Best Financial Reporting Software

Best financial reporting software solutions are CaptainBiz, Sage Intacct, Xero, Workiva, Prophix Software, and TrapAccounting. These software solutions exhibit a wide range of features that handles the digital management of accounting and financial reporting.

No Cost Personal Advisor

List of 20 Best Financial Reporting Software

Contenders | 2024

A World-Class Financial Reporting Software

Sage Intacct offers best-in-class accounting reporting software. Businesses benefit from increased operational effectiveness, better IT budget management, and significant real-time financial intelligence that boosts output and profitability. It is a finance management program that offers extensive consolidated features. Additionally, it includes features like time and expense management, revenue management, built-in dashboards, real-time reporting, yield management, and project accounting. Read Sage Intacct Reviews

Explore various Sage Intacct features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Sage Intacct Features- Inventory Management

- Multi-Department/Project

- Revenue Recognition

- Consolidation/Roll-Up

- Online Payment Processing

- Financial forecasting

- Profit/Loss Statement

- Sales Tax Management

Sage Intacct Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Online Accounting Software for Growing Businesses

Zoho Books is a renowned software for financial reporting. It provides a centralized location for managing accounting tasks and transaction organization. Users can quickly track, verify, and examine all financial transactions. It's a safe place where users can manage all of their business's bills and invoices, manage spending, reconcile bank statements, supervise projects, and forget about being concerned about GST compliance. Read Zoho Books Reviews

Explore various Zoho Books features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Zoho Books Features- Accounting

- Graphs & Charts

- Multi Company

- Payment Processing

- Dashboards & Analytics

- Mobile App

- e-Payment

- Customizable invoices

Pricing

Zoho Books Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Airbase, the leading spend management platform for

Airbase modern spend management combines accounts payable, expense management, and corporate cards on one platform. It offers a guided procurement experience to manage all spend. Read Airbase Reviews

Explore various Airbase features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Airbase Features- Transaction Approval

- Reporting/Analytics

- Financial Reporting

- ACH Check Transactions

- Expense Management

- Financial Accounting

- Recurring Billing

- Workflow Configuration

Airbase Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

A Businessman's Best Friend

Vyapar is an uncomplicated and adaptable accounting, investing, invoicing, and Financial statement software that aids businesses in masterfully handling accounting and money. Inventory management, payment reminders, billing, reporting, barcode scanning, and other attributes are included. The creation of transactions can be sped up by utilizing bar codes, shortcut keys, and other automated methods. Read Vyapar Reviews

Explore various Vyapar features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Vyapar Features- Invoice

- Inventory Management & Consumption Tracking

- Manufacturing

- Quotes / Estimates

- Data Synchronization

- Mobile Support

- Income Statements

- Returns Management

Pricing

Silver- Desktop (1 year)

$ 40

Device/Year

Silver- Desktop + Mobile (1 year)

$ 47

Device/Year

Silver- Desktop (3 years)

$ 92

Device/ 3 Years

Vyapar Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Model and plan business processes for better decis

Oracle Fusion Cloud EPM is one of the top financial reporting software. Users can model and plan across finance, supply chain, HR, and sales with this software, which also speeds up the financial close procedure and helps make smarter decisions. Planning, Financial Consolidation, Account Reconciliation, Tax Reporting, and Enterprise Data Management are just a few of the modules in Oracle Cloud EPM. Read Oracle Fusion Cloud EPM Reviews

Explore various Oracle Fusion Cloud EPM features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

- Financial Planning and Budgeting

- Dashboard

- Strategic Planning

- Risk Management

- Data Integration and Consolidation

- Workforce Planning and Analytics

- Cash flow management

- Inventory Management

Oracle Fusion Cloud EPM Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Making Modern Businesses GST friendly

QuickBooks is a simple-to-use software for preparing financial statements. It is a user-friendly, straightforward accounting program that keeps track of a company's revenue and spending. It also aids in managing financial data while removing the need for manual data entry. Multiple users can have a look at comprehensive reports and accounts of the company finances on a single dashboard. Read QuickBooks Online Reviews

Explore various QuickBooks Online features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all QuickBooks Online Features- Project billing

- Taxation Management

- Payments

- VAT / CST / GST Reports

- Multi Currency

- Multi-Currency

- Online invoicing

- Invoice Designer

Pricing

Simple Start

$ 30

Per Month

Essentials

$ 60

Per Month

Plus

$ 90

Per Month

QuickBooks Online Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

An Impressive Software for Financial Reporting

Xero Accounting offers useful financial reporting tools. Users can manage their small businesses online from anywhere. They can maintain an accurate record of unpaid and past-due invoices, profit and loss, bank account balances, cash flow, and bills that need to be paid. Users can also reconcile their bank accounts and turn quotes into invoices. Businesses can run everything smoothly, maintain orderly online bookkeeping records, and simplify compliance. Read Xero Accounting Reviews

Explore various Xero Accounting features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Xero Accounting Features- HR & Payroll

- Bonus

- Task Management

- Time Tracking

- Taxation Management

- Supplier and Purchase Order Management

- Banking Integration

- Multi Currency

Pricing

Starter

$ 9

Per Month

Standard

$ 30

Per Month

Premium

$ 60

Per Month

Xero Accounting Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

The #1 Cloud ERP solution

Oracle NetSuite is one of the best integrated financial statement reporting software. It supports the maintenance of CRM systems and inventories, e-commerce sites, and finances. Small and medium sized firms and manufactures looking out for advanced functionality can easily benefit from Oracle NetSuite. It's a fantastic choice for expanding businesses with a global clientele. Read Oracle NetSuite Reviews

Explore various Oracle NetSuite features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Oracle NetSuite Features- Demand Planning

- Collaboration Tools

- Dashboard

- Drill Down

- Accounting

- Online Payment Processing

- Version Control

- Income Statements

Oracle NetSuite Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

The Leading Balance Sheet Software Solution

Workiva is a financial reporting software that transforms the manner in which people handle and report data. This connected cloud platform is used by people all over the world to facilitate collaboration and deep integration into current workstreams to streamline financial and ESG reporting. The most difficult reporting and disclosure difficulties are made simpler by streamlining procedures, integrating data and teams, and assuring consistency. Read Workiva Reviews

Explore various Workiva features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Workiva Features- Financial Reports

- Marketing Reports

- Dashboard Creation

- Drill Down

- Sales reporting

- Data Visualization

- Collaboration

- Ad Hoc Reports

Workiva Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Cloud Accounting Software Making Billing Painless

FreshBooks is a financial reporting solution suitable for small businesses. Invoicing, time tracking, reporting, expenditure tracking, and payments management are some of FreshBooks' key features. Users can set up automatic payment reminders, take online payments, and brand their invoices. Tracking spending involves taking pictures of receipts, adding reoccurring charges, and linking receipts to invoices. Read FreshBooks Reviews

Explore various FreshBooks features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all FreshBooks Features- ACH Payment Processing

- Dashboard

- Activity Tracking

- Recurring invoice

- Recurring Billing

- Receipt Printing

- Receipt Management

- Accounts Receivable

Pricing

Lite

$ 19

Per Month

Plus

$ 33

Per Month

Premium

$ 60

Per Month

FreshBooks Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Software by Budgyt

A dynamic accounting reporting software called Budgyt makes forecasting, budgeting, and reporting easier without sacrificing the specifics. It helps finance teams to integrate financials, streamline procedures, and manage numerous departments from a single platform using Budgyt's user-friendly solutions for complicated financial planning needs. With figures that everyone in the boardroom can rely on, Budgyt enables businesses and NGOs to make smarter choices more quickly. Learn more about Budgyt

Explore various Budgyt features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Budgyt Features- Forecasting

- Asset Planning

- Multi-Company

- Version Control

- Audit Trail

- Multi-Department/Project

- What If Scenarios

- Profit / Loss Statement

Budgyt Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Software by Workday, Inc

Workday Adaptive Planning is a widely used corporate financial reporting software. It offers web-based systems for reporting, forecasting, and budgeting. It makes budgeting, forecasting, reporting, and analytics easier. This software features the security, scalability, expandability, and flexibility required for futuristic planning, as well as industry-leading serviceability. It offers size and performance, an easy-to-use interface, and AI and ML-driven insights for strategic decisions that can change the game. Read Workday Adaptive Planning Reviews

Explore various Workday Adaptive Planning features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Workday Adaptive Planning Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

An All-in-one Balance Sheet Solution

CCH Tagetik is comprehensive financial reporting software perfect for small and medium-sized businesses. The system accelerates consolidation and closing while permiting users to model, evaluate, access, and analyze the outcome of various business structures' financial effects. The solution facilitates user collaboration on company reviews and automates board reporting and transparency. Learn more about CCH Tagetik

Explore various CCH Tagetik features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all CCH Tagetik Features- Surveys & Feedback

- Consolidation / Roll-Up

- Budgeting & Forecasting

- Ad hoc Analysis

- CRM & Sales Dashboards

- Self Service Portal

- Performance Appraisal

- Qualitative Analysis

CCH Tagetik Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Software by DataRails

DataRails is a widely used financial statement preparation software. It automates financial reporting and planning while still letting finance teams use the well-known Excel spreadsheets and financial models to their advantage. By automating these laborious manual processes, financial teams will have more time to analyze data and less time to gather it. Learn more about DataRails

Explore various DataRails features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all DataRails Features- Archiving & Retention

- Collaboration

- Version Control

- Database Creation

- Sarbanes-Oxley Compliance

DataRails Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Accelerate Your FP&A

Cube Planning is one of the best financial reporting software. It provides easy and convenient access to real-time financial & transactional data. Users can cut down on time, eliminate mistakes, and sharpen their insights. Cube blends the comfort and adaptability of a spreadsheet with the administration and scalability of performance software, making it possible for teams to get started in days as opposed to months. Learn more about Cube Planning

Explore various Cube Planning features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Cube Planning Features- Resource Management

- Multi-Company

- Modeling & Simulation

- Data Visualization

- Income Statements

- Task Management

- Consolidation / Roll-Up

- Multi-Department/Project

Pricing

Essentials

$ 1250

Per Month

Premium

$ 2450

Per Month

Enterprise

$ 3750

Per Month

Cube Planning Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Software by Sage

Sage 50cloud is a corporate financial reporting software. It offers fundamental features, including financial reporting, customer administration, and A/R and A/P. With practical, cloud-connected capabilities like digital invoicing, automated bank reconciliation, online payments, Microsoft Excel-based reporting, and more, Sage 50cloud increases user productivity. Accounting and compliance controls already present in the program preserve accuracy and guard against typical mistakes. Read Sage 50cloud Reviews

Explore various Sage 50cloud features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Sage 50cloud Features- Project Accounting

- Purchase Orders

- Billing Portal

- Tax Management

- Spend Management

- Payment Processing

- Tax Calculator

- Mobile Payments

Pricing

Pro Accounting

$ 51

Per Month

Premium Accounting

$ 78

Per Month

Quantum Accounting

$ 198

Per Month

Sage 50cloud Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Software by Vena Solutions

Vena is a widely used financial statement software. It is the only native Excel Complete Planning platform that contains everything financial teams require to ensure the success of the company. Every component of the Vena Growth Engine works together to direct the growth journey, from simple processes and connectors to enterprise-level security and sophisticated modeling. Vena is a flexible budgeting tool built on Excel. Vena can also assist in finding efficiencies and preserving data security and integrity in order to improve overall business performance. Learn more about Vena

Explore various Vena features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Vena Features- CPA Firms

- Inventory Management

- Project Management

- Task Management

- Tax Management

- Payment Handling

- Fund accounting

- Cash Management

Vena Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

100% free accounting for your small business

Wave Accounting is a feature-rich, cloud-based financial reporting solution. Organizations can easily streamline and automate their bookkeeping processes. Wave's bank reconciliation technologies help organizations to manage all bank account and credit card data in real-time, boosting the competency and precision of their bookkeeping. The dashboard for Wave includes useful functions such as invoicing that collects payment for invoices. Read Wave Accounting Reviews

Explore various Wave Accounting features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Wave Accounting Features- General Ledger

- HR & Payroll

- Accounts Receivable

- Accounting Integration

- Payroll Management

- Trust Accounting

- Accrual Accounting

- Banking Integration

Pricing

Accounting Software

$ 0

Forever

Wave Accounting Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

#1 GST billing software

myBillBook is a corporate financial reporting software. Small business owners can manage their company accounts directly from their mobile and desktop devices with the help of this GST billing software. Business owners can save lots of time and money by streamlining their operations. It provides fully customizable bills and invoices with a wide range of templates. It also provides barcode scanning. Read myBillBook Reviews

Explore various myBillBook features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all myBillBook Features- Compliance Management

- Accounts payable

- Loyalty Program

- Bookkeeping

- Payment Processing

- Barcode / Ticket Scanning

- 24/7 Support

- Balance Sheet

Pricing

Silver Plan

$ 0

Per Month

Diamond Plan

$ 3

Per Month

Platinum Plan

$ 3

Per Month

myBillBook Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Limelight is the next-generation of Excel offering

Limelight is a modern and user-friendly financial planning and reporting platform that is quick to deploy and easily managed by business users. A web-based application accessible anywhere and on any device, offering data integration, collaboration, real-time planning an Learn more about Limelight

Explore various Limelight features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Limelight Features- Budgeting & Forecasting

- Profit / Loss Statement

- Expense Tracking

- Cash Management

- Income Statements

- Balance Sheet

Limelight Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

The ability to generate comprehensive financial statements, analyze data, and ensure compliance with regulatory requirements has never been more critical for businesses of all sizes. To meet these demands and streamline financial reporting processes, organizations turn to Financial Reporting Software.

Financial Reporting Software is a cutting-edge solution designed to empower businesses with the tools and capabilities necessary to efficiently manage, analyze, and report financial data. It offers a user-friendly platform that facilitates the creation of detailed financial statements, simplifies data consolidation, and enhances decision-making by providing insights derived from financial information.

What Is Financial Reporting Software?

Financial Reporting Software is a specialized application designed to streamline and simplify the process of creating, managing, and disseminating financial reports within an organization. This software serves as a powerful tool for businesses to compile, analyze, and present their financial data in a structured and standardized manner.

It typically offers a wide range of features, such as automated data collection, financial statement generation, customizable reporting templates, and real-time data visualization. Financial Reporting Software is instrumental in improving the accuracy and efficiency of financial reporting, enabling businesses to comply with regulatory requirements and make data-driven decisions.

What Are the Deployment Options for Financial Reporting Software Tools?

The deployment options for Financial Reporting Software tools play a pivotal role in determining how organizations manage their financial data and reporting processes. Whether it's the traditional on-premises solution, the flexibility of cloud-based deployment, or the convenience of Software as a Service (SaaS), each approach offers distinct advantages and considerations.

-

On-Premises Deployment

On-premises deployment, the traditional approach, involves installing and running the financial reporting software on servers and hardware located within an organization's premises. This option provides businesses with complete control over their data, as it is stored and managed internally. It is often favored by larger enterprises with stringent security and compliance requirements.

-

Cloud-Based Deployment

Cloud-based deployment involves hosting the financial reporting software on remote servers provided by a third-party cloud service provider. This option offers scalability, accessibility, and cost-efficiency, making it a popular choice for businesses of all sizes.

-

Software as a Service (SaaS)

Software as a Service (SaaS) is a subset of cloud-based deployment, where the financial reporting software is provided as a service accessible through a web browser. SaaS solutions are known for their ease of use and rapid implementation.

What Is the Difference Between an Annual Report and a Financial Report?

An Annual Report and a Financial Report are two distinct documents that serve different purposes within the context of a business or organization. Here are the key differences between the two -

-

Annual Report

Purpose: An Annual Report is a comprehensive document that provides a detailed overview of a company's performance and activities over the course of a year. It is intended for a wide audience, including shareholders, investors, customers, employees, and the general public.

Content: An Annual Report typically includes not only financial information but also non-financial data, such as a letter from the CEO, information about the company's mission and values, a discussion of corporate social responsibility initiatives, and other narrative content.

Presentation: Annual Reports often focus on the company's strategic goals, achievements, challenges, and long-term vision. They are typically more visually appealing and may include images, infographics, and design elements to make the document engaging.

-

Financial Report

Purpose: A Financial Report, on the other hand, is a specific component of the Annual Report that focuses solely on the financial performance and financial position of the company. Its primary audience is typically internal, including management, auditors, and regulatory authorities. It may also be used by external parties, such as creditors and potential investors, to assess the financial health of the organization.

Content: A Financial Report includes financial statements like the income statement (profit and loss statement), balance sheet, cash flow statement, and notes to the financial statements. These documents provide a detailed breakdown of the company's revenues, expenses, assets, liabilities, and cash flows.

Presentation: Financial Reports are usually more technical and detailed, with a strong emphasis on numbers, accounting principles, and compliance with accounting standards. They are typically less visually engaging than Annual Reports.

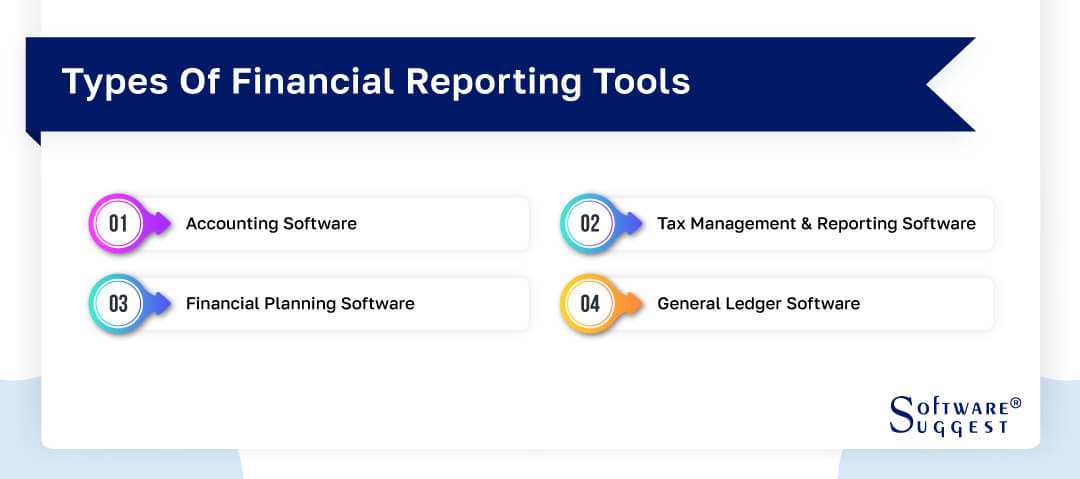

What Are the Types of Financial Reporting Tools?

Financial reporting tools are essential for businesses and organizations to effectively manage their finances, track transactions, and comply with accounting standards and tax regulations. These tools come in various forms and serve different functions to meet the diverse financial needs of companies. Below are the main types of financial reporting tools you can check -

-

Accounting Software

Accounting software is a fundamental tool for businesses to manage their financial transactions and record-keeping. It automates various accounting processes, such as bookkeeping, accounts payable and receivable, payroll, and financial statement preparation software.

Accounting software can range from basic applications suitable for small businesses to robust solutions designed for larger enterprises. It helps maintain accurate financial records and generates reports that provide insights into a company's financial performance.

-

Tax Management & Reporting Software

Tax management and reporting software are critical for organizations to comply with tax laws and regulations. These tools streamline the tax preparation process, ensuring accurate and timely tax submissions. They typically include features for calculating and managing taxes, handling deductions and credits, and generating tax reports. Tax software helps businesses minimize errors and avoid penalties by keeping tax-related data organized and up-to-date.

-

Financial Planning Software

Financial planning software assists businesses and individuals in creating comprehensive financial plans and budgets. These tools often include features for forecasting revenue and expenses, setting financial goals, and evaluating the potential impact of different financial decisions.

Financial planning software helps organizations make informed choices to achieve their financial objectives and monitor progress toward those goals over time.

-

General Ledger Software

The general ledger is the core of a company's financial record-keeping. General ledger software is designed to manage and maintain a complete record of all financial transactions. It typically includes double-entry accounting principles, ensuring that debits and credits balance and it helps organizations produce accurate financial statements.

General ledger software is a foundational tool for businesses of all sizes to maintain the integrity and reliability of their financial data.

What Are the Benefits of the Best Financial Reporting Software?

Effective financial reporting is essential for businesses and organizations to make informed decisions, ensure compliance, and achieve their financial goals. The best financial reporting software offers a wide range of benefits that can significantly enhance an organization's financial management and decision-making processes.

-

Accurate Financial Data

One of the primary benefits of the best financial reporting tools is their ability to provide accurate and error-free financial data. These tools automate data entry and calculations, reducing the risk of human errors that can occur during manual data handling. As a result, businesses can trust the reliability of their financial reports and make decisions based on accurate information.

-

Real-time Data Access & Insights

Modern financial reporting software offers real-time data access and insights, allowing users to monitor their financial performance on an ongoing basis. This real-time visibility into financial data empowers organizations to respond quickly to changing market conditions, identify trends, and make timely adjustments to their financial strategies.

-

Better Collaboration

Top financial reporting software often includes collaborative features that enable teams to work together efficiently. Users can access and update financial data simultaneously, which promotes better communication and collaboration among departments. This enhanced teamwork can lead to more effective financial planning and decision-making.

-

Streamlined Tax Management

Managing taxes can be a complex and time-consuming task for businesses. The best financial reporting software typically includes features for streamlined tax management. It can automate tax calculations, ensure compliance with tax regulations, and generate tax reports, making the tax filing process more efficient and reducing the risk of costly errors.

-

Time and Cost Saving

Implementing high-quality financial reporting software can lead to significant time and cost savings. By automating repetitive tasks, reducing the need for manual data entry, and improving efficiency, organizations can allocate resources more effectively and focus on strategic financial initiatives.

-

Forecasting and Predictive Analytics

Advanced financial reporting software often includes forecasting and predictive analytics capabilities. These tools use historical financial data to make projections and identify potential future scenarios. This assists organizations in making data-driven decisions, planning for the future, and mitigating risks effectively.

What Are the Features of the Best Financial Reporting Software Tools?

Financial reporting software tools are essential for organizations to manage and analyze financial data effectively. The best financial statement software provides a range of features to streamline financial reporting processes and provide valuable insights.

-

Automated Data Import

The best financial reporting software simplifies data management by offering automated data import capabilities. Users can connect their software to various data sources, such as accounting systems, spreadsheets, and databases, and schedule automatic data imports. This feature reduces the need for manual data entry, minimizes errors, and ensures that financial reports are based on the most up-to-date information available.

-

Report Customization

Report customization is a crucial feature that allows users to tailor financial reports to their specific needs. The best financial reporting software offers a wide range of customization options, including the ability to choose data visualization formats, add or remove data fields, apply branding elements, and define report layouts. Customization ensures that reports are relevant and meaningful to different stakeholders within the organization.

-

Multi-user Access

Collaboration is essential in financial reporting, and top financial reporting software supports multi-user access. This feature enables multiple team members to work on the same reports simultaneously, promoting efficient collaboration among departments. Access control and permission settings ensure that users only see and modify the data relevant to their roles, enhancing data security and integrity.

-

Drag-and-Drop Report Builders

The best financial reporting software often includes drag-and-drop report builders that simplify the process of creating and designing reports. Users can select data elements, graphs, charts, and tables and easily arrange them within reports. This user-friendly interface empowers non-technical users to build sophisticated reports without the need for extensive programming or design skills.

-

Dashboards

Dashboards are a powerful feature in financial reporting software that provides at-a-glance insights into key financial metrics. Users can create interactive dashboards that display real-time data in a visually appealing manner. Dashboards enable decision-makers to monitor performance, track KPIs, and identify trends quickly. They are valuable tools for executives and managers who need instant access to critical financial information.

How to Select the Right Financial Reporting Tools?

Selecting the right financial reporting tools is a crucial decision for any organization. These tools play a pivotal role in managing financial data, ensuring accuracy, and supporting decision-making processes. To make an informed choice, consider the following key factors when selecting the right financial reporting tools.

-

Deployment Options

One of the first decisions to make when selecting financial reporting tools is choosing the right deployment option. Financial reporting tools can be deployed on-premises or in the cloud. On-premises solutions provide control and security but often come with higher upfront costs and maintenance responsibilities.

Cloud-based solutions offer scalability, accessibility, and reduced infrastructure costs. Consider your organization's infrastructure, security requirements, and scalability needs when deciding on the deployment option that suits you best.

-

Your Business Needs

The specific needs of your business should drive your selection of financial reporting tools. Consider the size of your organization, the complexity of your financial data, and the number of users who will need access to the system. Additionally, think about the industry-specific requirements, compliance regulations, and integration needs relevant to your business. A tool that aligns with your unique requirements will deliver better results.

-

Budget Considerations

Financial reporting tools come with varying price points, and budget considerations are vital. Evaluate the total cost of ownership, including initial setup, licensing, ongoing maintenance, and potential scalability costs. Also, consider the return on investment (ROI) these tools can provide in terms of time savings, reduced errors, and improved decision-making. It's important to strike a balance between cost and functionality to ensure the tool aligns with your financial goals.

-

User-Friendliness

The ease of use of the financial reporting tool is a critical factor. A user-friendly interface can save time and reduce training costs. Look for tools with intuitive dashboards, drag-and-drop report builders, and straightforward data visualization features. Usability is essential not only for the finance team but also for other departments that may need to access and work with financial data.

-

Reporting Speed and Performance

Reporting speed and performance are key considerations, especially for organizations dealing with large datasets or requiring real-time reporting. Evaluate the tool's ability to generate reports quickly and handle complex calculations. Performance should be seamless and not impede productivity. Also, consider the tool's ability to provide real-time data access and maintain responsiveness as your organization scales.

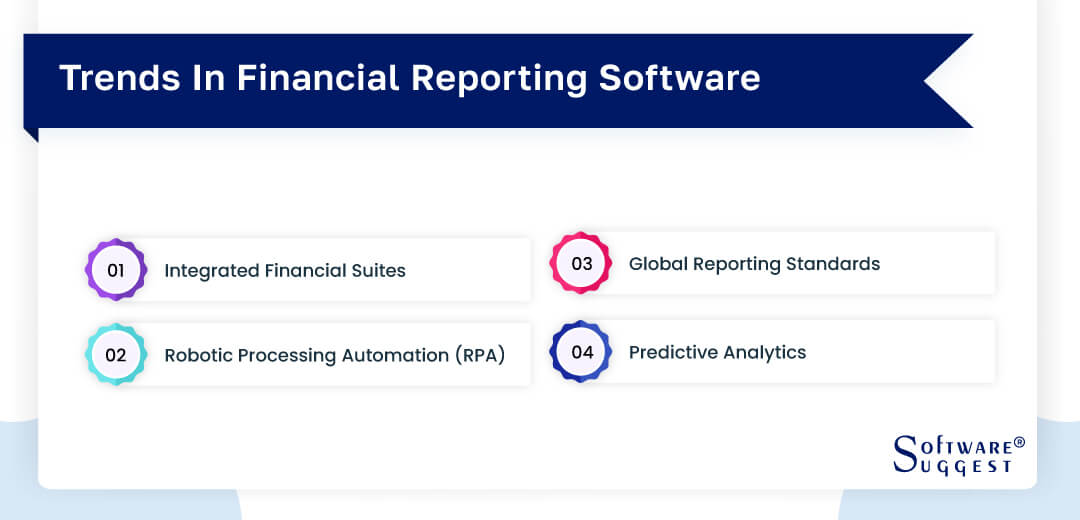

Market Trends in Financial Reporting Software

Keeping updated with the latest market trends in financial reporting software is crucial for staying competitive and making informed decisions. In this discussion, we will explore some of the noteworthy market trends that are shaping the landscape of financial reporting software.

-

Integrated Financial Suites

One significant market trend is the increasing demand for integrated financial suites. Organizations are seeking comprehensive solutions that not only handle financial reporting but also encompass other financial management functions. These integrated suites often include features for accounting, budgeting, forecasting, compliance, and analytics, all under one roof.

This trend reflects a shift toward a more holistic approach to financial management, where data flows seamlessly across different financial processes, reducing data silos and enhancing efficiency.

-

Robotic Processing Automation (RPA)

Robotic Process Automation (RPA) is gaining prominence in financial reporting software. RPA involves the use of software robots to automate repetitive, rule-based tasks within financial reporting and data entry processes.

RPA can handle data extraction, reconciliation, and even report generation with high accuracy and speed. As a result, organizations can reduce manual labor, improve data accuracy, and accelerate financial reporting processes. RPA is particularly valuable for handling large volumes of data and achieving consistency in reporting.

-

Global Reporting Standards

The convergence of global reporting standards is another significant trend. As international trade and business operations expand, the need for standardized financial reporting practices becomes paramount.

Organizations are increasingly adopting global accounting and reporting standards, such as the International Financial Reporting Standards (IFRS). This trend helps ensure consistency and comparability in financial reporting across different regions, facilitating international business and investment.

-

Predictive Analytics

Predictive analytics is becoming a key feature in financial reporting software. These tools leverage historical financial data to make forecasts and predictions about future financial performance. Predictive analytics can provide valuable insights into trends, identify potential risks, and support data-driven decision-making. By using predictive analytics, organizations can anticipate market fluctuations and make proactive adjustments to their financial strategies.

What Is the Cost of a Financial Reporting Software Tool?

The cost of a financial reporting software tool can vary significantly depending on several factors. These factors include the complexity of the software, the features and functionalities it offers, the size and needs of your organization, and the vendor you choose. The pricing range of financial reporting software is between $40 to $450.

Conclusion

In conclusion, financial reporting software plays a pivotal role in modern business and organizational operations. These tools facilitate accurate and efficient financial data management, reporting, and analysis, which are vital for informed decision-making and compliance with regulatory standards.

The best financial reporting software offers features like automated data import, customization, multi-user access, user-friendliness, and real-time reporting capabilities. It also adapts to emerging market trends, such as integrated financial suites, Robotic Process Automation (RPA), global reporting standards, and predictive analytics.

By selecting the right financial reporting software and staying updated on market trends, organizations can enhance their financial management processes and gain a competitive edge in an ever-evolving financial landscape.

FAQs

Financial reporting includes various types such as internal financial reports, external financial reports (for stakeholders), audited financial statements, and management reports.

Financial reporting includes the preparation and presentation of financial statements, income statements, balance sheets, cash flow statements, and related disclosures, offering a comprehensive view of an organization's financial performance and position.

The primary aim of financial reporting is to provide accurate, transparent, and understandable financial information to help stakeholders make informed decisions about an organization's financial health, performance, and future prospects.

To create a financial report, gather and organize financial data, prepare financial statements (income statement, balance sheet, and cash flow statement), add necessary disclosures, and present the information in a clear and structured format using financial reporting software or tools.

Yes, many financial reporting software solutions are designed to handle multi-currency and multi-company operations. They allow organizations with international operations to consolidate financial data from different currencies and entities into a single, coherent report.

.png)

.jpg)

.png)