About Sleek Bill:

Headquartered in Bucharest, Sleek Bill is a GST Invoice Software, targeting Indian businesses. The company was founded by Victor Antiu in January 2014. The software aims to make the invoicing process easy for businesses by delivering quick invoice generation. The software is available in both modules – online and offline.

I got a chance to see how Sleek Bill works from its 14 days free trial, and this is what I have to say about Sleek Bill:

Full Sleek Bill Review:

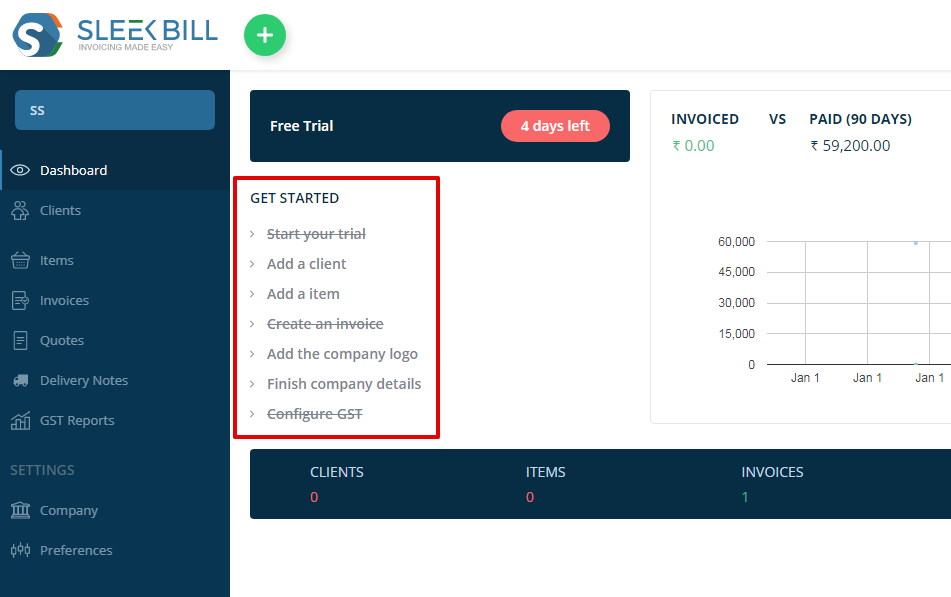

The way I understood the software from one of the members of Sleek Bill, was very easy! So, we will go through the software in the same pattern. And when you will see its dashboard for the first time, you will find the same pattern as well.

The first thing to do when you hop onto this platform is – Configure it with a GST number. As we all know, GST has become a prime requirement for every Indian business. So, the first thing, the billing software will ask if your company details and a GST number.

As we can see, there are few tasks that you have to complete before you start making invoices. This process is a one-time thing, after that it will hardly take 5 minutes to make an invoice! Let’s have a look at the steps to complete:

- Feeding Company Details

- Adding Items

- Adding Clients

- Generate an Invoice

Let’s starts with the first step.

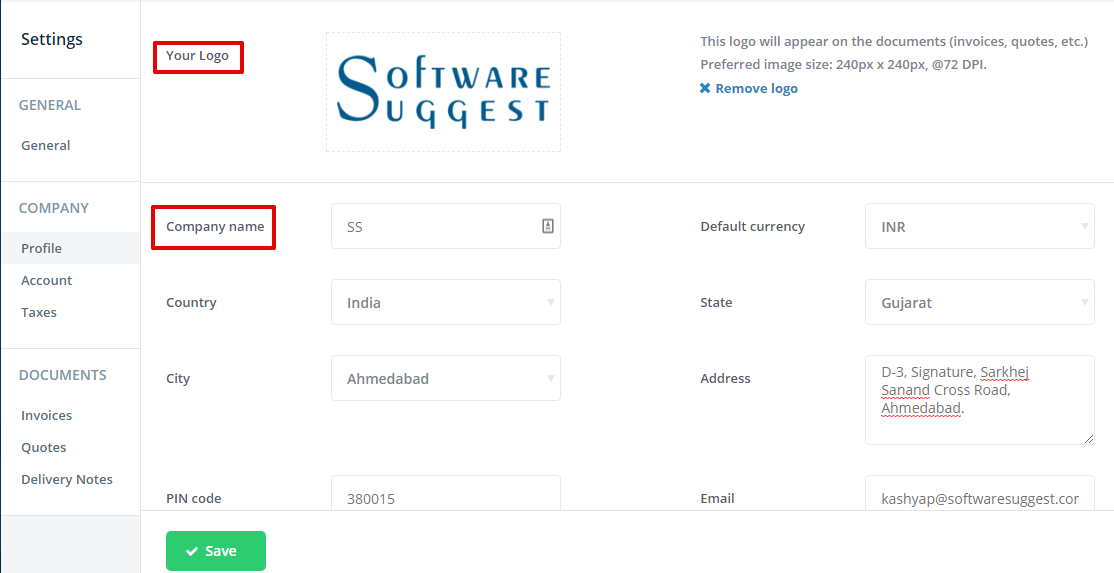

- Feeding Company Details:

You have to fill the necessary details of your company like name, logo, address, taxation type (GST/composition scheme/non-GST), service tax number, GSTIN etc.

You can also add your bank details, and these primary details will be reflected in your every invoice.

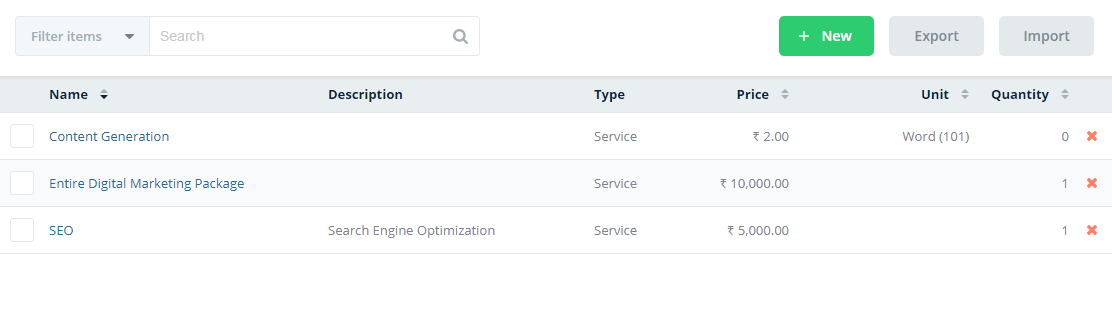

- Add an Item:

In this process, you have to mention a service or a product that you’re offering to your clients. On the time of invoice generation, you can directly add the service or product in the invoice.

For the reference, I’m taking a random example where I’m offering my clients three kinds of services:

- Search Engine Optimization (SEO)

- Content Generation

- Website Designing

Here, I have added three dummy services with their prices. You can add various units like (kg, liter, Per word, km, etc.) Have a look:

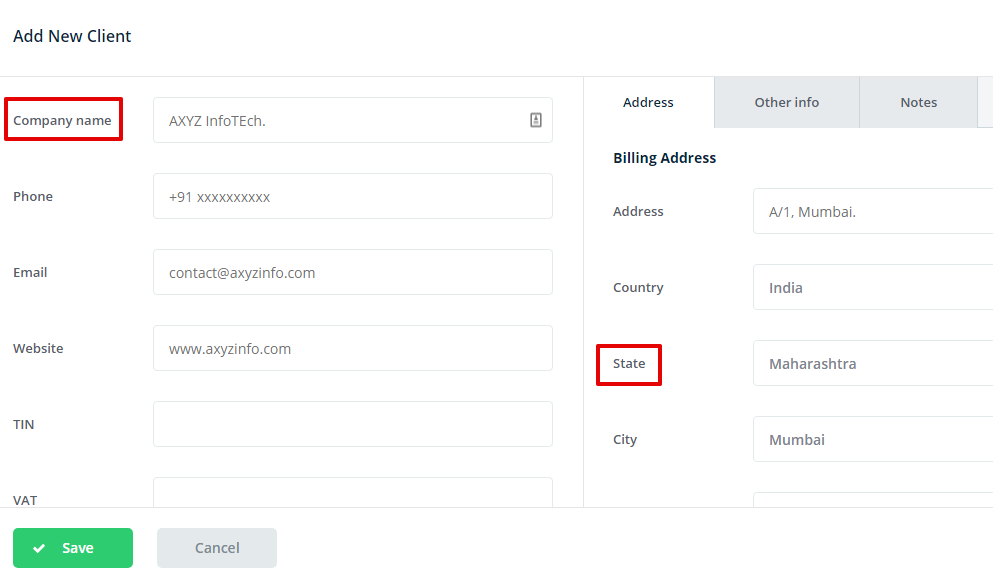

- Adding Clients:

Well, we provide services to someone! Mentioning a client is pretty common in any invoice, so it’s one of the essential things in Sleek Bill. For the purpose of understanding, I’m adding a dummy company:

If the client is from the same state where you reside, then the 18% GST will be divided into two parts CGST and SGST. But, if the client’s state of existence differs from yours, there will be one tax of 18% IGST.

Let’s move to the next step which is generating an Invoice!

- Generating an Invoice:

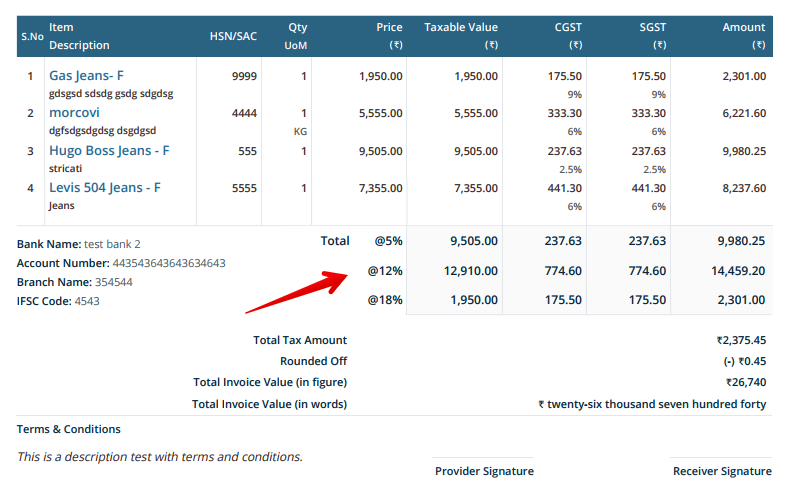

You can use the previously saved details like clients and items (service/good) here. The generation of an invoice hardly takes 5 minutes! Have a look at the piece that I have tried:

As soon as you click on the “Save” button, you have your invoice ready! Just like this:

You can make additional changes like changing the format of the invoice from portrait to landscape, assigning a label to the invoice, changing the color of the invoice. You can directly download the invoice with pdf format.

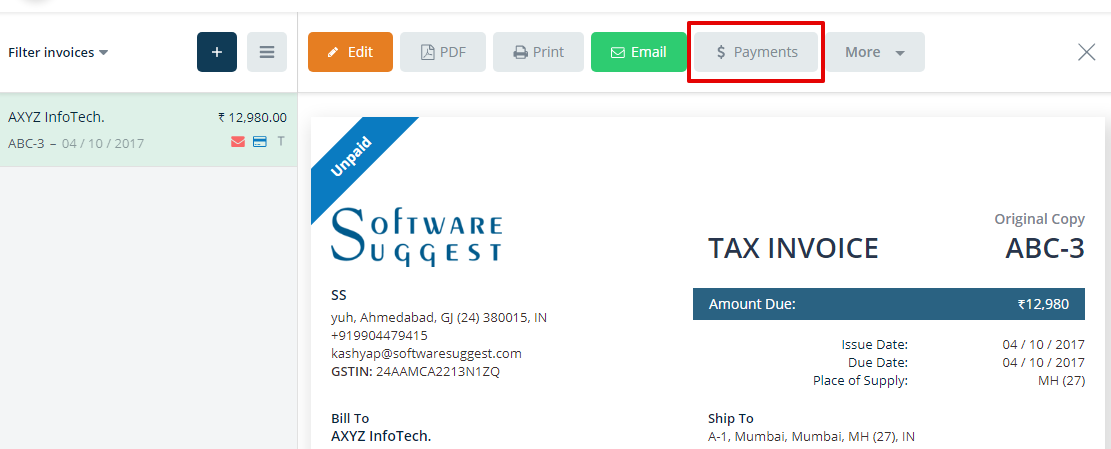

Now, when you receive the whole payment from the client, you can directly put an entry of the payment, and the invoice will be cleared.

As soon as you pass the payment, the dashboard will show you that you have no payments due:

GST Reports:

One of the most important parts of adopting a GST ready invoice accounting software is, to get a ready GST reports. Let’s see the process of how easily you can generate the GST report with Sleek Bill.

There are two kinds of reports Sleek Bill will generate for you:

- GSTR1

- GSTR3B

GSTR3B is the lump sum amount you have to pay to Indian Government according to your sales. When you generate GSTR3B from Sleek Bill, it will send you the GST report to the registered email address. You can download the entire report from the email itself.

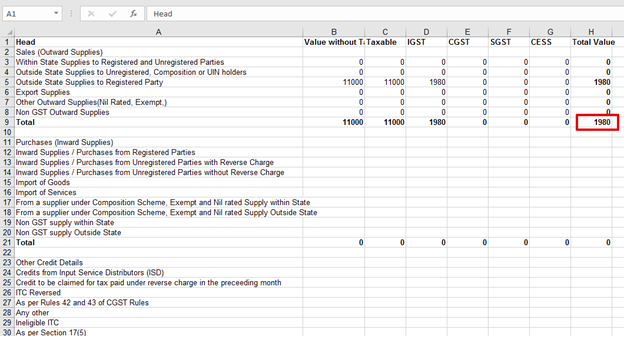

It shows you the total amount of tax you have to pay according to your sales. It also generates the sheet where you can differentiate your state-wise taxes.

On the other hand, Sleek Bill will generate GSTR1 report which will have all the details of transactions you have made, and payable amounts.

You can make the total of the payable amount of each transaction and figure out what amount of tax you have to pay to the government.

File GSTR-1 Directly from Sleek Bill Online:

From the upgraded account, you can file your GSTR-1 by following this simple method:

- In the dashboard, select GST Reports.

- Select the month you wish to file GSTR-1.

- Click on the “Sync Data to LegalRaasta”.

- Click on “Activate GSTR Filling”, this will activate your account on LegalRaasta.

- After syncing your data in LegalRaasta, click on “Login to LegalRaasta”.

- After clicking on “Work on GST Return”, it will show you green ticks after filling all the details.

- Then you can “File” your GSTR-1 Report.

Other Features:

Apart from generating invoices and quick GST reports, you can also generate a proforma invoice, quotation, bill of supply, delivery notes, credit notes etc.

The attitude of GST is fluctuating at this stage, so Sleek Bill keeps updating the software as per the government. After the December, GSTR3B will be removed, so you can expect the change in Sleek Bill as well.

Bottom Line:

As we discussed, the laws of the GST is changing, and Sleek Bill is constantly adopting every change as per the laws. I did find some minor hitches while using the online version, but they can be ignored as the software is efficiently performing every element of an invoice software.

In a nutshell, spending Rs. 1999/year for such a beautiful GST invoice software is a total thumb up!

SoftwareSuggest empowers businesses to discover top business software and service partners. Our software experts list, review, compare and offer a free consultation to help businesses find the right software and service solutions as per their requirement. We have helped 500,000+ businesses get the right software and services globally. Get a free consultation today!