Best Payroll Outsourcing Services

Discover the top-notch payroll outsourcing services such as Qandle, HRMantra, Keka, Zoho Payroll, & HROne. Eliminate the hassle of managing an in-house payroll team with these trusted providers, ensuring accurate and efficient payroll processing for your business needs.

No Cost Personal Advisor

List of 20 Best Payroll Outsourcing Services

Services by Rippling

Rippling is a fully featured HR Software designed to serve Agencies, Enterprises. Rippling provides end-to-end solutions designed for Macintosh. This online HR system offers E-Verify/I-9 Forms, Multi-Country, Employee Database, Recruitment Management, Employee Lifecycle Management at one place. Read Rippling Reviews

Explore various Rippling features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Rippling Features- Deduction Management

- Recruitment Management

- Mobile Device Management

- Provider Management

- Workflow Management

- Onboarding

- Orientation Management

- Expense Management

Rippling Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Keep your time and money

Our secure online payroll system, paying your employees has never been easier. We’ll help you get started by setting up your payroll, employees, payroll tax information, etc. Read Patriot Payroll Reviews

Explore various Patriot Payroll features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Patriot Payroll Features- Payroll Management

- Variable Workforce

- Multiuser Login & Role-based access control

- PF/ESIS Calculation

- Insurance Tracking

- Salary Adjustment

- Multiple Pay Schedules

- Bonus

Pricing

Patriot Payroll Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Services by Oyster HR, Inc

Oyster Payroll is a fully featured Payroll Software designed to serve SMEs, Startup, Agencies, Enterprises. Oyster Payroll provides end-to-end solutions designed for Web App. This Payroll System offers Dashboard, Vacation/Leave Tracking, Self Service Portal, Benefits Management, Document Management and Multi-Country at one place. Read Oyster Payroll Reviews

Explore various Oyster Payroll features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Oyster Payroll Features- Expense Management

- Leave Management

- Time & Expense Tracking

- Employee Lifecycle Management

- Employee Profile

- Multi-Country

- Performance Management

- Talent Management

Pricing

Oyster Payroll Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

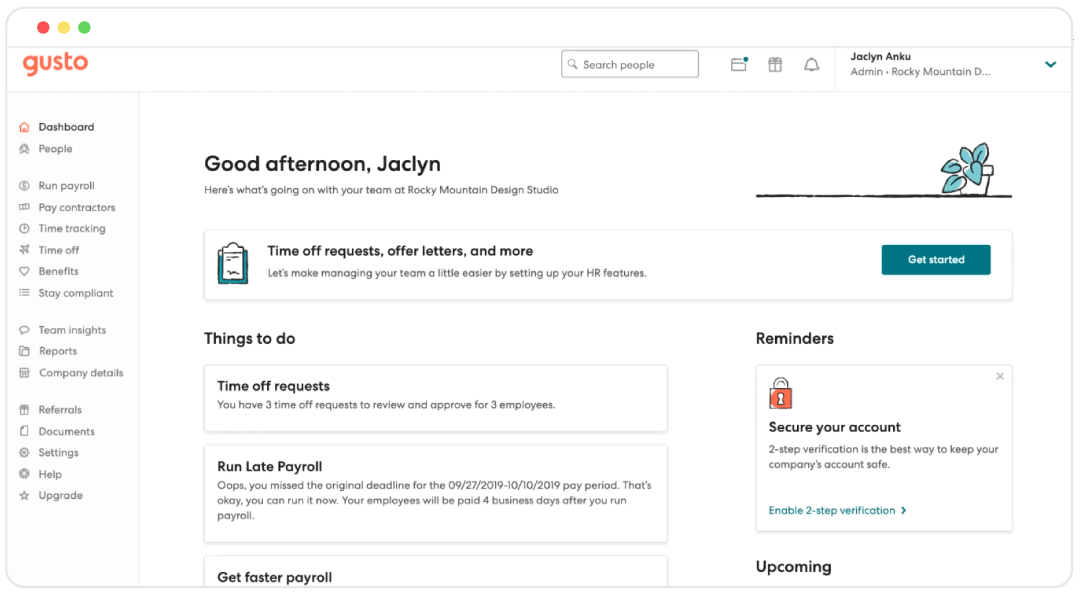

Category Champions | 2024

Payroll Management Software for Small Businesses

Gusto is one of the best payroll outsourcing companies in India. It runs payrolls easily in minutes and helps with onboarding, hiring, and offering employee benefits. Gusto is an easy-to-use and reliable choice for running payrolls that are automatically calculated, error-free, and compliant. It also helps with performance tracking and report generation. Read Gusto Reviews

Explore various Gusto features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Gusto Features- Self-onboarding

- HR & Payroll

- Salary Adjustment

- Document Management

- Payroll Management

- Benefits Administration

- Back Office Assistance

- Expense Management

Pricing

Gusto Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Services by Papaya Global

PapayaGlobal offers the best-outsourced payroll solutions for all types of employment. It automates payroll processes and helps you reduce costs and maximize efficiency. The service checks data compliance with 100% accuracy and audits preventative reports to determine payroll inconsistencies while standardizing all payroll data under a unified platform. Read Papaya Global Reviews

Explore various Papaya Global features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Papaya Global Features- Workforce Management

- Scheduling

- Self Service Portal

- Cap Table Management

- Payroll Reporting and Analytics

- Employee Onboarding and Offboarding

- Leave & Absence Reporting

- Time Off Requests

Pricing

Papaya Global Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Services by WorkOtter

WorkOtter is a fully featured Project Management Software designed to serve Agencies, Enterprises. WorkOtter provides end-to-end solutions designed for Windows. This online Project Management system offers Portfolio Management, Product Roadmapping, Filtered Search, Collaboration, Capacity Management at one place. Read WorkOtter Reviews

Explore various WorkOtter features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all WorkOtter Features- Document Indexing

- Gantt Charts

- Document Management

- Project Planning

- Kanban Board

- Skills Tracking

- Resource Management

- Progress Tracking

Pricing

WorkOtter Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Get Accurate and On-time Payroll effortlessly

Qandle offers terrific payroll outsourcing services for modern workplaces. The service enables you to customize payroll policies and incentives, allowing employees to view payroll-related information like CTC, payslips, tax slips, etc. It provides completely accurate payroll processing while syncing data with all HR records. Read Qandle Reviews

Explore various Qandle features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Qandle Features- Time & Expense Tracking

- Accounting Integration

- Dashboard

- Document Management

- Progress Tracking

- Data Security

- Job Marketplace

- Compensation Calculation

Pricing

Foundation

$ 1

Employee/Month

Regular

$ 1

Employee/Month

Plus

$ 1

Employee/Month

Qandle Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Top payroll outsourcing company in India

HROne is one of the best payroll management companies that takes manual work off your plate and gives you more time to make strategies for business growth. HROne payroll outsourcing solution ensures error-free payroll and reduces post-payroll queries with timely payouts while maintaining detailed records of the entire payroll process. Read HROne Reviews

Explore various HROne features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all HROne Features- Training Management

- Employee Directory

- Real Time Reporting

- Employee Handbook

- Analytics

- Alerts & Reminders

- Benefits Management

- Statutory Compliances

Pricing

Basic

$ 1

User/Month

Professional

$ 2

User/Month

HROne Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Content writing service platform

Upwork provides a platform where business owners can hire content writers for their requirements. It has a global network of skilled freelancers and agencies to help you grow your business. Furthermore, you can chat with your writers and easily share files using Upwork. Read Upwork Reviews

Explore various Upwork features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Upwork Features- Analytics & Reporting

- Admission Essay Writing

- Reporting

- PDF export

- Text Editor

- Publishing / Sharing

- Content Import / Export

- Drag & Drop

Pricing

Basic

$ 0

Per Month

Plus

$ 50

Per Month

Business

$ 499

Per Month

Upwork Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Cloud-based payroll outsourcing software

ADP offers easy and cost-effective payroll outsourcing services in India. The service helps efficiently manage HR, payroll, benefits, hiring, and more for small or midsized businesses. It also provides additional services such as recruitment, onboarding, performance tracking, and more, all under one umbrella. Read ADP Vista HCM Reviews

Explore various ADP Vista HCM features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all ADP Vista HCM Features- Salary Information & History

- Account Management

- Exit Management & Seperation Management

- Dashboard

- Workflow Management

- Employee Data Base

- Leave Management

- Workflow Administration

ADP Vista HCM Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

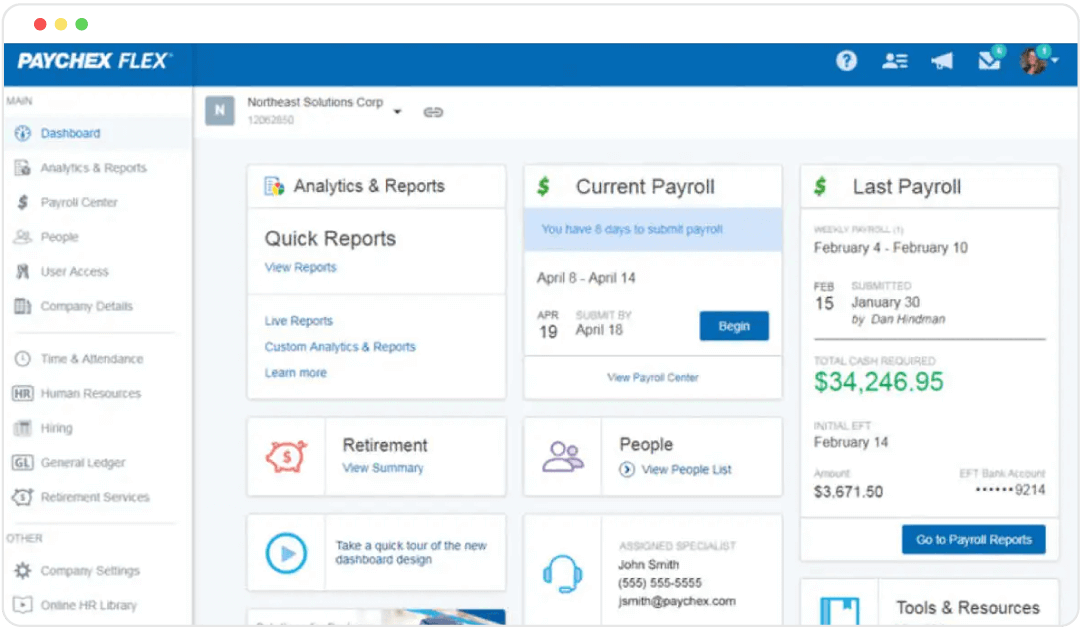

Contenders | 2024

Services by Paychex Inc

Paychex Flex is a web-based human management need and access traffic of customers if they have a heavy rush on the product. In this system, only one user can use the system at a time no more users can log in that time. That's why it is a very short time wasting. It includes some characteristics like ATS, HRIS, payroll and cheap. Read Paychex Flex Reviews

Explore various Paychex Flex features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Paychex Flex Features- Recruitment Management

- Data Security

- Employee Self Service Management

- Performance Appraisal

- Leave Management

- Workflow Management

- Time & Attendance

- Time Clock

Paychex Flex Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Making Modern Businesses GST friendly

QuickBooks is an online accounting software for business owners to make stay on top of their finances. Easy to use interface, 100% data security and features such as Online bank connect and Whatsapp integration helps business owners to focus on growing their business. Read QuickBooks Online Reviews

Explore various QuickBooks Online features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all QuickBooks Online Features- Employee Data Base

- Time Tracking

- Tax Management

- Accounting Integration

- Database backup/restore (Management)

- Cost Tracking

- Timesheet Management

- Bank Reconciliation

Pricing

Simple Start

$ 30

Per Month

Essentials

$ 60

Per Month

Plus

$ 90

Per Month

QuickBooks Online Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

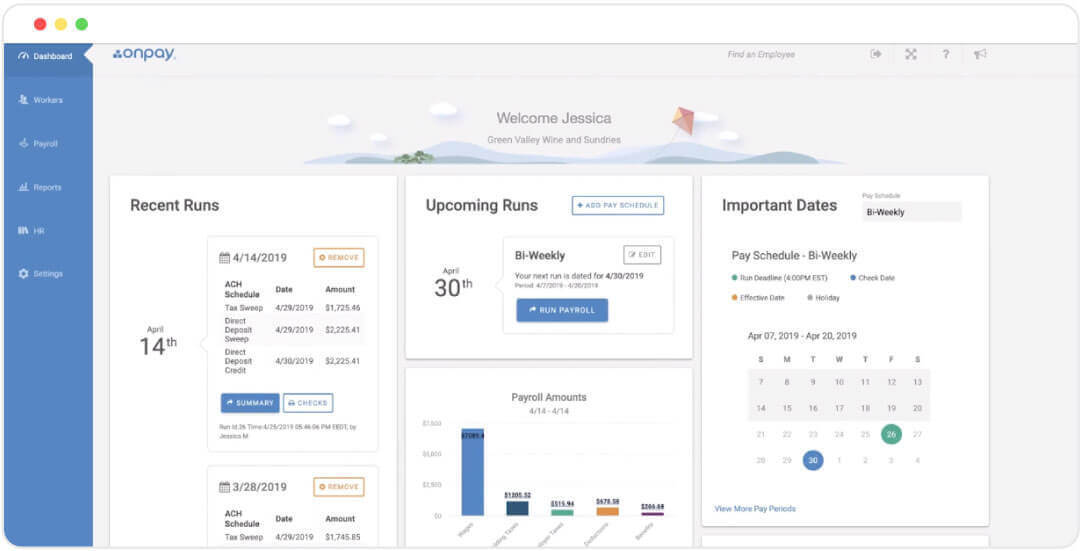

Services by OnPay, Inc

OnPay is among the most powerful payroll software available in the market. It is working from the last 30 years to help small business enterprises. It integrates with Xero, QuickBooks, etc. Read OnPay Reviews

Explore various OnPay features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all OnPay Features- Payroll Management

- Shift Management

- Data Imports/Exports

- Document Management

- Pay Slip

- Expense Management

- Time & Attendance Management

Pricing

Basic

$ 40

User/Month

OnPay Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Services by Deluxe Enterprise Operations

Deluxe is a fully featured Online Payroll Software designed to serve Startups, SMEs and Enterprises. Deluxe provides end-to-end solutions designed for Web App. This online Online Payroll Software offers at one place. Learn more about Deluxe

Explore various Deluxe features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Deluxe Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

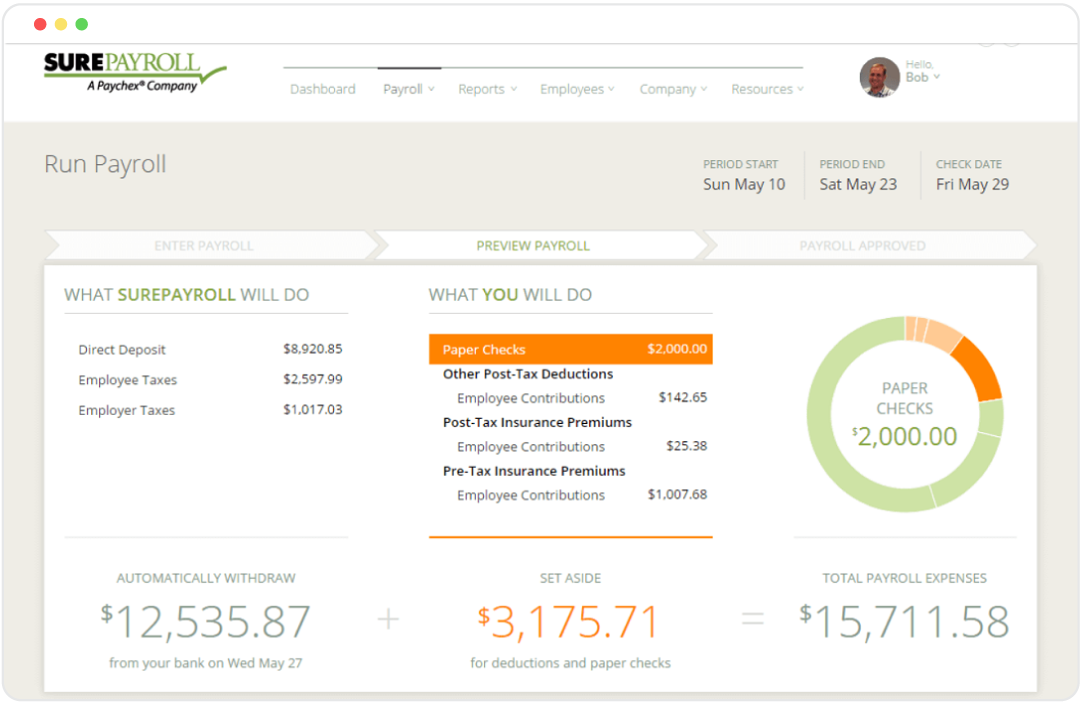

Emergents | 2024

Services by SurePayroll

Surepayroll(Mobile Paycheck) is a one-stop solution for payroll needs. It helps in better tax filling, provides you with two-days processing time for transactions, calculates payroll automatically once you set it up, etc. Learn more about SurePayroll

Explore various SurePayroll features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all SurePayroll Features- Time & Attendance Management

- Eligibility Management

- Payroll Management

- Document Management

- Expense Management

- Leave Management

SurePayroll Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Services by TriNet

Shift your focus on revenue generation instead of managing the man power by hiring TriNet. The HR outsourcing services provider has various enterprises-focused benefits and comes with fully automated integration. Learn more about TriNet

Explore various TriNet features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all TriNet Features- Recruitment Management

- Payroll Management

- Performance Management

- Onboarding

- Employee Database

- Document Management

- Applicant tracking

TriNet Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

All-in-one HR

Zenefits is an all-in-one SaaS human resources and employee onboarding platform that helps more than 11,000 small to mid-sized companies streamline hiring, onboarding, and employee management, in the office or on the go. Read Zenefits Reviews

Explore various Zenefits features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Zenefits Features- Statutory Compliances

- Appraisal Management

- Email Integration

- Scheduling

- HR & Payroll

- Help Desk

- Recruitment Management

- Analytical Reports

Pricing

Essentials

$ 8

Per User

Growth

$ 16

Per User/Month

Zen

$ 21

Per User/Month

Zenefits Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Best cloud-based payroll outsourcing services

SumHR is a great choice for full-service payroll outsourcing solutions. It offers a wide range of payroll and HR services, including hassle-free and timely payroll processing, automated tax and statutory compliance, attendance and leave management, etc. SumHR also helps with recruitment, onboarding, career development, attendance tracking, and goal tracking. Read sumHR Reviews

Explore various sumHR features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all sumHR Features- Performance Appraisal

- Mobile App

- Mobile Support

- Onboarding

- Workflow Management

- Pay Slip

- Goal Management

- Reimbursement Management

Pricing

STARTUP

$ 1

User/Month

BASIC

$ 1

User/Month

ADVANCED

$ 2

User/Month

sumHR Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

End to End Payroll Outsourcing Services

Paybooks is one of the top payroll outsourcing companies for getting complete freedom from manual payroll and compliance. Paybooks provide services like salary payments, compliance payments, virtual HR, payroll & HRMS tools, and much more. The services also offer a virtual HR that manages everything on demand. Read Paybooks for Payroll Outsourcing Reviews

Explore various Paybooks for Payroll Outsourcing features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

- Time & Attendance Management

- Payroll Management

- Pay Slip

- Leave Management

- Expense Management

- Statutory Compliances

- Document Management

Paybooks for Payroll Outsourcing Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Get 60% cost effective. Save 40% HR time

ApHusys is an HR and payroll outsourcing services provider designed to help organizations streamline payroll operations and simplify HR processes while complying with regulatory requirements. Its accurate and timely global payroll processing increases efficiency and employee retention and reduces the time and burden of monotonous tasks. Read ApHusys Reviews

Explore various ApHusys features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all ApHusys Features- Workflow Management

- Training Management

- Compatibility with Swap Card

- Task Management

- Talent Management

- Income Statements

- Recruitment Management

- Workforce Management

ApHusys Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Payroll management is one of the most crucial aspects of any business, regardless of size or industry. Handling payroll involves a significant amount of time, effort, and resources. It requires expertise, specialized software, and constant monitoring to ensure compliance with government regulations and accurate payment to employees. Many companies are turning to payroll outsourcing services to smoothen and streamline payroll management.

What are Payroll Outsourcing Services?

Payroll outsourcing services refers to hiring a service provider to manage the administrative and compliance functions related to employees’ salaries and benefits.

It is worth mentioning that payroll service providers can only handle your employees' payroll and do not act as a local employer of record for international companies. This means that to hire local employees, international companies will still need to incorporate their company in the country of operations.

In 2024, the worldwide market for outsourcing payroll services reached a valuation of USD 8.2 Billion. Projections indicate a significant expansion, with an anticipated value of $12.5 billion by 2027. This growth is expected to occur at a compound annual growth rate (CAGR) of 7.2% from 2024 to 2027. (Source: Allied Market Research)

There are various payroll outsourcing packages you can choose from, ranging from simple tax, pension, and salary calculation to end-to-end logging of employee hours and issuing salary at the right time.

How Does Payroll Outsourcing Services Work?

Third-party suppliers of payroll outsourcing services handle every facet of payroll administration. They gather employee information, handle payroll, prepare tax returns, and offer reports and analytics. To stay in line with evolving governmental laws, the service providers employ sophisticated payroll software that is routinely updated. The business must sign a service contract with the provider before implementing a payroll outsourcing service.

The service provider then gathers all pertinent employee data, including pay rates, hours worked, and deductions. The payroll outsourcing companies also handle tax payments and filing.

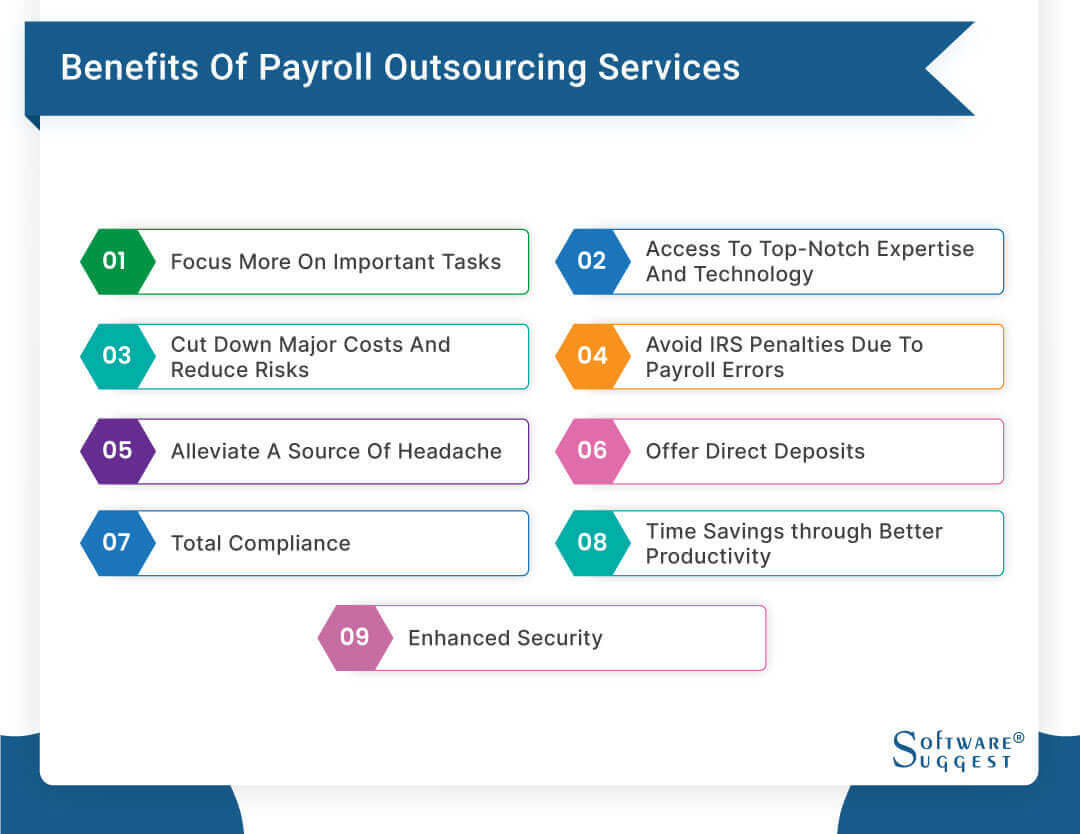

Benefits of Payroll Outsourcing Companies

Using a payroll outsourcing company can provide many benefits to businesses. A few of the most significant benefits of hiring a payroll outsourcing service are listed below:

-

Focus More on Important Tasks

By outsourcing payroll, businesses can concentrate on their main activities rather than wasting resources and time on payroll management. The supplier takes care of all payroll-related tasks, allowing the employer to focus on other important business areas.

Payroll Management is one of those important tasks that do not contribute to your sales directly. You cannot ignore the endless stream of laws requiring absolute compliance when it comes to payroll matters. But you might not always be updated about the recent legislative updates. So that means, despite sapping up your attention and time, matters regarding payroll can hurtle your business down a destructive path.

With payroll outsourcing companies, you are left to focus only on things that really matter and require your attention. It enables you to make plans that will allow your business to improve, rather than getting stuck processing payrolls or managing appointments. By freeing up your time, you might gain greater value out of that time, compared to what you are paying. What does that imply in the long run? It means you are always one step ahead of your competitors who are stuck on these mundane tasks.

-

Access to Top-Notch Expertise and Technology

Payroll outsourcing services have an up-to-date team of experts on the latest payroll regulations and requirements. They use advanced software to process payroll and provide comprehensive reports and analytics. Businesses can benefit from the experience and technology of the vendor by outsourcing payroll.

There is no good reason to manage payrolls in-house. By payroll outsourcing to a good and reputed company, you can use the latest technology and expertise benefits without spending an extra dime! Employers rely on the latest, changing technology trends to operate efficiently. As the number of employees grows, so does the complexity of reporting and record-keeping.

These employees expect transparency and efficient technology use through options like direct deposit or self-service access to payroll online information. If you start handling all these payroll requests yourself, you’ll end up doing just this throughout the day while your business seeps away. Payroll outsourcing services help you gain access to the best technology used efficiently by trained experts. What would take you hours might take them a few minutes with the latest technology at their disposal and their arsenal of expertise!

-

Cut Down Major Costs and Reduce Risks

Maintaining an in-house payroll team can be costly, especially for small and medium-sized businesses. By outsourcing payroll, businesses can reduce the costs associated with payroll management, such as salaries, benefits, and training. Additionally, outsourcing payroll can reduce the risk of errors and non-compliance, which can result in costly penalties.

-

Avoid IRS Penalties Due to Payroll Errors

Payroll errors can result in costly penalties from the IRS. Outsourcing payroll to a third-party provider can help businesses avoid these penalties by ensuring compliance with government regulations and accurate employee payment.

Legal requirements surrounding taxes, overtime payments, calculating employees’ portion of taxes, filing at local and state levels, unemployment compensation, wage, and hour laws, to name a few, may take up more time than you wish to spare. Despite all your efforts, you might still find your business embroiled in a dispute resolution, causing unnecessary complications, especially for small business owners.

-

Alleviate A Source of Headache

Managing payroll can be a source of stress and headache for business owners. This stress can be reduced by outsourcing payroll to a third-party supplier, freeing up time and resources for other crucial responsibilities

-

Offer Direct Deposits

These services offer direct deposits to employees, eliminating the need for paper checks and reducing the risk of lost or stolen checks. Direct deposit is also more convenient for employees, who do not have to visit the bank to deposit their paychecks.

While outsourcing payroll can be a boon for your business, you need to be wary before selecting a company that handles your payroll. Choose a company that is widely recommended and trusted. Look at prospective options and select the one with the highest level of experience and reputation in this field. I prefer companies that have a track record of working with businesses similar to yours.

Efficient payroll & HR outsourcing can save you time, reduce the need for in-house trained payroll staff, and appropriate software packages, and keep you compliant with the regularly updated PAYE legislation. In short, outsourcing your payroll can prove to be a truly cost-effective investment for your Business! Consider integrating HR and payroll software solutions for seamless management and compliance.

-

Total Compliance

Government rules and policies are always changing, and it’s difficult for small business owners to stay on top of these changes. Dealing with payroll means that you need to have a thorough and up-to-date knowledge of the current taxation policies, regulations, and legal enforcement! That is surely not an easy task – that is why it is highly recommended to outsource your payroll function for complete compliance with government policies.

Outsourcing your payroll function means that there will be no errors in your transactions; hence you will not have to give any penalties or fines if there are audits or checks by the requisite agencies.

-

Time Savings through Better Productivity

As your business grows, the complexity of payroll processing will also increase, making it a tedious and time-consuming task. There is an immense amount of work in calculating wage deductions, benefits, managing new hires, and ensuring 8with ever-changing governmental laws.

Outsourcing payroll to a specialized agency frees business owners and managers to concentrate on vital business functions and reduces their administrative workload to a huge extent. The various repetitive and mundane tasks of the payroll function kill productivity and waste your employees' precious time.

-

Enhanced Security

There are severe risks of data tampering, fraud, embezzlement, and identity theft for payroll processing companies having an in-house payroll software solution. There is also the chance that hackers could hack your organization’s computer servers and obtain highly sensitive employee information for personal gain.

Outsourcing your payroll function is the best way to ensure that your confidential data remains safe and secure. Professional payroll vendors have state-of-the-art security management systems that can store and protect colossal amounts of company records.

In-house Payroll or Outsource Payroll Services?

For any organization, deciding whether to get in-house payroll software or outsource services is a crucial decision. The ideal alternative will rely on the business's particular needs and has both pros and downsides.

With payroll outsourcing services, all the payroll information is captured on printed forms and sent to the external payroll provider. The main parent organization has no direct access to the underlying application or payroll calculations and will end up with complete paychecks. The external payroll processing provider manages the data entry, financial calculations, payroll check processing and comprehensively.

On the other hand, with an in-house payroll team, you have a unified solution that is fully accessible to your payroll staff members. Your payroll processing team captures all employee data in your internal systems, and your payroll staff manages the entire payroll process, right from data entry to funding and remittance.

To help you to design the best payroll outsourcing companies for your small business, here are a few important questions you might want to ask:

- Which are the steps in your current payroll processing system that cause the most difficulty?

- How much detailed time and effort do these steps cost your company?

- What is the impact of risk, if any, that your existing payroll processes pose to your organization?

- Is your organization ready to hand over the control of sensitive and valuable information to an external outsourcing provider?

- How would payroll outsourcing services impact your organization’s ability to budget and forecast salary-related information accurately?

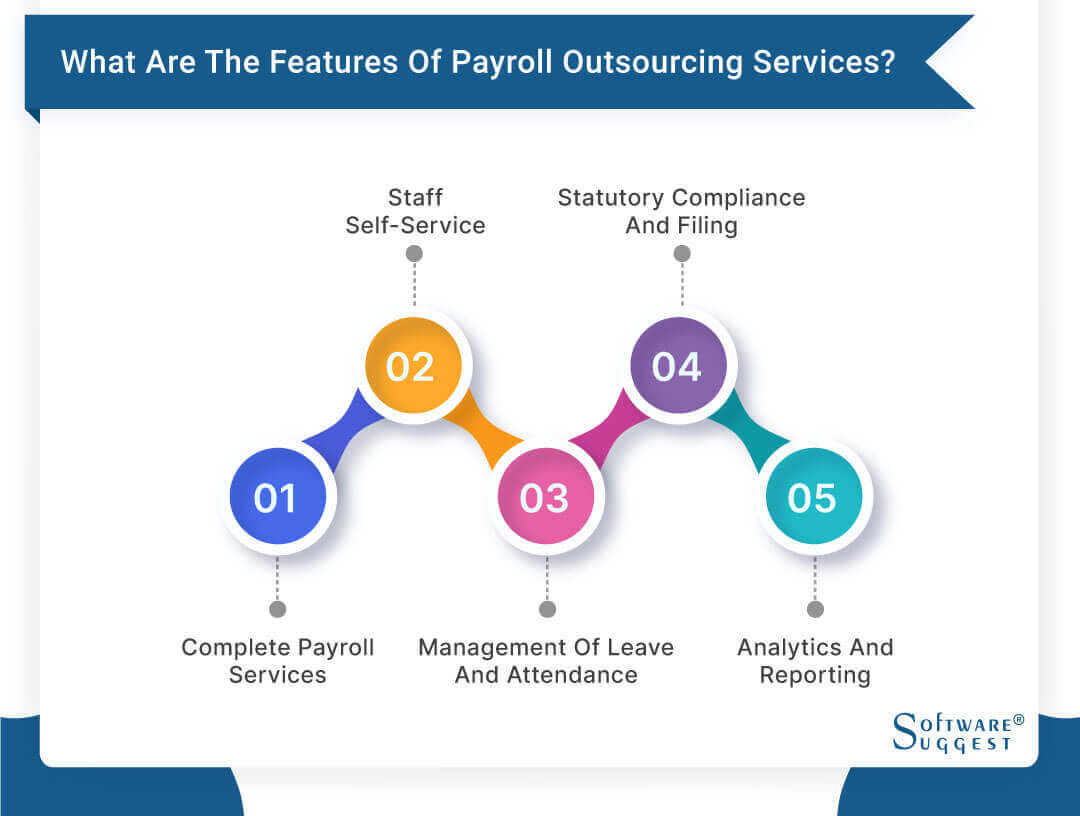

What are the Features of Best Payroll Outsourcing Services?

Let's examine some of these outsourcing services' key features after talking about their benefits.

-

Complete Payroll Services

End-to-end payroll solutions, including employee data administration, payment processing, tax filing, and compliance reporting, are provided by payroll outsourcing services. To maintain adherence to legal requirements, they use sophisticated payroll software that is frequently updated.

-

Staff Self-Service

Employee self-service portals are provided by the best payroll outsourcing companies, so staff members can view their pay stubs, tax returns, and other crucial paperwork. The payroll team will have less work to do thanks to this innovation, which also gives workers easy access to their pay information.

-

Management of Leave and Attendance

Employers can track employee absences and attendance with the help of leave and attendance management software provided by hr outsourcing services. This feature lowers the possibility of payroll errors while ensuring that workers are fairly reimbursed for their time

-

Statutory Compliance and Filing

All statutory filing and compliance needs, including tax filings and government reporting, are handled by hr outsourcing services. Ensuring that companies adhere to all laws and regulations, this function lowers the possibility of incurring expensive fines.

-

Analytics and Reporting

Employers can obtain insight into their payroll data by using the comprehensive reports and analytics offered by payroll outsourcing providers. This function aids in the identification of problem areas and assists firms in making well-informed payroll management decisions.

Pros and Cons of Payroll Outsourcing Services

Businesses may gain from outsourcing payroll services, but there may be some negatives as well. The benefits and drawbacks of hr payroll outsourcing companies will be covered in this section. Managing the payroll function is a challenging job. However, it is a vital task that contributes to overall organizational productivity and bottom-line results. In recent times, most payroll processing companies have started outsourcing payroll functions. Here is a compiled list of the pros and cons of outsourcing payroll to an external agency:

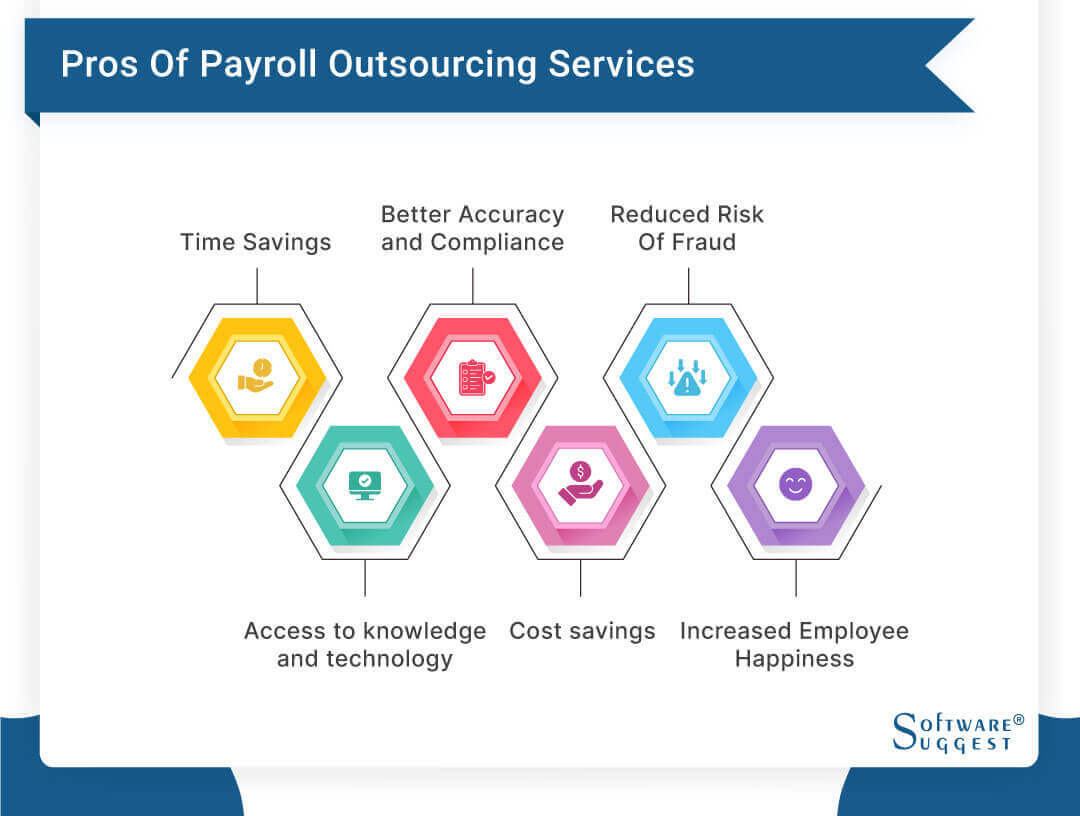

A) Pros

-

Time savings

Saving organizations a ton of time is among the most important advantages of outsourcing payroll services. Processing payroll can take a long time, particularly for small businesses with few employees.

-

Access to knowledge and technology

Businesses using payroll management companies have access to a team of payroll specialists that have handled processing payroll for a variety of businesses.

-

Saves Time

Payroll is a time-consuming task. It consists of heavy manual calculations, and companies often need to manage a heavy workforce to maintain the payroll function. Outsourcing all vital payroll activities ensure that employees do not waste endless hours on tasks; rather they can focus on more productive work.

-

Better Accuracy and Compliance

Since the payroll function involves a lot of manual calculations, it is prone to errors and mistakes. Outsourcing payroll helps ensure better accuracy, as fewer mistakes are made and operations are more streamlined. Most external payroll vendors are also well aware of mandatory compliance issues and ensure that organizations do not default on any parameters.

-

Cost savings

Outsourcing payroll services may enable businesses to make significant financial savings. Outsourcing can also lessen the possibility of expensive mistakes like arithmetic errors or missed tax files, which can incur hefty fines and penalties.

-

Reduced risk of fraud

Businesses that conduct payroll procedures internally run a substantial risk of payroll fraud. By employing appropriate controls and security measures, organizations can lower the risk of theft by outsourcing payroll services to a reliable source.

-

Increased employee happiness

By offering employees accurate and timely paychecks, direct deposit choices, and access to self-service portals where they can monitor their pay stubs, benefits, and other pertinent information, outsourcing payroll services can help increase employee satisfaction.

B) Cons

-

Loss of control

One of the possible negative effects of outsourcing payroll services is that it may lead to a reduction of control over payroll procedures. Payroll processing companies contract out their payroll processing might not have complete control over the procedure and could have to rely on the service provider for correct and timely payroll processing

-

Data security risk

As the provider receives sensitive employee information when you outsourced payroll solutions, there are data security risks involved.

-

Extra Costs

Sometimes organizations need to pay additional costs for services that they will not avail of. This is because service providers offer an all-inclusive package at a fixed cost. Hence, organizations may tend to increase their budget and overspend on payroll activities.

-

Incorrect Results

It is essential to choose a credible service provider for outsourcing payroll processes. If you invest with an unprofessional agency, the result may have errors, and they're also may be security lapses.

-

Communication problems

If the supplier is based in a different time zone or speaks a different language, outsourcing payroll services may cause communication problems as well.

Buying Tips for Online Payroll Outsourcing Services

There are hundreds of payroll outsourcing companies (if not thousands). You need to be extremely careful when choosing your payroll provider. That’s because there’s money involved.

You don’t want to partner with a payroll outsourcing company that has a history of calculating incorrect payrolls or misrepresenting benefits. This will not only affect your company’s reputation as an employer but will also bring you to the government’s notice.

Here are four key points you should consider when choosing a payroll outsourcing software.

- Their price compared to other providers

- The integrity and scope of their service

- The reputation of their business

- Security, privacy, and reliability of the provider

Why is this particularly important? Because you are exposing confidential information to third parties: Names of your employees, their social security numbers, addresses, and bank account numbers.

To be on the safer side, take a financially strong provider with good controls in place. You don’t want to find yourself in a blind where your provider may steal your money. Or face an IRS action because at the end of the day, whether your provider steals your money or not, you’ll have to shoulder the responsibility of filing your tax returns.

Additionally, follow these tips to narrow down your search.

-

Look for a Stable Provider

Make sure to choose a market leader in India's payroll outsourcing services with a good reputation and a satisfied client list. To ensure long-term stability, a payroll service provider should ideally sustain at least a hundred clients who avail of their services.

-

Verify the financial situation is stable

It is important to be completely thorough in appraising the first paychecks issued through the payroll outsourcing services and the finances paid to cover legal tax obligations.

-

Evaluate the Pricing over Time

Make sure that you are not swayed by payroll outsourcing services that waive off initial charges upon sign-up. This is because the prices go up or start accruing after around six months to a year of payroll service. Keep a keen eye on pricing and always do a detailed market comparison to gain maximum financial benefit for your business organization.

"Business is all about people." Having a satisfied and motivated workforce is the key to achieving success in any business. Employees work hard to ensure your business runs seamlessly. So, it is essential to pay them appropriately.

In addition to wages, you also need to regularly pay accurate taxes to the state to continue running your operations. These payroll tax laws are subject to frequent changes, making payroll processing difficult, and you often find your business penalized for payroll errors.

It is easy to understand that payroll is a crucial part of any business organization. Despite its importance, it is an undisputed fact that payrolls chug up huge amounts of time that could be devoted to other more important business matters. To avoid this mundane task from clogging up your schedule, "outsourcing" has emerged as a significant alternative to eliminating payroll processing difficulties and challenges.

Top 5 Payroll Outsourcing Companies Comparison

|

Name

|

Free Trial

|

Demo

|

Pricing

|

|---|---|---|---|

| Yes |

Yes |

$79/month | |

|

30 Days |

Yes | $46/month | |

|

30 Days |

Yes |

On-Request | |

| 60 Days |

Yes |

$19.99/month | |

|

30 Days |

Yes |

$36/month |

When considering online payroll outsourcing services, it's important to research the company's reputation and track record. Look for a provider with experience in your industry, and consider their level of customer support and data security measures. It's also wise to compare pricing and contract terms from multiple providers before making a decision.

The well-known payroll outsourcing company ADP (Automatic Data Processing) provides a variety of payroll and HR solutions for companies of all sizes.

- Automatic payroll processing and tax filing

- Employee self-service portal for access to pay stubs, W-2s, and other information

- HR tools for benefits, time and attendance, recruiting, and compliance

- Mobile app for on-the-go access and management

- Comprehensive and customizable solutions

- Scalable for small to large businesses

- Trusted and reliable reputation

- Excellent customer service

- Can be more expensive than other options

- May require some training to use all features effectively

Pricing

- ADP does not disclose its pricing publicly, but it offers custom quotes based on business needs.

Gusto is one of the modern and user-friendly payroll outsourcing companies that emphasizes simplicity, automation, and employee experience.

- Easy setup and intuitive interface

- Automated payroll processing and tax filing

- Employee self-onboarding and management

- HR tools for benefits, compliance, and surveys

- Mobile app for employees and managers

- User-friendly and streamlined solutions

- Competitive and transparent pricing

- Exceptional customer support

- Integrations with popular business tools

- Limited customization options for some features

- May not be suitable for very large or complex businesses

Pricing

- Gusto offers three pricing plans based on the number of employees and features, ranging from $19/month to $149/month plus $6/month per employee.

Paychex is a well-known payroll outsourcing company that offers a range of payroll, HR, and benefits solutions for small to medium-sized businesses.

- Customizable payroll processing and tax services

- HR tools for time and attendance, hiring, onboarding, and compliance

- Benefits administration and retirement services

- Access to HR experts and resources

- Mobile app for employees and managers

- Flexible and comprehensive solutions

- Strong compliance and security measures

- Dedicated support for HR and payroll needs

- Competitive Pricing

- Limited customization options for some features

- Can be less suitable for very small or very large businesses

Pricing

- Paychex offers custom pricing based on business needs and size, with a monthly service fee and additional charges for certain features and services.

SurePayroll is a cloud-based payroll outsourcing company that specializes in serving small businesses with simple payroll needs.

- Online payroll processing and tax services

- Employee self-service portal

- HR tools for compliance and reporting

- Mobile app for payroll management

- Affordable and straightforward solutions

- Easy to use and setup

- Transparent and predictable pricing

- Good customer service

- Limited features and customization options

- It may not be suitable for larger or more complex businesses

Pricing

- SurePayroll offers three pricing plans based on the number of employees and frequency of payroll, ranging from $19.99/month to $49.99/month.

OnPay is one of the top payroll outsourcing companies that offer full-service payroll and HR solutions for small to medium-sized businesses.

- Customizable payroll processing and tax services

- HR tools for benefits, time and attendance, and compliance

- Contractor and vendor payments

- Integrations with popular accounting and HR software

- Comprehensive and flexible solutions

- Transparent and affordable pricing

- Intuitive and easy-to-use interface

- Excellent customer support

- May not be suitable for very large or complex businesses

- Limited options for advanced reporting and analytics

Pricing

- OnPay offers two pricing plans based on the number of employees and features, ranging from $36/month plus $4/month per employee to $4/month plus $8/month per employee for additional HR features.

Challenges in Payroll Outsourcing Services

Although there are several advantages of outsourcing payroll services, there could also be some disadvantages for the same. It is important to be aware of these difficulties when considering whether or not to outsource payroll services.

-

Payroll services offered internally versus externally

Deciding between internal and external payroll services is one of the biggest issues that payroll processing companies deal with. Although there are many perks to outsourcing payroll services, some firms may opt to manage their payroll locally. This selection may depend upon the size of the company, the complexity of the payroll system, and the resources available.

-

Choosing the ideal payroll outsourcing provider

It can be difficult to select the best payroll outsourcing services. Because there are so many options available on the market, selecting a business can be challenging. To make an informed selection, it's vital to conduct in-depth research and analyze the services, costs, expertise, and dependability of each company.

-

Evaluating the feasibility of the cost of payroll HR outsourcing services

One of the most significant concerns that companies have when considering outsourcing payroll services is the cost. It's essential to evaluate the feasibility of the cost of outsourced payroll providers before making a decision. The cost of outsourcing payroll services may vary based on the size of the firm, the complexity of the payroll process, and the level of support required.

-

The trustworthiness of payroll outsourcing firms

The dependability of firms that outsource payroll is another issue for businesses. It's important to select a business with a track record of delivering precise and timely payroll services. In order to confirm the credibility of top payroll outsourcing companies, businesses should examine references and read reviews.

-

Ensuring the security and privacy of data

The confidentiality and security of sensitive payroll information is one of the main worries when outsourcing payroll services. Businesses should check the security procedures in place at the payroll outsourcing services they select to give that their data is well-protected. To safeguard the security of the employee's payroll information, the organization should also have stringent confidentiality rules and processes in place.

-

Collaboration and communication with the outsourced company

For payroll outsourcing solutions to be successful, communication must be effective. Establishing a strong communication channel with the outsourcing provider is crucial to guarantee that any problems or concerns are quickly resolved. To make sure the payroll process is functioning effectively, businesses should keep in constant contact with the outsourced provider.

-

Keeping up a high standard of customer care and assistance

Also, businesses should make sure that the outsourcing company they choose provides excellent customer service and support. The outsourcing supplier needs to be reachable and attentive to the needs and inquiries of the business. A trustworthy outsourcing company should have a committed customer service team that can offer assistance and swiftly address any problems.

-

Maintaining a high level of customer service and support

Payroll outsourcing services are no exception to the need for all businesses to uphold a high level of customer care and assistance. To do this, it is important to pay close attention to client expectations, respond to their requests as soon as possible, and uphold a high level of client service. By giving customer satisfaction a top priority, businesses can both attract and retain customers.

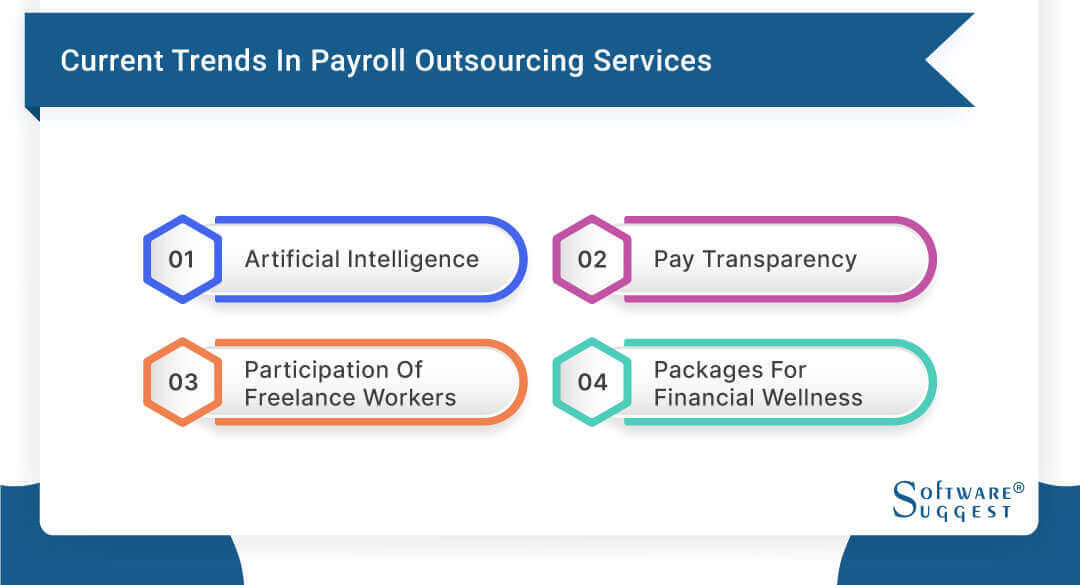

Latest Trends in Payroll Outsourcing Companies

Top payroll outsourcing companies have trends that are evolving along with technology. The following are some of the most recent payroll outsourcing trends in the sector:

-

Artificial Intelligence

Artificial intelligence (AI) has been gaining popularity in the payroll outsourcing industry. AI-powered payroll systems can automate repetitive and time-consuming tasks such as data entry, calculations, and record keeping. This allows outsourced payroll providers to reduce costs and improve accuracy while freeing up time for more strategic work.

-

Pay Transparency

Transparency in pay has become a vital issue for many companies and employees. Various companies are more focused on outsourcing their payroll operations to make sure they are in compliance with the norms and regulations governing pay transparency. Utilizing payroll outsourcing companies may help businesses guarantee that they are offering their employees exact and concise data, which can boost employee morale and loyalty.

-

Participation of Freelance Workers

Payroll outsourcing firms are creating innovative solutions to address the particular needs of gig workers as a result of the gig economy's rapid growth. For contractors, freelancers, and other gig workers, many businesses are now providing specialized solutions, such as flexible payment schedules, real-time payment tracking, and simple access to financial institutions.

-

Packages for financial wellness

Numerous businesses have recently begun to put more emphasis on employee financial wellness. Hence, financial wellness packages with financial planning, budgeting, and investment management services are increasingly provided by payroll outsourcing organizations. This can aid workers in managing their money more effectively, lessen stress, and enhance general well-being.

Conclusion

Outsourcing your top payroll management companies can help streamline your business, reduce costs, and improve accuracy. When choosing a payroll outsourcing company, it is important to consider factors such as reliability, data security, and customer support.

Furthermore, it's critical to stay current with market developments like AI, pay transparency, the inclusion of gig workers, and financial wellness programs. By staying informed and partnering with the top 10 payroll outsourcing companies, businesses can save time, money, and resources while focusing on what they do best – growing their business.

Related Research Articles:

FAQs

It varies from company to company. Most payroll service providers prefer to have long-term contracts. But you can always cancel the agreement on a one-month notice time.

The payroll outsourcing cost on a monthly basis varies from $40 to $160, whereas yearly costs range from $1,000 to $6,000. Price varies depending on the number of employees and the services available.

Payroll outsourcing providers stay updated on tax regulations and handle all aspects of tax compliance, including calculating payroll taxes, filing tax returns, issuing W-2 forms to employees, and addressing any tax-related inquiries from authorities.

Reputable payroll outsourcing providers have error correction procedures in place. If errors occur, they promptly rectify them and ensure that affected employees receive the correct payments. Additionally, they investigate the root cause to prevent similar errors in the future.

When selecting a payroll outsourcing provider, consider factors such as their reputation, experience, range of services, pricing, technology infrastructure, customer support, compliance track record, and compatibility with your business needs and values. It's also helpful to request references and conduct thorough due diligence before making a decision.

By Countries

By Cities

By Industries

.png)

.png)