What is Easebuzz?

Easebuzz, a software-enabled payments platform, empowers small businesses to digitize payments seamlessly. It eliminates worries about business process challenges, offering smart APIs and cost-effective solutions in one place.

Easebuzz Starting Price

$ 0/Per User

Our Awards and Recognition

Talk with a software expert for free. Get a list of software that's great for you in less than 10 minutes.

Key Features of Easebuzz

Here are the powerful features that make Easebuzz stand out from the competition. Packed with innovative tools and advanced functionalities, this software offers a range of benefits.

- Card Storage Vault

- Dynamic Event Notification

- Electronic Check Processing

- Flat Transaction Fee

- Fraud Screening

- Integrated Merchant Account

- Invoice Payments

- Invoices

- Live Monitoring

- Multicurrency

- Multicurrency payment processing

- Multilingual Checkout Page

- Multiple Bank Connection

- Multiple Payment Options

- Multiple Payment Types

- No Paperwork

- Access Controls/Permissions

- Account Management

- Account Tracking

- Accounting

- Accounts payable

- Accounts Receivable

- ACH Check Transactions

- ACH Payment Processing

- Ad hoc Analysis

- Ad hoc Query

- Ad Hoc Reports

- Analytical Reporting

- Approval Process Control

- Approval Workflow

- ATM Management

- Auto Loans

- ACH Check Transactions

- Credit Note Management

- Customer Communication

- Data Entry Saver

- Debit Card Support

- Fraud Prevention

- Generate Comprehensive Reports

- Gift Card Management

- Integrate Different Payment Gateways

- Internet Merchant Account

- Invoice Application

- Invoice Management

- Invoice Payments

- Invoices

- MIS Reports

- Multiple Merchant Numbers

- ACH / eCheck support

- ACH Check Transactions

- Bitcoin Compatible

- Credit / Debit Support

- Debit Card Support

- Mobile Payments

- Online Payments

- POS Transactions

- Recurring Billing

- Signature Capture

- Access control

- Account Tracking

- ACH Check Transactions

- ACH Payment Processing

- Audit Trail

- Bitcoin Compatible

- Billing & Invoicing

- Carrier Access Billing

- Contract Management

- Customer Portal

- Customizable Billing

- Deferred Billing

- Delayed Billing

- Discount Management

- Dunning Management

- Flexible Rate Tables

- Internet

- Invoice history

- Multi-Currency

- Multi-Period Recurring Billing

- Order Management

- Payment Processing

Easebuzz Pricing

Here are the pricing plans for Easebuzz. Choose the plan that best fits your requirements and budget. Get Detailed Easebuzz pricing as per your requirements.

- All features are free

- No setup charges

Easebuzz Specifications

Get a closer look at the technical specifications and system requirements for Easebuzz. Find out if it's compatible with your operating system and other software.

- iFrame

- Semaless

- Web

- Mobile

- Third Party

Easebuzz Comparisons

Compare Easebuzz with other similar options available in Payment Gateway Services. Explore the key differences to see why it's the top choice for businesses and individuals.

Easebuzz Description

Here's the comprehensive description of Easebuzz. Gain a brief understanding of its unique features and exceptional benefits.

Easebuzz is an online payment solution catering to small and medium sector enterprises. Most of these businesses find it difficult to go online with their business. Many of the freelancers working from home don’t have much IT or technical knowledge and they want an easy and cost-effective solution. We launched “Easebuzz” solving this major problem in the current industry. You can go online on Easebuzz in minutes with just 2 documents. We need your business PAN card and cheque book’s 1st page or Bank statement’s 1st page.

1. Easebuzz allows you to sell any of the following:

- Physical Products

- Digital Goods

- Membership or Services

- Event Tickets

An Indian seller with a bank account can easily set-up their own digital shop or webstore from where buyers could buy their products. We also allow you to integrate our payment API’s over your own website. Many of the businesses need an advanced dashboard with analytics and insights on each sales that they do. We have created a dashboard which makes the payment solution extremely customizable. We have created the payment API’s for almost all the available Ecommerce websites.

2. A few features that makes us different ?

- A digital product can be uploaded here and a buyer pays via Easebuzz payment gateway & everything including delivery is taken care by Easebuzz.

- We offer 50% cashback in the form of coupons after each purchase to all the customers. Suppose your customer makes a payment of Rs 100, then he/she shall receive coupons worth Rs 50 which he/she can select on the payment page.

- There are no setup fees & it takes 5 or maximum 10 minutes to get started.

- You get a seamless experience as we don’t ask customers to register on our portal before making payments. There is always a guest checkout and the customers can easily pay from all devices

- You can also list your own own coupons on our payment page as a co-branding facility to promote your business. These coupons are visible on the payment page where the customer enter his/her Debit,Credit or Netbanking options

- You can request for customized payment via a link where a customer can just enter the amount and pay to you via Debit,Credit or Netbanking options.

- We are PCI-DSS compliant which is an international standard followed to make your payments secure. We also allow processing of payments through All debit cards, Credit cards and over 90 + Netbanking options.

- We can enable wallets for your business. We have wallets of Paytm, Mobikwik, Airtel Money,etc.

3. Pricing and Other Details

- All merchants can avail flat pricing from us for the link or webstore payment solutions. We charge only 2.5% per transaction. (inclusive of all taxes)

- We do not have any set-up fees or hosting charges. We do not charge any Annual Maintenance fees.

- You can go live with us in 5 minutes

- For merchants who wants to use our API solution can have differential pricing as follows –

|

Particulars |

Pricing |

|

All Debit Cards (Visa,Master and Maestro) |

1.2% |

|

All Credit Cards |

2.2% |

|

Netbanking Options (Over 90 + banks) |

2 % |

|

Wallets (Mobikwik, Paytm, Oxigen, Airtel Money,etc) |

2.4% |

|

Debit + ATM Pin Option |

1.2% |

Taxes shall be extra at actuals. Please note that this pricing is only possible for merchants who will use our API’s.

Sell your products online with ease and now you can also go live with your business in minutes. Just register on Easebuzz and get started

The world has only understood the importance of financial technology in the wake of this pandemic. Businesses, governments, and financial institutions have realized that sustainability and continuity are hard to achieve without embracing the digital revolution. While financial technologies (fintech) rapidly evolved in the past years, the pandemic has skyrocketed the adoption rates, with many fintech providers expanding their services and offering tailored solutions.

Both large corporations and emerging businesses have faced challenges in performing business operations during the pandemic. However, since enterprises have more resources, they can quickly adapt to changing circumstances. On the other hand, small and medium-sized businesses find it challenging to overcome such obstacles because they receive limited support from financial institutions and since there aren’t many fintech providers that cater to their needs.

Digitizing stores, processing payments, digital disbursements, automated invoicing, and credit lending are some major problems that Indian (and global) SMEs have had to deal with over the past year. Moreover, frequent lockdowns halted cash flow and stopped their expansion plans. Thankfully, a few fintech providers have come to the rescue of mid-sized businesses, helping them level up with a personalized payment, loan, and digital finance solutions.

This review will focus on Easebuzz — a unique online payment solution designed for small and medium enterprises. Easebuzz offers core financial and ancillary services to help firms digitize their business transactions, collections, and settlements.

Through this review, we will cover the following points:

- Introduction to Easebuzz

- Key Features of Easebuzz

- Our Final Verdict

So let’s get started on Easebuzz and what it can do.

Introduction to Easebuzz

Easebuzz is an India digital payment solution provider that helps businesses collect and make payments online. Available both as a web and mobile application, Easebuzz is dedicated to creating APIs that help include fintech services within your existing software or ERP system. This novel application caters to over 50,000 businesses and merchants worldwide, helping them collect and disburse payments digitally to multiple vendors, customers, and accounts.

Easebuzz makes it extremely easy for businesses to create their virtual store, digitize their services, and transact online. The application allows you to add product/service details, assign categories, and configure custom rules and refund policies. In addition, you can also enable search engine optimization (SEO) and analytics on your online store. There are also dedicated modules to track sales, orders and refunds.

Anyone with minimal IT experience and understanding can use Easebuzz to sell products, services, subscriptions, memberships, and event tickets, which can be shared instantly on social media. The online store can be populated and set up in minutes, requiring minimal documentation. Moreover, Easebuzz allows you to configure coupon codes and avail of them for discounts.

Easebuzz allows you to create a payment link for any products/services you sell and instantly share it with your customers for online payments. You can also integrate its payment API with your personal/business website for a seamless payment experience. Easebuzz also lets you create customized payment links. Your customers/vendors/partners can enter an amount to make payments via Debit/Credit Cards, net banking, digital wallets, EMIs, UPIs, Ola Money, and SIMPL.

Unlike many contemporary payment portals, Easebuzz allows you to take your business online in minutes. All you have to do is sign up with your email and KYC documents to get started. From then on, you can enter your bank and your business details to initiate and monitor transactions.

Easebuzz is designed to help emerging businesses by embedding payment infrastructure within their existing business setup. This allows you to provide personalized financial services according to your needs and convenience. Here are a few functionalities of Easebuzz that help you digitize, automate and streamline your firm’s transactions:

- EasyCollect: Easebuzz makes payment collections easy and automated with its EasyCollect feature, which sends reminders based on due dates. This feature allows you to create links for vendors, customers, or loan collections with custom fields and information. In addition, you can choose link expiry dates, add messages from in-built templates and communicate via SMS, Whatsapp, email, or calls. Easebuzz can also auto-trigger calls based on the due dates and automatically determine the ideal calling time for a contact based on their payment history.

- WIRE: Easebuzz lets you create beneficiaries and manage payouts from a single interface. You can upload the entire list of beneficiaries/vendors into the application for managing payouts, salaries, or refunds in bulk. In addition, they inform you about the success or failure of each transaction with a reference number. What’s more, not only can you use multiple account numbers for making the payments, the payee can choose which account they want the money transferred to.

- Payment Gateway: With Easebuzz, you get payment APIs for your website to integrate any platform. This allows you to offer hosted and iframe-based checkouts for payments. Thus your users do not have to move to a separate page for payments and are directed to the bank page. This not only improves the customer experience but also improves your brand image.

- Bridgebuzz: This feature allows you to split and settle funds to vendors after each sale without having a nodal account. This allows for easy vendor onboarding with proper compliance and KYC details.

- SmartBilling: Another major functionality of Easebuzz, SmartBilling helps you build your recurring billing, subscription billing, and invoicing solution with facilities such as payment bifurcation, billing cycle configuration, and partial payments. This allows you to share payment links with customers via SMS, email, and Whatsapp, which they can use for a seamless checkout experience using just a single click. You can also set up upfront charges and shipping costs and customize billing cycles for your services.

- BuildBuzz: This lead management solution includes an online form builder and marketing automation feature. This is particularly useful for registrations and record management, where many users' payments are involved.

- FeesBuzz: Easebuzz offers a FREE fee portal for educational institutions with over a hundred payment options. Feesbuzz provides offline payment reconciliation on fee installments and allows you to check installments paid by each student for each semester/quarter/year via real-time records. You can also create multi-step forms with custom fields where users can provide their responses. You can also set up options for installments, penalties, and discounts based on start dates, due dates, etc.

Now that we know what Easebuzz is and how it works let us move toward some of its unique features.

Key Features of Easebuzz

Easebuzz offers several essential features to help you bring digital transformation to your business. They are:

- Smart Dashboard: Easebuzz’s intelligent and user-friendly dashboard enables you to view a snapshot of your transactions, revenues, success rate, and earnings for a set period. You can filter all transactions based on their date, title, and subcategories and edit each entry before publishing it. In addition, all transaction records can be instantly shared with other users, downloaded, and embedded at the click of a button.

- Multi-user Payments & Collections: The InstaCollect functionality of Easebuzz help you collect payments from various account numbers by creating a virtual account. You can create different accounts for students, parties, partners, or vendors with separate UPI addresses reconciled automatically.

Easebuzz also helps you create multiple users with individual permissions and logins based on their roles, which allows you to easily onboard merchants, earn commissions directly from transactions, and fix charges based on their UPIs, banks, locations, etc. Additionally, the application allows you to manually trigger payment reminders if a customer has not received your message.

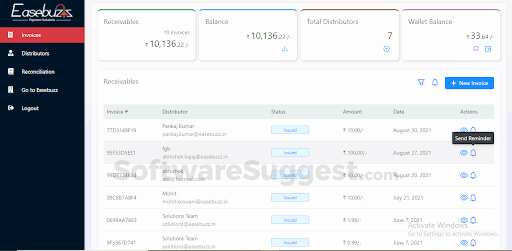

- Invoice Reports: Easebuzz helps you create invoices and send them directly to users from your interface with a payment link. You can also view reports on the status of each invoice and filter them based on their unique invoicing number, customer’s name, date of issuance, status, or expiry date.

Easebuzz allows you to perform multiple actions on each invoice, such as sending reminders, extending expiry dates, invoice duplication, and recording offline payments. Moreover, Easebuzz helps you view and download reports for expected settlements, loan repayments, defaulter lists, settlement history, and GST-deducted invoices.

-

Webhook Integration: With Easebuzz, you can send API requests on servers for easy integrations with their ERPs, CRMs, etc. The Easebuzz server notifies your server about each transfer. The records of every transaction made reflect directly on your ERP dashboard as both systems become synchronized.

- In-built Templates: As mentioned above, Easebuzz offers in-built templates for better interactions with your clients and customers via emails, Whatsapp, and SMS. These templates are customizable and can be triggered automatically based on payment history and due dates. Communication with clients and vendors gets smooth owing to the application’s ability to create forms for payment collections.

- Custom Payment Forms: Easebuzz helps you configure detailed forms for payments and assign custom logic to them for payments. For example, the amount/percentage of money to be paid can be determined by the user’s location, bank account, qualifications, roll number, registration number, email ID, etc. In addition, the application allows you to add your company’s logo in the payment forms for better branding. You can also apply for a loan directly from the application and choose a lending partner for payments by providing your PAN card details.

- Robust Security: Since security is a significant concern in B2B payments, Easybuzz adheres to PCI DSS compliance measures and offers end-to-end encryptions. It also has a fraud prevention suite and uses 128-bit encryption to transmit data securely to banks for instant payment processing.

Apart from the above features, Easebuzz can also auto-convert currencies to INR based on current exchange rates. It also has a mobile app that you can use for making and receiving payments on the go. Moreover, it allows you to configure referral codes for additional transaction bonuses.

Our Final Verdict

Easebuzz offers a gamut of unique features that can quickly bring digital transformation within a firm. It improves payment flexibility, communication, and transaction visibility while providing users with a smooth and seamless experience. Be it collecting, disbursing, organizing, or distributing payments, Easebuzz has come further than many competitors.

Easebuzz has a huge potential to help SMEs, educational institutions, e-commerce merchants, and financial institutions improve their processes with minimal effort. Thus, it could help many businesses recover from slowdowns and modernize their business transactions. Considering the massive potential of the software, its usefulness in the present era, and its innovative features, we are inclined to give Easebuzz a ‘Perfect Ten’ in our review, hoping that it would transform how finances are managed in the Indian subcontinent and beyond it.

Easebuzz Resources

Easebuzz Videos

Overall Easebuzz Reviews

Thinking about using Easebuzz? Check out verified user reviews & ratings based on Easebuzz's features, user-friendliness, customer support, and other factors that contribute to its overall appeal.

5 Easebuzz Reviews

Hear directly from customers who have used Easebuzz. Read their experiences, feedback, and ratings to gain valuable insights into how this software has benefited their businesses.

Shoeb

BDE

Used the software for : 2+ years

Company Size :51-200 employee

The best Payment Gateway Services

I have been a user of Easebuzz now for 1 year and use this portal to collect all my payments. Being not so well-versed in handling accounts, I wanted a payment solution that I could rely on with the least possible efforts. Easebuzz provides me with the best possible features to keep track of all the payments that I receive. They are a helpful bunch of people. The best part about their team is that they are available 24*7. I was very apprehensive of online payments thinking my money could get stuck or I could end up paying a lot of interest to the company. But ever since I tried Easebuzz I feel that my money is safe with them because the feeling of trust flows through their employees and their work. They give you all the available payment methods from wallets to cards to net banking at the best rate. I can trust them because they understand my concerns and business.

Jay

Developer

Used the software for : 2+ years

Company Size :51-200 employee

Verified By :

Stable and reliable

Go live in one day with Fast integration and support. Low pricing.

Kinnary

Accountant

Used the software for : 2+ years

Company Size :51-200 employee

Verified By : ![]()

Reliable Payment Gateway

User friendly payment page with Cashback Offer. Great support team.

Vikram

Director

Used the software for : 2+ years

Company Size :51-200 employee

Verified By :

Nice Serve and Support

The service provided by the team is awesome and they are very much co-operative.

Alternatives of Easebuzz

Explore alternative software options that can fulfill similar requirements as Easebuzz. Evaluate their features, pricing, and user feedback to find the perfect fit for your needs.

Easebuzz FAQs

How much does Easebuzz cost?

The starting price of Easebuzz is ₹ 0/Per User. It has different pricing plans:

- Free Payment Gateway : ₹ 0/Per User

Easebuzz also provides a free trial to users.

What apps do Easebuzz integrate with?

Easebuzz integrates with various apps:

- iFrame

- Semaless

- Web

- Mobile

- Third Party

What are the top 5 features for Easebuzz?

The top 5 features for Easebuzz are:

- Zero Setup Cost

- Payment Analytics

- Invoices

- Multiple Payment Types

- No Paperwork