What is LoansNeo?

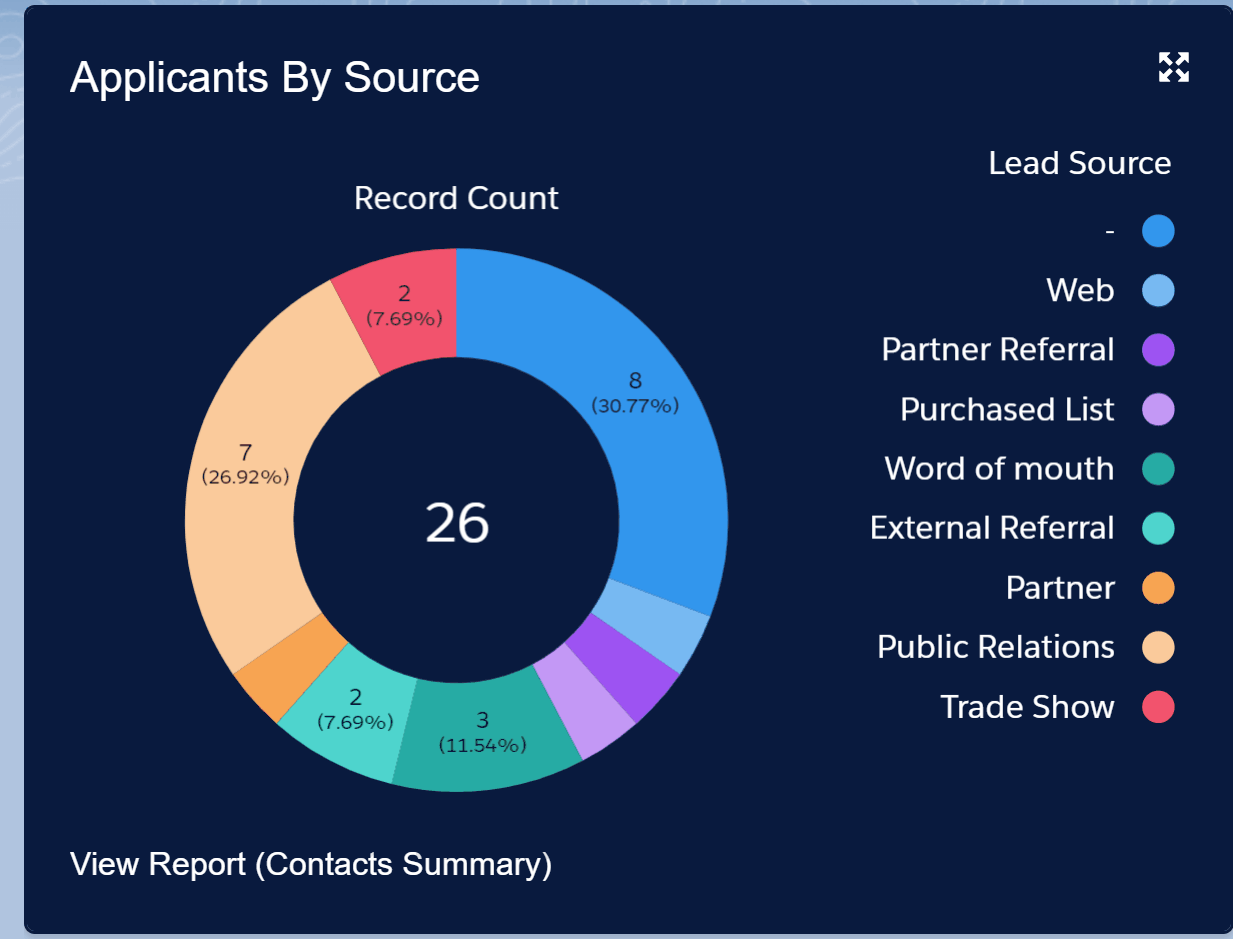

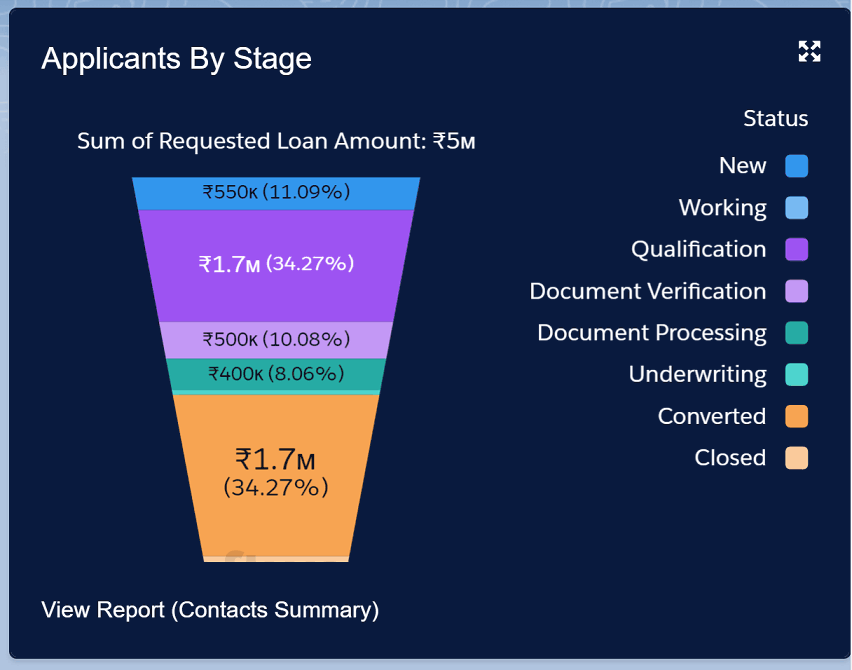

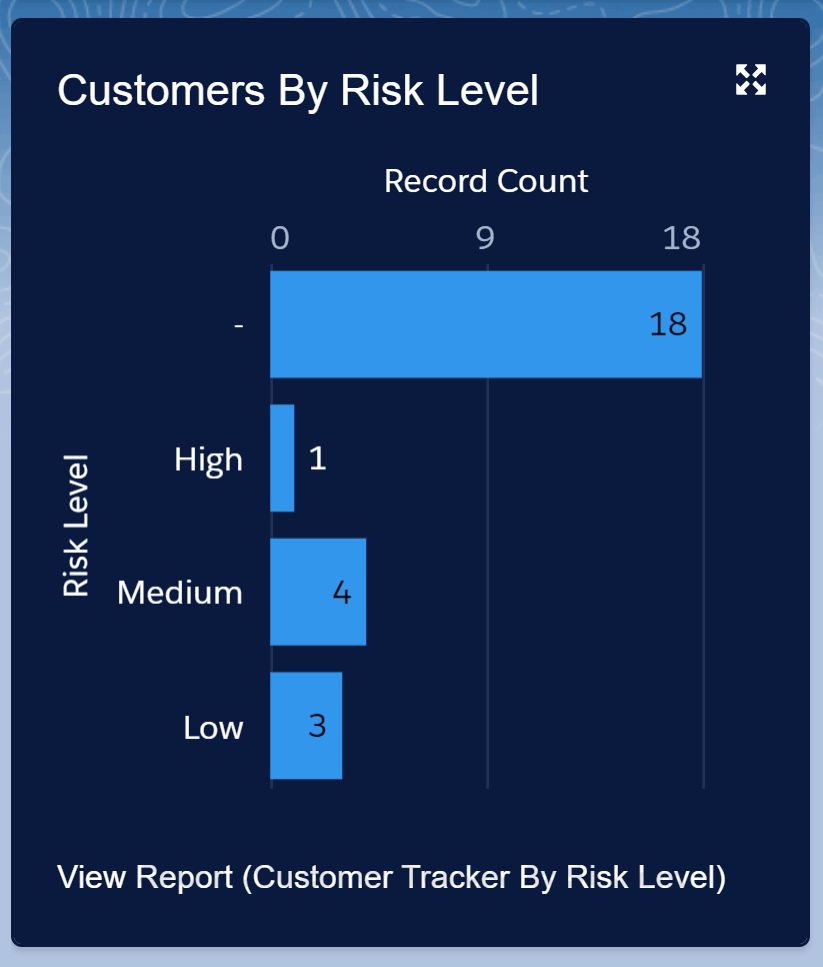

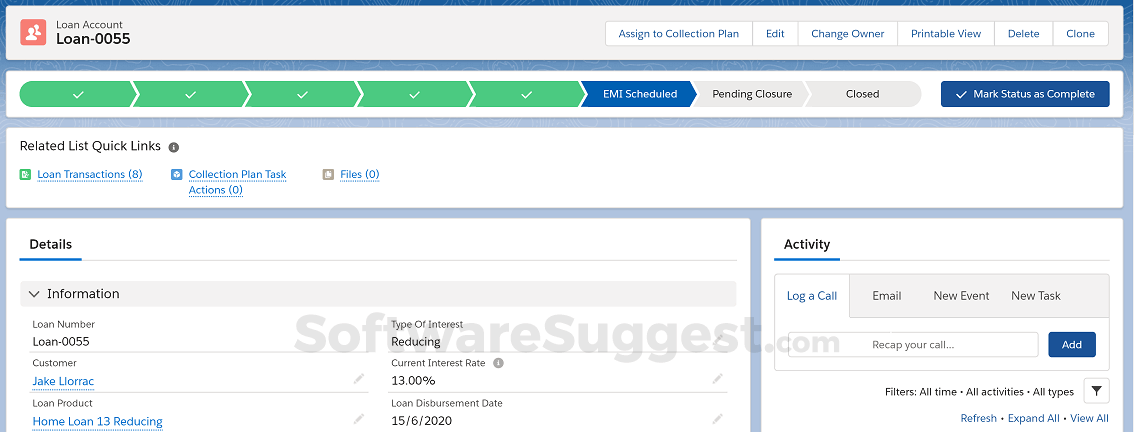

LoansNeo is a lending management software developed for Banks and NBFCs. It comes with custom workflows, visual analytics, and AI-based recommendation features and can simplify loan origination, journey management, scheduling, payment tracking, and other activities.

LoansNeo Starting Price

Our Awards and Recognition

Talk with a software expert for free. Get a list of software that's great for you in less than 10 minutes.

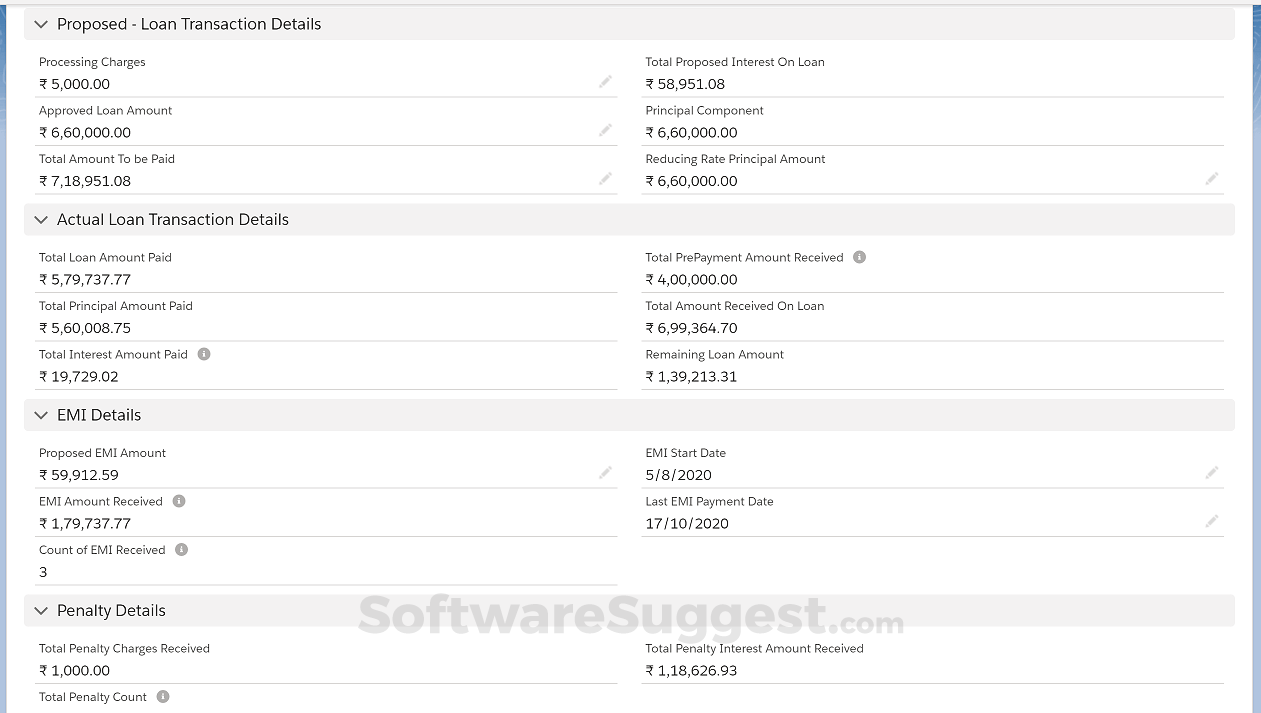

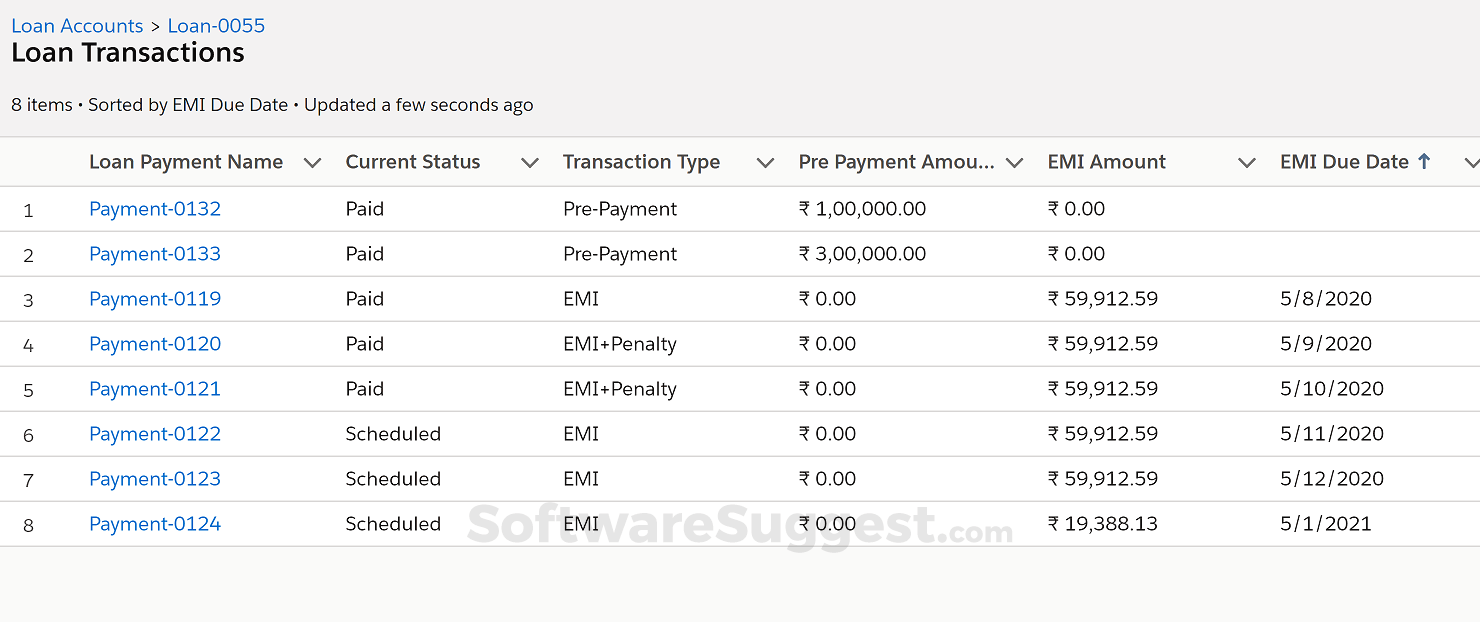

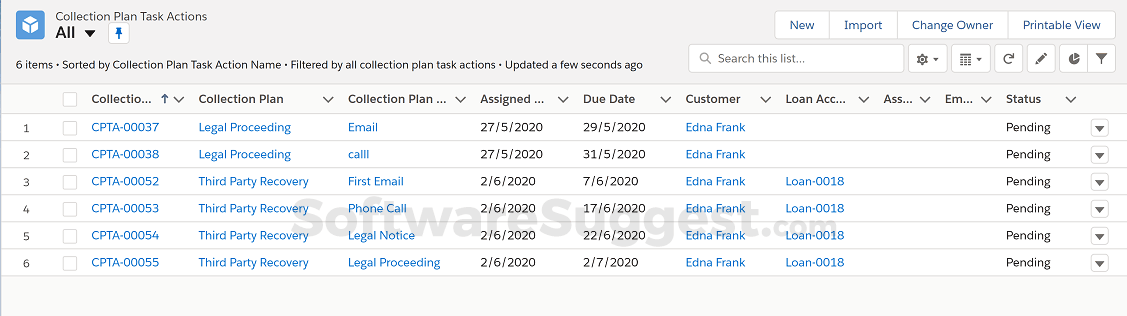

LoansNeo Screenshots

Key Features of LoansNeo

Here are the powerful features that make LoansNeo stand out from the competition. Packed with innovative tools and advanced functionalities, this software offers a range of benefits.

- Account Alerts

- Accounting Management

- Activity Tracking

- Amortization Schedule

- Application Management

- Asset Management

- Audit Trail

- Auto Loans

- Automatic Funds Distribution

- Automatic Reset

- Billing & Invoicing

- Browsing Restrictions

- Business Loans

- Check Writing

- Client database

- Closing Documents

LoansNeo Specifications

Get a closer look at the technical specifications and system requirements for LoansNeo. Find out if it's compatible with your operating system and other software.

- Salesforce

LoansNeo Description

Here's the comprehensive description of LoansNeo. Gain a brief understanding of its unique features and exceptional benefits.

LoansNeo is an AI-driven solution for Banks & NBFCs for comprehensive lending operations management. Manage end-to-end customer journeys from lead to a customer, track payments, schedule loans, put penalties, and much more with LoansNeo.

LoansNeo Resources

LoansNeo Customers

Overall LoansNeo Reviews

Thinking about using LoansNeo? Check out verified user reviews & ratings based on LoansNeo's features, user-friendliness, customer support, and other factors that contribute to its overall appeal.

LoansNeo Pros and Cons

"Easy integration with payment gateways and other marketing apps.Assists with risk profiling and predictive analytics for each customer.Facilitates faster interactions via inbuilt automated and customized approvals."

"What sets LoansNeo apart from other products is its transparency, from the easy application process to the transparent terms and efficient customer service. It requires no IT involvement and offers pre-built support for receivables, audit trails, ris"

"It is based on Salesforce’s gold-standard framework and can be customized to fit in the business needs appropriately. It offers flexible reporting with detailed data-based insights and can be configured easily."

"Failing to utilize the software to its full potential might be costlier, which can be one of the cons.It is advised to check if the software works well for your business-specific needs.Otherwise, there are no cons as such"

"As of now, I haven’t found any loopholes in the product. Instead, it can be customized according to the business needs."

"There is nothing to dislike about this product as it completely suits my organization’s needs."

Alternatives of LoansNeo

Explore alternative software options that can fulfill similar requirements as LoansNeo. Evaluate their features, pricing, and user feedback to find the perfect fit for your needs.

LoansNeo FAQs

What apps do LoansNeo integrate with?

LoansNeo integrates with various apps:

- Salesforce

What are the top 5 features for LoansNeo?

The top 5 features for LoansNeo are:

- Activity Tracking

- Pipeline Management

- Marketing Management

- Loan Processing

- Application Management

What type of customer support is available from LoansNeo?

The available support which LoansNeo provides is:

- Phone