Countries

By Cities